Kaiser Health News

Pot Boom Wakes Sleepy Dinosaur, Colorado

Markian Hawryluk

Mon, 25 Sep 2023 09:00:00 +0000

DINOSAUR, Colo. — There isn't much to this town a short drive from the national monument of the same name. A couple of gas stations, a liquor store, and a small motel line the two main drags, Brontosaurus Boulevard and Stegosaurus Freeway.

But this community of about 315 and its four marijuana dispensaries — one shop for every 79 residents — is a contender for the title of cannabis capital of Colorado.

Dinosaur, nestled in the northwestern corner of the state, is a five-minute drive to the Utah line and a couple of hours away from Wyoming, both states where recreational marijuana use is illegal.

Dinosaur lies at the intersection of U.S. Highway 40 (that's Brontosaurus Boulevard) and Colorado Highway 64 (Stegosaurus Freeway). The crossroads had long been a stop where truckers filled their fuel tanks and their bellies. But until weed came to town, there was little to sustain the local economy.

It's a classic story of a border town prospering from differing laws state to state, and how arbitrary lines drawn through a desolate landscape drive economic patterns. Coloradans from Dinosaur cross the border to get groceries and health care. Utahans come to Dinosaur for lottery tickets, liquor, and pot.

The four cannabis stores, which opened after the passage of a 2016 ballot measure, have changed the fortunes of a town that made repeated losing bets on other commodities before finally hitting the jackpot with marijuana.

“You'd be shocked how much money comes through here,” said Jim Evans, the town's treasurer. “There's money running out of our ears.”

Lando Blakley, who has lived in Dinosaur most of his life, opened the town's third retail store, Dino Dispensary, in 2018. He estimates that 95% of his business comes from out-of-state customers, some from as far away as North Dakota.

“Right now, cannabis is Dinosaur's lifeblood,” he said.

Utah has legalized medical marijuana, but with tight restrictions and few places to buy it. So, patients may have to travel hours to outlets in Salt Lake City or Ogden for an in-state supplier. But for those living in Vernal or other eastern towns, Dinosaur is the closest place to buy cannabis in person.

“If anyone had to travel in the wintertime to go to a dispensary in Salt Lake City, they're not going to do it,” said Michael, a 37-year-old who, like most pot-shop customers who spoke with KFF Health News, declined to give his last name after buying marijuana at one of the stores. “Why drive 300 miles and put your life at risk, when you can drive 30?”

It is illegal to bring marijuana over the border to Utah, but multiple customers said they've never had a problem. Still, a traffic stop for other reasons could have more serious consequences if police find marijuana in the car.

Utah residents Jackson and Chelsea order their cannabis online from Rocky Mountain Cannabis, located, appropriately, at 420 E. Brontosaurus Blvd. (420 is shorthand for smoking marijuana), and drive across the state line to pick it up.

“Everybody in Utah goes and gets their green card and then comes here and gets their marijuana,” Jackson said.

The cards, carried by people registered with Utah's medical marijuana program (about 70,000 of the state's 3.4 million residents), provide cover in case they get pulled over. Other customers say it's not worth the hassle to apply for a card and pay the $15 annual fee when none of that is required in Colorado.

At least two other Colorado towns rival Dinosaur in per capita retail cannabis outlets. Moffat in south-central Colorado boasts four marijuana stores in a town and surrounding area of just 818 people, due to a massive cannabis growing operation.

Sedgwick is another border town that has banked on weed, with three stores and a population of 172. The town sits in the northeastern corner of the state, less than 10 minutes from Nebraska, where marijuana is illegal for both medical and recreational use.

Some border towns opted against allowing marijuana stores, such as Rangely, from which residents now make the 18-mile trip to Dinosaur to buy cannabis.

The four stores in Dinosaur are bunched on the east side of town, just off Highway 40, pretty much the only locations that satisfy the town mandate to be at least 1,000 feet from a school. Most outlets want to be along the highway, to capture customers passing through. Someone could easily walk to all four stores, and some people do just that to dodge the state's daily 1-ounce purchase limit.

To say that cannabis has transformed the appearance of town would be a stretch. It remains a sleepy little town, with little else to drive its economy. Despite the thriving marijuana trade, there still seem to be more closed businesses than open ones.

In fact, the town isn't quite sure what to do with all the money it collects. It once limped along with an annual budget of $100,000 or less, but Dinosaur now rakes in that much each month in cannabis revenue alone.

In 2021, the town collected about $1.4 million in cannabis-related taxes and licensing fees.

When it first approved cannabis sales, the town collected a 5% tax that flowed into its general revenue fund. Residents voted to add a second 5% tax earmarked for infrastructure projects. It collects licensing fees from the retail stores and a marijuana grow operation and gets a portion of the cannabis revenue collected by the state.

That money has allowed the town to build new sewage ponds, repaint the inside of its water tank, and add new housing lots with paved roads and sewer and water connections. The town is in the midst of a beautification project, planting trees and flowers, and is refurbishing the former school building into a community recreation center. Where the town previously relied on the county sheriff for law enforcement and suffered through long response times, it has now hired three marshals of its own.

And last year, for the first time in decades, the town revived its annual festival, now called the Dinosaur Stone Age Stampede, with food, games, and music.

But most of the marijuana tax revenue goes into savings. The town expects to have about $3.5 million in its coffers by year-end, and, Evans said, Dinosaur draws some $230,000 a year in interest alone.

Becoming a cannabis hot spot wasn't a given. Heated debate erupted when the Town Council first considered allowing retail stores. Town leaders ultimately decided to let the residents choose at the polls. An initial ballot measure in 2010 failed.

By 2016, opinions changed as residents saw other border towns in Colorado flourishing while their town was quickly becoming … well, a dinosaur.

“People were seeing that the towns that had [legalized] was prospering,” said Mayor Richard Blakley, 70, who is the father of Dino Dispensary owner Lando Blakley. “And no real bad crime increase or stuff like that.”

