Kaiser Health News

An Arm and a Leg: How a Surprise Bill Can Hitch a Ride to the Hospital

by Dan Weissmann

Wed, 16 Aug 2023 09:00:00 +0000

How did three siblings who took identical ambulance rides (from the same car wreck to the same hospital) end up with three wildly different bills? The answer lies in the No Surprises Act.

That law has protected patients from some of the most outrageous out-of-network medical bills since it took effect in 2022 — except when it comes to ground ambulances. Host Dan Weissmann and producer Emily Pisacreta unpack the story with Bram Sable-Smith of KFF Health News and PIRG’s Patricia Kelmar and share what to do if you get hit with an out-of-network ambulance bill.

Dan Weissmann

Host and producer of “An Arm and a Leg.” Previously, Dan was a staff reporter for Marketplace and Chicago’s WBEZ. His work also appears on All Things Considered, Marketplace, the BBC, 99 Percent Invisible, and Reveal, from the Center for Investigative Reporting.

Credits

Emily Pisacreta

Producer

Adam Raymonda

Audio Wizard

Ellen Weiss

Editor

Click to open the Transcript

Transcript: How a Surprise Bill Can Hitch a Ride to the Hospital

Note: “An Arm and a Leg” uses speech-recognition software to generate transcripts, which may contain errors. Please use the transcript as a tool but check the corresponding audio before quoting the podcast.

Dan: Hey there —

I have been following the world of medical bills for more than four years now — which makes me still a newbie, really. And here’s one thing that’s surprised me — beyond how much there is to know, and how deep the problems go.

It’s this: Sometimes, some things do actually change for the better.

Like, when I started, one of the most outrageous problems was something called “surprise bills”:

That’s when you go someplace, like a hospital, that takes your insurance, and then, SURPRISE! You get a bill from somebody there who says they DON’T take your insurance, and they feel free to charge you ANY ridiculous amount they want, and your insurance may cover a LITTLE of it, or none of it.

I was like, “I will be making episodes about this outrage for a long time.”

Except, at the end of 2020, about two years in for me, Congress actually did something about this outrage. They passed a law called the No Surprises Act.

It said, if you went somewhere in network — someplace your insurance covers — then any bill you get from anybody there? You should be covered as if they were in network. So, they don’t take your insurance? Not your problem. They’ve gotta work something out with your insurer. And if they can’t, an arbitrator steps in.

The law went into effect at the beginning of 2022. And: Surprise! In a lot of ways, it’s working. One study shows that it’s preventing a million of these surprise bills every month. A million. Every month.

Except, of course, nothing’s perfect. There are a lot of nuances we could look into, but one thing really stands out: There’s actually a hole written into the law that you could drive an ambulance through.

We’re gonna look at how that hole got there, what it means, and what MAYBE could get done about it.

This is “An Arm and a Leg,” a show about why health care costs so freaking much and what we can maybe do about it. I’m Dan Weissmann. I’m a reporter, and I like a challenge. So our job on this show is to take one of the most enraging, terrifying, depressing parts of American life and bring you something entertaining, empowering and useful.

And today we’re talking about ambulances. With help from producer Emily Pisacreta.

Emily: Wee-oo-wee-oo

Dan: Haha! Emily you have spent the last few weeks looking at this whole deal

with ambulances. Why don’t you take it away?

Emily: Here’s a story that illustrates how weird ambulance bills can be. It’s a totally wild installment of “Bill of the Month,” the series from NPR and our co-producers KFF Health News.

I talked to the KFF reporter who did the story, Bram Sable-Smith, a Midwest correspondent there.

Bram Sable-Smith: I kind of focus on issues that face consumers, people who are living their lives.

Emily: One person who was just living her life was a woman named Peggy.

Bram Sable-Smith: She’s 55 years old. She works in a fine jewelry store in the Chicago suburbs. And her two siblings, Jim and Cynthia, were coming to visit her.

Emily: So Peggy and her siblings are in the car. They’re driving out into the country, going to see some horses. They’re out on this country road, they come up to an intersection, and all of sudden, bam, the car gets hit by a truck.

Bram Sable-Smith: It spun around and slammed into an electrical box right there on the side of the highway.

Emily: They survive, but they do get pretty banged up. Someone calls 911, and ambulances arrive. And here’s where the story goes from being scary to kinda weird. Peggy and her brother and sister need to go to the hospital.

But because an ambulance is not a bus, with seats for everyone, each sibling needs their own ambulance, and: Each of those ambulances is run by a different ambulance service. They end up at the same hospital, they get billed for the exact same services.

Bram: They were all charged for a life support fee and they were all charged a mileage fee.

