Mississippi News

Key credit rating agency voices concerns about Reeves’ proposed tax cuts, says it is watching

Key credit rating agency voices concerns about Reeves' proposed tax cuts, says it is watching

One of the most watched issues by Mississippians when the Legislature convenes on Jan. 4 will be Gov. Tate Reeves' proposal to eliminate the personal income tax.

But Mississippians will not be the only people watching. Also watching will be some prominent New Yorkers who can impact the state's ability to issue and pay for debt to fund long-term projects.

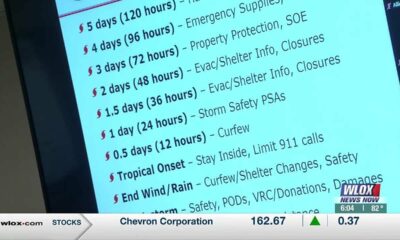

“Mississippi's general fund relies on a diverse set of revenues… There appears to be interest, however, in making a significant change in the state tax structure with both the governor and legislators proposing various means of reducing or eliminating the PIT,” Fitch, one of the three major credit rating agencies, said in an analysis of Mississippi's financial condition. “Fitch will continue to monitor developments related to the proposed changes. A structure that results in a slower growth, a more volatile revenue system or that results in a revenue gap relative to spending needs would be a negative credit consideration.”

Fitch's analysis is important because if the agency gives a state a bad credit rating, it will become more difficult for the state to issue bonds.

Mississippi's general fund tax collections for the last fiscal year were $6.7 billion. If the state's personal income tax had been eliminated, as Reeves wants to do within the next five years, the total would be $4.5 billion.

Take away the revenue from the tax on personal income and the state would have roughly the same amount of revenue it was collecting before 2010.

In essence, without the personal income tax, Mississippi's political leadership would be trying to fund the needs of the state in health care, education and in other areas at today's costs with the revenue from more than a decade ago.

Inflation over time normally drives up the costs of goods, wages and, yes, the revenue collected by governmental entities and private businesses. If a tax is phased out over time as Reeves wants to do, overall revenue collections may not ever decline year over year, but that does not factor in the cost of inflation. With the phase-out of the tax, the state's ability to keep up with the rising costs of goods and services is weakened.

Reeves maintains that the income tax phase-out will spur economic growth, resulting in an increase in revenue collections.

“Eliminating the individual income tax will further help us fuel Mississippi's economic engine for the next 100 years,” the governor said in a narrative setting his goals for the 2022 session.

But State Economist Corey Miller said research indicates “changes to state taxes in Mississippi are likely to have marginal effects on economic growth, employment, and population.” In a report to legislators, Miller added that studies have been inconclusive, to a certain degree, on how tax policy relates to economic growth.

But in general in a small state like Mississippi, national economic conditions play a larger factor than does tax policy. Miller said various studies “suggest state spending on elementary education, secondary education, and higher education as well as infrastructure can promote economic growth over the long term.”

But Reeves contends state revenue is booming and that some of the surplus should be used to begin the phase out of the income tax.

True revenue is growing at perhaps a record pace.

In the 1990s, revenue also was growing at a record pace thanks primarily to the introduction of casino gambling in Mississippi. But by the end of the decade that revenue growth was slowing, soon followed by a national recession.

That recession centered around the first large-scale exodus of low paying manufacturing jobs from America to foreign countries. Mississippi was hit particularly hard because it had more of those jobs per capita than any other state.

The result was, for the first time in the modern era, that the state collected less revenue one year than the previous year, forcing legislators to make significant budget cuts.

Tax collections did not really rebound until Hurricane Katrina pummeled the Gulf Coast in 2005, resulting in a massive influx of federal funds, insurance payments and a large-scale rebuilding effort that led to increased tax collections for the state.

The latest growth, many economists say, is being spurred not just in Mississippi but nationwide by COVID-19 and the massive influx of federal funds states have received because of the pandemic.

Reeves believes that because of that growth, now is the appropriate time to enact the largest tax cut in the state's history.

Eyes both in Mississippi and in other key parts of the country will be watching to see if legislators agree.

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.

Mississippi News

Fatal crash in West Point takes the life of a Starkville man

SUMMARY: A fatal one-vehicle crash in West Point, Mississippi took the life of 20-year-old Cameron Blair on May 12 around 1:25 a.m. Blair was driving a 2023 Chevy Camaro with two other passengers when the car left the road and struck a culvert on Industrial Road. One passenger was flown to Tupelo in serious condition, while the other was taken to North Mississippi Medical Center in West Point. The incident is currently under investigation by the West Point Police, with limited details available about the cause of the accident.

The post Fatal crash in West Point takes the life of a Starkville man appeared first on www.wcbi.com

Mississippi News

Columbus Farmers’ market hosts its grand opening

SUMMARY: The Hitching Lot Farmers' Market in Columbus, Mississippi had a successful grand opening with live music, arts, crafts, and vendors. The market allowed local gardeners to sell their fresh plants and vegetables, while also offering educational sessions on health and safety. Market coordinator, Chelsea Best emphasized the importance of supporting local vendors who work hard to provide fresh produce. Customers like Cream McCloud expressed their satisfaction with the market and its offerings. The market is open on Tuesday evenings and Saturday mornings. Overall, the community enjoyed shopping locally and engaging in fun activities at the Hitching Lot Farmers' Market.

The post Columbus Farmers' market hosts its grand opening appeared first on www.wcbi.com

Mississippi News

Town of Carrollton celebrates new municipal playground

SUMMARY: Pickens County, Alabama is focused on economic development, with the town of Carrollton recently celebrating the opening of a new municipal playground. The project began six years ago and was completed in collaboration with the Alabama Department of Economic and Community Affairs. Officials believe that amenities like the playground will attract more people to the town. Mayor Mickey Walker highlighted the potential for hosting events at the playground area, which includes a walking track and pavilion. Overall, this initiative is seen as a positive step towards increasing community engagement and attracting visitors to the area.

The post Town of Carrollton celebrates new municipal playground appeared first on www.wcbi.com

-

SuperTalk FM4 days ago

Mississippi governor approves bill allowing electronic search warrants

-

SuperTalk FM6 days ago

Legislation outlawing ‘squatted’ vehicles in Mississippi signed into law

-

228Sports6 days ago

PRC’s Bats Come Alive Late As Blue Devils Beat Picayune To Advance To 6A South State Title Series

-

Mississippi News5 days ago

Strong storms late Wednesday night – Home – WCBI TV

-

Mississippi News4 days ago

Louisville names street after a former high school

-

SuperTalk FM4 days ago

$30 million RV park coming to Natchez features amphitheater, pickle ball courts, and more

-

Mississippi News4 days ago

Crews close Jackson street due to large sinkhole

-

Mississippi News3 days ago

Man arrested for allegedly breaking into home, robbing owner