Mississippi Today

In surprise move, House votes to send Senate income tax elimination plan to governor. But is it over?

This story will be updated.

In a stunning move, the House on Thursday morning voted 92-27 to agree with the Senate’s latest proposal to eliminate the state income tax and increase the gasoline tax, perhaps ending what could have been a raucous intraparty debate at the Capitol for the next two weeks.

“Let’s end the tax on work once and for all in the state of Mississippi,” House Ways and Means Chairman Trey Lamar said.

If the measure is passed into law, then oddly, a handful of Senate Democrats would have been crucial in passage of the largest tax cut in state history, and a sea change towards more regressive taxation that puts more burden on the poor and those of modest means through increased consumption taxes.

The vote was a surprise. The House and Senate up until the vote had appeared to still be far apart on particulars of a tax overhaul. The bill approved Thursday was held on a motion to reconsider by the GOP House leadership, and Gov. Tate Reeves, House Speaker Jason White and Lt. Gov. Delbert Hosemann all declined comment on the issue — bizarre for such monumental policy.

It’s unclear whether Reeves would sign the measure if it makes it to his desk.

Despite calling for elimination of the income tax, Gov. Reeves has in the past vehemently opposed “tax swap” increases in gasoline or sales taxes along with cuts, and has declined comment on whether he would support the House or Senate proposals with included tax increases. He has not offered any specific plan of his own.

Senate Finance Chair Josh Harkins said he and Lamar exchanged text messages Thursday morning, and Lamar indicated a motion to concur might be coming. Harkins sees the motion to reconsider as a procedural hurdle, and that the Senate bill wouldn’t change.

“I think they passed the negotiated version, I think that’s the final version that you’re going to see. That was a product our talks and discussion,” Harkins said. “I’m pleased that they concurred on the changes that we made and came up with through discussions. They’ve got one more hurdle to clear with tabling the motion to reconsider, and then it will be more final than it is right now.”

In their conversation on Thursday, Harkins said Lamar was excited about getting a final product across the finish line: “I think he was relieved after a lot of work on this over the last several years,” Harkins said. “Their goal was elimination, and they got a plan to eliminate.”

Rep. Karl Oliver, a Republican from Winona who is part of House leadership, held the bill on a procedural motion, meaning lawmakers could still debate and work on the proposal before it goes to the governor’s office for consideration.

The proposal would decrease the 4% income tax rate by .25% each year from 2027 to 2030 and leaves it at 3% in 2030. After it reaches 3%, the income tax would be reduced with “growth triggers” or at a proportional rate depending on the difference between the state’s revenue and spending plans that year.

The proposal also would reduce the sales tax on groceries from 7% to 5%, increases the 18.4-cents-a-gallon gasoline tax by 9 cents over three years and change benefits for government employees hired after March 2026 to a more austere retirement plan.

Gov. Reeves and Speaker White, a Republican from West, have forcefully pushed lawmakers to eliminate what they refer to as the “tax on work.” Hosemann and the Senate had been reluctant on full elimination of the tax, urging caution in uncertain economic times and calling for only a cut to the tax instead. However, the Senate this week had passed a counter offer, that would eliminate the income tax over many years, provided economic growth “triggers” are met along the way.

The plan the House voted to send to the governor — pending the holding motion — on Thursday would increase the tax on gasoline by a total of 9 cents a gallon over three years, then increase along with road construction prices thereafter. The House had at first proposed a 5% sales tax on gasoline, then countered with a 15 cents a gallon increase.

The Senate had refused to entertain the House’s proposal to include an increase in the state’s sales tax. The latest House offer would have increased sales taxes from 7% to 8%. It’s original proposal would have increased it to 8.5%/

Mississippi is perennially among the most federally dependent states, receiving nearly a 3-1 return for every dollar in federal taxes it pays. Some Democratic lawmakers have said that, given the uncertainty surrounding the federal spending cuts, now is not the time to drastically rework the state’s tax code. Others had warned that a shift from income taxes to higher sales and gasoline taxes would help the wealthy and hurt those of more modest means and retirees.