Emily: However …

Bram: Months later when the bills came for the three of them, they got billed

three very different amounts for the exact same services.

Emily: And the bills were all out of network, and all pretty substantial. Especially Peggy’s. Cynthia’s bill was $1,250, Jim’s $1,415, and poor Peggy? Who invited her siblings on this ill-fated drive?

Bram Sable-Smith: Peggy’s bill was for $3,606.

Emily: That’s almost three times what her sister got charged. And these are all heavy-duty bills. Higher than what research shows is the average out-of-network ambulance bill.

But the fact that they’re out of network, like not billed to their insurance? That’s not an outlier. It’s estimated that 71% of ambulance bills are out of network on commercial plans. Which means 71% of the time …

Bram Sable-Smith: … ambulances are essentially able to charge whatever they want.

Emily: Result? These random ass charges.

Dan: Hold up. So this is exactly the kind of thing the No Surprises Act was supposed to prevent: out-of-network bills from someone you didn’t pick yourself. You know, like an ambulance. And you’re saying ambulances are especially unlikely to be covered by your insurance. But they’re not governed by the No Surprises Act.

Emily: That’s right.

Dan: OK, so why did Congress leave ambulances out of the No Surprises Act?

Emily: I mean, I had the same question. It’s like … Congress was able to juggle all the demands of the insurance lobby and health care providers including, I should mention, AIR ambulance companies

Dan: Wait, that’s helicopter rides?

Emily: Yep. Helicopters, air ambulances, that were charging tens of thousands of dollars a ride. Congress dealt with them here, but, like … not regular degular ambulances? So yeah, why not?

And the answer has to do with who actually runs ambulances in the U.S. And how they get their funding.

That story starts decades ago. You ready for this?

Dan: What, a ride in the Wayback Machine? Yeah, I mean have you met me? I was born ready for this.

Emily: OK, sea tbelts on. Once upon a time, about 60 years ago …

Patricia Kelmar: We really didn’t have an emergency transportation system for

medical care in the U.S.

Emily: That’s Patricia Kelmar. She runs health care campaigns at a consumer-advocacy organization called the Public Interest Research Group. She lobbied for the No Surprises Act. And when we talked, we got into the history of ambulances, because everything has an origin story. She says a national ambulance system started with a big federal report in 1966. And here’s what it said:

Patricia Kelmar: We were losing a lot of people who were having medical emergencies at home or out in the community and didn’t get to the hospital fast enough.

Emily: The report identified accidental injuries as the leading cause of death for Americans in the first half of their life span. It said more Americans died from motor vehicle accidents in 1965 than American troops in the Korean War.

Patricia Kelmar: So this report really opened the eyes of public health officials, and there was a movement in the early Seventies to create a national emergency transportation system.

Dan: Wait! This reminds me of a show that was on when I was a kid called Emergency! with an exclamation point.

Emily: Yeah totally!

[Emergency! theme]

[Clip from Emergency! plays]

Dispatcher: Rampart Emergency?

Paramedic 1: Rampart, this is Squad 51.

Dan: Yeah! Kids I knew had Emergency! lunchboxes

Emily: Yeah, it was a whole cultural moment. It seems like this apparently had American audiences on the edge of their seats.

[Clip from Emergency! plays]

Dispatcher: Go ahead, 51.

Paramedic 1: Rampart, we have a male patient here, age 17. He has, uh, acute abdominal pain.

Emily: That first aired in 1972.

[Clip from Emergency! plays]

Paramedic 1: Patient’s, uh, ingested two loaves of raw dough. Ambulance has just arrived.

[Emergency! Sound]

Emily: Lawmakers had a vision to match. In 1973, Congress passed the Emergency Medical Services Systems Act, to bring high-quality emergency care to every part of the country.

Patricia Kelmar: It was developed thinking about regions so that we didn’t have too many ambulances, but we had enough ambulances to serve different populations, and the best part was there was federal funding to make this happen.

Emily: But then in the ’80s … the structure of that funding changed. Now states would get block grants, big chunks of federal health care dollars that they would decide for themselves how to use.

Patricia Kelmar: And so every community then, throughout our country, responded to this change in the funding system by … understanding that we still need ambulances, but funding it in different ways.

Emily: Which is why in some places you’d never get a bill for an ambulance. The local city or county governments owns and operates it, and a mix of funding streams, including local taxes just cover it.

And in other places, you certainly would get a bill. And it wouldn’t be from the county, but it’d be from a hospital, or a for-profit EMS company. Because they run about 40% of this landscape too, and some of those companies are even owned by private equity.