The settlement that became Dinosaur was initially called Baxter Flats, but was established as a town in 1947, and named Artesia, a nod to the artesian wells in the surrounding hills. In 1966, the National Park Service told local leaders if they changed the name to Dinosaur, the town would prosper from its connection to the national monument known for its prehistoric fossils and petroglyphs.

Residents agreed and renamed their home and the streets. But prosperity never followed, in part because the Colorado side of the national monument has few dinosaur fossils. It's mostly a showcase of geology.

“People come in and ask, ‘Where's the museum? Where's the skeletons?'” Evans said. Other than a few scientifically questionable dinosaur sculptures, there's no Tyrannosaurus rex or Stegosaurus, no Velociraptor or Allosaurus.

As the national park rangers say, Utah has the bones, Colorado has the stones — or, as people say on the Utah side of the border, the stoned.

“We have a reputation,” Evans said. “You talk about Dinosaur in Utah, and it's like, ‘Yeah, they're all potheads and stuff.'”

The mayor said the town has seen few negative consequences from allowing marijuana, among them some people unprepared for the drug's potency being sickened by it. The town is growing. The population, which had dropped to 243 residents in the 2020 census, has rebounded to about 315, Blakley said. Many people have also purchased vacant lots to take advantage of the relatively cheap cost of real estate, making it difficult to find land in town.

Blakley hopes the economic growth will bring a grocery store. Residents drive 40 minutes to Vernal, Utah, or two hours to Grand Junction, to stock up on food or to receive medical care. Children go to school in Rangely since Dinosaur's school closed years ago. An urgent care clinic opened across from the town hall a few years ago, but it couldn't make a go of it.

Even if Dinosaur continues to grow, it won't add more cannabis stores. The Town Council capped the available licenses at four. And those four stores are now the essence of Dinosaur.

“Otherwise,” Evans, the treasurer, said, “this is a sad little town.”

——————————

By: Markian Hawryluk

Title: Pot Boom Wakes Sleepy Dinosaur, Colorado

Sourced From: kffhealthnews.org/news/article/pot-marijuana-boom-dinosaur-colorado-utah/

Published Date: Mon, 25 Sep 2023 09:00:00 +0000

Did you miss our previous article…

https://www.biloxinewsevents.com/officials-agree-use-settlement-funds-to-curb-youth-addiction-but-the-how-gets-hairy/

Kaiser Health News

Sign Here? Financial Agreements May Leave Doctors in the Driver’s Seat

Katheryn Houghton

Tue, 30 Apr 2024 09:00:00 +0000

Cass Smith-Collins jumped through hoops to get the surgery that would match his chest to his gender.

Living in Las Vegas and then 50, he finally felt safe enough to come out as a transgender man. He had his wife's support and a doctor's letter showing he had a long history of gender dysphoria, the psychological distress felt when one's sex assigned at birth and gender identity don't match.

Although in-network providers were available, Smith-Collins selected Florida-based surgeon Charles Garramone, who markets himself as an early developer of female-to-male top surgery and says that he does not contract with insurance. Smith-Collins said he was willing to pay more to go out-of-network.

“I had one shot to get the chest that I should have been born with, and I wasn't going to chance it to someone who was not an expert at his craft,” he said.

Smith-Collins arranged to spend a week in Florida and contacted friends there who could help him recover from the outpatient procedure, he said.

Garramone's practice required that the patient agree to its financial policies, according to documents shared by Smith-Collins. One document stated that “full payment” of Garramone's surgical fees is required four weeks in advance of surgery and that all payments to the practice are “non-refundable.”

Smith-Collins said he and his wife dipped into their retirement savings to cover the approximately $14,000 upfront. With prior authorization from his insurer in hand saying the procedure would be “covered,” he thought his insurance would reimburse anything he paid beyond his out-of-pocket maximum for out-of-network care: $6,900.

The day before surgery, Smith-Collins signed another agreement from the surgeon's practice, outlining how it would file an out-of-network claim with his insurance. Any insurance payment would be received by the doctor, it said.

The procedure went well. Smith-Collins went home happy and relieved.

Then the bill came. Or in this case: The reimbursement didn't.

The Patient: Cass Smith-Collins, now 52, who has employer-based coverage through UnitedHealthcare.

Medical Services: Double-incision top surgery with nipple grafts, plus lab work.

Service Provider: Aesthetic Plastic Surgery Institute, doing business as The Garramone Center, which is owned by Garramone, according to Florida public records.

Total Bill: The surgeon's practice billed the patient and insurance a total of $120,987 for his work. It charged the patient about $14,000 upfront — which included $300 for lab work and a $1,000 reservation fee — and then billed the patient's insurer an additional $106,687.

The surgeon later wrote the patient that the upfront fee was for the “cosmetic” portion of the surgery, while the insurance charge was for the “reconstructive” part. Initially, the insurer paid $2,193.54 toward the surgeon's claim, and the patient received no reimbursement.

After KFF Health News began reporting this story, the insurer reprocessed the surgeon's claim and increased its payment to the practice to $97,738.46. Smith-Collins then received a reimbursement from Garramone of $7,245.

What Gives: Many patients write to Bill of the Month each year with their own tangled billing question. In many cases — including this one — the short answer is that the patient misunderstood their insurance coverage.

Smith-Collins was in a confusing situation. UnitedHealthcare said his out-of-network surgery would be “covered,” then it later told Smith-Collins it didn't owe the reimbursement he had counted on. Then, after KFF Health News began reporting, he received a reimbursement.

Adding to the confusion were the practice's financial polices, which set a pre-surgery payment deadline, gave the doctor control of any insurance payment, and left the patient vulnerable to more bills (though, fortunately, he received none).

Agreeing to an out-of-network provider's own financial policy — which generally protects its ability to get paid and may be littered with confusing insurance and legal jargon — can create a binding contract that leaves a patient owing. In short, it can put the doctor in the driver's seat, steering the money.

