Mississippi News

Grocery tax cut considered, but never acted upon by state’s political leadership

Grocery tax cut considered, but never acted upon by state’s political leadership

Mississippi’s political leaders have talked for years about cutting the 7% tax on groceries, the highest statewide tax of its kind in the nation in its poorest state.

But those efforts never go anywhere.

Earlier this session, tax cut plans touted by the leadership of both the House and Senate included a cut to the grocery tax in addition to reductions or elimination of the personal income tax.

But the plan finally approved by legislators cuts only the income tax.

“We are not opposed to a grocery tax cut, but as we have said the income tax cut is the priority,” said House Speaker Philip Gunn, R-Clinton.

Referencing the $525 million income tax cut that passed during the just-completed session and the negotiations with Senate leaders to develop the plan, Gunn added, “Even with this plan we insisted the $500 million tax break we passed this year be income tax. Some of the negotiations that took place early on had about $120 million of that being grocery tax and we said we are not looking at a $500 million tax cut, which includes $120 million of groceries. We want $500 million in income tax. If y’all want to throw a grocery tax (cut) on top of that, we are fine with that … But we are looking at income tax as the main objective.”

For some time, many have viewed it as a cruel irony that Mississippi, the poorest state in the nation with fewer safety nets in place for the poor, taxes food at the highest rate in the nation. Some states provide local options that place a higher tax on food in individual municipalities or other local governmental entities, but no state levies a higher tax on food statewide.

Most states, recognizing the tax on groceries as a regressive tax that places more of a burden on the poor, either do not tax food or tax it at a lower rate than what is levied on other items.

Through the years Mississippi politicians have talked about cutting or eliminating the tax on food. In the early 2000s, the Legislature, led by Lt. Gov. Amy Tuck, made several efforts at eliminating or reducing the tax on food. Most of those efforts offset the lost revenue by increasing the tax on cigarettes.

Then-Gov. Haley Barbour, who previously served as a national tobacco lobbyist, vetoed those efforts. Barbour later acquiesced and signed legislation increasing the 18-cent per pack tax on cigarettes by 50 cents. But interestingly, the governor never agreed to reduce the tax on food. He said it was a fair tax that he supported.

In 2016, when the Legislature, led by then-Lt. Gov. Tate Reeves, who is now governor, and Gunn passed at the time what was the largest tax cut it history, nary a dime went for the elimination of the tax on groceries. Instead, there were tax cuts for businesses and on personal income. Research of state Department of Revenue data at the time revealed that most of the companies being aided by the cut were based out of state.

The north star under Barbour and now for many Republican leaders is cutting or eliminating the income tax, which accounts for about one-third of state general fund revenue. Another priority for Mississippi politicians also has been reducing the tax on businesses — primarily large out of state corporations.

It was interesting that the bulk of that tax cut went primarily to out of state corporations in light of an earlier 2013 study by the Department of Revenue that revealed 111 of the state’s 150 largest companies, in terms of employment, paid no income tax. While the companies were not named, the bulk of those companies not paying were likely large out of state retailers.

In 2016, legislation was passed to phase out the franchise tax, which was the only tax many of those companies paid.

Despite the 2016 tax cut and the 2022 tax cut, both of which were billed at the time as the largest in state history, Gunn and Reeves, who also advocate for the elimination of the income tax, both made it clear they are not finished.

The 2022 legislation even includes language saying “it is the intent of the Legislature that before calendar year 2026, the Legislature will consider whether the revised (reduced) tax rates will be further decreased.”

But both Gunn and Reeves point out their intent is to take further steps as soon as possible to wipe from the state tax code the income tax.

“Elimination would be the ultimate goal and we pressed hard for that,” Gunn said.

But that is not the goal for the state’s tax on groceries that disproportionally impacts the poor.

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.