And still in other places, you get volunteer ambulance companies running bake sales or even raising money on GoFundMe.

In the case of Peggy and her siblings, just by virtue of where they got into the accident, they ended up in publicly run ambulances from three different jurisdictions, each with their own funky funding, each with their own unique pricing scheme.

Dan: Huh. So that’s where things stood with ambulances when Congress was cooking up the No Surprises Act. Coming right up: Why did that lead Congress to punt? And what might come next?

[midroll]

Dan: This episode of “An Arm and a Leg” is produced in partnership with KFF Health News. That’s a nonprofit newsroom covering health care in America. Their work is absolutely terrific; I love partnering with them. We’ll have a little more information about KFF Health News at the end of this episode.

[midroll music fades out]

Dan: OK … So, since the 1960s, we’ve got ambulance care around the country that meets certain standards — great. But how the ambulances get funded, who owns them, and how much you get billed after it drops you off, all these things depend on location — not so great.

But, you know: hospital funding, hospital bills … that’s not standard across the country, either. Why did Congress apply the No Surprises Act to hospitals, but not ambulance rides? Emily, looking at you here.

Emily: Hey, look, even experts have a tough time with that one. Here’s an economist named Loren Adler from the Brookings Institution. He researches health insurance and he watched the whole No Surprises Act take shape.

I asked him: So, no ambulances. Why’s that?

Loren Adler: So, I’m not sure I can give you a super satisfactory answer. I don’t really think there’s a great reason. Uh, I can give the sort …

Emily: You don’t have to … you certainly don’t have to defend …

Loren Adler: Yeah, um, that’s true.

Emily: Actually he did have a couple of reasons. He started with: who actually runs ambulance services most of the time.

Loren Adler: About 60% of emergency ground ambulance transport is actually billed by local governments or fire departments.

Dan: So “Big Ambulance Incorporated” didn’t steamroll Congress?

Emily: Not according to Loren.

Loren Adler: As much as observers might think that lobbyists and sort of stakeholder industry have a lot of say over Congress, I’m not objecting to that characterization. Uh, you know, calls from local lawmakers and mayors and fire department chiefs have even more weight.

Dan: So, OK. We’re talking local public servants. Like, Leslie Knope from Parks and Rec, if she were a fire chief.

Emily: Yeah, and as Loren might say: A high ambulance bill looks like an outrage to you, but to her it looks like something else.

Loren Adler: It is effectively a source of local government revenue.

Dan: So Congress was hearing from Leslie Knope, “Are you trying to bankrupt

my little town of Pawnee?” And they were like, “OK. So, no ambulances then.”

Emily: Right. Loren also sees a much nerdier factor at play.

Dan: Hit me.

Emily: Remember, whether it’s Leslie Knope or “Big Ambulance Inc.” running them, local ambulance services are overwhelmingly out of network.

And so according to Loren, the mechanisms that make the No Surprises Act work would be hard to apply.

Loren Adler: The sort of structure of the No Surprises Act is all kind of based around this median in-network price,

Emily: Did you catch that? Median in-network price.

That is, Congress had to decide: If we’re gonna make a law where an out-of-network provider can’t just charge Whatever They Want anymore in these situations, then … what are they supposed to get paid? Congress said …

Loren: We’re gonna tell insurers you have to pay whatever your sort of average in-network price was for the service.

Emily: But with so few in-network providers, there is no reliable, average in-network price.

Dan: OK. That was super-nerdy. And I’m gonna note that even if Leslie Knope and a bunch of nerds led the charge here, Big Ambulance Inc. got the benefit too. So what now?

Emily: Well, Congress did recognize that they were leaving this giant sign up at the door that said “Welcome Surprise Ambulance Bills.” And they said, OK, we can’t figure this shit out now. But let’s have a bunch of experts get together and let’s have them write us some recommendations for later. They told the Department of Health and Human Services: Go form a committee.

And now Loren is on that committee. So is Patricia Kelmar — the consumer advocate we heard from earlier.

Patricia Kelmar: The advisory committee is called the Ground Ambulance and Patient Billing Advisory Committee. If that’s not a mouthful, I don’t know …

Emily: Yeah. Yep.

Patricia Kelmar: But it’s, it’s probably indicative of how complicated finding solutions to surprise billing can be.

Emily: Patricia and the panel, they first met in early May, and the law says they have 180 days after that to come up with some policy recommendations for lawmakers to take under advisement. After that, it’ll be up to Congress to take action again.

Dan: And, I mean, not to be a cynic, but it took years to get the No Surprises Act passed. What if I decide not to hold my breath until Congress does something about ambulances?

Emily: You’ll be forgiven, my dude.