The agreement Smith-Collins signed the day before surgery says that the patient understands he is receiving out-of-network care and “may be responsible for additional costs for all services provided” by the out-of-network practice.

Federal billing protections shield patients from big, out-of-network bills — but not in cases in which the patient knowingly chose out-of-network care. Smith-Collins could have been on the hook for the difference between what his out-of-network doctor and insurer said the procedure should cost: nearly $102,000.

Emails show Smith-Collins had a couple of weeks to review a version of the practice's out-of-network agreement before he signed it. But he said he likely hadn't read the entire document because he was focused on his surgery and willing to agree to just about anything to get it.

“Surgery is an emotional experience for anyone, and that's not an ideal time for anyone to sign a complex legal agreement,” said Marianne Udow-Phillips, a health policy instructor at the University of Michigan School of Public Health.

Udow-Phillips, who reviewed the agreement, said it includes complicated terms that could confuse consumers.

Another provision in the agreement says the surgeon's upfront charges are “a separate fee that is not related to charges made to your insurance.”

Months after his procedure, having received no reimbursement, Smith-Collins contacted his surgeon, he said. Garramone replied to him in an email, explaining that UnitedHealthcare had paid for the “reconstructive aspect of the surgery” — while the thousands of dollars Smith-Collins paid upfront was for the “cosmetic portion.”

Filing an insurance claim had initially led to a payment for Garramone, but no refund for Smith-Collins.

Garramone did not respond to questions from KFF Health News for this article or to repeated requests for an interview.

Smith-Collins had miscalculated how much his insurance would pay for an out-of-network surgeon.

Documents show that before the procedure Smith-Collins received a receipt from Garramone's practice marked “final payment” with a zero balance due, as well as prior authorization from UnitedHealthcare stating that the surgery performed by Garramone would be “covered.”

More from Bill of the Month

-

A Mom's $97,000 Question: How Was Her Baby's Air-Ambulance Ride Not Medically Necessary?

Mar 25, 2024

-

Without Medicare Part B's Shield, Patient's Family Owes $81,000 for a Single Air-Ambulance Flight

Feb 27, 2024

-

The Colonoscopies Were Free. But the ‘Surgical Trays' Came With $600 Price Tags.

Jan 25, 2024

But out-of-network providers aren't limited in what they can charge, and insurers don't have a minimum they must pay.

An explanation of benefits, or EOB, statement shows Garramone submitted a claim to UnitedHealthcare for more than $106,000. Of that, UnitedHealthcare determined the maximum it would pay — known as the “allowed amount” — was about $4,400. A UnitedHealthcare representative later told Smith-Collins in an email that the total was based on what Medicare would have paid for the procedure.

Smith-Collins' upfront charges of roughly $14,000 went well beyond the price the insurer deemed fair, and UnitedHealthcare wasn't going to pay the difference. By UnitedHealthcare's math, Smith-Collins' share of its allowed amount was about $2,200, which is what counted toward his out-of-pocket costs. That meant, in the insurer's eyes, Smith-Collins still hadn't reached his $6,900 maximum for the year, so no refund.

Neither UnitedHealthcare nor the surgeon provided KFF Health News with billing codes, making it difficult to compare the surgeon's charges to cost estimates for the procedure.

Garramone's website says his fee varies depending on the size and difficulty of the procedure. The site says his prices reflect his experience and adds that “cheaper” may lead to “very poor results.”

Though he spent more than he expected, Smith-Collins said he'll never regret the procedure. He said he had lived with thoughts of suicide since youth, having realized at a young age that his body didn't match his identity and feared others would target him for being trans.

“It was a lifesaving thing,” he said. “I jumped through whatever hoops they wanted me to go through so I could get that surgery, so that I could finally be who I was.”

The Resolution: Smith-Collins submitted two appeals with his insurer, asking UnitedHealthcare to reimburse him for what he spent beyond his out-of-pocket maximum. The insurer denied both appeals, finding its payments were correct based on the terms of his plan, and said his case was not eligible for a third, outside review.

But after being contacted by KFF Health News, UnitedHealthcare reprocessed Garramone's roughly $106,000 claim and increased its payment to the practice to $97,738.46.

Maria Gordon Shydlo, a UnitedHealthcare spokesperson, told KFF Health News the company's initial determination was correct, but that it had reprocessed the claim so that Smith-Collins is “only” responsible for his patient share: $6,755.

“We are disappointed that this non-contracted provider elected to charge the member so much,” she said.

After that new payment, Garramone gave Smith-Collins a $7,245 refund in mid-April.

The Takeaway: Udow-Phillips, who worked in health insurance for decades and led provider services for Blue Cross Blue Shield of Michigan, said she had never seen a provider agreement like the one Smith-Collins signed.

Patients should consult a lawyer before signing any out-of-network agreements, she said, and they should make sure they understand prior authorization letters from insurers.

The prior authorization Smith-Collins received “doesn't say covered in full, and it doesn't say covered at what rate,” Udow-Phillips said, adding later, “I am sure [Smith-Collins] thought the prior authorization was for the cost of the procedure.”

Patients can seek in-network care to feel more secure about what insurance will cover and what their doctors might charge.

But for those who have a specific out-of-network doctor in mind, there are ways to try to avoid sticker shock, said Sabrina Corlette, a research professor and co-director of the Center on Health Insurance Reforms at Georgetown University:

- Patients should always ask insurers to define what “covered” means, specifically whether that means payment in full and for what expenses. And before making an upfront payment, patients should ask their insurer how much of that total it would reimburse.

- Patients also can ask their provider to agree in advance to accept any insurance reimbursement as payment in full, though there's no requirement that they do so.

- And patients can try asking their insurer to provide an exact dollar estimate for their out-of-pocket costs and ask if they are refundable should insurance pick up the tab.

Bill of the Month is a crowdsourced investigation by KFF Health News and NPR that dissects and explains medical bills. Do you have an interesting medical bill you want to share with us? Tell us about it!

