Kaiser Health News

A $229,000 Medical Bill Goes to Court

by Dan Weissmann

Thu, 20 Apr 2023 09:00:00 +0000

In 2014, Lisa French had spinal surgery. Before the operation, she was told she would have to pay $1,337 in out-of-pocket costs and that her insurance would cover the rest. However, the hospital ended up sending French a bill for $229,000. When she didn't pay, it sued her.

The case went all the way to the Colorado Supreme Court. In this episode of “An Arm and a Leg,” host Dan Weissmann finds out how the court ruled and how the decision is reshaping the fine print on hospital bills in ways that could cost patients a lot of money.

Dan Weissmann

Host and producer of “An Arm and a Leg.” Previously, Dan was a staff reporter for Marketplace and Chicago's WBEZ. His work also appears on All Things Considered, Marketplace, the BBC, 99 Percent Invisible, and Reveal, from the Center for Investigative Reporting.

Credits

Emily Pisacreta

Producer

Adam Raymonda

Audio Wizard

Afi Yellow-Duke

Editor

Click to open the Transcript

Transcript: A $229,000 Medical Bill Goes to Court

Note: “An Arm and a Leg” uses speech-recognition software to generate transcripts, which may contain errors. Please use the transcript as a tool but check the corresponding audio before quoting the podcast.

Dan: Hey there–

Lisa French was a clerk for a trucking company in Denver. She'd been in a car crash, and her doctor told her that to keep her spine stable, she ought to get surgery.

She asked the folks at the hospital what it was gonna cost her, out of pocket. They ran her insurance and told her: Your end is going to be one thousand, three hundred thirty-six dollars, and ninety cents.

She said, thanks.

Then, she and her husband sat down at their kitchen table and talked it over: They had a rainy-day fund. A thousand dollars they'd socked away, they kept it at home, in cash. Were they ready to spend it all for this?

They decided they were, and Lisa went to the hospital with a thousand dollars cash.

She had the surgery, it went fine. The hospital had been expecting about 55 thousand dollars from Lisa's insurance. They actually got more like 74 thousand.

But they decided that wasn't enough. They decided they wanted their full sticker price: 303 thousand dollars. So they billed Lisa French for the rest: 229 thousand dollars.

And when they didn't get it, they sued her.

Lisa French had her surgery in 2014. The court case finally got resolved last year, in 2022, by the Colorado Supreme Court.

If you've been listening to this show for a while, you probably remember: We have gotten VERY interested in understanding, when we get a wild medical bill, what legal rights do we have? How can we use those rights to fight back? Even on a small scale, like in small claims court?

And even though Lisa French's case is a LONG way from small claims court, it has a LOT to teach us about these questions.

This is An Arm and a Leg, a show about why health care costs so freaking much, and what we can maybe do about it. I'm Dan Weissmann. I'm a reporter, and I like a challenge. So our job on this show is to take one of the most enraging, terrifying, depressing parts of American life, and bring you something entertaining, empowering, and useful.

And I should say upfront: We won't be hearing from Lisa French directly.

Her case made a lot of headlines– in 2018, when a jury heard it, in YEAR when an appeals court overturned the trial court, and last year when the state supreme court made its ruling.

Not in the kind of detail that we're gonna go into, but come on: Who can resist the headline?

Male Anchor: Well, tonight we have a story of David versus Goliath. David being a woman who needed spinal surgery in 2014 Goliath, the hospital that charged her more than $200,000 to do it.

Dan: So over the years, a lot of reporters wanted a sound bite from Lisa French. Her attorney used to let her know when there was an inquiry, and she'd say yes or no.

Eventually, she told her lawyer: Don't even tell me when they call anymore. I just want to live my life.

Fair enough.

So here's who we've got.

Ted Lavender: I'm Ted Lavender. I'm an attorney in Atlanta, Georgia. I've been practicing law for 26 years,

Dan: And he spent several of those years representing Lisa French.

It's probably worth answering one question up front: If Lisa French had to empty her family's rainy-day fund to pay the hospital a thousand bucks, who's paying the lawyer from Atlanta?

The insurance from her job. Which had played a role in starting the whole mess.

Ted Lavender: the company that she worked for had a health benefits plan that was slightly different than what you might call run of the mill health insurance.

Dan: It worked this way: They weren't in-network with any hospitals. Instead, they'd just take whatever bill any hospital sent, make their own evaluation of what a fair price would be, and send the hospital a check.

It's a somewhat unusual model– one survey says about 2 percent of employers use a plan like this– but Ted Lavender says it often works.

Ted Lavender: a very large percentage of the time , the hospital would accept the check and no one would hear anything more from the hospital, which in legal parlance would mean acceptance

Dan: And as a backstop, in case there was any trouble, the health plan would send a lawyer. That's Ted.

And here's what happened that led to all the trouble in Lisa French's case: Whoever ran her insurance card at the hospital, they didn't read it very carefully.

If they had, they would've seen a little logo under the insurance-company name that said, “provider only” — that is: This plan only has doctors and nurses and other PROVIDERS in network.

With hospitals, there's no network, no “in-network rate.” We'll just send a check for what we think is right.

The same health-benefits company has a different plan, one that does have a hospital network. You know how it is. Insurance companies, a million different plans, every one its own snowflake.

The hospital mistook Lisa French's snowflake for another one, and that's how they came up with that estimate.