Dan: So, where does that leave us? Scrounging for in-the-meantime advice, right?

Emily: Yep. Patricia has some tips.

Patricia Kelmar: The first thing we recommend is that you talk to both your insurer and the ambulance company and try to negotiate better coverage or lowering of the bill.

Emily: If you get your insurance through work, your HR department may be able to help. Let them know what happened and see whether they can get insurance to pay it off.

If that’s not an option, try to negotiate with the ambulance provider.

Patricia Kelmar: Always explain your financial situation. Try to work out something. I have. Patients who called me about their ambulance bills, and when they call and explain, sometimes they get a discount.

Emily: And finally, there might actually be state local laws in your area that pertain to balance bills, that include ambulances.

Dan: Ooh, I’ve got one more tip!

Emily: Mmmhm?

Dan: This one is from our pal Jared Walker. He runs a group called Dollar For. Their whole thing is helping people get financial assistance, or charity care. ‘Cause, you know, nonprofit hospitals are required to give price breaks to at least SOME people with low incomes.

And Jared says: Ambulance companies aren’t required to have those kinds of policies, but A LOT OF THEM DO.

He also says: You should look them up. Like, the specific policy for whatever company you are dealing with. Because these policies can have funny names … like “Compassionate Care Policy.” And if you don’t ask for them by name, the person you call may pretend they don’t know what you’re talking about. That’s what Jared says. So, Jared, if you’re listening, big thanks to you for those crucial details.

Emily: Cool cool cool. But none of these solutions work for everyone.

Peggy, the woman who got into an accident with her siblings? Her bill went to collections, and she had a hell of a time fighting back. The bill disappeared only after her story aired on national radio.

Dan: That one’s definitely not gonna work for everybody.

Emily: No. Which reminds me of another thing Patricia told me.

Patricia: For the ambulance committee, there’s a public portion. People can log in, they can listen, people can share their stories, tell us something about what they want us to do, and if they don’t get called on that time, they can just write a note, and let us know.

Dan: Wherever you’re listening to this, we’ll post information about how you can chime in.

Also, I found a list of 10 states that have surprise-billing protections for ambulances — including Illinois, Ohio, New York, Colorado. We’ll have a link to the list of all 10 states as well.

Emily, thank you so much for telling us all about ambulances.

Emily: My pleasure.

Dan: And I’ve got a request here. Something I could use everybody’s help with:

We are planning an upcoming episode about AI. ‘Cause we’re wondering: Can we train ChatGPT to make it easier to appeal stupid insurance denials?

And we’re gonna need … some raw material. Some stupid insurance denials.

If you’ve gotten one recently, and you’d like some help from a chatbot — and an actual human expert that we will recruit — can you please get in touch? Go to armandalegshow.com/contact.

Let us know the story. Please include the relevant documents. We won’t share your personal information without your OK, but if we use your story, we will want to talk with you, maybe put your voice on the show.

Are you game? Or: Do you know somebody who might be? Let’s get our new robot overlords working for us, you know, while we can.

And besides: I’m pretty sure the folks at the insurance companies are already trying to do the same. Let’s start catching up.

Again: The place to share is: armandalegshow.com/contact.. Thank you so much. This should be fun.

We’ll have another episode for you in a few weeks.

Till then, take care of yourself.

This episode of “An Arm and a Leg” was produced by Emily Pisacreta — with help from Lucy Little, Bella Cjazkowski, and me, Dan Weissmann — and edited by Ellen Weiss.

Daisy Rosario is our consulting managing producer. Adam Raymonda is our audio wizard. Our music is by Dave Winer and Blue Dot Sessions.

Gabrielle Healy is our managing editor for audience. She edits the First Aid Kit Newsletter.

Bea Bosco is our consulting director of operations. Sarah Ballema is our operations manager.

“An Arm and a Leg” is produced in partnership with KFF Health News — formerly known as Kaiser Health News.

That’s a national newsroom producing in-depth journalism about health care in America, and a core program at KFF — an independent source of health policy research, polling, and journalism.

And yes, you did hear the name Kaiser in there, and no: KFF isn’t affiliated with the health care giant Kaiser Permanente. You can learn more about KFF Health News at armandalegshow.com/KFF.

Zach Dyer is senior audio producer at KFF Health News. He is editorial liaison to this show.

Thanks to Public Narrative — that’s a Chicago-based group that helps journalists and nonprofits tell better stories — for serving as our fiscal sponsor, allowing us to accept tax-exempt donations. You can learn more about Public Narrative at www.publicnarrative.org.

And thanks to everybody who supports this show financially.