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.

Mississippi Today

Brain drain: Mother understands her daughters’ decisions to leave Mississippi

Editor’s note: This Mississippi Today Ideas essay is published as part of our Brain Drain project, which seeks answers to Mississippi’s brain drain problem. To read more about the project, click here.

Back when I was a kid in 1988, my mama and I had an argument about what I wanted to major in at college.

I had dreamed of being a journalist since the age of 8. To me, that meant that I was going to Ole Miss, which had the journalism department.

My mama said I could only go away from home to Ole Miss if I was going to major in law.

So I settled on going to Mississippi State University just down the road and majoring in communication. She told me I should major in engineering since that’s what State was known for.

I said, “That’s even dumber than me going to law school. I hate math.”

“Well, you could at least try,” she said.

I said no. Then she told me I was wasting my education and turned her back on me.

I get it. She knew and I knew that I couldn’t stay in Choctaw County where I was raised and earn a living with that degree. I would have to go somewhere else — probably to the Jackson metro area and work for Gannett or the Associated Press. Or to Memphis. Or Biloxi. Or even New Orleans. She never really forgave me for moving to the Jackson metro, working in my field and raising her grandchildren so far from her.

After a while, I got used to the pace of life around here. I knew I probably wouldn’t ever move anywhere else because I noticed that people who left Mississippi often came back, whether due to family obligations or a realization that “somewhere else” wasn’t quite all it was cracked up to be.

I also noticed that a lot of people played up how they were from Mississippi while making a very good living being someplace else. I decided I wanted to prove you could be from Mississippi, live in Mississippi, work in Mississippi and make something of yourself without leaving Mississippi.

But I noticed something else over the years, too. Most of the kids in Brandon dreamed of going off from home to cities like Atlanta, Nashville, Dallas, DC, New York or Orlando. They didn’t seem to have reasons — just a desire to get away from the state as fast as they could.

Then my three daughters and I started having conversations about what they wanted to major in when they went to college. My oldest wanted to be a chef. My middle one was undecided between chemical engineering and landscape architecture. And my youngest was fascinated with roads and bridges.

I was all too aware of what had happened in the job markets in Mississippi since I had come up. Companies closed operations in a globalized economy and fled to cheaper labor markets. The advent of the internet meant employers could hire from all over the world. Longtime business leaders retired and sold out to big corporations that reduced investments in local communities that had supported those businesses for decades and then complained that those towns didn’t offer enough amenities for their employees to want to relocate there.

But the reality really set in when my chef daughter chose her first internship — in historic Williamsburg, Virginia.

I would never have dreamed of driving that far from home to try out a place to work when I was her age. Then after her senior year, she interned at Walt Disney World and got hired full-time before the internship was over. She was off to live in Orlando where now with her husband and young son she’s creating community and loves going to work every day with a pretty enviable benefits package, too, a thing unheard of in the culinary world in Mississippi.

My middle one finally settled on chemical engineering and was picked for a co-op job in her first semester at age 18 at a company in Georgia. When she graduated four years later, we packed her off to Indiana for a research and development job, and she now lives in New Hampshire with her husband, making six figures a year at 26 years old and looking forward to partaking in the cultural offerings in New York City when she can.

The youngest is currently in college for civil engineering, and I’m bracing myself for the inevitable. She doesn’t want to work for state government, so she’s likely going out of state as well. Her comment about coming back to Jackson metro was the most damning of all. “There’s nothing to do here,” she says.

A lot of people ask me questions: How often do you see your daughters? How can you stand being so far from your grandson? Don’t they at least come home for Christmas?

The answer to all of those questions is that we do the best we can. We text, we message on Facebook, we talk on the phone at least once a week, every Sunday. We arrange visits; sometimes it’s us driving to them while other times they drive to us.

I can’t imagine making my children as miserable as my mom made me over my life choices. We are flexible, understanding, and very, very proud of our daughters, who are grappling with enough in their lives without us loading them down with guilt over when they are coming home.

