Kaiser Health News

When Copay Assistance Backfires on Patients

Julie Appleby, KFF Health News

Fri, 15 Mar 2024 10:00:00 +0000

In early 2019, Jennifer Hepworth and her husband were stunned by a large bill they unexpectedly received for their daughter's prescription cystic fibrosis medication. Their payment had risen to $3,500 from the usual $30 for a month's supply.

That must be a mistake, she told the pharmacy. But it wasn't. It turned out that the health insurance plan through her husband's job had a new program in which it stopped applying any financial assistance they received from drugmakers to the family's annual deductible.

Insurers or employers can tap into funds provided to patients by drugmakers through copay assistance programs, which were designed by the companies to help patients afford increasingly expensive medications. But, because those payments are no longer counted toward the deductible, patients must pay an amount out-of-pocket, too, often for the same drugs. Those deductibles or other out-of-pocket costs can easily run into thousands of dollars.

Here's what that meant for Hepworth, who lives in Utah. Before the change, the drugmaker's copay assistance would almost immediately meet her family's deductible for the year, because both Hepworth and her daughter need expensive medications. As a result, the family was responsible for copays of only 20% of their medical costs instead of the 100% required by their plan until they met their deductible. By the middle of the year, the family would have reached the plan's out-of-pocket maximum of nearly $10,000 and would no longer owe any copays.

Hepworth ended up paying the $3,500 to the pharmacy, equivalent to the family's annual deductible, because she didn't want to stop giving her daughter a treatment that could extend her life. “We were struggling and everything went on credit cards.”

Why did the insurer do this?

Employers or the health insurance plans they hire are saving 10% to 15% of the cost of prescription plan claims by using these copay accumulator programs, said Edward Kaplan, a senior vice president at Segal, a benefits consulting firm. Even so, Kaplan doesn't recommend that his clients, who include public and private employers, take advantage of the program because of the increasing pushback from lawmakers and advocacy groups. However, the majority of insured people are in plans governed by these types of programs, according to Avalere, a consulting firm.

Nineteen states now limit copay accumulator programs for some insurance plans. And patient advocacy groups have won a favorable court ruling against the programs. States' limits on the practice, however, do not apply to larger, self-insured job-based plans, through which many Americans have coverage.

Bipartisan legislation has been introduced in both chambers of Congress that would require financial assistance to count toward deductibles and other out-of-pocket costs. Called the Help Ensure Lower Patient Copays Act, it would govern plans that are exempt from state rules.

Change is unlikely to come soon.

Insurers and employers have long complained that copay assistance programs are mainly a marketing ploy by the drug industry that encourages patients to stay on costly drugs when lower-cost alternatives might be available. Insurers say capturing more of that money themselves can help slow the rising price of premiums.

In a recent letter to regulators, the Blue Cross Blue Shield Association called the practice “a vital tool in keeping health insurance affordable.”

Patient advocacy groups, including the HIV+Hepatitis Policy Institute and two diabetes groups, disagreed and took a case against copay accumulator programs to U.S. District Court last fall.

And “we won,” said Carl Schmid, executive director of the institute. The groups argued the practice can cause some patients to skip their medications because of the unexpected costs they must now shoulder.

Some critics say it's a form of double dipping because even though the patient hasn't personally paid out-of-pocket, “that payment was made, and it was made on your behalf. I think that should get counted,” said Rachel Klein, deputy executive director with the AIDS Institute, an advocacy group.

The court decision, Schmid said, essentially overturns a 2021 provision in Centers for Medicare & Medicaid Services rules that allowed insurers to expand the practice to cover almost any drug. Previous rules from 2020 would now be in effect, said Schmid, and those rules say copay assistance should count toward the deductible for all drugs for which there is no medically appropriate generic alternative available.

Even so, billing changes for many insured patients may take a while.

While the Biden administration dropped an appeal of the court decision, it has filed motions noting “it does not intend to take any enforcement action against issuers or plans” until regulators draw up new rules, said Ellen Montz, deputy administrator and director of the Center for Consumer Information and Insurance Oversight at CMS, in a written statement to KFF Health News.