If you haven’t yet, we’d love for you to join us. The place for that is armandalegshow.com/support.

Thank you!

“An Arm and a Leg” is a co-production of KFF Health News and Public Road Productions.

To keep in touch with “An Arm and a Leg,” subscribe to the newsletter. You can also follow the show on Facebook and Twitter. And if you’ve got stories to tell about the health care system, the producers would love to hear from you.

To hear all KFF Health News podcasts, click here.

And subscribe to “An Arm and a Leg” on Spotify, Apple Podcasts, Pocket Casts, or wherever you listen to podcasts.

By: Dan Weissmann

Title: An Arm and a Leg: How a Surprise Bill Can Hitch a Ride to the Hospital

Sourced From: kffhealthnews.org/news/podcast/how-a-surprise-bill-can-hitch-a-ride-to-the-hospital/

Published Date: Wed, 16 Aug 2023 09:00:00 +0000

Kaiser Health News

States Brace for Reversal of Obamacare Coverage Gains Under Trump’s Budget Bill

Shorter enrollment periods. More paperwork. Higher premiums. The sweeping tax and spending bill pushed by President Donald Trump includes provisions that would not only reshape people’s experience with the Affordable Care Act but, according to some policy analysts, also sharply undermine the gains in health insurance coverage associated with it.

The moves affect consumers and have particular resonance for the 19 states (plus Washington, D.C.) that run their own ACA exchanges.

Many of those states fear that the additional red tape — especially requirements that would end automatic reenrollment — would have an outsize impact on their policyholders. That’s because a greater percentage of people in those states use those rollovers versus shopping around each year, which is more commonly done by people in states that use the federal healthcare.gov marketplace.

“The federal marketplace always had a message of, ‘Come back in and shop,’ while the state-based markets, on average, have a message of, ‘Hey, here’s what you’re going to have next year, here’s what it will cost; if you like it, you don’t have to do anything,’” said Ellen Montz, who oversaw the federal ACA marketplace under the Biden administration as deputy administrator and director at the Center for Consumer Information and Insurance Oversight. She is now a managing director with the Manatt Health consulting group.

Millions — perhaps up to half of enrollees in some states — may lose or drop coverage as a result of that and other changes in the legislation combined with a new rule from the Trump administration and the likely expiration at year’s end of enhanced premium subsidies put in place during the covid-19 pandemic. Without an extension of those subsidies, which have been an important driver of Obamacare enrollment in recent years, premiums are expected to rise 75% on average next year. That’s starting to happen already, based on some early state rate requests for next year, which are hitting double digits.

“We estimate a minimum 30% enrollment loss, and, in the worst-case scenario, a 50% loss,” said Devon Trolley, executive director of Pennie, the ACA marketplace in Pennsylvania, which had 496,661 enrollees this year, a record.

Drops of that magnitude nationally, coupled with the expected loss of Medicaid coverage for millions more people under the legislation Trump calls the “One Big Beautiful Bill,” could undo inroads made in the nation’s uninsured rate, which dropped by about half from the time most of the ACA’s provisions went into effect in 2014, when it hovered around 14% to 15% of the population, to just over 8%, according to the most recent data.

Premiums would rise along with the uninsured rate, because older or sicker policyholders are more likely to try to jump enrollment hurdles, while those who rarely use coverage — and are thus less expensive — would not.

After a dramatic all-night session, House Republicans passed the bill, meeting the president’s July 4 deadline. Trump is expected to sign the measure on Independence Day. It would increase the federal deficit by trillions of dollars and cut spending on a variety of programs, including Medicaid and nutrition assistance, to partly offset the cost of extending tax cuts put in place during the first Trump administration.

The administration and its supporters say the GOP-backed changes to the ACA are needed to combat fraud. Democrats and ACA supporters see this effort as the latest in a long history of Republican efforts to weaken or repeal Obamacare. Among other things, the legislation would end several changes put in place by the Biden administration that were credited with making it easier to sign up, such as lengthening the annual open enrollment period and launching a special program for very low-income people that essentially allows them to sign up year-round.

In addition, automatic reenrollment, used by more than 10 million people for 2025 ACA coverage, would end in the 2028 sign-up season. Instead, consumers would have to update their information, starting in August each year, before the close of open enrollment, which would end Dec. 15, a month earlier than currently.

That’s a key change to combat rising enrollment fraud, said Brian Blase, president of the conservative Paragon Health Institute, because it gets at what he calls the Biden era’s “lax verification requirements.”