Ted Lavender: based on their calculation, they expected to collect a total of

$56,000, the 1,336 from Ms. French and the remainder from her health plan.

Dan: And they presumably would've been happy with 56 thousand. But they got more. They got about 75 thousand dollars.

But once they got it, they wised up to the mistake they had made about Lisa French's insurance. They had no agreement with the insurance plan to accept 56 thousand.

So, they decided: There's no reason for us not to charge our full sticker price here.Three hundred and three thousand dollars.

So Lisa French had been expecting a bill for three hundred thirty-six dollars and ninety cents. That's the difference between what she'd been quoted and the thousand dollars she'd paid in advance. But the bill she got wasn't what she expected.

Ted Lavender: it turned out to be a whopper of a bill. We ended up with an itemized bill that showed every line item for every charge that totaled this

$303,000

And then at the bottom was, you know, subtracting the thousand she paid, subtracting the money the insurance paid, leaving a balance of 229,000 and change

Dan: Of course, Lisa French did not have 229 thousand dollars, or anything like it.

Ted Lavender: Eventually she got a visit from the sheriff who served her with a lawsuit and she was sued for that $229,000.

Dan: And that's where Ted Lavender entered the scene.

The jury trial in 2018 took six days. As Ted Lavender says, it wasn't exactly a splashy murder trial, in terms of drama.

Ted Lavender: this was a six day trial involving hospital billing. So, you know, there was no murder weapon. There was no aha, big, gotcha moment that was really exciting.

Dan: But Ted Lavender did his best. Like one time, when he got a hospital executive on the witness stand.

To stabilize Lisa French's spine, surgeons had implanted 13 pieces of metal into her body. So Ted Lavender had the hospital executive walk the jury through the price for each of those bits of metal. Or actually, the prices..

Ted Lavender: And I first showed him the itemized bill and asked him to identify what they charged for these 13 pieces of hardware .

I had given him sort of an oversized calculator that was sitting there in front of him on the witness stand, admittedly, for some dramatic effect

And through adding these up on the itemized bill, he arrived at the number which was $197,000.

Dan: A hundred and ninety-seven thousand dollars. So that's about two-thirds of the three hundred and three thousand dollars the hospital is trying to charge Lisa French.

And then the next thing I did was I handed in the 13 invoices that we had received from the hospital,

Dan: That is, Ted handed the guy the invoices the hospital had received — and paid — when it bought those bits of metal..

Ted Lavender: and I asked him to add up and tell this jury what did the hospital pay for these 13 pieces of hardware.

He's adding, and he's adding and he's punching in numbers, and he's turning pages and he's adding, and he's adding with each addition, with each plus the jury seemed to ease a little closer up to the front of their chair, and ultimately he arrived at the total, which was $31,000 and change.

Dan: So the hospital's charging like six and a half times what they paid. And that's two thirds of this 300 thousand dollar bill.

Ted Lavender: It just, you know, the jury seemingly did not like that.

Dan: So that was a good moment for Lisa French's side. I mean getting the jury mad at the other side, that's a win.

And the big calculator wasn't Ted Lavender's only visual: He also had a giant post-it note, where he wrote down, in magic marker, all the different prices the hospital accepted for the surgery, depending on who was paying.

Ted Lavender: and we got these numbers from the hospital, they would've accepted $146,000 from private insurance.

Dan: That's less than half of what they were trying to charge Lisa French. And they accepted less than that — a LOT less — from government-funded insurance, like Medicare, Medicaid, or Tricare, which covers folks in the military.

Ted Lavender: The average of what they would've accepted for these. Procedures that Ms. French had were $63,199. Again, Ms. French and her insurance company combined paid almost $75,000.

Dan: You can hear that post-it rustling around. It was a good prop, he's held onto it. So, he'd shown the jury that the hospital charged a HUGE markup, and that what they were suing Lisa French for was way, way more than they charged anybody else.

On the hospital's side, they were like, Yeah, but this is our actual sticker price. And Lisa French signed a piece of paper that said she would pay “all charges of the hospital.”

So the hospital was like, yep, and these are our charges. That 303 thousand dollars, it comes from a list we keep. It's called the chargemaster. That's what Lisa French was signing up for.

And this became something the jury had to decide:

When Lisa French signed a piece of paper saying she'd pay “all charges of the hospital” — was she specifically agreeing to pay what was on the chargemaster?

And here's one thing that might've made jurors a little skeptical on that score: The hospital never showed that chargemaster list to Lisa French. Not before her surgery, not after it. They said it was a trade secret.

Ted Lavender: they went all the way through trial. Never producing it though. We, we, we asked at the very beginning, once the lawsuit was filed, , basically you get to ask questions. Give me this information, give me information that supports your case or helps my case.

And we ask specifically for the charge master and they refuse to produce it on the basis that it was confidential and proprietary.

Dan: By withholding that list, the hospital may have helped Ted Lavender make his argument: How could Lisa French have known what she was signing up for, if she couldn't see the prices?

Ted Lavender: if we can't get it through our subpoena power, how in the world would Lisa Friendship been able to use it by, had she asked?

And admittedly she didn't ask for it, but if she had, surely they wouldn't have given it to her either.

Dan: In the end, the jury agreed: Lisa French had not specifically agreed to pay the hospital's chargemaster prices.

And the only other alternative was: She agreed to pay something reasonable.

The jury decided she owed the hospital seven hundred seventy six dollars and 74 cents

Basically, that's the three hundred and some left over from the original estimate, plus some extra — because she wound up staying in the hospital one night more than expected: She owed a fee for late check-out.

