Mississippi Today

Rebuilding trust: How Ted Henifin hopes to repair the relationship between Jacksonians and their water system

Rebuilding trust: How Ted Henifin hopes to repair the relationship between Jacksonians and their water system

Eager to spread the news of a massive federal investment in his city’s drinking water system, Jackson Mayor Chokwe Antar Lumumba called several town hall events over the last few months to update his constituents.

But to the residents in attendance, the $800 million coming to Jackson is far less tangible than the problems right in front of them, as many directed the same, commonly heard refrains towards Lumumba: What is with my water bill? Why am I being charged for water that’s unsafe to drink? Who’s going to fix the sewage spewing onto my lawn?

“I’m being charged for water I’m not even using,” one man said at a Forest Hill High School town hall in February, saying the water he was being charged for was leaking across his yard.

A woman in attendance said her monthly bill went from $55 to over $200, which she eventually just refused to pay. At another town hall in December, a resident said he got a bill in the thousands even though the water from his tap was brown.

Unable to speak to each person’s problem, Lumumba echoed a hopeful sentiment: While the city didn’t have the resources it needed before, it does now, and help is on the way.

While much has happened for the future of Jackson’s water since last fall – a federal takeover that placed a third-party team in control of the system’s improvement, the $800 million investment provided through several federal funding streams, a grant program that’s already eliminated $8 million in resident’s water bill debt in less than a week – the process of restoring trust among residents in what comes out of their taps is a long road ahead.

“I mean we’re going on, what, 40 years of distrust in Jackson’s water system?” said Brooke Floyd, a coordinator with the JXN People’s Assembly.

Floyd, a Jackson native, mother, and former teacher, said she distrusted the water even as a child, recalling her grandparents boiling the water for as long as she remembers.

“People are centering this on (the current) administration, but this is a deep-seated distrust that goes for years,” Floyd said. “So, I think it’s going to take some time for residents to understand, and it’s going to take some showing; you have to show people that the billing is going to get straightened out, and that our water is safe and that the pipes work, all those things.”

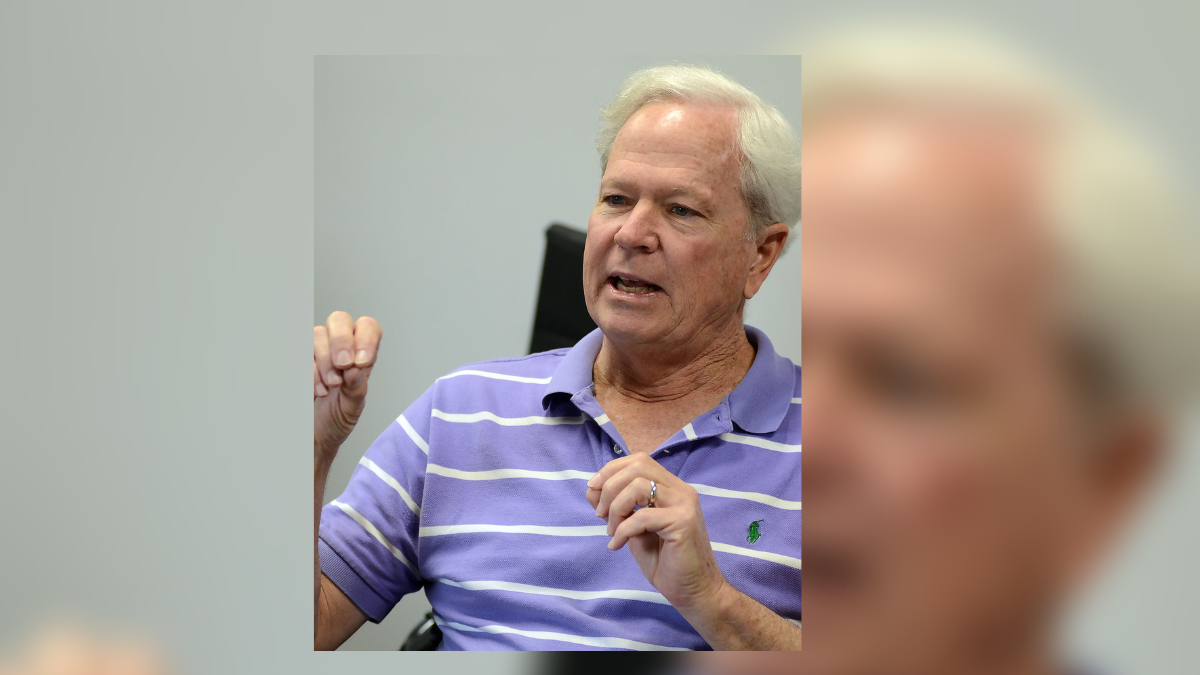

Last November, a federal judge appointed Ted Henifin to be the one in charge of lifting Jackson’s water system into a state of self-reliance.

Henifin recently sat down with Mississippi Today to talk about his game plan, as well as rebuilding trust in a water system among the people who have to pay for it.

Henifin said restoring credibility comes down to three changes: fixing the billing system, providing consistent water pressure by replacing small water lines and finally clarifying the existence of lead in Jackson’s distribution system.

Henifin’s plan

After working for 40 years in Virginia, it wasn’t until getting to Jackson that Henifin realized being a municipal utility worker could earn him public notoriety.

“People will recognize me pretty much everywhere I go, which is a little weird,” Henifin told Mississippi Today at his office. “I’ll be going out to dinner and people will say, ‘Oh, you’re the water guy.’”

But Henifin is in a city where such basic services – whether it’s garbage pickup, sewage disposal or drinking water – regularly leave residents without guarantees. He’s also in a position where few very, if any, municipal water professionals have ever sat.