The calculus may change in the future. We may have declines in health and need to move closer to one of our children if we need assistance. Or we may need to be in assisted living care here in Mississippi where such care may be marginally cheaper than wherever our girls land.

But I don’t wish our girls had settled for life in Mississippi.

What I wish is that Mississippi could find a way to live up to its potential — to be a place more worthy of my daughters’ loyalty, affections and investment in themselves.

Maybe it will be someday. I hope so, for all of our sakes.

Julie Liddell Whitehead lives and writes from Mississippi. An award-winning freelance writer, Julie covered disasters from 9/11 to Hurricane Katrina throughout her career. Her first book is “Hurricane Baby: Stories,” published by Madville Publishing. She writes on mental health, mental health education and mental health advocacy. She has a bachelor’s degree in communication, with a journalism emphasis, and a master’s degree in English, both from Mississippi State University. In 2021, she completed her MFA from Mississippi University for Women.

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.

The post Brain drain: Mother understands her daughters' decisions to leave Mississippi appeared first on mississippitoday.org

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Center-Left

This essay reflects a Center-Left perspective by focusing on social and economic challenges faced by Mississippi, such as brain drain, job market changes, and community decline. The tone is empathetic and advocates for investment in local opportunities and amenities to retain talent, aligning with progressive concerns about economic inequality and regional development. However, it remains largely personal and reflective rather than explicitly ideological or partisan. The article critiques systemic economic shifts without advancing a polarized political agenda, emphasizing hope for future improvement and a more supportive environment for young professionals.

Mississippi Today

After 30 years in prison, Mississippi woman dies from cancer she says was preventable

Behind Bars, Beyond Care:

A Mississippi Today investigation into suffering, secrecy and the business of prison health care

Susie Balfour, diagnosed with terminal breast cancer two weeks before her release from prison, has died from the disease she alleged past and present prison health care providers failed to catch until it was too late.

The 64-year-old left the Central Mississippi Correctional Facility in December 2021 after more than 30 years of incarceration. She died on Friday, a representative for her family confirmed.

Balfour is survived by family members and friends. News of her passing has led to an outpouring of condolences of support shared online from community members, including some she met in prison.

Instead of getting the chance to rebuild her life, Balfour was released with a death sentence, said Pauline Rogers, executive director of the RECH Foundation.

“Susie didn’t just survive prison, she came out fighting,” Rogers said in a statement. “She spent her final years demanding justice, not just for herself, but for the women still inside. She knew her time was limited, but her courage was limitless.”

Last year, Balfour filed a federal lawsuit against three private medical contractors for the prison system, alleging medical neglect. The lawsuit highlighted how she and other incarcerated women came into contact with raw industrial chemicals during cleaning duty. Some of the chemicals have been linked to an increased risk of cancer in some studies.

The companies contracted to provide health care to prisoners at the facility over the course of Balfour’s sentence — Wexford Health Sources, Centurion Health and VitalCore, the current medical provider — delayed or failed to schedule follow-up cancer screenings for Balfour even though they had been recommended by prison physicians, the lawsuit says.

“I just want everybody to be held accountable,” Balfour said of her lawsuit. “ … and I just want justice for myself and other ladies and men in there who are dealing with the same situation I am dealing with.”

Rep. Becky Currie, who chairs the House Corrections Committee, spoke to Balfour last week, just days before her death. Until the very end, Balfour was focused on ensuring her story would outlive her, that it would drive reforms protecting others from suffering the same fate, Currie said.

“She wanted to talk to me on her deathbed. She could hardly speak, but she wanted to make sure nobody goes through what she went through,” Currie said. “I told her she would be in a better place soon, and I told her I would do my best to make sure nobody else goes through this.”

During Mississippi’s 2025 legislative session, Balfour’s story inspired Rep. Justis Gibbs, a Democrat from Jackson, to introduce legislation requiring state prisons to provide inmates on work assignments with protective gear.

Gibbs said over 10 other Mississippi inmates have come down with cancer or become seriously ill after they were exposed to chemicals while on work assignments. In a statement on Monday, Gibbs said the bill was a critical step toward showing that Mississippi does not tolerate human rights abuses.