Of course the hospital did not take that lying down. They appealed the outcome– and won! Ted Lavender appealed that decision, which is how the case ended up in front of the Colorado Supreme Court.

We've actually got tape of those proceedings. They're kinda juicy. Plus the outcome, and why it matters for the rest of us. That's right after this.

This episode of An Arm and a Leg is produced in partnership with KFF Health News–formerly known as Kaiser Health News.

They're a national newsroom producing in-depth journalism about health care in America. We'll have more information about KFF Health News at the end of this episode.

OK, so Lisa French's case was headed to the Colorado Supreme Court.

And here's the big issue. Remember how the jury found that Lisa French hadn't actually agreed to pay the hospital's chargemaster price, the three hundred and three thousand dollars?

The hospital argued: The jury never should've been asked to consider that question.

The law — legal precedent — makes it open and shut: The appeals court had agreed. And it had cited other cases from courts around the country.

So when the hospital's lawyer, Mike McConnell, got up to address the Supreme Court, he led with those citations.

Mike McConnell: All of the questions that you have raised have been addressed in more than a dozen cases around the country. carefully and thoroughly.

Justice Richard L. Gabriel: Well, let me push back on you. Good morning to you, Mr. McConnell.

Mike McConnell: Good morning.

Dan: This is Justice Richard L Gabriel, stepping right in. He notes that these dozen other decisions all rest on one original case, from 2008, where a court had said: We can't intervene in health care pricing. Courts shouldn't try. Health care is too complicated.

Justice Gabriel wasn't convinced.

Justice Richard L. Gabriel: I guess the question I have is why, you know? I, you know, we may not be the smartest people in the world, but this is a contract and why should the hospital industry— different than any other industry on the planet —have different rules for contract principles?

Dan: The hospital lawyer argued that hospitals couldn't predict everything that would happen in a patient's care. In fact, the hospital can't even control it: Only physicians can decide what treatment to order.

Mike McConnell: You can, uh, I guess imagine that hospitals ought to be able to predict in advance what a particular physician is going to order for a particular patient. Um, and, uh, perhaps, you know, obviously you feel that is the way it ought to be. It is not the way it is, but now

Justice Melissa Hart: Mr. Mr. McConnell, I'm sorry, to interrupt…

Dan: Here's justice Melissa Hart breaking in

Justice Melissa Hart: …the hospital did provide an estimate in this case. They did calculate what they thought this was going to cost and tell her that. So it is, it seems false to me that they can't do it. Of course, they can't predict with absolute certainty. In this case, she had the extra night stay in the hospital and she paid for that. But they can predict in a case like this, and they do.

Dan: The justices didn't seem super-persuaded by McConnell's response to that. And that left one more big question in front of the justices.

When Lisa French signed a document promising to pay “all charges,” was she definitely agreeing to pay three hundred and three thousand dollars? Or 229 after insurance.

The appeals court found that the chargemaster rate — the 303 thousand — had been “incorporated by reference” to the document she'd signed, officially called the “hospital services agreement.”

The supreme court wasn't convinced. Here's Justice Richard Gabriel again.

Justice Richard L. Gabriel: There's no reference to the charge master on the face of the hospital services agreement.

How could she have assented to something she never even knew existed?

Dan: And here's how the hospital's lawyer responded.

Mike McConnell: When she read the provision, all charges not otherwise paid by insurance. She understood that the hospital charges would, she was responsible for paying the hospital charges that her insurance company did it,

Justice Richard L. Gabriel: Whatever it was. They could have charged her a billion dollars and she's your position to be she's bound because she agreed. All charges means all charges.

Dan: Huh! There wasn't a real comeback to that.

The Supreme Court ruled against the hospital, unanimously. Specifically, they ruled that the chargemaster– the 303 thousand dollars– had not been “incorporated by reference” to the piece of paper Lisa French had signed.

She didn't know those chargemaster list prices even existed. How could she agree to pay them?

So that meant, the court ruled that, quote, “the hospital services agreements left the price term open.”

Which is language that may ring a bell, if you've been listening to this show. It's a legal principle — a bedrock of contract law:

How the law treats an open-price contract — a contract that doesn't specify a price term.

Here's a refresher on that principle from Ted Lavender.

Ted Lavender: if you go to McDonald's and order a, a quarter pounder with cheese and you know, value meal number three, they tell you the price and that is the price that you have to pay. And then they give you your meal.

You enter that contract with an actual price term

Dan: But you can also enter an open-price contract — a contract without a price term.

Ted Lavender: if you have a contract without a price term, without a specific price in it, then the law infer into that contract a reasonable price.

Dan: In other words, a contract with the price term OPEN is not a blank check. I don't have to pay whatever number the other side makes up.

And that's what the Colorado Supreme Court found here.

They ruled that, quote, “principles of contract law can certainly be applied to hospital-patient contracts.” They say, a court may have ruled otherwise in 2008, and other courts may have cited that opinion. We disagree.

The Colorado Supreme Court is saying, even in health care, when no price is specified– when the price term is open– you have the right to a reasonable price.

Yes!

And that's why Lisa French's case is so interesting to us, here on this show.

Because we've talked here about using this legal principle to fight back against outrageous bills.

We've heard from one guy, Jeffrey Fox, who actually took a hospital to small claims court to enforce his right to a reasonable price. And won.