In one of the largest federal interventions of a local utility system in American history, the U.S. government equipped Henifin with far-reaching authority that allows him to bypass local and state regulation, as well as nearly a billion dollars to spend on projects and a $400,000 personal salary.

His new title is chief executive officer of JXN Water, a nonprofit established to carry out the federal order put in place in November.

Although he’s heading a non-public entity that can avoid public record laws and government procurement rules, Henifin said he’s committed to transparency.

At the December town hall, Henifin waited afterwards to greet attendees, handing out his phone number to anyone who asked. While he said connecting with people directly is important for him to build credibility with Jackson residents, he admitted it’s been a little overwhelming at times trying to get back to everyone who reaches out.

But restoring trust is more than just being a personable face. Henifin said he wants residents, who will have to fund the water system once he’s left and the federal money has dried up, to feel that they’re paying into something worthwhile and that they’re being charged fairly.

“The billing system’s not helping us whatsoever at the moment, sending out terrible bills and continuing to struggle answering calls,” he said. “The trust-building where (residents) connect to us, which is really billing, is the big piece.”

While it’s a widely accepted practice for cities to charge customers based on how much water they consume, Jackson hasn’t had a reliable metering system in place for years due to the fallout from a failed Siemens contract, and residents are constantly burdened with inconsistent or incorrect bills.

As part of a debt relief program – funded through a new social safety net grant created under the CARES Act – Jackson last week began offering to correct water bills for customers who felt they were given incorrect charges. In less than a week, the city corrected $8 million in residents’ debt.

Recognizing the damage the broken water meters had done to the whole system’s credibility, Henifin in January laid out a novel approach in a financial proposal he was required to submit by the federal order: charging residents based on their property value. He conceded then that, as far as he knew, the only city to try something similar was Milwaukee with its wastewater system.

According to an analysis he presented, this system wouldn’t change much for the lower-income and average rate-payers: the median single-family household would see a $50 monthly bill; lower-value property owners would pay slightly less; and and higher-value owners would pay slightly more, with bills capped at $150.

What would change, Henifin explained, is that residents would be getting the same bill amount every month, taking away the monthly mystery that has haunted Jackson customers since the Siemens fiasco.

But on Wednesday, lawmakers passed a bill in the Senate that would ban charging customers for water in a way that doesn’t include consumption. The bill is headed back to a committee for further debate.

Henifin called out the Legislature’s efforts to interfere during a recent town hall at Millsaps college.

“There are so many things we pay for that aren’t directly connected to our use,” he. “We all pay for schools, not all of us have children. We all pay for trash, some people put out tons of trash, some people only put out a bit.

“We’re just stuck in this, ‘water has to be based on consumption’ mindset, but so many other things that are for society we pay for without even giving it much thought, because it’s all about a community that’s supporting the other members of the community.”

Lumumba has yet to comment on the idea, saying he hasn’t seen Henifin’s proposal.

The JXN Water CEO will spend the next few weeks and months at roundtables with community members to hear their thoughts on his idea, among others he put in his January financial plan.

Trusting the water

In 2015, test results for lead in Jackson’s water system showed samples above the “action level,” or legal limit, of 15 parts per billion (ppb). Just months later, the state Department of Health found that nearly a quarter of homes it tested had lead levels above 15 ppb.

The Environmental Protection Agency has since required the city to issue quarterly notices to residents, reminding pregnant women and children to take extra precautions before drinking the water. The EPA requirement is still in place for Jackson because the city has yet to complete a corrosion control plan to ensure no lead or copper dissolves into the water during the treatment process.

“How can you have trust if you have to have that statement on everything you put out about the water?” Henifin said.

He said the system to complete the corrosion control, which the city has put off completing for years, should be in place this summer, which would then allow the city to stop sending the quarterly notices.

But even after fixing the treatment process, the city will still have to ensure there’s no lead in the water lines of the distribution system. Henifin said he has a contractor set to do an inventory analysis of Jackson’s piping to determine if there are any lead service lines, and said that information should be presented to the public within a year.

Jackson is facing multiple lawsuits that allege the city exposed residents to lead, including one representing 600 children that alleges a coverup dating back to 2013.

Danyelle Holmes, National Social Justice Organizer with the Poor People’s Campaign, said that even with the city upgrading its water lines, there is still a concern of the presence of lead in the city’s homes, especially in poorer neighborhoods where pipe replacements are less feasible.

“If they’re old pipes they need to be replaced,” Holmes said. “We know that in south Jackson, and in west Jackson as well, a large portion of those homes are old homes, and those are the homes that we’re concerned will be disproportionately affected.”

In the city’s latest quarterly notice, it disclosed that during the July-December testing period it found the 90th percentile of results showed 6 ppb of lead; while 15 ppb is the legal limit, health experts say that no amount of lead is safe to consume.

Last year, a series of tests conducted by the Clarion Ledger and Mississippi Center for Investigative Reporting found positive results for lead throughout Jackson, with the highest being about 6 ppb at Jackson State University.

Restoring pressure: replacing lines, plugging leaks

Because of leaks throughout the distribution system, the city of Jackson loses about half of the water that it treats and puts out everyday. On average, water systems around the country lose about 15% of the water they put out.

Henifin’s team, led by former Jackson planning director Jordan Hillman, is finding major leaks throughout the city, he said, in some cases by detecting chlorine in puddles that wouldn’t otherwise be there. He projects that, through contracted work, they’ll be able to fix some of the larger leaks within the next two years.

The other issue, though, is the city’s small diameter water lines. The modern standard is that water lines should be at least 6 inches in diameter; Jackson, though, has over 100 miles of lines smaller than that.

