www.youtube.com – WLOX News – 2024-10-28 22:28:03 SUMMARY: Construction at a busy roundabout intersection in Wool Market has been halted for over a month, causing frustration...

www.youtube.com – WJTV 12 News – 2024-10-22 12:15:31 SUMMARY: The Mississippi Department of Transportation is closing ramps on I-55 in Pike County, specifically the I-55 north...

www.youtube.com – 16 WAPT News Jackson – 2024-10-16 17:12:24 SUMMARY: A bridge in Simpson County collapsed on Wednesday afternoon while undergoing replacement work. The incident occurred...

www.youtube.com – 16 WAPT News Jackson – 2024-10-11 22:50:30 SUMMARY: Starting the evening of October 15, both directions of I-55 will close two lanes to repair...

www.youtube.com – WTVA 9 News – 2024-10-11 10:17:40 SUMMARY: Oxford is set to add another roundabout, as announced by Mayor Robin Tanah Hill, amid mixed reactions...

www.youtube.com – WTVA 9 News – 2024-09-26 19:27:21 SUMMARY: Sheriff Greg Pollen of Calhoun County is frustrated with the Mississippi Department of Transportation (MDOT) over persistent...

www.youtube.com – WTVA 9 News – 2024-09-13 19:32:06 SUMMARY: A $40 million improvement project aimed at upgrading Highway 182 in Starkville, named after Dr. Martin Luther...

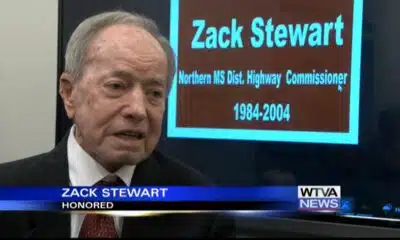

www.youtube.com – WTVA 9 News – 2024-09-12 21:58:04 SUMMARY: A bridge in downtown New Albany, located at the Union County Heritage Museum, has been dedicated in...

www.youtube.com – WLOX News – 2024-09-10 20:40:41 SUMMARY: As people evacuate ahead of the storm, important safety information has been shared. The Mississippi Department of Transportation...

www.youtube.com – WTVA 9 News – 2024-09-10 09:00:17 SUMMARY: Road improvement projects will commence in Starkville, with officials breaking ground on the State Route 182 project...