We've heard from a listener who tried and failed, but said, more of us should try this.

And this Colorado decision seems like good news for anybody interested in doing something like that.

But honestly, it also raises a few concerns that I had not known about before. First:

Well, there ARE all those other cases out there, in other states, that follow the 2008 case, the one that says health care is too complicated for courts to get into.

And yeah, here's Colorado saying, “No it isn't.”

But courts in other states aren't bound by Colorado's decision. Hm. And second: there's also something the Colorado court DIDN'T decide:

What if the paper Lisa French signed had specified, “I agree to pay the hospital's CHARGEMASTER rates?” Could she be required to pay them then? Even if they were a billion dollars?

In their decision, The Colorado court wrote that the chargemaster rates are “increasingly arbitrary” and “inflated” and “have lost any direct connection to hospitals actual cost.”

So Ted Lavender thinks they might've said, No, we can't be held to a billion dollars, just by adding the word “chargemaster.”

Ted Lavender: I think they would've answered that. No, but they did not come right out and actually answer that.

Dan: Because they didn't HAVE to answer that question.

Ted Lavender: Courts routinely, in fact, it's almost an objective of appeals courts. They answer as few a number of questions as possible to get to an answer. ,

Dan: So the Colorado court simpley ruled that in Lisa French's case, the chargemaster rates weren't “incorporated by reference” into papers she signed.

Those papers didn't didn't mention the chargemaster at all– and the hospital kept that chargemaster as a trade secret. Open, shut.

But… hospitals aren't supposed to keep those rates secret anymore. For the last couple of years, thanks to an executive order from the Trump administration, federal rules have required them to post their chargemaster to the internet.

And so I had all that in mind when I heard from a listener in Atlanta.

Cindi Gatton: my name is Cindy Gatton and I've been an independent patient advocate for 11 years now.

Dan: Cindi's job is helping people deal with medical bills, but she had actually written to me about her experience as a patient.

Before a medical appointment, she got the usual forms online, including one for “Patient Financial Agreement and Responsibilities”

Cindi Gatton: so I thought, you know what? I'm gonna print it and just see exactly what it says. And I'm reading through the thing it says, patient understands and agrees that he, she will be charge. The Piedmont Healthcare Standard charge master rates for all services not covered by a payer or that are self-pay.

I've never seen that before, and it shocked me that there was a reference to charge master rates in the financial disclosure.

Dan: And Cindi has been dealing with medical bills full-time for a decade. She's seen a lot. So when she says it's new, and that it's shocking, that seems worth noting.

Cindi Gatton: it just feels wrong to me. It feels really wrong because it, it reminds me of, you know, you, you go to a website and they give you their terms and conditions. Nobody reads those. I don't read them. You click yes so that you can move on with what it is you wanna do, which is to get care, to be seen by the doctor to, you know, have your procedure.

And I don't know this, this feels, um, it feels manipulative to me

Dan: Yeah, and to me, it feels ominous. Like lawyers who work for hospitals have been paying attention to the Lisa French decision and thinking:

There's a wedge here maybe we could exploit. Like, if we get you to sign a document that says “chargemaster” on it, we're getting you to sign away your right to a reasonable price. After all, the court in Colorado didn't come out and say that wouldn't be kosher.

So, where I'm landing at the end of this story is: I've got a couple big homework assignments:

First, if I'm interested in seeing how we can use our legal rights to fight back against outrageous, unreasonable bills — and I am —

I need to learn more about which states recognize our rights to a reasonable price in health care, and which ones … maybe don't. I'm on it, and if you've got any tips, please bring them.

That's the first assignment, and for the second, I'd love your help: How many hospitals are using this “chargemaster” language these days in those financial responsbility documents they ask us to sign?

Do me a favor: See if you can get a copy of that document from any hospital system or doctor group where you get seen. And send me a copy of it?

Redact anything you need to. And also know: we're not aiming to share this with anybody outside our reporting team.

Here's what happened when I tried this.

A hospital where I get seen uses a portal called MyChart– a lot of hospitals use it. I just logged on to MyChart there, and I did a little digging around. I found a link to something called “My Documents.” And I found a form there called Universal Consent.”

It has stuff about financial responsibility.

It doesn't mention chargemaster rates. But it's a year old. It also says it's expired.

And here's an idea I got from Cindi, which I'm gonna try– and which seems worth passing around.

When Cindi found that chargemaster language in the document from her Hospital, here's what she did. She printed it out and changed it:

Cindi Gatton: what I did is instead of the standard charge master rates, I drew a line through it and I wrote in two x Medicare rates.

Dan: In other words, instead of saying “I'll pay the chargemaster rates,” it says, “I'll pay two times the Medicare rate.”

We've heard about this strategy before, from former ProPublica reporter Marshall Allen, who wrote about it in his book, “Never Pay the First Bill.”

Here's the rationale. Medicare pays less than most commercial insurance; hospitals say that at least sometimes they lose money on Medicare. Doubling it seems … generous enough. But it also sets a limit.

So that's what Cindi wrote on her printout.

Cindi Gatton: I have been taking it with me when I go to be seen that if they ask me for the document that I can say, you know, here it is.

Dan: So far, she says, nobody's asked for it.

And, I don't think anybody will be confused, but just to make sure, I'll say: This isn't legal advice. I'm not a lawyer. Cindi's not a lawyer.

She's just a person going to the doctor, doing her best not to leave too many openings where she could get really screwed. And I'm gonna try following her example.