Henifin projected it’ll take between five to 10 years to make the necessary fixes, with the goal of doing about 20 miles of replacements each year.

“Hopefully soon after we’ll get the anecdotal stories that people say, ‘Wow, the water’s great, it’s no longer discolored,’” Henifin said. “So, if we get a couple of those stories out by fall, I think by next year we could have some movement towards trust building if (we fix) the billing system, pipe replacement, and we get the corrosion control. Those three things should help to at least begin to build some trust.”

Optimistically speaking, Henifin added, if his team of contractors plug enough of the city’s leaks, Jackson could reach a point within the next year where it wouldn’t need the century-old J.H. Fewell, one of the system’s two treatment plants. City officials have for years hoped to retire Fewell, which would save Jackson “significant money” from not having to operate it, Henifin said.

What’s next

Pending the legislative session and feedback from upcoming community roundtables and city leaders, Henifin hopes to have the new billing system in place by October.

On Tuesday, Henifin also mentioned early talks of Jackson’s wastewater system, which is under an EPA consent decree, joining the drinking water system in the federal stipulated order. But he said that decision is at least a few weeks away.

Looking ahead, Henifin is already thinking about how he plans to leave the city. In his January proposal, he looked at the various options for long-term governance, and suggested the best option would be placing the water system under a corporate nonprofit, similar to JXN Water but with a board of governors made of local constituents.

Under that model, Jackson would retain ownership of the water system assets, and contract out its services. Henifin said while he hadn’t thoroughly researched it, he didn’t know of any water systems in the U.S. with a similar model.

He added that he didn’t think it’d be wise to give the city back full control of the system, citing local politics and obstacles in issuing contracts. He said he’s had that conversation with Jackson leadership, and thinks they may come around to the idea at some point.

“I don’t believe the city has demonstrated that they’re able to do this,” Henifin said. “With a track record like that, what would make any of us think that changes just because there’s an influx of federal dollars?”

On Wednesday, proposed legislation to create a state-controlled regional authority over Jackson’s water system died in the House.

Floyd, the coordinator with JXN People’s Assembly, said she’s encouraged by the work Henifin has done so far, and thinks he’s serious about winning over residents’ trust.

“There’s going to be a lack of trust with whoever is (running the water system),” Floyd said. “I don’t think people are really that worried with (Henifin) being from wherever and coming from the outside. When is the water going to be fixed and when is my bill going to be fixed? That’s the number one concern for everybody.”

In conversations with those affected by the ongoing water crisis, Henifin said he’s been surprised by the empathy he’s gotten from Jacksonians.

“The folks have very high expectations that I might be able to make a difference, but they also seem willing to be patient,” he said. “Much more so than if I was in their shoes and had lost water pressure for weeks during the summer and again at Christmas. I’ve found it actually to be increasing my personal pressure to succeed because so many people have been really nice about encouraging me.”

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.

Mississippi Today

They own the house. Why won’t they cut the grass?

Just four doors down from the Medgar and Myrlie Evers Home National Monument in west Jackson, a tangled mass of bushes, trees and vines obscure a house with a caved-in roof at 2300 Margaret Walker Alexander Drive.

Inside the only room left standing, pieces of plaster and foam insulation cover the sunken floor. A radio, an ornate console table and floor-length drapes, still hanging behind steel-frame windows, are the sole indications that someone once cared for this place.

In August, the storied home will go up for auction for the 7th year in a row because of unpaid taxes – joining thousands of properties across Jackson stuck in a complicated loop and for which no one claims responsibility.

Nearly 30 years ago, the home’s original owner, a fashionable woman named Arthurine Wansley, impressed her neighbors with the upgrades she’d made to the ranch-style home, recalled Lee Davis, a retired hospital environmental service technician who lives next door. Ceiling fans, wood-paneled walls and a cheerful lime green facade.

“Anybody would want to have a house like that,” Davis, 69, said.

But ever since Wansley developed dementia and her relatives moved her to California in the early 2000s, Davis bore witness as the home fell into dereliction. Wansley, who is still listed as the property’s owner in county records, died nearly 20 years ago. When the waist-high grass started to encroach on his lawn, Davis called the city of Jackson for help.

Then one day a few months ago, Davis noticed a for-sale sign outside the house. It was red, white and blue and said “Best Properties.” So Davis dialed the number on the sign to ask if they were going to cut the grass.

No, the woman who answered said – though the investment company she represented, also known as Viking Investments, is indeed selling the property for $2,500.

“They said they don’t do that, it’s the city’s responsibility,” Davis said.

2300 Margaret Walker Alexander Drive had been sold for unpaid taxes. But that doesn’t mean the government can force the investor to clean it up.

When a property owner doesn’t pay taxes, Mississippi counties hold an auction called a tax sale. The goal is to collect much-needed local revenue.

But in Jackson, where thousands of parcels go to auction each year, properties stuck in a tax sale loop year after year perpetuate blight. The bidders are often not prospective homeowners but investors who seek to profit from collecting interest on the unpaid taxes.

The scope of the problem is hard to quantify. To complicate matters, when investors come to own the properties they’ve bid on, there is no legal obligation for them to secure the property in their name. The outdated recordkeeping keeps the city of Jackson from knowing who owns these properties, impeding code enforcement efforts.

Investors also don’t have to pay the taxes, punting the property back to a tax sale.

“We’re a lien investment company. We’re not really wanting to acquire property,” said Nick Miller, the owner of Viking, which is based in downtown Jackson. “That’s a byproduct of investing in the tax liens.”

Viking has not paid taxes on 2300 since it acquired the property. So unless someone bids on it during this year’s tax sale in August, it will fall to the state.

