Home sales surged in the United States in the early months of the pandemic. From the first quarter of 2020 to the second, the homeownership rate in the U.S. climbed from 65.3% to 67.9% – the largest quarterly increase since record keeping began in the mid 1960s. And while owning a home offers several advantages over renting, it also comes with added expenses – not the least of which are property taxes.

Property taxes, specifically those on land and residential structures, are typically levied at the local level – by cities, counties, or school districts. State governments also often impose additional taxes on personal property such as cars or boats.

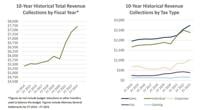

Typically used for funding public services such as schools, law enforcement, and infrastructure improvements, property taxes are the lifeblood of local communities across the United States. Nationwide, property taxes accounted for 32.2% of all state and local tax revenue in fiscal 2020, more than any other tax, including sales and income taxes. Depending on the state, property taxes account for anywhere from 16.8% to 64.0% of tax revenue. (Here is a look at the counties where families need to budget the most for taxes in every state.)

Exactly how much Americans pay each year in property taxes depends both on their local property tax rate and the value of their property. For example, if a single family home is valued at $200,000 in a given year and the local property tax rate is 1%, the property tax bill would come to $2,000.

With a median home value of $145,600 in 2021, Mississippi has the second least expensive housing market in the country, based on data from the U.S. Census Bureau's American Community Survey. And according to the Tax Foundation, an independent nonprofit tax policy research organization, the effective property tax rate in Mississippi was 0.67% in 2021, the 15th lowest among the 50 states.

Meanwhile, per capita state and local property tax collections in Mississippi totaled $1,167 in fiscal 2020, compared to $1,810 across the entire country.

All tax data in this story was compiled by the Tax Foundation.

| Rank | State | Effective property tax rate, 2021 (%) | Per capita state & local prop. tax collections, FY2020 ($) | Median home value, 2021 ($) |

|---|---|---|---|---|

| 1 | New Jersey | 2.23 | 3,431 | 389,800 |

| 2 | Illinois | 2.08 | 2,268 | 231,500 |

| 3 | New Hampshire | 1.93 | 3,285 | 345,200 |

| 4 | Vermont | 1.83 | 2,860 | 271,500 |

| 5 | Connecticut | 1.79 | 3,295 | 311,500 |

| 6 | Texas | 1.68 | 2,216 | 237,400 |

| 7 | Nebraska | 1.63 | 2,088 | 204,900 |

| 8 | Wisconsin | 1.61 | 1,717 | 230,700 |

| 9 | Ohio | 1.59 | 1,458 | 180,200 |

| 10 | Iowa | 1.52 | 1,806 | 174,400 |

| 11 | Pennsylvania | 1.49 | 1,644 | 222,300 |

| 12 | New York | 1.40 | 3,118 | 368,800 |

| 13 | Rhode Island | 1.40 | 2,449 | 348,100 |

| 14 | Michigan | 1.38 | 1,594 | 199,100 |

| 15 | Kansas | 1.34 | 1,712 | 183,800 |

| 16 | Maine | 1.24 | 2,862 | 252,100 |

| 17 | South Dakota | 1.17 | 1,606 | 219,900 |

| 18 | Massachusetts | 1.14 | 2,638 | 480,600 |

| 19 | Minnesota | 1.11 | 1,776 | 285,400 |

| 20 | Maryland | 1.05 | 1,744 | 370,800 |

| 21 | Alaska | 1.04 | 2,276 | 304,900 |

| 22 | Missouri | 1.01 | 1,114 | 198,300 |

| 23 | North Dakota | 0.98 | 1,538 | 224,400 |

| 24 | Oregon | 0.93 | 1,730 | 422,700 |

| 25 | Georgia | 0.92 | 1,336 | 249,700 |

| 26 | Florida | 0.91 | 1,541 | 290,700 |

| 27 | Oklahoma | 0.89 | 883 | 168,500 |

| 28 | Virginia | 0.87 | 1,830 | 330,600 |

| 29 | Washington | 0.87 | 1,727 | 485,700 |

| 30 | Indiana | 0.84 | 1,146 | 182,400 |

| 31 | Kentucky | 0.83 | 33 | 173,300 |

| 32 | North Carolina | 0.82 | 1,082 | 236,900 |

| 33 | California | 0.75 | 1,955 | 648,100 |

| 34 | Montana | 0.74 | 1,806 | 322,800 |

| 35 | New Mexico | 0.67 | 899 | 214,000 |

| 36 | Mississippi | 0.67 | 1,167 | 145,600 |

| 37 | Tennessee | 0.67 | 845 | 235,200 |

| 38 | Idaho | 0.67 | 1,131 | 369,300 |

| 39 | Arkansas | 0.64 | 798 | 162,300 |

| 40 | Arizona | 0.63 | 1,206 | 336,300 |

| 41 | Delaware | 0.61 | 1,049 | 300,500 |

| 42 | Nevada | 0.59 | 1,153 | 373,000 |

| 43 | Utah | 0.57 | 1,209 | 421,700 |

| 44 | West Virginia | 0.57 | 1,002 | 143,200 |

| 45 | South Carolina | 0.57 | 1,314 | 213,500 |

| 46 | Louisiana | 0.56 | 914 | 192,800 |

| 47 | Wyoming | 0.56 | 2,163 | 266,400 |

| 48 | Colorado | 0.55 | 1,956 | 466,200 |

| 49 | Alabama | 0.40 | 632 | 172,800 |

| 50 | Hawaii | 0.32 | 1,556 | 722,500 |