And I've got another request for you: If you try this trick of printing the thing out, exxing out the chargemaster language and writing 2 x medicare rates– LET ME KNOW WHAT HAPPENS, OK?

The place to do all this is on our website at arm and a leg show dot com, slash contact. That's arm and a leg show dot com, slash, contact.

You are this show's secret weapon. You're our eyes and ears. Cindi Gatton's a listener who got in touch.

How did I first learn about Lisa French's case? Email from a listener. [Thank you, Terry N, for that note last year! Took us a minute, but we got to this.]

Thank you for listening. You absolutely rule. I'll catch you soon.

Till then, take care of yourself.

This episode of An Arm and a Leg was produced by me, Dan Weissmann, with help from Emily Pisacreta, and edited by Afi Yellow-Duke.

Daisy Rosario is our consulting managing producer. Adam Raymonda is our audio wizard. Our music is by Dave Winer and Blue Dot Sessions.

Gabrielle Healy is our managing editor for audience. She edits the First Aid Kit Newsletter.

Bea Bosco is our consulting director of operations. Sarah Ballema is our operations manager.

An Arm and a Leg is produced in partnership with KFF Health News–formerly known as Kaiser Health News.

That's a national newsroom producing in-depth journalism about health care in America, and a core program at KFF — an independent source of health policy research, polling, and journalism.

And yes, you did hear the name Kaiser in there, and no: KFF isn't affiliated with the health care giant Kaiser Permanente. You can learn more about KFF Health News at arm and a leg show dot com, slash KFF.

Zach Dyer is senior audio producer at KFF Health News. He is editorial liaison to this show.

Thanks to Public Narrative — That's a Chicago-based group that helps journalists and nonprofits tell better stories– for serving as our fiscal sponsor, allowing us to accept tax-exempt donations. You can learn more about Public Narrative at www dot public narrative dot org.

And thanks to everybody who supports this show financially.

If you haven't yet, we'd love for you to join us. The place for that is arm and a leg show dot com, slash support.

Thank you!

“An Arm and a Leg” is a co-production of KFF Health News and Public Road Productions.

To keep in touch with “An Arm and a Leg,” subscribe to the newsletter. You can also follow the show on Facebook and Twitter. And if you've got stories to tell about the health care system, the producers would love to hear from you.

To hear all KFF Health News podcasts, click here.

And subscribe to “An Arm and a Leg” on Spotify, Apple Podcasts, Stitcher, Pocket Casts, or wherever you listen to podcasts.

By: Dan Weissmann

Title: A $229,000 Medical Bill Goes to Court

Sourced From: kffhealthnews.org/news/podcast/a-229000-medical-bill-goes-to-court/

Published Date: Thu, 20 Apr 2023 09:00:00 +0000

Did you miss our previous article…

https://www.biloxinewsevents.com/the-cdc-lacks-a-rural-focus-researchers-hope-a-newly-funded-office-will-help/

Kaiser Health News

Millions Were Booted From Medicaid. The Insurers That Run It Gained Medicaid Revenue Anyway.

Phil Galewitz, KFF Health News

Fri, 26 Apr 2024 13:55:00 +0000

Private Medicaid health plans lost millions of members in the past year as pandemic protections that prohibited states from dropping anyone from the government program expired.

But despite Medicaid's unwinding, as it's known, at least two of the five largest publicly traded companies selling plans have continued to increase revenue from the program, according to their latest earnings reports.

“It's a very interesting paradox,” said Andy Schneider, a research professor at Georgetown University's McCourt School of Public Policy, of plans' Medicaid revenue increasing despite enrollment drops.

Medicaid, the state-federal health program for low-income and disabled people, is administered by states. But most people enrolled in the program get their health care through insurers contracted by states, including UnitedHealthcare, Centene, and Molina.

The companies persuaded states to pay them more money per Medicaid enrollee under the assumption that younger and healthier people were dropping out — presumably for Obamacare coverage or employer-based health insurance, or because they didn't see the need to get coverage — leaving behind an older and sicker population to cover, their executives have told investors.

Several of the companies reported that states have made midyear and retrospective changes in their payments to plans to account for the worsening health status of members.

In an earnings call with analysts on April 25, Molina Healthcare CEO Joe Zubretsky said 19 states increased their payment rates this year to adjust for sicker Medicaid enrollees. “States have been very responsive,” Zubretsky said. “We couldn't be more pleased with the way our state customers have responded to having rates be commensurate with normal cost trends and trends that have been influenced by the acuity shift.”

Health plans have faced much uncertainty during the Medicaid unwinding, as states began reassessing enrollees' eligibility and dropping those deemed no longer qualified or who lost coverage because of procedural errors. Before the unwinding, plans said they expected the overall risk profile of their members to go up because those remaining in the program would be sicker.

UnitedHealthcare, Centene, and Molina had Medicaid revenue increases ranging from 3% to 18% in 2023, according to KFF. The two other large Medicaid insurers, Elevance and CVS Health, do not break out Medicaid-specific revenue.

The Medicaid enrollment of the five companies collectively declined by about 10% from the end of March 2023 through the end of December 2023, from 44.2 million people to 39.9 million, KFF data shows.

In the first quarter of 2024, UnitedHealth's Medicaid revenue rose to $20.5 billion, up from $18.8 billion in the same quarter of 2023.

Molina on April 24 reported nearly $7.5 billion in Medicaid revenue in the first quarter of 2024, up from $6.3 billion in the same quarter a year earlier.