——————————

By: Katheryn Houghton

Title: Sign Here? Financial Agreements May Leave Doctors in the Driver's Seat

Sourced From: kffhealthnews.org/news/article/financial-agreements-out-of-network-doctors-top-surgery-bill-of-the-month-april-2024/

Published Date: Tue, 30 Apr 2024 09:00:00 +0000

Did you miss our previous article…

https://www.biloxinewsevents.com/an-arm-and-a-leg-the-hack/

Kaiser Health News

An Arm and a Leg: The Hack

Dan Weissmann

Tue, 30 Apr 2024 09:00:00 +0000

When Change Healthcare, a subsidiary of UnitedHealth Group, got hit by a cyberattack this winter, a big chunk of the nation's doctors, pharmacists, hospitals, and therapists stopped getting paid. The hack also limited health providers' ability to share medical records and other information critical to patient care.

The cyberattack revealed an often overlooked part of how health care is paid for in the United States and raised concerns for antitrust advocates about how large UnitedHealth has grown.

Host Dan Weissmann speaks with reporters Brittany Trang of Stat News and Maureen Tkacik of The American Prospect about their reporting on the hack and what it says about antitrust enforcement of health care companies.

Dan Weissmann

Host and producer of “An Arm and a Leg.” Previously, Dan was a staff reporter for Marketplace and Chicago's WBEZ. His work also appears on All Things Considered, Marketplace, the BBC, 99 Percent Invisible, and Reveal, from the Center for Investigative Reporting.

Credits

Emily Pisacreta

Producer

Adam Raymonda

Audio wizard

Ellen Weiss

Editor

Click to open the Transcript

Transcript: The Hack

Note: “An Arm and a Leg” uses speech-recognition software to generate transcripts, which may contain errors. Please use the transcript as a tool but check the corresponding audio before quoting the podcast.

Dan: Hey there.

Brittany Trang is a reporter at STAT News– that's a health care news outlet. We talked with Brittany's colleague Bob Herman in our last episode. Like Bob, she's been covering the business of health care.

And for Brittany, this story starts with Bob flagging a story to their team. He…

Brittany Trang: Dropped a link in the chat that said like, hey guys, I think we should write about this, question mark, and nobody replied,

Dan: The story was about a cyber-attack against a company called Change Healthcare.

Brittany Trang: I was like that sounds like a startup and I was like who cares about some sort of health tech startup

Dan: But Bob kept bringing it up.

Brittany Trang: And I finally clicked on the link, and I was like, oh no, this is a big deal. This touches most of the American healthcare system.

Dan: Yeah, and it's no joke. Change Healthcare is what's called a data clearinghouse. And it's a big one. It's an important part of health care's financial plumbing. Someone had gone in and basically hijacked their computer system and said, Unless we get $22 million dollars, we're not giving it back. So Change went offline, and a huge chunk of the country's Pharmacists, doctors, therapists, hospitals just stopped getting paid. And Change Healthcare stayed offline for weeks and weeks. As we record this, seven weeks in, big parts of it remain offline. And here's this other thing: Change Healthcare is not a startup. It's been around for like 20 years. And in late 2022, Change got purchased by another company– a company that's starting to become a real recurring character on this show: UnitedHealth Group.

You may remember: They're the country's biggest insurance company AND they've got their hands in just about every other part of health care, in a big way. For instance, they're the very biggest employer of physicians in the country, by a huge margin. They've got their own bank, which– among other things– offers payday loans to doctors. And they have a huge collection of companies that do back-end services. In our last episode we heard about Navi Health— and how, under United's ownership, insurance companies have been using NaviHealth's algorithm to cut off care for people in nursing homes. [Boy, yeah– that was a fun story…] And as we've been learning: When one company like this gets so big, their problems– like this cyber-attack– become everybody's problem. And in this case, everybody's problem seems to create an opportunity for United. We'll break down how THAT could possibly work, but obviously it doesn't seem like the way a lot of us would WANT things to work.. And we'll end up talking about what we can maybe do about it. Not “we” as in a bunch of individuals trying to tackle an opponent this big. Good luck with that. But “we” as in the “We the people” of the United States Constitution. We may already be on the case.

This is An Arm and a Leg– a show about why health care costs so freaking much, and what we can maybe do about it. I'm Dan Weissmann. I'm a reporter, and I like a challenge. So our job on this show is to take one of the most enraging, terrifying, depressing parts of American life, and bring you a show that's entertaining, empowering, and useful.

We'll start with an attempt to answer what you'd think would be a simple question: What does Change Healthcare do?

Here's Brittany Trang from STAT News again.

Brittany Trang: It's kind of like Visa or Mastercard or something. Like, when you go to the grocery store and you pay with a credit card, you are not putting your money directly into the pockets of the grocery store. There's a middleman in there and change is that middleman, but for a ton of different things.

Dan: Like insurance claims. Brittany says hospitals and doctors offices often don't submit claims directly to insurance companies. They send the claim to a middleman like Change. And then Change figures out where that claim needs to go next. Like: I'm sending a bunch of mail– I put it all in one mailbox, and the post office figures out how to get it where it goes. Except of course, there's no paper here, no envelopes, no physical packages: All those claims are basically data. Which is why a company like Change is called a data clearinghouse. And even if a given provider uses some other clearinghouse– and of course there are others– Change may still be involved. Because INSURANCE companies like Aetna also use Change as a place to COLLECT claims from providers. On that side, Change is kind of like a post-office box. But claims are just one of the types of data that Change handles. For instance…

Brittany Trang: when you went to the pharmacy counter or when you would check in at the doctor's office and they take your insurance information and figure out like what you're going to pay for this visit. Both of those processes were messed up.

Dan: Yeah, and there's more! Prior authorizations– like when your doctor checks in advance to make sure your insurance company is OK with paying for whatever. Those all go through companies like Change. So, if change is offline, do they do your MRI, or your surgery– and just hope it doesn't get denied when Change comes back? And once claims get approved, data for payments goes through Change too. So payments– a lot of payments– just stopped going out. Here's Brittany Trang.

