News from the South - North Carolina News Feed

Budget proposal from NC Senate has Helene relief, income tax cuts

RALEIGH — In February, state economists warned of a looming fiscal cliff if the income and corporate tax rates continue to drop. Senate Republicans don’t exactly believe them. On Monday, they presented a budget proposal that doubled down on income tax cuts, not only ignoring advice to pause them, but also eliminating pesky revenue “triggers” getting in the way of further reductions.

The proposed budget would spend $32.6 billion in the first year and $33.3 billion during the second year (North Carolina operates on a two-year budget.). These are 5.8% and 2.1% year-over-year budget increases, respectively.

Overall, Senate Bill 257 shows “modest growth” to reflect North Carolina’s rising population and economy, Senate leader Phil Berger said.

[Subscribe for FREE to Carolina Public Press’ alerts and weekend roundup newsletters]

Tax policy and Helene recovery were the focuses of the 439-page proposal — the first major move in a months-long spending negotiation with the state House.

In a statement, the NC Budget & Tax Center, a nonprofit organization that documents economic conditions, blasted the proposal, saying it was “rooted in magical thinking and cruel cuts that will leave North Carolina unprepared for recessions, federal cost shifts and climate disasters.”

Meanwhile, the budget bill sped through a series of committee hearings Tuesday and will be fast-tracked to the Senate floor. If it passes the Senate, the House will likely make changes.

The final budget will almost certainly be crafted in a joint committee during the coming months.

Then, that version will go to Gov. Josh Stein’s desk, who may opt to sign or veto it, sending it back to the legislature.

Helene big part of budget proposal

It’s estimated that it will cost $60 billion to pay for Western North Carolina’s full Hurricane Helene recovery.

But the state doesn’t have that kind of money, Republican Sen. Ralph Hise, who represents nine counties on the state’s western border, told reporters during a press conference on Monday.

Instead, the working strategy is to load millions of dollars into the Hurricane Helene Disaster Recovery Fund, not to be spent now, but to be saved for future federal matching requirements.

The NC Senate’s budget proposal shifts $700 million from various state funds to the Helene Fund, but only reserves $25.5 million for specific purposes:

- $10 million to the Governor’s Recovery Office for Western North Carolina

- $5 million to the Division of Community Revitalization

- $8 million to the UNC Board of Governors to improve emergency response in Western North Carolina schools

- $2.5 million to the North Carolina community college system for enrollment loss

Hise said North Carolina is in a “good position” to meet matching requirements as it anticipates a variety of funds to come from the federal government.

The budget proposal also takes $634 million of underutilized transportation funds and reserves them for federal matching requirements for transportation infrastructure recovery.

It further divides $686 million in federal American Relief Act money between Helene-related clean water, drinking water and wastewater treatment system improvement needs.

Finally, it directs state agencies administering certain grant programs to prioritize applicants from the most impacted counties.

Since Helene, the state has used a significant portion of its “Rainy Day Fund.” So, the budget replenishes it to pre-Helene levels, to the tune of $1.1 billion.

Democratic Senate Minority Leader Sydney Batch isn’t pleased with the lack of actual spending, calling the budget proposal “a blueprint for neglect and cowardice.”

“Instead of investing in the people who make this state work, Republicans are continuing to hoard taxpayer dollars in a Rainy Day Fund — undermining critical agencies and ducking their responsibility by kicking tough decisions over to the House of Representatives,” she said in a statement.

Tax ‘triggers’

If you don’t meet your goals, well, why not just lower the goalpost?

That’s what Senate Republicans chose to do in their budget proposal. Under current law, the state needs to meet specific revenue “triggers” in order to drop the income tax rate another half percent each fiscal year.

Based on February’s Consensus Revenue Forecast, produced by the Office of the State Budget and Management, North Carolina met the revenue threshold for the first year of the biennium, but missed it by less than $100 million the second year.

While North Carolina is growing, the state budget office forecast that the downward pressure of income and corporate tax rate cuts, as well as the unpredictability of inflation and tariffs, would outweigh any revenue increases in fiscal year 2026-27.

The current income tax rate is 4.25% and is scheduled to drop to 3.99% in 2026.

After meeting the first-year trigger, the state is free to further drop the rate another half percent to 3.49% in 2027. But current law would force a pause in 2028.

The Senate budget works around that obstacle by eliminating the trigger from 3.49% to 2.99%.

The budget proposal leaves the next trigger, from 2.99 to 2.49%, in place for 2029, and adds two quarter percent drops the two following years.

Heba Atwa, the director of legislative advocacy and campaigns for the NC Budget & Tax Center, spoke out against the proposed cuts in a Tuesday legislative committee.

She said rate reductions would cost $13 billion annually. Furthermore, Atwa argued that lawmakers weren’t adequately considering the potential loss of federal funds. Last year, North Carolina received federal funding in an amount equivalent to its entire state budget ($30.8 billion). The next two-year budget cycle may be different.

“Y’all will be left holding the bag when North Carolinians come to you and say, ‘What happened to our services and our programs?’” Atwa said.

Berger isn’t convinced federal cuts will actually happen, but his caucus is monitoring things.

“I think we’ll be able to, if necessary, make adjustments, but it’s our belief that we have adequate reserves to address any scenario that is likely to occur,” said Berger, a Rockingham County Republican.

While the Senate’s proposed budget doesn’t account for potential federal funding cuts, it does take inspiration from Elon Musk’s cost-cutting agency: the Department of Government Efficiency. It dedicates $5 million so that State Auditor Dave Boliek could oversee a state version of DOGE, aptly named the Division of Accountability, Value and Efficiency (DAVE).