On April 26, Centene reported that its Medicaid enrollment fell 18.5% to 13.3 million in the first quarter of 2024 compared with the same period a year ago. The company's Medicaid revenue dipped 3% to $22.2 billion.

Unlike UnitedHealthcare, whose Medicaid enrollment fell to 7.7 million in March 2024 from 8.4 million a year prior, Molina's Medicaid enrollment rose in the first quarter of 2024 to 5.1 million from 4.8 million in March 2023. Molina's enrollment jump last year was partly a result of its having bought a Medicaid plan in Wisconsin and gained a new Medicaid contract in Iowa, the company said in its earnings news release.

Molina added 1 million members because states were prohibited from terminating Medicaid coverage during the pandemic. The company has lost 550,000 of those people during the unwinding and expects to lose an additional 50,000 by June.

About 90% of Molina Medicaid members have gone through the redetermination process, Zubretsky said.

The corporate giants also offset the enrollment losses by getting more Medicaid money from states, which they use to pass on higher payments to certain facilities or providers, Schneider said. By holding the money temporarily, the companies can count these “directed payments” as revenue.

Medicaid health plans were big winners during the pandemic after the federal government prohibited states from dropping people from the program, leading to a surge in enrollment to about 93 million Americans.

States made efforts to limit health plans' profits by clawing back some payments above certain thresholds, said Elizabeth Hinton, an associate director at KFF.

But once the prohibition on dropping Medicaid enrollees was lifted last spring, the plans faced uncertainty. It was unclear how many people would lose coverage or when it would happen. Since the unwinding began, more than 20 million people have been dropped from the rolls.

Medicaid enrollees' health care costs were lower during the pandemic, and some states decided to exclude pandemic-era cost data as they considered how to set payment rates for 2024. That provided yet another win for the Medicaid health plans.

Most states are expected to complete their Medicaid unwinding processes this year.

——————————

By: Phil Galewitz, KFF Health News

Title: Millions Were Booted From Medicaid. The Insurers That Run It Gained Medicaid Revenue Anyway.

Sourced From: kffhealthnews.org/news/article/medicaid-unwinding-insurer-revenue/

Published Date: Fri, 26 Apr 2024 13:55:00 +0000

Did you miss our previous article…

https://www.biloxinewsevents.com/california-is-investing-500m-in-therapy-apps-for-youth-advocates-fear-it-wont-pay-off/

Kaiser Health News

California Is Investing $500M in Therapy Apps for Youth. Advocates Fear It Won’t Pay Off.

Molly Castle Work

Fri, 26 Apr 2024 09:00:00 +0000

With little pomp, California launched two apps at the start of the year offering free behavioral health services to youths to help them cope with everything from living with anxiety to body acceptance.

Through their phones, young people and some caregivers can meet BrightLife Kids and Soluna coaches, some who specialize in peer support or substance use disorders, for roughly 30-minute virtual counseling sessions that are best suited to those with more mild needs, typically those without a clinical diagnosis. The apps also feature self-directed activities, such as white noise sessions, guided breathing, and videos of ocean waves to help users relax.

“We believe they're going to have not just great impact, but wide impact across California, especially in places where maybe it's not so easy to find an in-person behavioral health visit or the kind of coaching and supports that parents and young people need,” said Gov. Gavin Newsom's health secretary, Mark Ghaly, during the Jan. 16 announcement.

The apps represent one of the Democratic governor's major forays into health technology and come with four-year contracts valued at $498 million. California is believed to be the first state to offer a mental health app with free coaching to all young residents, according to the Department of Health Care Services, which operates the program.

However, the rollout has been slow. So slow that one of the companies has missed a deadline to make its app available on Android phones. Only about 15,000 of the state's 12.6 million children and young adults have signed up for the apps, and school counselors say they've never heard of them.

Advocates for youth question the wisdom of investing taxpayer dollars in two private companies. Social workers are concerned the companies' coaches won't properly identify youths who need referrals for clinical care. And the spending is drawing lawmaker scrutiny amid a state deficit pegged at as much as $73 billion.

An App for That

Newsom's administration says the apps fill a need for young Californians and their families to access professional telehealth for free, in multiple languages, and outside of standard 9-to-5 hours. It's part of Newsom's sweeping $4.7 billion master plan for kids' mental health, which was introduced in 2022 to increase access to mental health and substance use support services. In addition to launching virtual tools such as the teletherapy apps, the initiative is working to expand workforce capacity, especially in underserved areas.

“The reality is that we are rarely 6 feet away from our devices,” said Sohil Sud, director of Newsom's Children and Youth Behavioral Health Initiative. “The question is how we can leverage technology as a resource for all California youth and families, not in place of, but in addition to, other behavioral health services that are being developed and expanded.”

The virtual platforms come amid rising depression and suicide rates among youth and a shortage of mental health providers. Nearly half of California youths from the ages of 12 to 17 report having recently struggled with mental health issues, with nearly a third experiencing serious psychological distress, according to a 2021 study by the UCLA Center for Health Policy Research. These rates are even higher for multiracial youths and those from low-income families.

But those supporting youth mental health at the local level question whether the apps will move the needle on climbing depression and suicide rates.