He blames automatic reenrollment, coupled with the availability of zero-premium plans for people with lower incomes that qualify them for large subsidies, for a sharp uptick in complaints from insurers, consumers, and brokers about fraudulent enrollments in 2023 and 2024. Those complaints centered on consumers’ being enrolled in an ACA plan, or switched from one to another, without authorization, often by commission-seeking brokers.

In testimony to Congress on June 25, Blase wrote that “this simple step will close a massive loophole and significantly reduce improper enrollment and spending.”

States that run their own marketplaces, however, saw few, if any, such problems, which were confined mainly to the 31 states using the federal healthcare.gov.

The state-run marketplaces credit their additional security measures and tighter control over broker access than healthcare.gov for the relative lack of problems.

“If you look at California and the other states that have expanded their Medicaid programs, you don’t see that kind of fraud problem,” said Jessica Altman, executive director of Covered California, the state’s Obamacare marketplace. “I don’t have a single case of a consumer calling Covered California saying, ‘I was enrolled without consent.’”

Such rollovers are common with other forms of health insurance, such as job-based coverage.

“By requiring everyone to come back in and provide additional information, and the fact that they can’t get a tax credit until they take this step, it is essentially making marketplace coverage the most difficult coverage to enroll in,” said Trolley at Pennie, 65% of whose policyholders were automatically reenrolled this year, according to KFF data. KFF is a health information nonprofit that includes KFF Health News.

Federal data shows about 22% of federal sign-ups in 2024 were automatic-reenrollments, versus 58% in state-based plans. Besides Pennsylvania, the states that saw such sign-ups for more than 60% of enrollees include California, New York, Georgia, New Jersey, and Virginia, according to KFF.

States do check income and other eligibility information for all enrollees — including those being automatically renewed, those signing up for the first time, and those enrolling outside the normal open enrollment period because they’ve experienced a loss of coverage or other life event or meet the rules for the low-income enrollment period.

“We have access to many data sources on the back end that we ping, to make sure nothing has changed. Most people sail through and are able to stay covered without taking any proactive step,” Altman said.

If flagged for mismatched data, applicants are asked for additional information. Under current law, “we have 90 days for them to have a tax credit while they submit paperwork,” Altman said.

That would change under the tax and spending plan before Congress, ending presumptive eligibility while a person submits the information.

A white paper written for Capital Policy Analytics, a Washington-based consultancy that specializes in economic analysis, concluded there appears to be little upside to the changes.

While “tighter verification can curb improper enrollments,” the additional paperwork, along with the expiration of higher premiums from the enhanced tax subsidies, “would push four to six million eligible people out of Marketplace plans, trading limited fraud savings for a surge in uninsurance,” wrote free market economists Ike Brannon and Anthony LoSasso.

“Insurers would be left with a smaller, sicker risk pool and heightened pricing uncertainty, making further premium increases and selective market exits [by insurers] likely,” they wrote.

KFF Health News is a national newsroom that produces in-depth journalism about health issues and is one of the core operating programs at KFF—an independent source of health policy research, polling, and journalism. Learn more about KFF.

USE OUR CONTENT

This story can be republished for free (details).

KFF Health News is a national newsroom that produces in-depth journalism about health issues and is one of the core operating programs at KFF—an independent source of health policy research, polling, and journalism. Learn more about KFF.

Subscribe to KFF Health News’ free Morning Briefing.

This article first appeared on KFF Health News and is republished here under a Creative Commons license.

The post States Brace for Reversal of Obamacare Coverage Gains Under Trump’s Budget Bill appeared first on kffhealthnews.org

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Center-Left

This content presents a critique of Republican-led changes to the Affordable Care Act, emphasizing potential negative impacts such as increased premiums, reduced enrollment, and the erosion of coverage gains made under the ACA. It highlights the perspective of policy analysts and state officials who express concern over these measures, while also presenting conservative viewpoints, particularly those focusing on fraud reduction. Overall, the tone and framing lean toward protecting the ACA and its expansions, which traditionally aligns with Center-Left media analysis.

Kaiser Health News

Dual Threats From Trump and GOP Imperil Nursing Homes and Their Foreign-Born Workers

In a top-rated nursing home in Alexandria, Virginia, the Rev. Donald Goodness is cared for by nurses and aides from various parts of Africa. One of them, Jackline Conteh, a naturalized citizen and nurse assistant from Sierra Leone, bathes and helps dress him most days and vigilantly intercepts any meal headed his way that contains gluten, as Goodness has celiac disease.

“We are full of people who come from other countries,” Goodness, 92, said about Goodwin House Alexandria’s staff. Without them, the retired Episcopal priest said, “I would be, and my building would be, desolate.”