A version of these programs being used by insurers, sometimes called a “maximizer,” works a bit differently.

Under a maximizer program, insurers partner with outside firms such as PrudentRX and SaveOnSP. The programs declare certain drugs or classes of drugs “nonessential,” thus allowing them to circumvent some Affordable Care Act rules that limit patient cost sharing. That lets the insurer collect the maximum amount from a drugmaker's assistance program, even if that is more than the patient would owe through deductibles or out-of-pocket maximums had the drugs remained essential benefits. These partner companies also work with large pharmacy benefit managers that oversee prescription services for employers.

Those maximizer payments do not count toward a patient's deductible. Many insurers don't charge patients an additional copay for the drugs deemed nonessential as a way of enticing them to sign up for the programs. If patients choose not to enroll, they could face a copayment far higher than usual because of the “nonessential” designation.

“This is a loophole in the ACA that they are exploiting,” said Schmid of the HIV+Hepatitis Policy Institute, referring to the Affordable Care Act. Johnson & Johnson filed a lawsuit in federal court in New Jersey in 2022 against such a maximizer program, saying it coerced patients into participating because if they didn't they faced higher copays. The drugmaker warned it might reduce the amount of overall assistance available to patients because of the increasingly common practice.

Now, though, a provision in the proposed 2025 federal rules governing health insurers says plans must consider any covered drug an “essential benefit.” If finalized, the provision would hamper insurers' ability to collect the maximum amount of drugmaker assistance.

Employers are watching for the outcome of the lawsuit and the proposed federal rules and don't yet have clarity on how rulings or regulations will affect their programs, said James Gelfand, president and chief executive of the ERISA Industry Committee, which advocates for large, self-insured employers.

——————————

By: Julie Appleby, KFF Health News

Title: When Copay Assistance Backfires on Patients

Sourced From: kffhealthnews.org/news/article/drugmaker-copay-assistance-backfires-patient-deductibles/

Published Date: Fri, 15 Mar 2024 10:00:00 +0000

Did you miss our previous article…

https://www.biloxinewsevents.com/a-new-orleans-neighborhood-confronts-the-racist-legacy-of-a-toxic-stretch-of-highway/

Kaiser Health News

What Florida’s New 6-Week Abortion Ban Means for the South, and Traveling Patients

Christopher O'Donnell, Tampa Bay Times

Mon, 29 Apr 2024 09:00:00 +0000

Monica Kelly was thrilled to learn she was expecting her second child.

The Tennessee mother was around 13 weeks pregnant when, according to a lawsuit filed against the state of Tennessee, doctors gave her the devastating news that her baby had Patau syndrome.

The genetic disorder causes serious developmental defects and often results in miscarriage, stillbirth, or death within one year of birth. Continuing her pregnancy, doctors told her, could put her at risk of infection and complications that include high blood pressure, organ failure, and death.

But they said they could not perform an abortion due to a Tennessee law banning most abortions that went into effect two months after the repeal of Roe v. Wade in June 2022, court records show.

So Kelly traveled to a northwestern Florida hospital to get an abortion while about 15 weeks pregnant. She is one of seven women and two doctors suing Tennessee because they say the state's near-total abortion ban imperils the lives of pregnant women.

More than 25,000 women like Kelly traveled to Florida for an abortion over the past five years, state data shows. Most came from states such as Alabama, Louisiana, and Mississippi with little or no access to abortion, data from the Centers for Disease Control and Prevention shows. Hundreds traveled from as far as Texas.

But a recent Florida Supreme Court ruling paved the way for the Sunshine State to enforce a six-week ban beginning in May, effectively leaving women in much of the South with little or no access to abortion clinics. The ban could be short-lived if 60% of Florida voters in November approve a constitutional amendment adding the right to an abortion.