DAVE would determine whether state agencies and their vacant positions are necessary as well as how effectively they spend money.

Unlike its federal counterpart, the state auditor would not have the authority to eliminate programs or spending, but could offer recommendations to the General Assembly, Berger said.

This article first appeared on Carolina Public Press and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.

The post Budget proposal from NC Senate has Helene relief, income tax cuts appeared first on carolinapublicpress.org

News from the South - North Carolina News Feed

White House officials hold prayer vigil for Charlie Kirk

SUMMARY: Republican lawmakers, conservative leaders, and Trump administration officials held a prayer vigil and memorial at the Kennedy Center honoring slain activist Charlie Kirk, founder of Turning Point USA. Kirk was killed in Utah, where memorials continue at Utah Valley University and Turning Point USA’s headquarters. Police say 22-year-old Tyler Robinson turned himself in but has not confessed or cooperated. Robinson’s roommate, his boyfriend who is transitioning, is cooperating with authorities. Investigators are examining messages Robinson allegedly sent on Discord joking about the shooting. Robinson faces charges including aggravated murder, obstruction of justice, and felony firearm discharge.

White House officials and Republican lawmakers gathered at the Kennedy Center at 6 p.m. to hold a prayer vigil in remembrance of conservative activist Charlie Kirk.

https://abc11.com/us-world/

Download: https://abc11.com/apps/

Like us on Facebook: https://www.facebook.com/ABC11/

Instagram: https://www.instagram.com/abc11_wtvd/

Threads: https://www.threads.net/@abc11_wtvd

TIKTOK: https://www.tiktok.com/@abc11_eyewitnessnews

News from the South - North Carolina News Feed

Family, friends hold candlelight vigil in honor of Giovanni Pelletier

SUMMARY: Family and friends held a candlelight vigil in Apex to honor Giovanni Pelletier, a Fuquay Varina High School graduate whose body was found last month in a Florida retention pond. Giovanni went missing while visiting family, after reportedly acting erratically and leaving his cousins’ car. Loved ones remembered his infectious smile, laughter, and loyal friendship, expressing how deeply he impacted their lives. His mother shared the family’s ongoing grief and search for answers as authorities continue investigating his death. Despite the sadness, the community’s support has provided comfort. A celebration of life mass is planned in Apex to further commemorate Giovanni’s memory.

“It’s good to know how loved someone is in their community.”

More: https://abc11.com/post/giovanni-pelletier-family-friends-hold-candlelight-vigil-honor-wake-teen-found-dead-florida/17811995/

Download: https://abc11.com/apps/

Like us on Facebook: https://www.facebook.com/ABC11/

Instagram: https://www.instagram.com/abc11_wtvd/

Threads: https://www.threads.net/@abc11_wtvd

TIKTOK: https://www.tiktok.com/@abc11_eyewitnessnews

News from the South - North Carolina News Feed

NC Courage wins 2-1 against Angel City FC

SUMMARY: The North Carolina Courage defeated Angel City FC 2-1 in Cary, ending their unbeaten streak. Monaca scored early at the 6th minute, followed by Bull City native Brianna Pinto’s goal at the 18th minute, securing a 2-0 halftime lead. Angel City intensified in the second half, scoring in the 88th minute, but the Courage held firm defensively to claim victory. Pinto expressed pride in the win, emphasizing the team’s unity and playoff ambitions. Nearly 8,000 fans attended. Coverage continues tonight at 11, alongside college football updates, including the Tar Heels vs. Richmond game live from Chapel Hill.

Saturday’s win was crucial for the Courage as the regular season starts to wind down.

https://abc11.com/post/north-carolina-courage-wins-2-1-angel-city-fc/17810234/

Download: https://abc11.com/apps/

Like us on Facebook: https://www.facebook.com/ABC11/

Instagram: https://www.instagram.com/abc11_wtvd/

Threads: https://www.threads.net/@abc11_wtvd

TIKTOK: https://www.tiktok.com/@abc11_eyewitnessnews

-

News from the South - Kentucky News Feed6 days ago

Lexington man accused of carjacking, firing gun during police chase faces federal firearm charge

-

The Center Square7 days ago

California mother says daughter killed herself after being transitioned by school | California

-

News from the South - Arkansas News Feed6 days ago

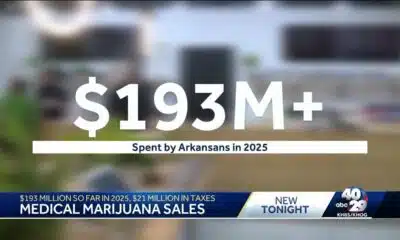

Arkansas medical marijuana sales on pace for record year

-

News from the South - Alabama News Feed6 days ago

Zaxby's Player of the Week: Dylan Jackson, Vigor WR

-

Local News Video6 days ago

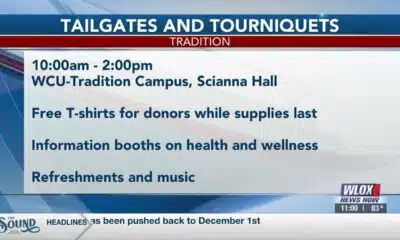

William Carey University holds 'tailgates and tourniquets' blood drive

-

News from the South - North Carolina News Feed5 days ago

What we know about Charlie Kirk shooting suspect, how he was caught

-

News from the South - Missouri News Feed6 days ago

Local, statewide officials react to Charlie Kirk death after shooting in Utah

-

Local News6 days ago

US stocks inch to more records as inflation slows and Oracle soars