Mississippi News

Suspect in Charlie Kirk assassination believed to have acted alone, says Utah governor

SUMMARY: Tyler Robinson, 22, was arrested for the targeted assassination of conservative activist Charlie Kirk in Orem, Utah. Authorities said Robinson had expressed opposition to Kirk’s views and indicated responsibility after the shooting. The attack occurred during a Turning Point USA event at Utah Valley University, where Kirk was shot once from a rooftop and later died in hospital. Engravings on bullets and chat messages helped link Robinson to the crime, which was captured on grim video. The killing sparked bipartisan condemnation amid rising political violence. President Trump announced Robinson’s arrest and plans to award Kirk the Presidential Medal of Freedom.

The post Suspect in Charlie Kirk assassination believed to have acted alone, says Utah governor appeared first on www.wjtv.com

Mississippi News

Americans mark the 24th anniversary of the 9/11 attacks with emotional ceremonies

SUMMARY: On the 24th anniversary of the 9/11 attacks, solemn ceremonies were held in New York, at the Pentagon, and in Shanksville to honor nearly 3,000 victims. Families shared personal remembrances, emphasizing ongoing grief and the importance of remembrance. Vice President JD Vance postponed his attendance to visit a recently assassinated activist’s family, adding tension to the day. President Trump spoke at the Pentagon, pledging never to forget and awarding the Presidential Medal of Freedom posthumously. The attacks’ global impact reshaped U.S. policy, leading to wars and extensive health care costs for victims. Efforts continue to finalize legal proceedings against the alleged plot mastermind.

The post Americans mark the 24th anniversary of the 9/11 attacks with emotional ceremonies appeared first on www.wcbi.com

Mississippi News

Hunt for Charlie Kirk assassin continues, high-powered rifle recovered

SUMMARY: Charlie Kirk, conservative influencer and Turning Point USA founder, was fatally shot by a sniper during a speech at Utah Valley University on September 10, 2025. The shooter, believed to be a college-aged individual who fired from a rooftop, escaped after the attack. Authorities recovered a high-powered rifle and are reviewing video footage but have not identified the suspect. The shooting highlighted growing political violence in the U.S. and sparked bipartisan condemnation. Kirk, a Trump ally, was praised by political leaders, including Trump, who called him a “martyr for truth.” The university was closed and security heightened following the incident.

The post Hunt for Charlie Kirk assassin continues, high-powered rifle recovered appeared first on www.wjtv.com

-

News from the South - Kentucky News Feed6 days ago

Lexington man accused of carjacking, firing gun during police chase faces federal firearm charge

-

The Center Square7 days ago

California mother says daughter killed herself after being transitioned by school | California

-

News from the South - Arkansas News Feed6 days ago

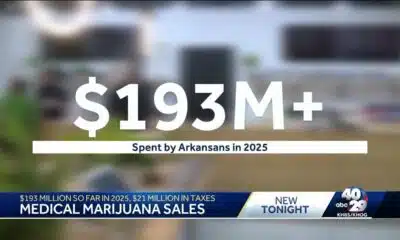

Arkansas medical marijuana sales on pace for record year

-

News from the South - Alabama News Feed6 days ago

Zaxby's Player of the Week: Dylan Jackson, Vigor WR

-

News from the South - Missouri News Feed6 days ago

Local, statewide officials react to Charlie Kirk death after shooting in Utah

-

Local News Video6 days ago

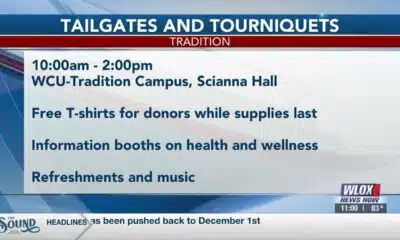

William Carey University holds 'tailgates and tourniquets' blood drive

-

News from the South - North Carolina News Feed4 days ago

What we know about Charlie Kirk shooting suspect, how he was caught

-

Local News6 days ago

US stocks inch to more records as inflation slows and Oracle soars