Related Coverage

Conservative Justices Stir Trouble for Republican Politicians on Abortion

In the meantime, nonprofit groups are warning they may not be able to meet the increased demand for help from women from Florida and other Southeastern states to travel for an abortion. They fear women who lack the resources will be forced to carry unwanted pregnancies to term because they cannot afford to travel to states where abortions are more available.

That could include women whose pregnancies, like Kelly's, put them at risk.

“The six-week ban is really a problem not just for Florida but the entire Southeast,” said McKenna Kelley, a board member of the Tampa Bay Abortion Fund. “Florida was the last man standing in the Southeast for abortion access.”

Travel Bans and Stricter Limits

Supporters of the Florida restrictions aren't backing down. Some want even stricter limits. Republican state Rep. Mike Beltran voted for both the 15-week and six-week bans. He said the vast majority of abortions are elective and that those related to medical complications make up a tiny fraction.

State data shows that 95% of abortions last year were either elective or performed due to social or economic reasons. More than 5% were related to issues with either the health of the mother or the fetus.

Beltran said he would support a ban on travel for abortions but knows it would be challenged in the courts. He would support measures that prevent employers from paying for workers to travel for abortions and such costs being tax-deductible, he said.

“I don't think we should make it easier for people to travel for abortion,” he said. “We should put things in to prevent circumvention of the law.”

Both abortion bans were also supported by GOP state lawmaker Joel Rudman. As a physician, Rudman said, he has delivered more than 100 babies and sees nothing in the current law that sacrifices patient safety.

“It is a good commonsense law that provides reasonable exceptions yet respects the sanctity of life for both mother and child,” he said in a text message.

Last year, the first full year that many Southern states had bans in place, more than 7,700 women traveled to Florida for an abortion, an increase of roughly 59% compared with three years ago.

The Tampa Bay Abortion Fund, which is focused on helping local women, found itself assisting an influx of women from Arkansas, Georgia, Mississippi, Louisiana, and other states, Kelley said.

In 2023, it paid out more than $650,000 for appointment costs and over $67,000 in other expenses such as airplane tickets and lodging. Most of those who seek assistance are from low-income families including minorities or disabled people, Kelley said.

“We ask each person, ‘What can you contribute?'” she said. “Some say zero and that's fine.”

Florida's new law will mean her group will have to pivot again. The focus will now be on helping people seeking abortions travel to other states.

But the destinations are farther and more expensive. Most women, she predicted, will head to New York, Illinois, or Washington, D.C. Clinic appointments in those states are often more expensive. The extra travel distance will mean help is needed with hotels and airfare.

North Carolina, which allows abortions through about 12 weeks of pregnancy, may be a slightly cheaper option for some women whose pregnancies are not as far along, she said.

Keeping up with that need is a concern, she said. Donations to the group soared to $755,000 in 2022, which Kelley described as “rage donations” made after the U.S. Supreme Court ended half a century of guaranteeing the federal right to an abortion.

The anger didn't last. Donations in 2023 declined to $272,000, she said.

“We're going to have huge problems on our hands in a few weeks,” she said. “A lot of people who need an abortion are not going to be able to access one. That's really scary and sad.”

Gray Areas Lead to Confusion

The Chicago Abortion Fund is expecting that many women from Southeastern states will head its way.

Illinois offers abortions up until fetal viability — around 24 to 26 weeks. The state five years ago repealed its law requiring parents to be notified when their children seek an abortion.

About 3 in 10 abortions performed in Illinois two years ago — almost 17,000 — involved out-of-state residents, up from fewer than a quarter the previous year, according to state records.

The Chicago nonprofit has prided itself on not turning away requests for help over the past five years, said Qudsiyyah Shariyf, a deputy director. It is adding staffers, including Spanish-language speakers, to cope with an anticipated uptick in calls for help from Southern states. She hopes Florida voters will make the crisis short-lived.

“We're estimating we'll need an additional $100,000 a month to meet that influx of folks from Florida and the South,” she said. “We know it's going to be a really hard eight months until something potentially changes.”