“It's fair to applaud the state of California for aggressively seeking new tools,” said Alex Briscoe of California Children's Trust, a statewide initiative that, along with more than 100 local partners, works to improve the social and emotional health of children. “We just don't see it as fundamental. And we don't believe the youth mental health crisis will be solved by technology projects built by a professional class who don't share the lived experience of marginalized communities.”

The apps, BrightLife Kids and Soluna, are operated by two companies: Brightline, a 5-year-old venture capital-backed startup; and Kooth, a London-based publicly traded company that has experience in the U.K. and has also signed on some schools in Kentucky and Pennsylvania and a health plan in Illinois. In the first five months of Kooth's Pennsylvania pilot, 6% of students who had access to the app signed up.

Brightline and Kooth represent a growing number of health tech firms seeking to profit in this space. They beat out dozens of other bidders including international consulting companies and other youth telehealth platforms that had already snapped up contracts in California.

Although the service is intended to be free with no insurance requirement, Brightline's app, BrightLife Kids, is folded into and only accessible through the company's main app, which asks for insurance information and directs users to paid licensed counseling options alongside the free coaching. After KFF Health News questioned why the free coaching was advertised below paid options, Brightline reordered the page so that, even if a child has high-acuity needs, free coaching shows up first.

The apps take an expansive view of behavioral health, making the tools available to all California youth under age 26 as well as caregivers of babies, toddlers, and children 12 and under. When KFF Health News asked to speak with an app user, Brightline connected a reporter with a mother whose 3-year-old daughter was learning to sleep on her own.

‘It's Like Crickets'

Despite being months into the launch and having millions in marketing funds, the companies don't have a definitive rollout timeline. Brightline said it hopes to have deployed teams across the state to present the tools in person by midyear. Kooth said developing a strategy to hit every school would be “the main focus for this calendar year.”

“It's a big state — 58 counties,” Bob McCullough of Kooth said. “It'll take us a while to get to all of them.”

Brightline's contract states that the company was required to launch downloadable apps for iOS and Android phones by January, but so far BrightLife Kids is available only on Apple phones. Brightline said it's aiming to launch the Android version over the summer.

“Nobody's really done anything like this at this magnitude, I think, in the U.S. before,” said Naomi Allen, a co-founder and the CEO of Brightline. “We're very much in the early innings. We're already learning a lot.”

The contracts, obtained by KFF Health News through a records request, show the companies operating the two apps could earn as much as $498 million through the contract term, which ends in June 2027, months after Newsom is set to leave office. And the state is spending hundreds of millions more on Newsom's virtual behavioral health strategy. The state said it aims to make the apps available long-term, depending on usage.

The state said 15,000 people signed up in the first three months. When KFF Health News asked how many of those users actively engaged with the app, it declined to say, noting that data would be released this summer.

KFF Health News reached out to nearly a dozen California mental health professionals and youths. None of them were aware of the apps.

“I'm not hearing anything,” said Loretta Whitson, executive director of the California Association of School Counselors. “It's like crickets.”

Whitson said she doesn't think the apps are on “anyone's” radar in schools, and she doesn't know of any schools that are actively advertising them. Brightline will be presenting its tool to the counselor association in May, but Whitson said the company didn't reach out to plan the meeting; she did.

Concern Over Referrals

Whitson isn't comfortable promoting the apps just yet. Although both companies said they have a clinical team on staff to assist, Whitson said she's concerned that the coaches, who aren't all licensed therapists, won't have the training to detect when users need more help and refer them to clinical care.

This sentiment was echoed by other school-based social workers, who also noted the apps' duplicative nature — in some counties, like Los Angeles, youths can access free virtual counseling sessions through Hazel Health, a for-profit company. Nonprofits, too, have entered this space. For example, Teen Line, a peer-to-peer hotline operated by Southern California-based Didi Hirsch Mental Health Services, is free nationwide.

While the state is also funneling money to the schools as part of Newsom's master plan, students and school-based mental health professionals voiced confusion at the large app investment when, in many school districts, few in-person counseling roles exist, and in some cases are dwindling.

Kelly Merchant, a student at College of the Desert in Palm Desert, noted that it can be hard to access in-person therapy at her school. She believes the community college, which has about 15,000 students, has only one full-time counselor and one part-time bilingual counselor. She and several students interviewed by KFF Health News said they appreciated having engaging content on their phone and the ability to speak to a coach, but all said they'd prefer in-person therapy.

“There are a lot of people who are seeking therapy, and people close to me that I know. But their insurances are taking forever, and they're on the waitlist,” Merchant said. “And, like, you're seeing all these people struggle.”

Fiscal conservatives question whether the money could be spent more effectively, like to bolster county efforts and existing youth behavioral health programs.

Republican state Sen. Roger Niello, vice chair of the Senate Budget and Fiscal Review Committee, noted that California is forecasted to face deficits for the next three years, and taxpayer watchdogs worry the apps might cost even more in the long run.

“What starts as a small financial commitment can become uncontrollable expenses down the road,” said Susan Shelley of the Howard Jarvis Taxpayers Association.

This article was produced by KFF Health News, which publishes California Healthline, an editorially independent service of the California Health Care Foundation.

——————————

By: Molly Castle Work

Title: California Is Investing $500M in Therapy Apps for Youth. Advocates Fear It Won't Pay Off.