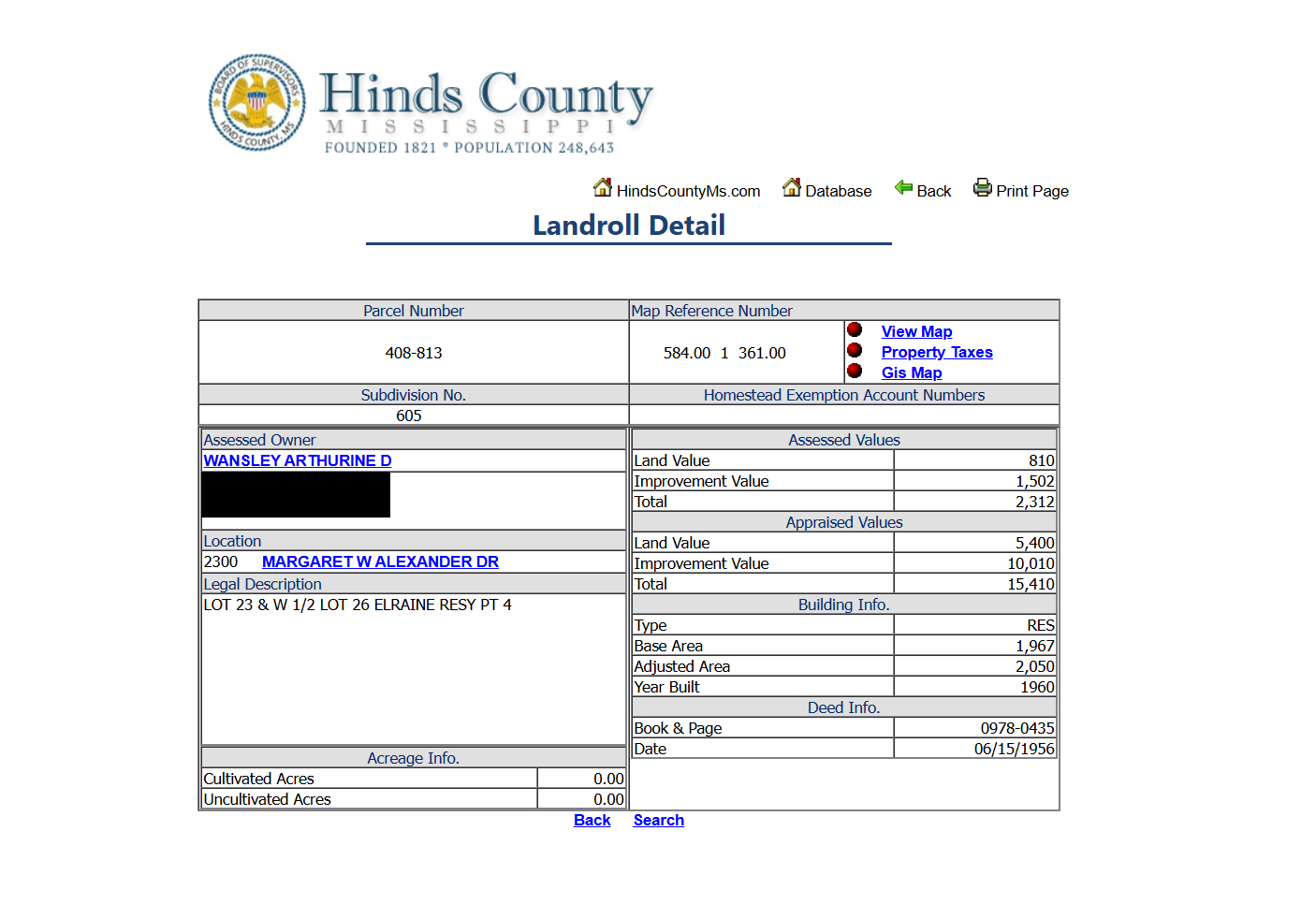

The government, then, will be responsible for cleaning it up. To work on a property, the city must send notices to whoever is listed as the owner on the Hinds County landroll.

For two years after Jackson opened a code enforcement case on 2300, Jackson sent repeated notices to Wansley’s last known address in California — even though she was not living and lost the home at the 2021 tax sale.

“You just found the perfect storm,” said Bill Chaney, an assistant secretary of state who oversees tax-forfeited properties that do not sell at auction. “This is an indication of all the cracks in the system.”

Outdated records leave properties dangling

2300 Margaret Walker Alexander Drive went up for auction in the fall of 2019 after someone in Wansley’s family failed to pay the initial $1,764 tax bill, according to Hinds County records. Despite repeated attempts, Mississippi Today could not reach any of Wansley’s relatives in California.

Over the next several years, a series of investment companies – some local, some not – bid on the unpaid taxes: GSRAN-Z LLC, Quicksilver Tax Funding LLC, College Investment Co., and FIG 20 LLC. None of these companies responded to Mississippi Today’s inquiries.

In what’s called the “redemption period,” Wansley’s family had two years to pay the overdue taxes. When that didn’t happen, her property became leverage. The winning bidders gained an opportunity to take her home through a document called a tax deed, which according to state law is “a perfect title with the immediate right of possession to the land sold for taxes.”

But none of the companies filed the tax deed with the Hinds County Chancery Clerk, likely because they could not find anyone to buy it and they did not want to become responsible for the condition of Wansley’s home.

The practice is common. There is no legal requirement to file the tax deed, nor is there a financial incentive. These companies often operate on slim margins, and the tax deed costs money. Plus, they may not want to end up like Wansley – listed as the owner of properties they aren’t responsible for.