Losing access to abortion, especially among vulnerable groups like pregnant teenagers and women with pregnancy complications, could also increase cases of mental illness such as depression, anxiety, and even post-traumatic stress disorder, said Silvia Kaminsky, a licensed marriage and family therapist in Miami.

related coverage

Can a Fetus Be an Employee? States Are Testing the Boundaries of Personhood After ‘Dobbs'

Kaminsky, who serves as board president of the American Association for Marriage and Family Therapy, said the group has received calls from therapists seeking legal guidance about whether they can help a client who wants to travel for an abortion.

That's especially true in states such as Alabama, Georgia, and Missouri that have passed laws granting “personhood” status to fetuses. Therapists in many states, including Florida, are required to report a client who intends to harm another individual.

“It's creating all these gray areas that we didn't have to deal with before,” Kaminsky said.

Deborah Dorbert of Lakeland, Florida, said that Florida's 15-week abortion limit put her health at risk and that she was forced to carry to term a baby with no chance of survival.

Her unborn child was diagnosed with Potter syndrome in November 2022. An ultrasound taken at 23 weeks of pregnancy showed that the fetus had not developed enough amniotic fluid and that its kidneys were undeveloped.

Doctors told her that her child would not survive outside the womb and that there was a high risk of a stillbirth and, for her, preeclampsia, a pregnancy complication that can result in high blood pressure, organ failure, and death.

One option doctors suggested was a pre-term inducement, essentially an abortion, Dorbert said.

Dorbert and her husband were heartbroken. They decided an abortion was their safest option.

At Lakeland Regional Health, she said, she was told her surgery would have to be approved by the hospital administration and its lawyers since Florida had that year enacted its 15-week abortion restriction.

Florida's abortion law includes an exemption if two physicians certify in writing that a fetus has a fatal fetal abnormality and has not reached viability. But a month elapsed before she got an answer in her case. Her doctor told her the hospital did not feel they could legally perform the procedure and that she would have to carry the baby to term, Dorbert said.

Lakeland Regional Health did not respond to repeated calls and emails seeking comment.

Dorbert's gynecologist had mentioned to her that some women traveled for an abortion. But Dorbert said she could not afford the trip and was concerned she might break the law by going out of state.

At 37 weeks, doctors agreed to induce Dorbert. She checked into Lakeland Regional Hospital in March 2023 and, after a long and painful labor, gave birth to a boy named Milo.

“When he was born, he was blue; he didn't open his eyes; he didn't cry,” she said. “The only sound you heard was him gasping for air every so often.”

She and her husband took turns holding Milo. They read him a book about a mother polar bear who tells her cub she will always love them. They sang Bob Marley and The Wailers' “Three Little Birds” to Milo with its chorus that “every little thing is gonna be alright.”

Milo died in his mother's arms 93 minutes after being born.

One year later, Dorbert is still dealing with the anguish. The grief is still “heavy” some days, she said.

She and her husband have discussed trying for another child, but Florida's abortion laws have made her wary of another pregnancy with complications.

“It makes you angry and frustrated. I could not get the health care I needed and that my doctors advised for me,” she said. “I know I can't go through what I went through again.”

——————————

By: Christopher O'Donnell, Tampa Bay Times

Title: What Florida's New 6-Week Abortion Ban Means for the South, and Traveling Patients

Sourced From: kffhealthnews.org/news/article/florida-6-week-abortion-ban-patient-travel-south/

Published Date: Mon, 29 Apr 2024 09:00:00 +0000

Did you miss our previous article…

https://www.biloxinewsevents.com/exposed-to-agent-orange-at-us-bases-veterans-face-cancer-without-va-compensation/

Kaiser Health News

Exposed to Agent Orange at US Bases, Veterans Face Cancer Without VA Compensation

Hannah Norman, KFF Health News and Patricia Kime

Mon, 29 Apr 2024 09:00:00 +0000

As a young GI at Fort Ord in Monterey County, California, Dean Osborn spent much of his time in the oceanside woodlands, training on soil and guzzling water from streams and aquifers now known to be contaminated with cancer-causing pollutants.