“It is sad to hear of multiple incarcerated individuals passing away this summer due to continued exposure of harsh chemicals,” Gibbs said. “We worked very hard last session to get this bill past the finish line. I am appreciative of Speaker Jason White and the House Corrections Committee for understanding how vital this bill is and passing it out of committee. Every one of my house colleagues voted yes. We cannot allow politics between chambers on unrelated matters to stop the passage of good common-sense legislation.”

The bill passed the House in a bipartisan vote before dying in the Senate. Currie told Mississippi Today on Monday that she plans on marshalling the bill through the House again next session.

Currie, a Republican from Brookhaven, said Balfour’s case shows that prison medical contractors don’t have strong enough incentives to offer preventive care or treat illnesses like cancer.

In response to an ongoing Mississippi Today investigation into prison health care and in comments on the House floor, Currie has said prisoners are sometimes denied life saving treatments. A high-ranking former corrections official also came forward and told the news outlet that Mississippi’s prison system is rife with medical neglect and mismanagement.

Mississippi Today also obtained text messages between current and former corrections department officials showing that the same year the state agreed to pay VitalCore $100 million in taxpayer funds to provide healthcare to people incarcerated in Mississippi prisons, a top official at the Department remarked that the company “sucks.”

Balfour was first convicted of murdering a police officer during a robbery in north Mississippi, and she was sentenced to death. The Mississippi Supreme Court reversed the conviction in 1992, finding that her constitutional rights were violated in trial. She reached a plea agreement for a lesser charge, her attorney said.

As of Monday, the lawsuit remains active, according to court records. Late last year Balfour’s attorneys asked for her to be able to give a deposition with the intent of preserving her testimony. She was scheduled to give one in Southaven in March.

Rogers said Balfour’s death is a tragic reminder of systemic failures in the prison system where routine medical care is denied, their labor is exploited and too many who are released die from conditions that went untreated while they were in state custody.

Her legacy is one RECH Foundation will honor by continuing to fight for justice, dignity and systemic reform, said Rogers, who was formerly incarcerated herself.

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.

The post After 30 years in prison, Mississippi woman dies from cancer she says was preventable appeared first on mississippitoday.org

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Center-Left

This article presents a critical view of the Mississippi prison health care system, highlighting systemic failures and medical neglect that led to the death of a formerly incarcerated woman. The tone and framing focus on social justice issues, prisoner rights, and the need for government accountability and reform, which align with Center-Left values emphasizing government responsibility for vulnerable populations. While the article is largely investigative and fact-based, its emphasis on advocacy for reform, criticism of privatized prison health contractors, and highlighting bipartisan legislative efforts suggest a Center-Left leaning perspective rather than neutral reporting.

Mississippi Today

FBI concocted a bribery scheme that wasn’t, ex-interim Hinds sheriff says in appeal

Former interim Hinds County sheriff Marshand Crisler is appealing bribery and ammunition charges stemming from his 2021 campaign, arguing that the federal government played on his relationship with a former supporter to entrap him.

Crisler had asked Tonarri Moore, who donated to past campaigns, for a financial contribution for the sheriff’s race. Moore said he would donate if Crisler helped with several requests. Without the previous relationship, Crisler would not have acted, his attorney argues, and Crisler had no reason to believe he was being bribed.

“The government, having concocted a bribery scheme to entrap Crisler, then had to contrive a corresponding quid pro quo to support the scenario with which to entrap him,” attorney John Holliman wrote in a Saturday appellant brief.

Crisler is asking the U.S. 5th Circuit Court of Appeals to reverse his conviction and render its own rulings on both counts.

He was convicted in federal court in November after a three-day trial and sentenced earlier this year to 2 ½ years in prison. Crisler is serving time in FCI Beckley in West Virginia.

The day before Crisler reached out to Moore to ask for support for his campaign for sheriff, Drug and Enforcement Administration agents raided Moore’s home and found guns and drugs. An FBI agent called to the scene looked through Moore’s phone and saw Crisler had called.

