Mississippi News

Tax cut battle continues: Hosemann wants to pause gas tax, House overhauls its plan

Tax cut battle continues: Hosemann wants to pause gas tax, House overhauls its plan

The tax cut battle between Mississippi Republican House and Senate leaders continued Monday with each chamber overhauling its proposal.

But the two sides still appear far apart as the legislative session enters its final weeks. The House wants to eliminate the state personal income tax. The Senate just wants cuts and rebates. Senate leaders have said the House plan is foolhardy during uncertain economic times. House leaders say the Senate cuts are a half measure.

Lt. Gov. Delbert Hosemann, who presides over the Senate, on Monday unveiled a proposal to suspend the state’s 18.4-cents-a-gallon gasoline tax for six months, to help Mississippians facing skyrocketing fuel prices and other inflation. The Senate is also increasing its proposed income tax cuts, but spreading them out over eight years.

“I started questioning what inflation was doing back in November, and it was 2.5%,” Hosemann said at a press conference Monday. “On March 8, I was informed it was at 6.7% … It cost me $106 to fill up my truck … Because of huge increases in inflation hitting everyone so hard, today I am requesting we do an immediate suspension of the state gasoline tax for six months.”

Hosemann and Senate leaders are proposing the state, with coffers overflowing largely from an influx of federal stimulus spending, use $215 million in surplus to reimburse the Mississippi Department of Transportation for suspending the gas tax for six months. This would reduce prices at the pump by 18.4 cents a gallon.

The Senate also changed its income tax cut plan. It had proposed phasing out the state’s 4% income tax bracket over four years. Now, in a plan that passed in committee Monday, Senate leaders propose cutting the state’s top, 5% income tax bracket to 4.6% over four years, then phasing out the 4% bracket over the four years after that.

In the House, leaders overhauled their plan to eliminate the state’s personal income tax, phasing in elimination more slowly and removing an accompanying increase in sales taxes. House leaders said they’ve addressed every concern Hosemann and Senate leaders have raised.

The Senate plan would still include a one-time tax rebate of up to 5% for taxpayers — from $100 to $1,000 — and would cut taxes on groceries from 7% to 5% in year one.

The House on Monday stripped a sales tax increase from 7% to 8.5% from its proposal, and slowed its roll a bit on the phase out of the personal income tax. It also removed its proposal to cut car tag fees in half, with the state subsidizing local governments who levy most of the fees on tags. It would still lower grocery taxes, but more slowly, by .25% a year down to 4%.

“Every objection the Senate has made to our plan has now been addressed,” House Ways and Means Chairman Trey Lamar, R-Senatobia. “The only objection you could have now to the plan is that you just don’t want to remove the tax on work in Mississippi.”

The House had previously proposed exempting $40,000 in income for individuals and $80,000 for couples from income taxes in year one, then phasing the tax out from there. The new proposal is to exempt $25,000 and $50,000 in income, respectively, to start.

The House plan had included a “growth trigger” of 1.5%, meaning any revenue growth beyond that each year would further reduce the income tax until it was gone. It has increased that trigger to 1.6%, and put a cap of $150 million a year that would go toward eliminating the income tax, meaning anything over that would go back into state coffers.

House leaders had predicted the income tax could be phased out in about 10 years or so. Lamar said Monday that with the changes, that would now take about 15 years, depending on growth.

The House passed this latest version of Speaker Philip Gunn’s income tax elimination proposal Monday afternoon with a vote of 83-33. Many Democrats who supported the earlier version said they could not vote for the latest proposal because it did not cut the local tax on car tags.

“I supported it basically because of the car tag cut,” said Rep. John Hines, D-Greenville. “Now you have nothing I can support.”

Lamar said the Senate leadership had been adamant in opposing a reduction in the cost of car tags.

“My own father is mad at me about that,” Lamar said from the well of the House. “But the Senate refused to do it.”

Other Democrats expressed concerns about cutting revenue while the state still has many vital needs.

Rep. Omeria Scott, D-Laurel, pointed out needs that local governments have needs in the area of education, in health care and in other areas.

“Until Mississippi addresses all these serious needs it has, I think this bill is premature,” Scott said.

In Senate committee debate on its new proposal, Democratic Sen. Hob Bryan of Amory also made this argument, with an emotional plea to his colleagues.

“This will do untold harm to our state,” Bryan said of the Senate plan. “$439 million every year, in perpetuity, out of the general fund forever. Forever! Forever! We don’t have clean drinking water in Mississippi. We have sewer systems that are inoperable … If you think reducing the income tax will bring a single person to this state you are wrong. But not having functioning water and sewer systems will keep them out … What about our roads? Do you drive on them? Don’t you see all the cracks?”

Neither Hosemann nor Gunn had comments on the other’s latest proposals on Monday.

READ MORE: 5 things to know about the Great Mississippi Tax Cut Battle of 2022

This is the second major overhaul of Gunn’s income tax plan since he unveiled it last year and it died in the Senate. In the first version last year it would have increased the state sales tax on most retails items from 7% to 9.5%. It would have increased other sales taxes by 2.5 cents on the dollar. For instance, originally automobiles now subject to a 5% tax would have seen that increase to 7.5%.