“Are we going to be on that landroll record for the next 15 years until they update the record?” Miller said.

Chancery clerks need a deed to update a county’s landrolls, according to Lakeysia Liddell, the manager of Hinds County land division. So when companies don’t file a tax deed, the number of blighted properties in Jackson owned by tax investors remains unknown. People who lost their homes because of unpaid taxes continue to receive notices.

“They come in trying to pay those taxes thinking they can keep their property even though the redemption period has expired,” Liddell said.

Jackson’s code enforcement officers also rely on the landroll to send notices to property owners in violation. Robert Brunson, Jackson’s code enforcement manager, said that ideally, the city would take these companies to environmental court, where a judge can levy fines and even criminal penalties for dilapidated properties like 2300.

That accountability can’t happen if the city doesn’t know who the owner is. Brunson said Viking will come to environmental court if they have an interest in the property, because the city can use county records to find out if that is the case. But that doesn’t always happen: Viking is not listed as an one of the “interested parties” on the code violation notice for 2300.

“This is a business deal to them, to make money off the city of Jackson, off of Hinds County, really,” Brunson said. “We need more teeth, to be honest with you.”

To keep the chain of title clear, the companies will file the tax deed if they find a buyer for the property. But they may just let the property fall back to the tax sale to be dealt with by someone else.

Viking, which also hasn’t filed a tax deed for 2300, acquired the home in 2024 after the last bidder – the Jacksonville, Florida-based FIG 20 LLC – transferred its interest in the property to a Viking affiliate called SDG 20, according to a quitclaim deed filed in Hinds County.

Miller declined to say how much SDG paid FIG for the properties, but all told, he estimates he has sunk about $2,000 into the property on Margaret Walker Alexander Drive. If he sells it, he will make a couple hundred dollars.

The tax sale gamble

Miller, a Jackson resident, views his job as something of a public service, because his bids on Mississippians’ unpaid taxes help fund county services like libraries or police.

Spread across hundreds of parcels a year in Hinds County – thousands across the state – Miller can make a profit. His goal is not to get property, but to make money off the financial penalties owed by the original owner, including 1.5% monthly interest on the unpaid taxes.

When that doesn’t happen, and Miller becomes the owner, it’s as if he lost the bet. Acquiring blighted property is just a risk of the game; the gamble then becomes whether Viking can sell it.

“You’re looking at just returning your investment with interest,” said Andy Hammond, a Young, Wells, Williams attorney who Miller occasionally consults. “You can’t expect to actually get property. That just ends up happening.”

The seemingly accidental way Miller comes to own property in Jackson is why he’s frustrated when Viking is blamed for the city’s blight, which existed before he bid on unpaid taxes.

“How are we the problem if we’re willing to take a risk and invest $2 million in Hinds County a year?” Miller said.

Of course, when Miller acquires a property, he does not usually pay the next year’s taxes, so any property purchase from Viking would also likely come with a hefty tax bill.

If the city wants to hold tax sale investors more accountable for the condition of the properties they own, Mississippi’s tax sale laws need to be changed, according to Miller, Hammond and Sam Martin, a lobbyist who is helping them form a tax lien investor association.

“That gets you to the pickle that all of this has created,” Hammond said. “You have a city that wants certain things done but a law that disincentivizes the tax sale purchaser from doing anything.”

Hammond and his associates said they don’t know yet what the solution is, but one possible idea is to make it easier for the investor to clear title to his or her tax-forfeited properties.

Original owners who’ve lost their homes through tax sales can often get their property back if they can hire an attorney and go to court, especially if they didn’t receive a warning they could lose their property.

The tax sale buyer will lose the money they’ve put into improving the property, Hammond said. That risk means Viking will not work on its properties without going through a court process called a title confirmation suit.

“Let’s say we go in there without confirming the title first and we fix it up and we clean it up,” Miller said. “What do you think is going to happen? That homeowner is going to have a renewed interest in that property.”

But some in government say these investors should be made to take more responsibility for their properties. Last year, the Legislature considered but did not pass a bill that would have required people who gain properties through the tax sale to file the tax deed within 90 days or else cede their interest to the state.

Chaney, from the Secretary of State’s office, said Viking’s defense that it hasn’t confirmed the titles to its properties is tantamount to “legalese for ‘I don’t want to clean it up.’ ‘We own it, but we don’t really own it.’ Well, trust me, they’ll sell it in a heartbeat.”

That’s if they can find a buyer. Most of the time, the properties that Miller’s companies come to own are as blighted as 2300 Margaret Walker Alexander Drive.

2300 over time:

2014

2019

2022

“This property right here is a prime example of what mostly matures to us,” Miller said. “People walk away from it because they don’t want to deal with it.”

Neither does Miller. But he said cleaning it up could be worth it to someone, if they can afford it.

“The neighbor could buy it for $2,500 if he wanted to tear it down and clean it up,” Miller said.

Blight on historic block

If someone wanted to buy 2300 Margaret Walker Alexander Drive, they might look through public records to determine who owns the home – a common process for people who dabble in tax-forfeited parcels called a “title search.”

That search would end at a piece of paper 435 pages into a thick, leather-bound book on the second floor of the Hinds County Chancery Clerk’s Office. This is the proof of ownership that Arthurine Wansley and her husband, Louis Wade Wansley, received when they bought the home in 1956, on a block known back then as Guynes Street.

With three bedrooms, a carport, and central air and heat, it’s likely the house was built just for them. The Lanier High School graduates had joined a special community, the first-of-its-kind in Mississippi: A subdivision built by Black entrepreneurs for Black middle class families.

