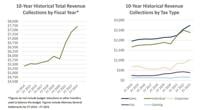

Last June, the average price of a gallon of gasoline in the United States exceeded $5 for the first time in the nation's history. The two biggest causes were the gradual end of the pandemic and the Russian invasion of Ukraine, resulting in Western nations imposing embargoes on Russian oil, with the U.S. banning Russian oil entirely in March 2022.

Since then, gas prices have fallen back down, but remain well above any pre-pandemic monthly average going back more than five years. Depending on the state, the average amount Americans are paying at the pump varies from a little over $3 to nearly $5. That variance is largely the result of different transportation and refining costs and, of course, taxes.

While the federal government levies a tax of 18.4 cents on every gallon of gas sold in the United States, each state adds on its own excise tax on top of that. State-imposed gas taxes and fees can account for anywhere from 2.3% of the total cost of gas to 16.5%, depending on where you live.

In Mississippi, gasoline is taxed at a rate of 18 cents per gallon, tied as the fourth lowest among states. With a gallon of gas costing an average of $3.14 in Mississippi in mid-April 2023, state gas taxes account for about 5.7% of the total cost of fuel.

Based on data from the Federal Highway Administration, fuel consumption was around 1,225 gallons per licensed driver in 2021, meaning the typical motorist spent an estimated $221 in state gas taxes alone that year.

Data on average state gas taxes as of April 2023 from business tax compliance platform IGEN. State gas taxes do not include the federal gas tax of 18.4 cents per gallon. Supplemental data on the average price of regular gas by state came from AAA and is current as of April 11, 2023. Data on motor fuel consumption and the number of licensed drivers used to calculate annual motor fuel consumption per licensed driver by state came from the Federal Highway Administration and is for 2021.

| Rank | State | Gasoline tax (cents per gal.) | Avg. cost of a gal. of regular gas; April 2023 ($) | State gas taxes as pct. of gas price (%) | State gas tax spending per capita ($) |

|---|---|---|---|---|---|

| 1 | Pennsylvania | 61.10 | 3.70 | 16.5 | 419 |

| 2 | California | 53.90 | 4.89 | 11.0 | 342 |

| 3 | Washington | 49.40 | 4.40 | 11.2 | 284 |

| 4 | Maryland | 42.70 | 3.54 | 12.1 | 295 |

| 5 | Illinois | 42.30 | 3.98 | 10.6 | 296 |

| 6 | New Jersey | 42.10 | 3.40 | 12.4 | 283 |

| 7 | North Carolina | 40.50 | 3.44 | 11.8 | 329 |

| 8 | Ohio | 38.50 | 3.66 | 10.5 | 303 |

| 9 | Oregon | 38.00 | 3.99 | 9.5 | 275 |

| 10 | West Virginia | 37.20 | 3.58 | 10.4 | 433 |

| 11 | Utah | 36.40 | 3.67 | 9.9 | 295 |

| 12 | Florida | 35.23 | 3.58 | 9.8 | 243 |

| 13 | Rhode Island | 34.00 | 3.36 | 10.1 | 196 |

| 14 | Indiana | 33.00 | 3.59 | 9.2 | 322 |

| 14 | Montana | 33.00 | 3.31 | 10.0 | 341 |

| 16 | Vermont | 32.37 | 3.45 | 9.4 | 241 |

| 17 | Idaho | 32.00 | 3.55 | 9.0 | 303 |

| 18 | Georgia | 31.20 | 3.38 | 9.2 | 257 |

| 19 | Wisconsin | 30.90 | 3.48 | 8.9 | 253 |

| 20 | Maine | 30.00 | 3.43 | 8.8 | 240 |

| 21 | Nebraska | 29.00 | 3.42 | 8.5 | 293 |

| 22 | Michigan | 28.60 | 3.61 | 7.9 | 199 |

| 23 | Minnesota | 28.50 | 3.42 | 8.3 | 224 |

| 24 | Alabama | 28.00 | 3.28 | 8.5 | 298 |

| 24 | South Carolina | 28.00 | 3.32 | 8.4 | 265 |

| 24 | South Dakota | 28.00 | 3.43 | 8.2 | 322 |

| 24 | Virginia | 28.00 | 3.46 | 8.1 | 249 |

| 28 | Iowa | 27.00 | 3.41 | 7.9 | 279 |

| 29 | Kentucky | 26.60 | 3.41 | 7.8 | 274 |

| 30 | Tennessee | 26.00 | 3.31 | 7.9 | 239 |

| 31 | Arkansas | 24.60 | 3.19 | 7.7 | 245 |

| 32 | Kansas | 24.00 | 3.23 | 7.4 | 211 |

| 32 | Massachusetts | 24.00 | 3.35 | 7.2 | 146 |

| 32 | Wyoming | 24.00 | 3.34 | 7.2 | 411 |

| 35 | Delaware | 23.00 | 3.48 | 6.6 | 158 |

| 35 | Nevada | 23.00 | 4.24 | 5.4 | 176 |

| 35 | North Dakota | 23.00 | 3.38 | 6.8 | 294 |

| 38 | New Hampshire | 22.20 | 3.30 | 6.7 | 155 |

| 39 | Colorado | 22.00 | 3.50 | 6.3 | 152 |

| 39 | Missouri | 22.00 | 3.26 | 6.7 | 223 |

| 41 | Connecticut | 20.00 | 3.43 | 5.8 | 131 |

| 41 | Louisiana | 20.00 | 3.28 | 6.1 | 176 |

| 41 | Texas | 20.00 | 3.26 | 6.1 | 222 |

| 44 | Oklahoma | 19.00 | 3.28 | 5.8 | 213 |

| 45 | New York | 18.15 | 3.56 | 5.1 | 104 |

| 46 | Arizona | 18.00 | 4.42 | 4.1 | 127 |

| 46 | Mississippi | 18.00 | 3.14 | 5.7 | 221 |

| 48 | New Mexico | 17.00 | 3.55 | 4.8 | 204 |

| 49 | Hawaii | 16.00 | 4.78 | 3.3 | 82 |

| 50 | Alaska | 8.95 | 3.85 | 2.3 | 68 |