The long-term health care industry is facing a double whammy from President Donald Trump’s crackdown on immigrants and the GOP’s proposals to reduce Medicaid spending. The industry is highly dependent on foreign workers: More than 800,000 immigrants and naturalized citizens comprise 28% of direct care employees at home care agencies, nursing homes, assisted living facilities, and other long-term care companies.

But in January, the Trump administration rescinded former President Joe Biden’s 2021 policy that protected health care facilities from Immigration and Customs Enforcement raids. The administration’s broad immigration crackdown threatens to drastically reduce the number of current and future workers for the industry. “People may be here on a green card, and they are afraid ICE is going to show up,” said Katie Smith Sloan, president of LeadingAge, an association of nonprofits that care for older adults.

Existing staffing shortages and quality-of-care problems would be compounded by other policies pushed by Trump and the Republican-led Congress, according to nursing home officials, resident advocates, and academic experts. Federal spending cuts under negotiation may strip nursing homes of some of their largest revenue sources by limiting ways states leverage Medicaid money and making it harder for new nursing home residents to retroactively qualify for Medicaid. Care for 6 in 10 residents is paid for by Medicaid, the state-federal health program for poor or disabled Americans.

“We are facing the collision of two policies here that could further erode staffing in nursing homes and present health outcome challenges,” said Eric Roberts, an associate professor of internal medicine at the University of Pennsylvania.

The industry hasn’t recovered from covid-19, which killed more than 200,000 long-term care facility residents and workers and led to massive staff attrition and turnover. Nursing homes have struggled to replace licensed nurses, who can find better-paying jobs at hospitals and doctors’ offices, as well as nursing assistants, who can earn more working at big-box stores or fast-food joints. Quality issues that preceded the pandemic have expanded: The percentage of nursing homes that federal health inspectors cited for putting residents in jeopardy of immediate harm or death has risen alarmingly from 17% in 2015 to 28% in 2024.

In addition to seeking to reduce Medicaid spending, congressional Republicans have proposed shelving the biggest nursing home reform in decades: a Biden-era rule mandating minimum staffing levels that would require most of the nation’s nearly 15,000 nursing homes to hire more workers.

The long-term care industry expects demand for direct care workers to burgeon with an influx of aging baby boomers needing professional care. The Census Bureau has projected the number of people 65 and older would grow from 63 million this year to 82 million in 2050.

In an email, Vianca Rodriguez Feliciano, a spokesperson for the Department of Health and Human Services, said the agency “is committed to supporting a strong, stable long-term care workforce” and “continues to work with states and providers to ensure quality care for older adults and individuals with disabilities.” In a separate email, Tricia McLaughlin, a Department of Homeland Security spokesperson, said foreigners wanting to work as caregivers “need to do that by coming here the legal way” but did not address the effect on the long-term care workforce of deportations of classes of authorized immigrants.

Goodwin Living, a faith-based nonprofit, runs three retirement communities in northern Virginia for people who live independently, need a little assistance each day, have memory issues, or require the availability of around-the-clock nurses. It also operates a retirement community in Washington, D.C. Medicare rates Goodwin House Alexandria as one of the best-staffed nursing homes in the country. Forty percent of the organization’s 1,450 employees are foreign-born and are either seeking citizenship or are already naturalized, according to Lindsay Hutter, a Goodwin spokesperson.

“As an employer, we see they stay on with us, they have longer tenure, they are more committed to the organization,” said Rob Liebreich, Goodwin’s president and CEO.

Jackline Conteh spent much of her youth shuttling between Sierra Leone, Liberia, and Ghana to avoid wars and tribal conflicts. Her mother was killed by a stray bullet in her home country of Liberia, Conteh said. “She was sitting outside,” Conteh, 56, recalled in an interview.

Conteh was working as a nurse in a hospital in Sierra Leone in 2009 when she learned of a lottery for visas to come to the United States. She won, though she couldn’t afford to bring her husband and two children along at the time. After she got a nursing assistant certification, Goodwin hired her in 2012.

Conteh said taking care of elders is embedded in the culture of African families. When she was 9, she helped feed and dress her grandmother, a job that rotated among her and her sisters. She washed her father when he was dying of prostate cancer. Her husband joined her in the United States in 2017; she cares for him because he has heart failure.

“Nearly every one of us from Africa, we know how to care for older adults,” she said.

Her daughter is now in the United States, while her son is still in Africa. Conteh said she sends money to him, her mother-in-law, and one of her sisters.

In the nursing home where Goodness and 89 other residents live, Conteh helps with daily tasks like dressing and eating, checks residents’ skin for signs of swelling or sores, and tries to help them avoid falling or getting disoriented. Of 102 employees in the building, broken up into eight residential wings called “small houses” and a wing for memory care, at least 72 were born abroad, Hutter said.