At that time, the housing options for Black Jacksonians were subpar and relegated to undesirable parts of the city.

“That community, that stability, that landownership, that power would have been really important,” said Robby Luckett, director of Jackson State University’s Margaret Walker Center.

A teacher in Jackson Public Schools, Arthurine Wansley played bridge with Margaret Walker Alexander, the acclaimed writer after whom the street is now named. She helped run neighborhood Spade and Fork Garden club with Myrlie Evers, the wife of civil rights icon Medgar Evers.

The families on the block were known for looking after each other’s kids and trading cucumbers and tomatoes they’d grown in their backyards. Wansley’s grandnephew, Michael Wade Wansley, grew up visiting 2300 for parties or holiday celebrations, when residents competed for the best Christmas decorations.

“We didn’t even think about it being a historic block when I was growing up,” he said. “We just knew that Dr. Margaret Walker Alexander lived on that block. George Harmon lived on that block. He owned Harmon’s Drug Store on Farish Street. So it was, I mean, everybody over there was either involved in politics or educated.”

But the tight-knit community ended on the corner of Ridgeway Street, where a working-class white neighborhood began, said Keena Graham, the superintendent of the Medgar and Myrlie Evers Home National Monument.

“You’re having a great time on this street, but you don’t go over too much, too far afield,” Graham said. “Two streets over, that’s dangerous.”

Much of that history is recounted in a 2013 application to include the Medgar Evers Historic District — which encompasses Margaret Walker Alexander Drive — on the National Register of Historic Places.

As an original home to the block, 2300 is covered by that designation. But that didn’t stop the home from falling into the tax sale loop.

“I knew it all of my life as a middle-class-type neighborhood,” said Frank Figgers, a member of Shady Grove M.B. Church just around the corner from 2300. “When that’s where your teachers lived, where your pharmacist lived, I just don’t think I’ll ever see it as blight.”

In search of a responsible party

Some family members of the original residents of Margaret Walker Alexander Drive still live in their homes. But the block today is mostly retirees like Davis, renter, and empty houses, surrounded by overgrown land, that are falling apart.

In neighborhoods like this, nonprofits, such one run by Jackson-area state Rep. Ronnie Crudup Jr, have used the tax sale to buy homes and rehabilitate them.

“I always tell people it’s good to have a good attorney on hand to do those title searches for you,” Crudup said.

More often, though, the tax sale loop creates a cycle of frustration.

When private individuals can’t or won’t fix up a property, the government must step in. The state owns more than 1,800 tax-forfeited properties in Jackson, according to data from the secretary of state — plots that no one wanted to buy at the tax sale auction.

“We got it in even worse condition than it was when it was in a bad condition,” Chaney said.

Brunson feels similarly. He has a handful of code enforcement officers for the entire city, but some Jacksonians complain his team is nowhere to be found.

“They won’t cut the grass, but they’ll sell it,” Brunson said of tax sale investors. “There should be a law against that, taking these people’s money, saying, ‘Oh well, you didn’t do your title search, thank you for $3,000 down.’”

But if the city started fining tax sale investors for the blight, Miller said some of them may stop bidding.

“People are going to drop out of the system,” Miller said. “If nobody is there to bid on these liens, what’s going to happen to the $19 million deficiency every year – struck to the state?”

It doesn’t seem likely anyone from Wansley’s family will save the property. Michael Wade Wansley, the grandnephew, is retired and lives in Pennsylvania. He said he doesn’t think he has any relatives left in Jackson. He wondered why Davis and his neighbors let the home deteriorate.

“I would think if people were still living over there they wouldn’t have let it go down to that level of poverty,” he said.

Barbara Walker, a retired teacher who lives directly across from 2300, used to go half and half with another neighbor to pay someone to cut the grass.

“To me, it was worth the investment,” she said. “I didn’t want the place looking as bad as it’s looking.”

When her neighbor moved away, Walker couldn’t afford the landscaping on her own. That’s when Davis started calling the city, hoping they’d cut the grass.

Informed that Miller said he could buy the property, Davis seemed puzzled.

“Who, me?” he said.

Every now and then, Davis will ask his lawn guy to mow a patch of grass by Viking’s for-sale sign. But until the overgrowth is addressed, Davis won’t let his 6-year-old granddaughter play outside when she comes to visit. He’s killed too many snakes in his yard.

In November, the city council declared the home a public nuisance, the first step to tear it down. Jackson will have to hire a company to do the demolition, which requires attaching a lien, or a debt that must be repaid, on the property. Whoever buys it next will have to repay that lien.

On a recent Tuesday, Davis looked at the pink and yellow notices – orders condemning the home – that Brunson pinned inside the decaying carport. When he opened the carport closet, he realized the water heater had been stolen. The only items left were glass Coca-Cola bottles, silver tinsel and a Santa Hat.

Walker said she hopes 2300 can become a park once the house is demolished: “It’s already tearing itself down.”

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.

The post They own the house. Why won’t they cut the grass? appeared first on mississippitoday.org

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Center-Left

The article presents a detailed examination of systemic issues related to tax-forfeited properties and blight in Jackson, Mississippi, with a focus on the human and community impact. The tone is sympathetic toward residents affected by neglect and highlights failures in local and state policies. While it reports on investors and government actions, the language and framing emphasize social justice concerns and the need for reform. This aligns with a center-left perspective that prioritizes community well-being, accountability, and government responsibility, without overt partisan rhetoric or ideological extremes.

Mississippi Today

Son like father: Vernon Dahmer Jr. was a patriot

The Vernon Dahmer family is one of the most patriotic families in America.

Six of his seven sons served a total of 78 years in the armed forces, and on Wednesday we said goodbye to Air Force Senior Master Sgt. Vernon Dahmer Jr., one of the finest men I’ve ever known.