According to the appellant brief, the agent asked Moore what Crisler would do if offered money, and if Moore was bribing him. Moore said he wasn’t bribing Crisler, and the agent asked if Moore would do it.

At that time, there weren’t reasonable grounds to start a bribery investigation into Crisler, his attorney argues, nor was there reason to believe he was seeking a bribe.

Moore agreed to become an informant for the FBI, in exchange for the government not prosecuting him for the guns and drugs.

The FBI fitted him with a wire to record Crisler during meetings, which began that day. The meetings included one inside Moore’s night club and a cigarette lounge in Jackson. Agents provided Moore with the $9,500 he gave to Crisler between September and November 2021.

Crisler’s 2023 indictment came as he campaigned again for sheriff and months before the primary election. He remained in the race and lost to the incumbent who he faced in 2021.

At trial, the government argued the exchange of money were attempts to bribe because Moore made several requests of Crisler: to move his cousin to a different part of the Hinds County Detention Center, to get him a job in the sheriff’s office and for Crisler to let Moore know if law enforcement was looking into his activities.

In closing arguments, Assistant U.S. Attorney Charles Kirkham pointed to examples of quid pro quo in recordings, including one where Moore said to Crisler, “You scratch my back, I scratch yours” and Crisler replied “Hello!” in a tone that the government saw as agreement.

The appellant’s brief argues that without Moore’s requests, the government lacked a way to show quid pro quo, a requirement of bribery charge: that Crisler committed or agreed to commit an official act in exchange for funds.

Moore also asked Crisler to give him bullets despite being a convicted felon, which is prohibited under federal law. The brief notes how the government directed Moore to come up with a story for needing the bullets and to ask Crisler to give them to him.

In response, Crisler told Moore he could buy bullets at several sporting goods stores. Moore said they ran out, and eventually Crisler gave him bullets.

Crisler also argues that the government prosecuted routine political behavior. Specifically, accepting campaign donations is not illegal, and can not constitute bribery unless there is an explicit promise to perform or not perform an official act in exchange for money.

“Our political system relies on interactions between citizens and politicians with requests being made for this or that which is within the power of the elected official to do,” the brief states. “This does not constitute a bribery scheme. It is the normal working of our political system.”

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.

The post FBI concocted a bribery scheme that wasn’t, ex-interim Hinds sheriff says in appeal appeared first on mississippitoday.org

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Center-Right

The article presents the legal appeal of former interim Hinds County sheriff Marshand Crisler with a focus on his argument that the FBI orchestrated an entrapment scheme. The language is largely factual and centers on the defense’s claims and legal standards for bribery, emphasizing normal political behavior versus illegal conduct. While the article reports on the government’s position, it gives significant space to Crisler’s defense and critiques of federal prosecution tactics. This framing, highlighting skepticism toward federal law enforcement and emphasizing the defense perspective, suggests a slight center-right leaning, reflecting a cautious stance on government overreach without overt ideological language.

-

News from the South - Texas News Feed7 days ago

Rural Texas uses THC for health and economy

-

Mississippi Today3 days ago

After 30 years in prison, Mississippi woman dies from cancer she says was preventable

-

News from the South - Georgia News Feed5 days ago

Woman charged after boy in state’s custody dies in hot car

-

Our Mississippi Home6 days ago

Porch Lights and Lightning Bugs: An August Evening in Mississippi

-

News from the South - Georgia News Feed7 days ago

Trump's new tariffs give some countries a break, shares and US dollar sink

-

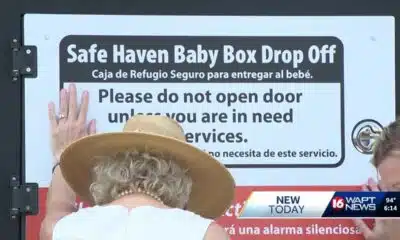

Mississippi News Video7 days ago

Safe Haven Baby Box opens in Gluckstadt

-

News from the South - Oklahoma News Feed7 days ago

Woman honored for 50 years of giving back

-

News from the South - Kentucky News Feed6 days ago

Bowling Green man faces drug charges following traffic stop