Brittany Trang: it's just kind of flabbergasting how big this is. This collapsed most of healthcare in some way or another.

Dan: Overall, the numbers are wild: Change reportedly processes 1.5 trillion dollars a year in claims. Maybe a third of everything that happens in healthcare. According to the American Hospital Association, 94 percent of hospitals said they were affected. Some more than others. Not all providers use Change as their primary clearinghouse. But lots do. And for them, everything just stopped.

Brittany Trang: I talked to one provider she's like, Oh, I can, I can talk. I'm, here today and tomorrow before we close. And I was like, before we close for spring break. And she said, no, we have 3 and 13 cents left in our bank account. Brittany says that provider got a last minute reprieve– an emergency loan from United. There have been two or three rounds of these loans so far, plus some advance payments from Medicare. But as the outage has dragged on– it started in February, and we're recording this seven weeks later– it's hard to know if those are going to be enough. At the end of March, I talked with Emily Benson. She runs a therapy practice in a Minneapolis suburb. Eight clinicians, mostly treating kids. She says the practice does maybe 70 or 80 thousand dollars worth of business a month. But then in February… Emily Benson: essentially everything went dark for us.

Dan: United publicly acknowledged the Change hack on February 21st. But Emily Benson says she didn't actually get a heads-up until almost a week later.

Emily Benson: a lot of alarm bells went off, that was the end of the month. And so a lot of payments came due

Dan: Her rent. Paychecks for her colleagues, and herself.

Emily Benson: I mean, I was in a panic. Y'know, I didn't know where I was going to go.

Dan: She says she usually gets two payments a week from insurance, with everything passing through Change. But it's not just the payments from insurance. Change also provides the documents that say how much an insurance company is GOING to pay for any given claim.

Emily Benson: That's a critical document because that tells me what does the family owe us. And then the beneficiary is also going to get that information. So they're not surprised by what we charge them. So now every week we're stacking up and stacking up these amounts that the family's going to owe us.

Dan: By the time we talked, Emily Benson had gotten two loans from United. About 40,000 each: maybe a month's worth of billing for her, between the two loans.

Emily Benson: That first one was wiped out. Pretty quickly because now we're on week five I'm working on the second, um, installment that I got from united. But, you know, that's half gone now too. So I don't know what the next step is. We're nowhere near. Getting claims processing yet and so. I'm kind of panicking Yeah.

Emily Benson: it looks like the terms are within 45 days. You have to pay back that temporary loan. How am I going to do that if I don't have claims coming?

Dan: God.

Emily Benson: I'm still panicking.

Dan: I'll bet. Oh my God. You're very, you're very calm for somebody in this situation.

Emily Benson: Well, you know, I've had a lot of therapy of my own. That's how you become a therapist. So panicking doesn't help anyone.

Dan: I guess that's, I'll take that under advisement.

Dan: So, to pay back those loans– which are supposed to be repaid within 45 days– Emily Benson is gonna have to start getting paid again. As we spoke, she'd had been living without systems for filing claims and getting paid for five weeks. And even when those systems get moving again, she's not gonna see all that money right away.

Emily Benson: Imagine the backlog and the clog. Five weeks worth of insurance claims I mean, we're looking at a major traffic jam.

Dan: Oh myGod.Andif everybody were to work double time for the next five weeks, then it would be 10 weeks. But people can't really work double time.

Emily Benson: When you say that out loud,

Dan: Sorry.

Emily Benson: I don't feel as grounded,

Dan: I'm so sorry.

Emily Benson: but, but, but it's probably realistic.

Dan: Other news outlets are talking to providers like Emily Benson all over the country. We're recording this in mid-April. United hasn't responded to our questions on this story, but their website says “We're determined to make this right.” It says they've put out 4 point 7 billion dollars in emergency loans to providers so far. And it says that for the vast majority of Change Healthcare's services, a restoration date is “still pending.” We have no idea what's going to happen. What it'll mean for our doctors, our therapists, our local hospitals. And look, there are elements of this story that go beyond health care. How many of us have personal health information– maybe financial information– that got seized by who the heck knows who in this? And yes, United's getting some heat. They got a list of pointed questions from U.S. Representative Jamie Raskin. Their CEO is supposed to testify in a Senate hearing at the end of April. But as we'll get into in a minute, this disaster– United's disaster– could turn out to have a silver lining– for United: An opportunity to keep on growing. And that opportunity arises precisely because they're so big, and doing so much business in so many parts of the medical-industrial complex. Which doesn't sound great. It raises questions about the, uh, potential downsides for a lot of people, when individual companies get this freaking big. And it raises questions about what we can maybe do about it. And the answer is: Maybe more than we think. That's all coming right up.

This episode of An Arm and a Leg is produced in partnership with KFF Health News. That's a nonprofit newsroom covering health care in America. Their reporters do amazing work, and we're honored to be in cahoots with them. So, as we've seen, a company like United is so big that their problems become everybody's problem. And at least in one case that I've seen so far, everybody's problem can become United's opportunity. That's what happened in Oregon, and a reporter from Washington, DC, was in a position to make it a national story.

Maureen Tkacik: My name is Maureen Tkacik, but you can call me Mo and I am the Investigations Editor at the American Prospect, and a Senior Fellow at the American Economic Liberties Project.