The first time I met him in 1994, I thought I was gazing at a ghost. He had his father’s distinctive features — a barrel-chested frame, closely cropped hair and a narrowly trimmed mustache across his upper lip.

The more we talked, the more I marveled at the similarities we shared. We had both been named after fathers we admired, and we both had family nicknames. His was “Bo,” and mine was “Boo.”

He led me to a table where he showed me a photograph taken by Chris McNair, whose daughter and three other girls had been killed in 1963 when the Ku Klux Klan bombed a Birmingham church.

The picture showed Vernon Jr., and three brothers, George, Martinez and Alvin. They were dressed in their uniforms, staring at the ashes of what had been their family home.

On Jan. 10, 1966, two carloads of Klansmen launched firebombs into the Forrest County home and the family’s grocery store, where Vernon Sr. had volunteered to let Black Mississippians pay their poll taxes so they could vote. (The state had adopted these taxes in its 1890 Constitution in hopes of barring Black Mississippians from voting.)

Another firebomb hit the family’s 1964 Ford Fairlane, setting it ablaze and causing the horn to stick. Dahmer’s wife, Ellie, stirred to the blare of the car horn, smelling smoke. She yelled out, “Vernon, I believe they got us this time.”

He jumped out of bed and grabbed a shotgun, loaded with double-aught buckshot. He fired back at Klansmen so that his family could escape safely out a back window. Unfortunately, the flames of the fire seared his lungs, and he died later that day.

Vernon Jr. was in the Air Force at the time, defending his country. He flew back home to find his father dead and his family home burned to the ground. “To come home and see what happened was totally devastating,” he said.

He had to handle the horrible details, such as the funeral and finding a new place for the family to live while the curious press swarmed around the cinders. “I didn’t have time to cry,” he told me.

He drove me to the Shady Grove Baptist Church, which his ancestors had started before slavery ended, and led me to a rose-tinted headstone that read, “Vernon Dahmer Sr., March 10, 1908—January 10, 1966.”

“If my dad hadn’t been killed by the Klan, he would have had an opportunity to see his grandkids grow up and enjoy the life that those who killed him are still enjoying,” he said. “He was killed for no reason, no valid reason other than hate.”

Despite that hate, the family had endured. Ellie Dahmer served for a dozen years as election commissioner in a mostly white county, and Vernon Jr. helped found the African American Military History Museum.

Not long after our meeting, he began to get calls from a mystery man who wouldn’t identify himself but said he had information on his father’s case. In 1997, we met that man, Bob Stringer, in a motel room on the Mississippi Gulf Coast.

Vernon Jr. asked what prompted him to come forward, and Stringer replied, “I saw you and your family on TV. You were saying how that you were sure there were some people out there who knew something vital that could help get the case reopened.”

Those words resonated with Stringer, who shared how he had overheard Imperial Wizard Sam Bowers give the order to kill Vernon Dahmer Sr. “It’s been a deep, dark secret for 30 years,” he said. “It took me so long to handle it.”

Stringer began cooperating with the Forrest County District Attorney’s office and the Mississippi attorney general’s office, which managed to get a copy of the unredacted FBI file on the case. The more than 40,000 pages enabled authorities to piece the case back together.

They met with the Dahmer family, whose quiet courage inspired them to work even harder. After then-Mississippi Attorney General Mike Moore spent the day with the Dahmer family, he tucked a photograph of the family in his car visor, a reminder that justice had yet to be done.

In spring 1998, authorities arrested Bowers, who went on trial before summer ended. In previous trials, all-white juries refused to convict, but this time would be different. Vernon Jr. was sitting in the balcony, watching the trial unfold when he finally heard the words he longed to hear: “Guilty.”

He covered his face with his fingers, tears streaming behind his calloused hands. He finally had time to cry.

Back at their home, the family gathered on the front lawn beneath the shade of the towering oaks. Friends drove by. They honked their horns and yelled out in victory.

Before darkness fell, he drove to a quiet cemetery and stared at a familiar rose-tinted headstone that read, “Vernon Dahmer Sr. Husband, Father, Community Leader, Voting Rights Activist.” He fell to his knees, telling his daddy that he could rest in peace now because justice had finally come.

On Wednesday, the man I admired and loved so much was buried in the same cemetery with his father.

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.

The post Son like father: Vernon Dahmer Jr. was a patriot appeared first on mississippitoday.org

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Center-Left

This article presents a respectful and humanizing profile of Vernon Dahmer Jr. and his family, emphasizing their patriotism, military service, and civil rights activism. The tone is empathetic and highlights historical racial violence and ongoing justice efforts, aligning with values typically associated with center-left perspectives focused on social justice and civil rights. However, it primarily reports facts and personal history without overt partisan framing or ideological rhetoric, maintaining a balanced narrative that honors the family’s legacy while documenting the historical context and legal outcomes.

Mississippi Today

GOP leaders make ‘school choice’ a focus at Neshoba County Fair

NESHOBA COUNTY — Two of the state’s political leaders said at the Neshoba County Fair on Thursday that they’re pushing lawmakers to adopt school choice legislation next year, indicating the issue may be one of the most fiercely debated policies during the next legislative session.

House Speaker Jason White, one of the most vocal school choice advocates in the state, said under the pavilion at Founder’s Square that his caucus plans to craft legislation in response to the Republican-controlled federal government’s efforts to incentivize “school choice” or “education freedom” – policies that proponents say empower parents to have more control over their children’s education. Opponents say such policies undermine public schools and exacerbate inequality.