Sourced From: kffhealthnews.org/news/article/california-youth-teletherapy-apps-rollout-slow/

Published Date: Fri, 26 Apr 2024 09:00:00 +0000

Kaiser Health News

KFF Health News’ ‘What the Health?’: Abortion — Again — At the Supreme Court

Wed, 24 Apr 2024 20:30:00 +0000

The Host

Julie Rovner

KFF Health News

Julie Rovner is chief Washington correspondent and host of KFF Health News' weekly health policy news podcast, “What the Health?” A noted expert on health policy issues, Julie is the author of the critically praised reference book “Health Care Politics and Policy A to Z,” now in its third edition.

Some justices suggested the Supreme Court had said its piece on abortion law when it overturned Roe v. Wade in 2022. This term, however, the court has agreed to review another abortion case. At issue is whether a federal law requiring emergency care in hospitals overrides Idaho's near-total abortion ban. A decision is expected by summer.

Meanwhile, the Centers for Medicare & Medicaid finalized the first-ever minimum staffing requirements for nursing homes participating in the programs. But the industry argues that there are not enough workers to hire to meet the standards.

This week's panelists are Julie Rovner of KFF Health News, Joanne Kenen of the Johns Hopkins University's nursing and public health schools and Politico Magazine, Tami Luhby of CNN, and Alice Miranda Ollstein of Politico.

Panelists

Joanne Kenen

Johns Hopkins University and Politico

Tami Luhby

CNN

Alice Miranda Ollstein

Politico

Among the takeaways from this week's episode:

- This week's Supreme Court hearing on emergency abortion care in Idaho was the first challenge to a state's abortion ban since the overturn of the constitutional right to an abortion. Unlike previous abortion cases, this one focused on the everyday impacts of bans on abortion care — cases in which pregnant patients experienced medical emergencies.

- Establishment medical groups and doctors themselves are getting more vocal and active as states set laws on abortion access. In a departure from earlier political moments, some major medical groups are campaigning on state ballot measures.

- Medicaid officials this week finalized new rules intended to more closely regulate managed-care plans that enroll Medicaid patients. The rules are intended to ensure, among other things, that patients have prompt access to needed primary care doctors and specialists.

- Also this week, the Federal Trade Commission voted to ban most “noncompete” clauses in employment contracts. Such language has become common in health care and prevents not just doctors but other health workers from changing jobs — often forcing those workers to move or commute to leave a position. Business interests are already suing to block the new rules, claiming they would be too expensive and risk the loss of proprietary information to competitors.

- The fallout from the cyberattack of Change Healthcare continues, as yet another group is demanding ransom from UnitedHealth Group, Change's owner. UnitedHealth said in a statement this week that the records of “a substantial portion of America” may be involved in the breach.

Plus for “extra credit” the panelists suggest health policy stories they read this week that they think you should read, too:

Julie Rovner: NBC News' “Women Are Less Likely To Die When Treated by Female Doctors, Study Suggests,” by Liz Szabo.

Alice Miranda Ollstein: States Newsroom's “Loss of Federal Protection in Idaho Spurs Pregnant Patients To Plan for Emergency Air Transport,” by Kelcie Moseley-Morris.

Tami Luhby: The Associated Press' “Mississippi Lawmakers Haggle Over Possible Medicaid Expansion as Their Legislative Session Nears End,” by Emily Wagster Pettus.

Joanne Kenen: States Newsroom's “Missouri Prison Agency To Pay $60K for Sunshine Law Violations Over Inmate Death Records,” by Rudi Keller.

Also mentioned on this week's podcast:

- American Economic Review's “Is There Too Little Antitrust Enforcement in the U.S. Hospital Sector?” by Zarek Brot-Goldberg, Zack Cooper, Stuart Craig, and Lev Klarnet.

- KFF Health News' “Medical Providers Still Grappling With UnitedHealth Cyberattack: ‘More Devastating Than Covid,” by Samantha Liss.

Credits

Francis Ying

Audio producer

Emmarie Huetteman

Editor

To hear all our podcasts, click here.

And subscribe to KFF Health News' “What the Health?” on Spotify, Apple Podcasts, Pocket Casts, or wherever you listen to podcasts.

——————————

Title: KFF Health News' ‘What the Health?': Abortion — Again — At the Supreme Court

Sourced From: kffhealthnews.org/news/podcast/what-the-health-344-abortion-supreme-court-april-25-2024/

Published Date: Wed, 24 Apr 2024 20:30:00 +0000

Did you miss our previous article…

https://www.biloxinewsevents.com/mandatory-reporting-laws-meant-to-protect-children-get-another-look/

-

Local News4 days ago

Sister of Mississippi man who died after police pulled him from car rejects lawsuit settlement

-

Mississippi Today4 days ago

At Lake High School in Scott County, the Un-Team will never be forgotten

-

Mississippi Today17 hours ago

On this day in 1951

-

Mississippi News2 days ago

One injured in Mississippi officer-involved shooting after chase

-

Mississippi News6 days ago

Cicadas expected to takeover north Mississippi counties soon

-

Mississippi News5 days ago

Viewers make allegations against Hatley teacher, school district releases statement – Home – WCBI TV

-

Mississippi News Video4 days ago

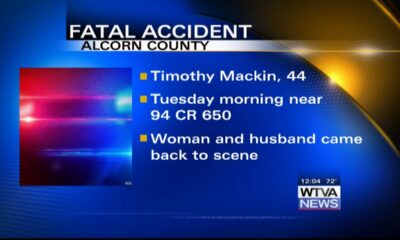

Vehicle struck and killed man lying in the road, Alcorn County sheriff says

-

Mississippi Today7 days ago

On this day in 1892