Dan: The Prospect is a politically-progressive news magazine, and the Economic Liberties Project is a non-profit that pushes an anti-monopoly agenda. A lot of Mo's reporting looks at how financial behemoths are looking like monopolists– especially in health care. So…

Maureen Tkacik: have come to know United Healthcare, pretty well, over past, year or so,

Dan: Looking at, for instance, how they gobble up medical practices. And as we mentioned, that kind of gobbling has made United the biggest employer of physicians in the country– by huge margins– in just the last few years. About one doc in ten now works for them, as employees or “affiliates.” As we've reported before, big players– like United, like big hospital systems, and like private equity groups– have been gobbling up medical practices for years. And: that kind of consolidation often leads to us paying more– and often for lousier healthcare. Moe Tkacik has been reporting on that kind of gobbling– and recently, she'd been looking at how the state of Oregon had been trying to slow it down. Then, in January 2024, a good-size medical group in Corvallis, Oregon said they were ready for United to gobble them up. The group is called the Corvallis Clinic, and it's got more than a hundred docs. But United and the Clinic would have to go through a whole process to get approval from state regulators. That process includes: regulators asking the public for comments on the transaction. And in this case…

Maureen Tkacik: they were. inundated with comments.

Dan: Like 378 of them in just a few weeks. And the comments were overwhelmingly AGAINST the sale. In February, the regulators sent United and Corvallis a 5-page list of conditions under which they might approve a deal. A source of Moe's sent me the document, which he got through a public-records request. The conditions are like, to not reduce service levels in the community for at least 10 years. To keep accepting non-United insurance. And to submit to a lot of monitoring. Then, as negotiations were starting, Change Healthcare went offline. And in early March, Moe got a tip: The clinic and United were gonna make an end run around this process. She talked with an anonymous insider at the clinic. Who told her: It turns out that all of the clinic's billing had been connected to Change.

Maureen Tkacik: So we're talking about just a calamitous cash crunch. Their revenue came to a standstill

Dan: And by the time Moe's insider source learned what was up– this had been going on for two weeks.

Maureen Tkacik: this source said that , Thursday, they all had a meeting and they were not sure they were going to be able to open their doors the following Monday.

Dan: That was Thursday March 7. The next day, March 8th, lawyers for Corvallis Clinic filed an application for an emergency exemption from the normal review process. A week later, they got that exemption. And this time regulators had not demanded any conditions. As Moe's story laid out, United's problem– the Change Healthcare hack– became everybody's problem, including Corvallis. And their problem seemed to have become United's opportunity. To gobble up the practice without having to agree to any conditions from pesky regulators. And a postscript to the Corvallis Clinic story: Shortly after regulators approved that deal, United sent notices to thousands of patients at another clinic it had taken over in nearby Eugene, saying basically: We don't have a doctor for you anymore. Goodbye and good luck. News reports said that clinic had lost more than 30 doctors since United took over. And among the public comments urging regulators to kibosh the Corvallis clinic, a bunch of people cited lousy experiences at that Eugene clinic under United's ownership. This is the kind of thing that Moe Tkacik and her colleagues at the American Economic Liberties Project– and what's become a kind of anti-monopoly movement– want to change. And here's where this episode becomes maybe just a little less of a horror story, and maybe a little more of an action movie. Because the anti-monopoly movement has gotten a big backer in the last three years: The Biden Administration. In 2017, a woman named Lina Khan made a name for herself in legal circles when she published a paper arguing that Amazon had become the kind of super-dominant company that antitrust laws were designed to constrain. Lina Khan was a law student when she published that paper. In 2021, Joe Biden appointed her to lead the Federal Trade Commission. The FTC and the Department of Justice split the job of antitrust enforcement, and they've both become super-aggressive. They've filed big lawsuits against Google, Amazon, and– in March of this year– Apple. And gotten a fair amount of attention. As we were writing up this episode, Jon Stewart interviewed Lina Khan on “The Daily Show.” And here's how she described her approach in that conversation.

LK: We've really focused on how companies are behaving. Are they behaving in ways that suggest they can harm their customers, harm their suppliers, harm their workers, and get away with it? And that type of too big to care type approach is really what ends up signaling that a company has monopoly power because they can start mistreating you, but they know you're stuck.

Dan: Earlier this year, the Wall Street Journal reported that Lina Khan's allies– antitrust folks at the Department of Justice are investigating United. Neither the Justice Department nor United has commented on that report. Meaning: Nobody's denied it. So far, some of the Biden administration's antitrust lawsuits have pan out, and some haven't. Actually, in 2021, the Justice Department sued to prevent UnitedHealth Group from buying Change Healthcare. That one, they lost. But when the sued to block Penguin Random House from buying another giant publisher, Simon and Schuster, they won. And as Lina Khan told Jon Stewart, she and her colleagues aren't just suing to prevent mergers. They sued to get infamous Pharma Bro Martin Skhreli banned for life from the pharma trade. And they won. And they're looking at other ways big companies, especially in health care, screw people.

LK: Just to give you one example, inhalers. They've been around for decades, but they still cost hundreds of dollars. So our staff took a close look and we've realized the, some of the patents that had been listed for these inhalers were improper. There were bogus. And so we sent hundreds of warning letters around these patents. And in the last few weeks, we've seen companies deal list these patents and three out of the four major manufacturers have now said, Within a couple of months, they're going to cap how much Americans pay to just 35.

Dan: I think we should start paying a lot more attention to what Lina Khan and her colleagues are up to– and what their chances are. I've started reading up, and getting in touch with folks who are in this fight, and who are watching it closely. Because this is looking like the kind of action movie I kind of like. Meanwhile, I'm posting a link to Jon Stewart's interview with Lina Khan wherever you're listening to this. I'll have a few other links for you in our newsletter– you can sign up for that at arm and a leg show dot com, slash, newsletter. And I'll catch you in a few weeks. Till then, take care of yourself.