“They were marching the snot out of us,” he said, recalling his year and a half stationed on the base, from 1979 to 1980. He also remembers, not so fondly, the poison oak pervasive across the 28,000-acre installation that closed in 1994. He went on sick call at least three times because of the overwhelmingly itchy rash.

Mounting evidence shows that as far back as the 1950s, in an effort to kill the ubiquitous poison oak and other weeds at the Army base, the military experimented with and sprayed the powerful herbicide combination known colloquially as Agent Orange.

While the U.S. military used the herbicide to defoliate the dense jungles of Vietnam and adjoining countries, it was contaminating the land and waters of coastal California with the same chemicals, according to documents.

The Defense Department has publicly acknowledged that during the Vietnam War era it stored Agent Orange at the Naval Construction Battalion Center in Gulfport, Mississippi, and the former Kelly Air Force Base in Texas, and tested it at Florida's Eglin Air Force Base.

According to the Government Accountability Office, however, the Pentagon's list of sites where herbicides were tested went more than a decade without being updated and lacked specificity. GAO analysts described the list in 2018 as “inaccurate and incomplete.”

Fort Ord was not included. It is among about four dozen bases that the government has excluded but where Pat Elder, an environmental activist, said he has documented the use or storage of Agent Orange.

According to a 1956 article in the journal The Military Engineer, the use of Agent Orange herbicides at Fort Ord led to a “drastic reduction in trainee dermatitis casualties.”

“In training areas, such as Fort Ord, where poison oak has been extremely troublesome to military personnel, a well-organized chemical war has been waged against this woody plant pest,” the article noted.

Other documents, including a report by an Army agronomist as well as documents related to hazardous material cleanups, point to the use of Agent Orange at the sprawling base that 1.5 million service members cycled through from 1917 to 1994.

‘The Most Toxic Chemical'

Agent Orange is a 50-50 mixture of two ingredients, known as 2,4-D and 2,4,5-T. Herbicides with the same chemical structure slightly modified were available off the shelf, sold commercially in massive amounts, and used at practically every base in the U.S., said Gerson Smoger, a lawyer who argued before the Supreme Court for Vietnam veterans to have the right to sue Agent Orange manufacturers. The combo was also used by farmers, forest workers, and other civilians across the country.

The chemical 2,4,5-T contains the dioxin 2,3,7,8-tetrachlorodibenzo-p-dioxin or TCDD, a known carcinogen linked to several cancers, chronic conditions and birth defects. A recent Brown University study tied Agent Orange exposure to brain tissue damage similar to that caused by Alzheimer's. Acknowledging its harm to human health, the Environmental Protection Agency banned the use of 2,4,5-T in the U.S. in 1979. Still, the other weed killer, 2,4-D is sold off-the-shelf today.

“The bottom line is TCDD is the most toxic chemical that man has ever made,” Smoger said.

For years, the Department of Veteran Affairs has provided vets who served in Vietnam disability compensation for diseases considered to be connected to exposure to Agent Orange for military use from 1962 to 1975.

Decades after Osborn's military service, the 68-year-old veteran, who never served in Vietnam, has battled one health crisis after another: a spot on his left lung and kidney, hypothyroidism, and prostate cancer, an illness that has been tied to Agent Orange exposure.

He says many of his old buddies from Fort Ord are sick as well.

“Now we have cancers that we didn't deserve,” Osborn said.

The VA considers prostate cancer a “presumptive condition” for Agent Orange disability compensation, acknowledging that those who served in specific locations were likely exposed and that their illnesses are tied to their military service. The designation expedites affected veterans' claims.

But when Osborn requested his benefits, he was denied. The letter said the cancer was “more likely due to your age,” not military service.

“This didn't happen because of my age. This is happening because we were stationed in the places that were being sprayed and contaminated,” he said.

Studies show that diseases caused by environmental factors can take years to emerge. And to make things more perplexing for veterans stationed at Fort Ord, contamination from other harmful chemicals, like the industrial cleaner trichloroethylene, have been well documented on the former base, landing it on the EPA's Superfund site list in 1990.