But facing opposition from many business lobbies and Gov. Tate Reeves, Gunn reduced the general sales tax increase and did away with the increases in other sectors such as automobiles and farm equipment. He also added a measure to cut car tag fees in half, with the state subsidizing local governments who levy most of the fees on car tags. The income tax exemptions in the original plan were also lowered in this year’s first proposal.

READ MORE: Gov. Reeves pours cold water on income tax cut plan as it passes House

The latest changes to the tax proposals come after a recent article from the conservative Tax Foundation — whose policies Gunn has said were an impetus for his plan — was critical of both his and the Senate’s income tax proposals.

The Tax Foundation article questioned whether the original House plan, with its 1.5% “growth triggers” on income tax elimination, would allow the state budget to keep up with inflation.

“General fund growth limits are not fundamentally bad, but HB 531 includes a mechanism that would restrict growth to no more than 1.5 percent per year,” the Tax Foundation article said. “To put that rate in perspective, at the end of January the 12-month change in inflation was 7.5 percent, the highest rate since 1982. Considerable uncertainty exists over how long it will take for inflation to return to the Federal Reserve’s target rate of 2 percent, but it is not unreasonable to assume that rates could remain somewhere above the target rate for several years. If that occurs, a 1.5 percent cap on revenue growth will significantly diminish the purchasing power of Mississippi’s general fund.”

The Tax Foundation article said the Senate plan was simpler and less risky, but notes flaws in both and says, “Mississippi is close to making meaningful reforms, but there is still more work to be done if the Magnolia State is to sustain the intended transformation.”

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.

Mississippi News

Events happening this weekend in Mississippi: August 1-3

SUMMARY: This weekend (August 1-3) in Mississippi offers diverse activities across the state. In Central Mississippi, enjoy Latin music and salsa at Fondren Fiesta in Jackson, family fun at 042 Nights in Brandon, food trucks in Byram, art exhibitions in Natchez and Jackson, and farmers markets in Jackson, Natchez, and Vicksburg. Special events include hurricane remembrance, back-to-school drives, and community wellness fairs. In the Pine Belt, Hattiesburg hosts Denim & Diamonds Casino Night, live music, themed balls, 5K fundraisers, and movie screenings. Laurel offers karaoke, art workshops, and a family farmers market. Activities cater to all ages, promoting culture, health, and community engagement.

The post Events happening this weekend in Mississippi: August 1-3 appeared first on www.wjtv.com

Mississippi News

Events happening this weekend in Mississippi: July 25-27

SUMMARY: Mississippi is packed with events this weekend (July 25–27), including the JXN Film Festival, interactive exhibits, and art showcases in Jackson. Clinton screens *Train to Busan*, and Vicksburg features live events, a catfish tournament, and farmers markets. Natchez hosts its Food & Wine Festival and community celebrations, while Ridgeland offers art parks and dinner theater. In the Pine Belt, Hattiesburg offers comedy, musical theater, a Jane Austen tea, and a murder mystery dinner at Ross Mansion. Toy, gun, and farmers markets span multiple cities, while special events like the Little Miss Black Mississippi Pageant round out a diverse, festive weekend.

The post Events happening this weekend in Mississippi: July 25-27 appeared first on www.wjtv.com

Mississippi News

Bryan Kohberger sentenced for murdering four University of Idaho students

SUMMARY: Bryan Kohberger was sentenced to four consecutive life terms without parole for the brutal 2022 stabbing deaths of four University of Idaho students. He pleaded guilty in July 2025 to avoid the death penalty. During sentencing, families shared emotional testimonies of loss and anguish. Kohberger, a criminology graduate student, broke into the victims’ home and killed them without known motive, remaining silent at the hearing. Police used DNA and genetic genealogy to identify him. The case deeply affected the community, with misinformation spreading online. Kohberger waived his right to appeal. Some victims’ relatives offered forgiveness and sought answers.

The post Bryan Kohberger sentenced for murdering four University of Idaho students appeared first on www.wjtv.com

-

Mississippi Today7 days ago

After 30 years in prison, Mississippi woman dies from cancer she says was preventable

-

News from the South - Texas News Feed7 days ago

Texas redistricting: What to know about Dems’ quorum break

-

News from the South - North Carolina News Feed5 days ago

Two people unaccounted for in Spring Lake after flash flooding

-

Mississippi Today6 days ago

Brain drain: Mother understands her daughters’ decisions to leave Mississippi

-

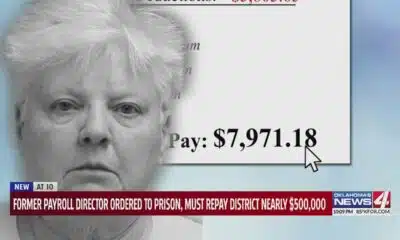

News from the South - Oklahoma News Feed2 days ago

Former payroll director ordered to prison, must repay district nearly $500,000

-

News from the South - Georgia News Feed6 days ago

29-year-old killed after driving off road in 'dangerous' section road | FOX 5 News

-

News from the South - Louisiana News Feed7 days ago

Plans for Northside library up for first vote – The Current

-

News from the South - Tennessee News Feed4 days ago

Trump’s new tariffs take effect. Here’s how Tennesseans could be impacted