This episode of an arm and a leg was produced by me, Dan Weissmann, with help from Emily Pisacreta, and edited by Ellen Weiss. Big thanks this time to the novelist, journalist and activist Cory Doctorow, who has been writing about the antitrust revival for years, breaking down complex, technical stories in clear, accessible ways. Thanks to professor Spencer Waller from the Loyola University Chicago law school for talking about antitrust with me. And thanks to Dr. John Santa in Oregon– for sharing material he got via a public-records request to the state, and for his observations. Adam Raymonda is our audio wizard. Our music is by Dave Weiner and blue dot sessions. Extra music in this episode from Epidemic Sound. Gabrielle Healy is our managing editor for audience. She edits the first aid kit newsletter. Bea Bosco is our consulting director of operations. Sarah Ballama is our operations manager. And Armand a Leg is produced in partnership with KFF Health News. That's a national newsroom producing in depth journalism about healthcare in America and a core program at KFF, an independent source of health policy research, polling and journalism. Zach Dyer is senior audio producer at KFF Health News. He's editorial liaison to this show. And thanks to the Institute for Nonprofit News for serving as our fiscal sponsor, allowing us to accept tax exempt donations. You can learn more about INN at INN. org. Finally, thanks to everybody who supports this show financially– you can join in any time at arm and a leg show dot com, slash, support– and thanks for listening.

“An Arm and a Leg” is a co-production of KFF Health News and Public Road Productions.

To keep in touch with “An Arm and a Leg,” subscribe to the newsletter. You can also follow the show on Facebook and the social platform X. And if you've got stories to tell about the health care system, the producers would love to hear from you.

To hear all KFF Health News podcasts, click here.

And subscribe to “An Arm and a Leg” on Spotify, Apple Podcasts, Pocket Casts, or wherever you listen to podcasts.

——————————

By: Dan Weissmann

Title: An Arm and a Leg: The Hack

Sourced From: kffhealthnews.org/news/podcast/the-hack/

Published Date: Tue, 30 Apr 2024 09:00:00 +0000

Did you miss our previous article…

https://www.biloxinewsevents.com/what-floridas-new-6-week-abortion-ban-means-for-the-south-and-traveling-patients/

Kaiser Health News

What Florida’s New 6-Week Abortion Ban Means for the South, and Traveling Patients

Christopher O'Donnell, Tampa Bay Times

Mon, 29 Apr 2024 09:00:00 +0000

Monica Kelly was thrilled to learn she was expecting her second child.

The Tennessee mother was around 13 weeks pregnant when, according to a lawsuit filed against the state of Tennessee, doctors gave her the devastating news that her baby had Patau syndrome.

The genetic disorder causes serious developmental defects and often results in miscarriage, stillbirth, or death within one year of birth. Continuing her pregnancy, doctors told her, could put her at risk of infection and complications that include high blood pressure, organ failure, and death.

But they said they could not perform an abortion due to a Tennessee law banning most abortions that went into effect two months after the repeal of Roe v. Wade in June 2022, court records show.

So Kelly traveled to a northwestern Florida hospital to get an abortion while about 15 weeks pregnant. She is one of seven women and two doctors suing Tennessee because they say the state's near-total abortion ban imperils the lives of pregnant women.

More than 25,000 women like Kelly traveled to Florida for an abortion over the past five years, state data shows. Most came from states such as Alabama, Louisiana, and Mississippi with little or no access to abortion, data from the Centers for Disease Control and Prevention shows. Hundreds traveled from as far as Texas.

But a recent Florida Supreme Court ruling paved the way for the Sunshine State to enforce a six-week ban beginning in May, effectively leaving women in much of the South with little or no access to abortion clinics. The ban could be short-lived if 60% of Florida voters in November approve a constitutional amendment adding the right to an abortion.

Related Coverage

Conservative Justices Stir Trouble for Republican Politicians on Abortion

In the meantime, nonprofit groups are warning they may not be able to meet the increased demand for help from women from Florida and other Southeastern states to travel for an abortion. They fear women who lack the resources will be forced to carry unwanted pregnancies to term because they cannot afford to travel to states where abortions are more available.

That could include women whose pregnancies, like Kelly's, put them at risk.

“The six-week ban is really a problem not just for Florida but the entire Southeast,” said McKenna Kelley, a board member of the Tampa Bay Abortion Fund. “Florida was the last man standing in the Southeast for abortion access.”

Travel Bans and Stricter Limits

Supporters of the Florida restrictions aren't backing down. Some want even stricter limits. Republican state Rep. Mike Beltran voted for both the 15-week and six-week bans. He said the vast majority of abortions are elective and that those related to medical complications make up a tiny fraction.

State data shows that 95% of abortions last year were either elective or performed due to social or economic reasons. More than 5% were related to issues with either the health of the mother or the fetus.

Beltran said he would support a ban on travel for abortions but knows it would be challenged in the courts. He would support measures that prevent employers from paying for workers to travel for abortions and such costs being tax-deductible, he said.

“I don't think we should make it easier for people to travel for abortion,” he said. “We should put things in to prevent circumvention of the law.”

Both abortion bans were also supported by GOP state lawmaker Joel Rudman. As a physician, Rudman said, he has delivered more than 100 babies and sees nothing in the current law that sacrifices patient safety.

“It is a good commonsense law that provides reasonable exceptions yet respects the sanctity of life for both mother and child,” he said in a text message.

Last year, the first full year that many Southern states had bans in place, more than 7,700 women traveled to Florida for an abortion, an increase of roughly 59% compared with three years ago.

The Tampa Bay Abortion Fund, which is focused on helping local women, found itself assisting an influx of women from Arkansas, Georgia, Mississippi, Louisiana, and other states, Kelley said.

In 2023, it paid out more than $650,000 for appointment costs and over $67,000 in other expenses such as airplane tickets and lodging. Most of those who seek assistance are from low-income families including minorities or disabled people, Kelley said.

“We ask each person, ‘What can you contribute?'” she said. “Some say zero and that's fine.”

Florida's new law will mean her group will have to pivot again. The focus will now be on helping people seeking abortions travel to other states.

But the destinations are farther and more expensive. Most women, she predicted, will head to New York, Illinois, or Washington, D.C. Clinic appointments in those states are often more expensive. The extra travel distance will mean help is needed with hotels and airfare.

North Carolina, which allows abortions through about 12 weeks of pregnancy, may be a slightly cheaper option for some women whose pregnancies are not as far along, she said.