Donald Goodness grew up in Rochester, New York, and spent 25 years as rector of The Church of the Ascension in New York City, retiring in 1997. He and his late wife moved to Alexandria to be closer to their daughter, and in 2011 they moved into independent living at the Goodwin House. In 2023 he moved into one of the skilled nursing small houses, where Conteh started caring for him.

“I have a bad leg and I can’t stand on it very much, or I’d fall over,” he said. “She’s in there at 7:30 in the morning, and she helps me bathe.” Goodness said Conteh is exacting about cleanliness and will tell the housekeepers if his room is not kept properly.

Conteh said Goodness was withdrawn when he first arrived. “He don’t want to come out, he want to eat in his room,” she said. “He don’t want to be with the other people in the dining room, so I start making friends with him.”

She showed him a photo of Sierra Leone on her phone and told him of the weather there. He told her about his work at the church and how his wife did laundry for the choir. The breakthrough, she said, came one day when he agreed to lunch with her in the dining room. Long out of his shell, Goodness now sits on the community’s resident council and enjoys distributing the mail to other residents on his floor.

“The people that work in my building become so important to us,” Goodness said.

While Trump’s 2024 election campaign focused on foreigners here without authorization, his administration has broadened to target those legally here, including refugees who fled countries beset by wars or natural disasters. This month, the Department of Homeland Security revoked the work permits for migrants and refugees from Cuba, Haiti, Nicaragua, and Venezuela who arrived under a Biden-era program.

“I’ve just spent my morning firing good, honest people because the federal government told us that we had to,” Rachel Blumberg, president of the Toby & Leon Cooperman Sinai Residences of Boca Raton, a Florida retirement community, said in a video posted on LinkedIn. “I am so sick of people saying that we are deporting people because they are criminals. Let me tell you, they are not all criminals.”

At Goodwin House, Conteh is fearful for her fellow immigrants. Foreign workers at Goodwin rarely talk about their backgrounds. “They’re scared,” she said. “Nobody trusts anybody.” Her neighbors in her apartment complex fled the U.S. in December and returned to Sierra Leone after Trump won the election, leaving their children with relatives.

“If all these people leave the United States, they go back to Africa or to their various countries, what will become of our residents?” Conteh asked. “What will become of our old people that we’re taking care of?”

KFF Health News is a national newsroom that produces in-depth journalism about health issues and is one of the core operating programs at KFF—an independent source of health policy research, polling, and journalism. Learn more about KFF.

Subscribe to KFF Health News’ free Morning Briefing.

This article first appeared on KFF Health News and is republished here under a Creative Commons license.

The post Dual Threats From Trump and GOP Imperil Nursing Homes and Their Foreign-Born Workers appeared first on kffhealthnews.org

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Center-Left

This content primarily highlights concerns about the impact of restrictive immigration policies and Medicaid spending cuts proposed by the Trump administration and Republican lawmakers on the long-term care industry. It emphasizes the importance of immigrant workers in healthcare, the challenges that staffing shortages pose to patient care, and the potential negative effects of GOP policy proposals. The tone is critical of these policies while sympathetic toward immigrant workers and advocates for maintaining or increasing government support for healthcare funding. The framing aligns with a center-left perspective, focusing on social welfare, immigrant rights, and concern about the consequences of conservative economic and immigration policies without descending into partisan rhetoric.

Kaiser Health News

California’s Much-Touted IVF Law May Be Delayed Until 2026, Leaving Many in the Lurch

California lawmakers are poised to delay the state’s much-ballyhooed new law mandating in vitro fertilization insurance coverage for millions, set to take effect July 1. Gov. Gavin Newsom has asked lawmakers to push the implementation date to January 2026, leaving patients, insurers, and employers in limbo.

The law, SB 729, requires state-regulated health plans offered by large employers to cover infertility diagnosis and treatment, including IVF. Nine million people will qualify for coverage under the law. Advocates have praised the law as “a major win for Californians,” especially in making same-sex couples and aspiring single parents eligible, though cost concerns limited the mandate’s breadth.

People who had been planning fertility care based on the original timeline are now “left in a holding pattern facing more uncertainty, financial strain, and emotional distress,” Alise Powell, a director at Resolve: The National Infertility Association, said in a statement.

During IVF, a patient’s eggs are retrieved, combined with sperm in a lab, and then transferred to a person’s uterus. A single cycle can total around $25,000, out of reach for many. The California law requires insurers to cover up to three egg retrievals and an unlimited number of embryo transfers.

Not everyone’s coverage would be affected by the delay. