News from the South - Florida News Feed

Fed goes with half-point interest rate cut. What that means for you | Quickcast

SUMMARY: In today’s CBS News Miami Quickcast, the Federal Reserve is expected to cut interest rates for the first time in over four years, aiming to lower borrowing costs and prevent a recession. Miami is experiencing heat and storms, with temperatures rising into the 90s. A fire in a Miami Beach high-rise was caused by a charging electric scooter, though no injuries occurred. Jalisa Hill pleads not guilty to orchestrating her grandparents’ murder. Sean “Diddy” Combs faces serious charges, including sex trafficking. Meanwhile, a solar panel canopy was unveiled in Fort Lauderdale, part of efforts to increase renewable energy in the community.

In today’s Quickcast:

The mortgage rate landscape is undergoing a rapid transformation now that inflation is cooling. For starters, there has been a notable drop in mortgage rates over the past few weeks, with rates hitting a two-year low on Wednesday. This shift has already begun to stir excitement, as more affordable borrowing costs open doors for those previously priced out of homeownership.

The Federal Reserve also conducted its first rate cut since 2020 on September 18, reducing the federal funds rate by an unexpected 50 basis points. Most analysts expected the Fed rate cut to be just 25 basis points, making this decision larger and more impactful than anticipated.

This move is expected to put additional downward pressure on interest rates across the board, including mortgages, and may present an opportunity for borrowers to lock in more favorable rates. But how exactly will this substantial Fed rate cut impact mortgages? Below, we’ll break down what you should know.

See how low of a mortgage rate you could lock in here today.

Here’s how the Fed’s big rate cut affects mortgages

The Federal Reserve’s decision to implement a 50 basis point rate cut has injected a new layer of complexity into the mortgage market. While the impact of a standard 25 basis point reduction has likely been factored into current mortgage rates, which are sitting at an average of 6.15%, it’s unclear exactly how mortgage rates will respond to this larger rate cut.

One outcome could be that the larger rate cut will cause mortgage rates to fall even further in the coming days and weeks, building on the recent trend of declining rates. This could create a more favorable environment for borrowers, with the possibility of mortgage rates dipping to levels not seen in years.

However, it’s crucial to understand that the Federal Reserve’s actions, while significant, are not the sole factor influencing mortgage rates. The mortgage market is a complex ecosystem affected by various economic indicators. Long-term bonds, particularly the 10-year Treasury yield, also play a pivotal role in determining mortgage rates. So while the Fed’s rate cut will likely push these yields lower, other factors can also sway bond yields and, consequently, mortgage rates.

The mortgage industry itself may also play a role in tempering any dramatic rate drops. For example, lenders might be hesitant to lower rates too quickly or too far as they balance their desire to attract borrowers with the need to maintain profitability. This could result in a more gradual decline in mortgage rates rather than an immediate, sharp drop.

For potential homebuyers or those considering refinancing, the Fed’s larger-than-expected rate cut presents both opportunities and potential challenges. On one hand, the prospect of lower mortgage rates is certainly appealing. Lower rates translate to more affordable monthly payments and increased buying power, potentially allowing borrowers to qualify for larger loans or more desirable properties.

The bottom line

The Federal Reserve’s unexpected 50 basis point rate cut will likely have a noticeable effect on the mortgage market, but its exact impact remains uncertain. While lower rates may materialize in the short term, a range of factors will influence how mortgage rates move in the future. So, homebuyers and homeowners who plan to refinance should carefully consider their options, recognizing that waiting for the perfect moment could be risky in an unpredictable market. Securing a favorable rate now may be the best course of action instead, especially with rates already at a two-year low.

The allure of lower rates could also bring its own set of complications, however. If mortgage rates decline even further, it’s likely to attract more buyers to the market. This increased demand could lead to heightened competition for available properties, potentially driving up home prices and offsetting some of the benefits of lower interest rates.

Those waiting for rates to bottom out before making a move may also find themselves in a precarious position. Timing the market is notoriously difficult, and there’s a risk that rates could begin to rise again before you can act. After all, economic conditions can shift rapidly, which could reverse the current downward trend in rates.

Lenders are also more likely to see an uptick in inquiries and applications in the wake of the Fed’s decision. This increased volume could lead to longer processing times and potentially stricter underwriting standards, so borrowers should be prepared for this possibility and consider getting pre-approved or starting the application process early.

Find out how low your mortgage loan rate could be now.

Catch the Quickcast with Najahe Sherman weekdays at 4PM ET streaming on the CBS Miami app and CBSMiami.com

#florida #miami #miamidade #localnews #local #community #politicalnews

News from the South - Florida News Feed

Orlando restaurant owner invites artists to parking lot amid federal fight against street art

SUMMARY: In response to Florida’s decision to paint over street art on public roads, including the rainbow crosswalk outside the Pulse nightclub, Orlando’s Se7en Bites restaurant owner Trina Gregory is opening 49 parking spaces for local artists to create vibrant artworks. The event, “Parking Spaces for Pride,” will take place Monday from 7 a.m. to 7 p.m. at 617 N Primrose Drive. It aims to transform controversy into a community celebration that uplifts Orlando’s LGBTQ+ community, preserving the city’s love for art. Gregory intends to make this an annual event promoting creativity, diversity, and resilience amidst the state’s restrictions on non-uniform traffic markings.

The post Orlando restaurant owner invites artists to parking lot amid federal fight against street art appeared first on www.clickorlando.com

News from the South - Florida News Feed

Community honors life of 10-year-old Harper Moyski, killed in shooting at Minneapolis church

SUMMARY: In Minneapolis, friends and family gathered to honor 10-year-old Harper Moyski, killed in a mass shooting at Annunciation Catholic School. Harper, remembered as fierce, curious, and unapologetically herself, was one of two children killed alongside 21 injured when a former student opened fire during Mass. Her mother, Jackie Flavin, described Harper as “extra in the very best way,” loving dogs and aspiring to be a veterinarian. Speakers at the outdoor memorial called for an end to gun violence, especially in schools. Rabbi Jason Rodich urged kindness amid societal division, encouraging people to support one another “for Harper.”

Read the full article

The post Community honors life of 10-year-old Harper Moyski, killed in shooting at Minneapolis church appeared first on www.news4jax.com

News from the South - Florida News Feed

A look at recent flooding across South Florida

SUMMARY: South Florida is still recovering from a week of severe flooding that made roads nearly impassable, stalled cars, and forced people to wade through water. In Hollywood, upgraded flood pumps and drainage systems helped subside water levels quickly, preventing damage to homes. However, in North Miami, residents along 141st Street report ongoing issues with backed-up drains and street flooding, which disrupt daily life, including doctor visits. The city claims the flooding is due to long tides rather than clogged drains and asserts the area has been checked. Concerns remain about the area’s vulnerability without further drainage maintenance.

Parts of South Florida are still drying out from the deluge of rain storms last week.

For video licensing inquiries, contact: licensing@veritone.com

-

News from the South - Kentucky News Feed7 days ago

Lexington man accused of carjacking, firing gun during police chase faces federal firearm charge

-

News from the South - Alabama News Feed7 days ago

Zaxby's Player of the Week: Dylan Jackson, Vigor WR

-

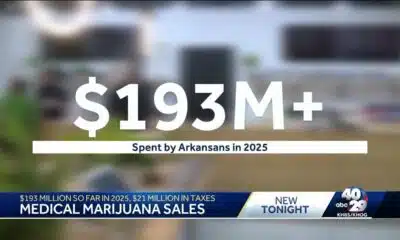

News from the South - Arkansas News Feed7 days ago

Arkansas medical marijuana sales on pace for record year

-

News from the South - North Carolina News Feed5 days ago

What we know about Charlie Kirk shooting suspect, how he was caught

-

News from the South - Missouri News Feed7 days ago

Local, statewide officials react to Charlie Kirk death after shooting in Utah

-

Local News7 days ago

US stocks inch to more records as inflation slows and Oracle soars

-

Local News Video6 days ago

Introducing our WXXV Student Athlete of the Week, St. Patrick’s Parker Talley!

-

Local News6 days ago

Russian drone incursion in Poland prompts NATO leaders to take stock of bigger threats