“We typically expect to see the effect years down the line,” said Lawrence Liu, a doctor at City of Hope Comprehensive Cancer Center who has studied Agent Orange. “Carcinogens have additive effects.”

In February, the VA proposed a rule that for the first time would allow compensation to veterans for Agent Orange exposure at 17 U.S. bases in a dozen states where the herbicide was tested, used, or stored.

Fort Ord is not on that list either, because the VA's list is based on the Defense Department's 2019 update.

“It's a very tricky question,” Smoger said, emphasizing how widely the herbicides were used both at military bases and by civilians for similar purposes. “On one hand, we were service. We were exposed. On the other hand, why are you different from the people across the road that are privately using it?”

The VA says that it based its proposed rule on information provided by the Defense Department.

“DoD's review found no documentation of herbicide use, testing or storage at Fort Ord. Therefore, VA does not have sufficient evidence to extend a presumption of exposure to herbicides based on service at Fort Ord at this time,” VA press secretary Terrence Hayes said in an email.

The Documentation

Yet environmental activist Elder, with help from toxic and remediation specialist Denise Trabbic-Pointer and former VA physician Kyle Horton, compiled seven documents showing otherwise. They include a journal article, the agronomist report, and cleanup-related documents as recent as 1995 — all pointing to widespread herbicide use and experimentation as well as lasting contamination at the base.

Though the documents do not call the herbicide by its colorful nickname, they routinely cite the combination of 2,4-D and 2,4,5-T. A “hazardous waste minimization assessment” dated 1991 reported 80,000 pounds of herbicides used annually at Fort Ord. It separately lists 2,4,5-T as a product for which “substitutions are necessary to minimize the environmental impacts.”

The poison oak “control program” started in 1951, according to a report by Army agronomist Floyd Otter, four years before the U.S. deepened its involvement in Vietnam. Otter detailed the use of these chemicals alone and in combination with diesel oil or other compounds, at rates generally between “one to two gallons of liquid herbicide” per acre.

“In conclusion, we are fairly well satisfied with the methods,” Otter wrote, noting he was interested in “any way in which costs can be lowered or quicker kill obtained.”

An article published in California Agriculture more than a decade later includes before and after photos showing the effectiveness of chemical brush control used in a live-oak woodland at Fort Ord, again citing both chemicals in Agent Orange. The Defense Department did not respond to questions sent April 10 about the contamination or say when the Army stopped using 2,4,5-T at Fort Ord.

“What's most compelling about Fort Ord is it was actually used for the same purpose it was used for in Vietnam — to kill plants — not just storing it,” said Julie Akey, a former Army linguist who worked at the base in the 1990s and later developed the rare blood cancer multiple myeloma.

Akey, who also worked with Elder, runs a Facebook group and keeps a list of people stationed on the base who later were diagnosed with cancer and other illnesses. So far, she has tallied more than 1,400 former Fort Ord residents who became sick.

Elder's findings have galvanized the group to speak up during a public comment period for the VA's proposed rule. Of 546 comments, 67 are from veterans and others urging the inclusion of Fort Ord. Hundreds of others have written in regarding the use of Agent Orange and other chemicals at their bases.

While the herbicide itself sticks around for only a short time, the contaminant TCDD can linger in sediment for decades, said Kenneth Olson, a professor emeritus of soil science at the University of Illinois Urbana-Champaign.

A 1995 report from the Army's Sacramento Corps of Engineers, which documented chemicals detected in the soil at Fort Ord, found levels of TCDD at 3.5 parts per trillion, more than double the remediation goal at the time of 1.2 ppt. Olson calls the evidence convincing.

“It clearly supports the fact that 2,4,5-T with unknown amounts of dioxin TCDD was applied on the Fort Ord grounds and border fences,” Olson said. “Some military and civilian personnel would have been exposed.”