White has said that he favors “universal school choice”, which often refers to policies that allow all households — regardless of income level — to use public education dollars to send their children to private schools or other institutions of their choice, rather than being assigned to public schools based on where they live.

But his own Republican caucus likely doesn’t support some of those efforts. Instead, legislative efforts to expand school choice will likely center on making it easier for students to transfer between public schools, opting into newly created federal tax credits awarding scholarships to private school students and potentially closing some underperforming schools.

Republican Gov. Tate Reeves also told reporters at the fair that he agrees “wholeheartedly” with White’s school choice push and is generally supportive of any policy that allows parents to become more involved with their children’s education.

“He’s on the right track in trying to get more opportunities and more options for students,” said Reeves of White’s plans.

The speeches from the two state leaders set the stage for school choice to be a central priority in the 2026 legislative session. Republican Lt. Gov. Delbert Hosemann and other leaders of the 52-member Senate have expressed support for some school choice policies, but the upper chamber has been reluctant to agree to more sweeping proposals.

Hosemann said at the fair on Wednesday that he personally is in favor of allowing public school students to transfer to other public school districts, a policy commonly called portability. He said he also believes students in F-rated school districts should have the option to transfer to any other district.

But it’s unclear if the Republican-majority Senate would support the measure. Earlier this year, during the legislative session, the Senate Education Committee killed those two measures.

Before the next session, White plans to use a select committee on “education freedom” to build consensus for a “big, beautiful bill” that will include the House’s education priorities.

Last month, White announced that his caucus will propose one sprawling education reform package containing many of the school choice provisions that died last session.

This is a departure from the piecemeal strategy House Republicans undertook last session, where the chamber passed a series of standalone education bills. Many of the House’s bills either died in the Senate or, in the case of a proposal that would have allowed some Mississippi parents to use taxpayer money to pay for private schools, didn’t come up for a vote on the House floor.

In his Thursday speech, White called for Hosemann to adopt his “education freedom” agenda, which he said aligns with President Donald Trump’s agenda just as much as the lieutenant governor’s newly proposed tax rebate plan.

“Yesterday, I heard the lieutenant governor and some of our folks on the other end of the building wanting to maybe copy President Trump with this idea of tax rebates with some of our surplus,” White said. “Maybe we’re all for that in the House. But I certainly hope we find that same copycat agenda when it comes to what President Trump wants to do on education freedom as well.”

Reeves, when asked by reporters whether he supported Hosemann’s tax rebate, said the lieutenant governor spoke to him about the idea before unveiling it publicly and that it highlights Mississippi’s budget surplus.

Aside from education and tax policy, Secretary of State Michael Watson said his office next April will roll out a new website where the public can search campaign finance reports and individual donors online, similar to info available to the public in most other states and how the Federal Election Commission’s website operates.

State law currently allows candidates for state office to file PDFs, or pictures of reports, and handwritten reports on the website. The files are not searchable, and sometimes are illegible, making it difficult for the public to examine who is funding their campaigns. County and municipal candidates are not required to file reports online.

Watson, the chief administrator of state elections, is pushing for the Legislature to adopt a law that requires all candidates running for office, “from dog catcher to governor,” to file reports online.

State Treasurer David McRae said that the treasury will begin accepting cryptocurrency in September. McRae told reporters that the state will only be accepting bitcoin for now.

“This is going to be a great investment opportunity for us,” McRae said to reporters. He’s recently indicated that he’s become more open to crypto due to its decentralized structure.

Attorney General Lynn Fitch announced that recent efforts from her office led to 72 arrests in connection with human trafficking, fentanyl and sex offender crimes.

Several justices on the state Supreme Court in fair speeches called on the Legislature to improve youth courts across the state.

When asked about a recent Mississippi Today investigation unveiling allegations from an ex-state corrections department official alleging widespread medical neglect and mismanagement in Mississippi’s prison system, Reeves said he was “comfortable” with the leadership of Mississippi Department of Corrections Commissioner Burl Cain, but would hold VitalCore, the system’s private medical contractor, accountable if the company fails to meet the terms of its contract.

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.

The post GOP leaders make 'school choice' a focus at Neshoba County Fair appeared first on mississippitoday.org

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Center-Right

The article primarily reports on the GOP leaders’ push for school choice legislation in Mississippi without overt editorializing, presenting statements from Republican figures and describing the legislative context. While the language remains largely factual, the focus on Republican initiatives and their framing as efforts to expand “education freedom” subtly reflects a center-right perspective aligned with conservative educational policy goals. The article fairly notes opposition views but gives prominence to GOP leadership and their agenda, suggesting a tilt toward conservative policy promotion without strong partisan critique, consistent with center-right coverage.

-

News from the South - Texas News Feed3 days ago

Rural Texas uses THC for health and economy

-

News from the South - Georgia News Feed6 days ago

South Carolina man detained by ICE over two years, ‘He is not here illegally’

-

News from the South - Alabama News Feed7 days ago

EXCLUSIVE VIDEO: Neighbor shares encounter with 18-year-old accused of beating her grandmother to de

-

News from the South - Georgia News Feed6 days ago

Berkeley County family sues Delta Airlines over explicit videos taken by employee on stolen iPad

-

Mississippi Today7 days ago

Some hope, some worries: Mississippi’s agriculture GDP is a mixed bag

-

News from the South - Texas News Feed7 days ago

How Trump's AI plan may impact energy costs

-

News from the South - Oklahoma News Feed7 days ago

Failed Seizure of a Vulnerable Vet at Oklahoma’s Largest Hospital Hints at Crisis to Come for Aging Population

-

Our Mississippi Home6 days ago

Mississippi Isn’t Just a State—It’s a State of Mind