Keeping up with that need is a concern, she said. Donations to the group soared to $755,000 in 2022, which Kelley described as “rage donations” made after the U.S. Supreme Court ended half a century of guaranteeing the federal right to an abortion.

The anger didn't last. Donations in 2023 declined to $272,000, she said.

“We're going to have huge problems on our hands in a few weeks,” she said. “A lot of people who need an abortion are not going to be able to access one. That's really scary and sad.”

Gray Areas Lead to Confusion

The Chicago Abortion Fund is expecting that many women from Southeastern states will head its way.

Illinois offers abortions up until fetal viability — around 24 to 26 weeks. The state five years ago repealed its law requiring parents to be notified when their children seek an abortion.

About 3 in 10 abortions performed in Illinois two years ago — almost 17,000 — involved out-of-state residents, up from fewer than a quarter the previous year, according to state records.

The Chicago nonprofit has prided itself on not turning away requests for help over the past five years, said Qudsiyyah Shariyf, a deputy director. It is adding staffers, including Spanish-language speakers, to cope with an anticipated uptick in calls for help from Southern states. She hopes Florida voters will make the crisis short-lived.

“We're estimating we'll need an additional $100,000 a month to meet that influx of folks from Florida and the South,” she said. “We know it's going to be a really hard eight months until something potentially changes.”

Losing access to abortion, especially among vulnerable groups like pregnant teenagers and women with pregnancy complications, could also increase cases of mental illness such as depression, anxiety, and even post-traumatic stress disorder, said Silvia Kaminsky, a licensed marriage and family therapist in Miami.

related coverage

Can a Fetus Be an Employee? States Are Testing the Boundaries of Personhood After ‘Dobbs'

Kaminsky, who serves as board president of the American Association for Marriage and Family Therapy, said the group has received calls from therapists seeking legal guidance about whether they can help a client who wants to travel for an abortion.

That's especially true in states such as Alabama, Georgia, and Missouri that have passed laws granting “personhood” status to fetuses. Therapists in many states, including Florida, are required to report a client who intends to harm another individual.

“It's creating all these gray areas that we didn't have to deal with before,” Kaminsky said.

Deborah Dorbert of Lakeland, Florida, said that Florida's 15-week abortion limit put her health at risk and that she was forced to carry to term a baby with no chance of survival.

Her unborn child was diagnosed with Potter syndrome in November 2022. An ultrasound taken at 23 weeks of pregnancy showed that the fetus had not developed enough amniotic fluid and that its kidneys were undeveloped.

Doctors told her that her child would not survive outside the womb and that there was a high risk of a stillbirth and, for her, preeclampsia, a pregnancy complication that can result in high blood pressure, organ failure, and death.

One option doctors suggested was a pre-term inducement, essentially an abortion, Dorbert said.

Dorbert and her husband were heartbroken. They decided an abortion was their safest option.

At Lakeland Regional Health, she said, she was told her surgery would have to be approved by the hospital administration and its lawyers since Florida had that year enacted its 15-week abortion restriction.

Florida's abortion law includes an exemption if two physicians certify in writing that a fetus has a fatal fetal abnormality and has not reached viability. But a month elapsed before she got an answer in her case. Her doctor told her the hospital did not feel they could legally perform the procedure and that she would have to carry the baby to term, Dorbert said.

Lakeland Regional Health did not respond to repeated calls and emails seeking comment.

Dorbert's gynecologist had mentioned to her that some women traveled for an abortion. But Dorbert said she could not afford the trip and was concerned she might break the law by going out of state.

At 37 weeks, doctors agreed to induce Dorbert. She checked into Lakeland Regional Hospital in March 2023 and, after a long and painful labor, gave birth to a boy named Milo.

“When he was born, he was blue; he didn't open his eyes; he didn't cry,” she said. “The only sound you heard was him gasping for air every so often.”

She and her husband took turns holding Milo. They read him a book about a mother polar bear who tells her cub she will always love them. They sang Bob Marley and The Wailers' “Three Little Birds” to Milo with its chorus that “every little thing is gonna be alright.”

Milo died in his mother's arms 93 minutes after being born.

One year later, Dorbert is still dealing with the anguish. The grief is still “heavy” some days, she said.

She and her husband have discussed trying for another child, but Florida's abortion laws have made her wary of another pregnancy with complications.

“It makes you angry and frustrated. I could not get the health care I needed and that my doctors advised for me,” she said. “I know I can't go through what I went through again.”

——————————

By: Christopher O'Donnell, Tampa Bay Times

Title: What Florida's New 6-Week Abortion Ban Means for the South, and Traveling Patients

Sourced From: kffhealthnews.org/news/article/florida-6-week-abortion-ban-patient-travel-south/

Published Date: Mon, 29 Apr 2024 09:00:00 +0000

Did you miss our previous article…

https://www.biloxinewsevents.com/exposed-to-agent-orange-at-us-bases-veterans-face-cancer-without-va-compensation/

-

Local News5 days ago

Sister of Mississippi man who died after police pulled him from car rejects lawsuit settlement

-

Mississippi Today5 days ago

At Lake High School in Scott County, the Un-Team will never be forgotten

-

Mississippi Today2 days ago

On this day in 1951

-

Mississippi News3 days ago

One injured in Mississippi officer-involved shooting after chase

-

Mississippi News7 days ago

Viewers make allegations against Hatley teacher, school district releases statement – Home – WCBI TV

-

Mississippi News Video6 days ago

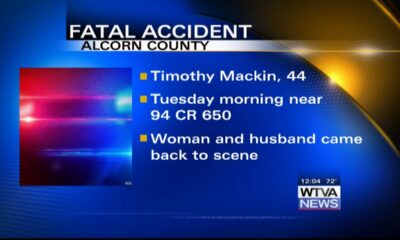

Vehicle struck and killed man lying in the road, Alcorn County sheriff says

-

Mississippi News5 days ago

Ridgeland man sentenced for molesting girl

-

Mississippi News6 days ago

Suspected Dollar General armed robber arrested in Pickens County