The Department of Defense has described the Agent Orange used in Vietnam as a “tactical herbicide,” more concentrated than what was commercially available in the U.S. But Olson said his research suggests that even if the grounds maintenance crew used commercial versions of 2,4,5-T, which was available in the federal supply catalog, the soldiers would have been exposed to the dioxin TCDD.

The half dozen veterans who spoke with KFF Health News said they want the military to take responsibility.

The Pentagon did not respond to questions regarding the upkeep of the list or the process for adding locations.

In the meantime, the Agency for Toxic Substances and Disease Registry is studying potential chemical exposure among people who worked and lived on Fort Ord between 1985 and 1994. However, the agency is evaluating drinking water for contaminants such as trichloroethylene and not contamination or pollution from other chemicals such as Agent Orange or those found in firefighting foams.

Other veterans are frustrated by the VA's long process to recognize their illnesses and believe they were sickened by exposure at Fort Ord.

“Until Fort Ord is recognized by the VA as a presumptive site, it's probably going to be a long, difficult struggle to get some kind of compensation,” said Mike Duris, a 72-year-old veteran diagnosed with prostate cancer four years ago who ultimately underwent surgery.

Like so many others, he wonders about the connection to his training at Fort Ord in the early '70s — drinking the contaminated water and marching, crawling, and digging holes in the dirt.

“Often, where there is smoke, there's fire,” Duris said.

——————————

By: Hannah Norman, KFF Health News and Patricia Kime

Title: Exposed to Agent Orange at US Bases, Veterans Face Cancer Without VA Compensation

Sourced From: kffhealthnews.org/news/article/agent-orange-us-bases-veterans-face-cancer-without-va-compensation/

Published Date: Mon, 29 Apr 2024 09:00:00 +0000

Did you miss our previous article…

https://www.biloxinewsevents.com/millions-were-booted-from-medicaid-the-insurers-that-run-it-gained-medicaid-revenue-anyway/

Kaiser Health News

Millions Were Booted From Medicaid. The Insurers That Run It Gained Medicaid Revenue Anyway.

Phil Galewitz, KFF Health News

Fri, 26 Apr 2024 13:55:00 +0000

Private Medicaid health plans lost millions of members in the past year as pandemic protections that prohibited states from dropping anyone from the government program expired.

But despite Medicaid's unwinding, as it's known, at least two of the five largest publicly traded companies selling plans have continued to increase revenue from the program, according to their latest earnings reports.

“It's a very interesting paradox,” said Andy Schneider, a research professor at Georgetown University's McCourt School of Public Policy, of plans' Medicaid revenue increasing despite enrollment drops.

Medicaid, the state-federal health program for low-income and disabled people, is administered by states. But most people enrolled in the program get their health care through insurers contracted by states, including UnitedHealthcare, Centene, and Molina.

The companies persuaded states to pay them more money per Medicaid enrollee under the assumption that younger and healthier people were dropping out — presumably for Obamacare coverage or employer-based health insurance, or because they didn't see the need to get coverage — leaving behind an older and sicker population to cover, their executives have told investors.

Several of the companies reported that states have made midyear and retrospective changes in their payments to plans to account for the worsening health status of members.

In an earnings call with analysts on April 25, Molina Healthcare CEO Joe Zubretsky said 19 states increased their payment rates this year to adjust for sicker Medicaid enrollees. “States have been very responsive,” Zubretsky said. “We couldn't be more pleased with the way our state customers have responded to having rates be commensurate with normal cost trends and trends that have been influenced by the acuity shift.”

Health plans have faced much uncertainty during the Medicaid unwinding, as states began reassessing enrollees' eligibility and dropping those deemed no longer qualified or who lost coverage because of procedural errors. Before the unwinding, plans said they expected the overall risk profile of their members to go up because those remaining in the program would be sicker.

UnitedHealthcare, Centene, and Molina had Medicaid revenue increases ranging from 3% to 18% in 2023, according to KFF. The two other large Medicaid insurers, Elevance and CVS Health, do not break out Medicaid-specific revenue.

The Medicaid enrollment of the five companies collectively declined by about 10% from the end of March 2023 through the end of December 2023, from 44.2 million people to 39.9 million, KFF data shows.

In the first quarter of 2024, UnitedHealth's Medicaid revenue rose to $20.5 billion, up from $18.8 billion in the same quarter of 2023.

Molina on April 24 reported nearly $7.5 billion in Medicaid revenue in the first quarter of 2024, up from $6.3 billion in the same quarter a year earlier.

On April 26, Centene reported that its Medicaid enrollment fell 18.5% to 13.3 million in the first quarter of 2024 compared with the same period a year ago. The company's Medicaid revenue dipped 3% to $22.2 billion.

Unlike UnitedHealthcare, whose Medicaid enrollment fell to 7.7 million in March 2024 from 8.4 million a year prior, Molina's Medicaid enrollment rose in the first quarter of 2024 to 5.1 million from 4.8 million in March 2023. Molina's enrollment jump last year was partly a result of its having bought a Medicaid plan in Wisconsin and gained a new Medicaid contract in Iowa, the company said in its earnings news release.

Molina added 1 million members because states were prohibited from terminating Medicaid coverage during the pandemic. The company has lost 550,000 of those people during the unwinding and expects to lose an additional 50,000 by June.

About 90% of Molina Medicaid members have gone through the redetermination process, Zubretsky said.

The corporate giants also offset the enrollment losses by getting more Medicaid money from states, which they use to pass on higher payments to certain facilities or providers, Schneider said. By holding the money temporarily, the companies can count these “directed payments” as revenue.

Medicaid health plans were big winners during the pandemic after the federal government prohibited states from dropping people from the program, leading to a surge in enrollment to about 93 million Americans.

States made efforts to limit health plans' profits by clawing back some payments above certain thresholds, said Elizabeth Hinton, an associate director at KFF.

But once the prohibition on dropping Medicaid enrollees was lifted last spring, the plans faced uncertainty. It was unclear how many people would lose coverage or when it would happen. Since the unwinding began, more than 20 million people have been dropped from the rolls.

Medicaid enrollees' health care costs were lower during the pandemic, and some states decided to exclude pandemic-era cost data as they considered how to set payment rates for 2024. That provided yet another win for the Medicaid health plans.

Most states are expected to complete their Medicaid unwinding processes this year.

——————————

By: Phil Galewitz, KFF Health News

Title: Millions Were Booted From Medicaid. The Insurers That Run It Gained Medicaid Revenue Anyway.

Sourced From: kffhealthnews.org/news/article/medicaid-unwinding-insurer-revenue/

Published Date: Fri, 26 Apr 2024 13:55:00 +0000

Did you miss our previous article…

https://www.biloxinewsevents.com/california-is-investing-500m-in-therapy-apps-for-youth-advocates-fear-it-wont-pay-off/

-

Local News4 days ago

Sister of Mississippi man who died after police pulled him from car rejects lawsuit settlement

-

Mississippi Today4 days ago

At Lake High School in Scott County, the Un-Team will never be forgotten

-

Mississippi Today1 day ago

On this day in 1951

-

Mississippi News2 days ago

One injured in Mississippi officer-involved shooting after chase

-

Mississippi News7 days ago

Cicadas expected to takeover north Mississippi counties soon

-

Mississippi News6 days ago

Viewers make allegations against Hatley teacher, school district releases statement – Home – WCBI TV

-

Mississippi News Video5 days ago

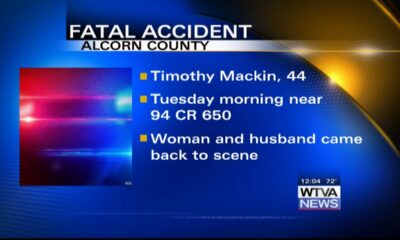

Vehicle struck and killed man lying in the road, Alcorn County sheriff says

-

Mississippi News4 days ago

Ridgeland man sentenced for molesting girl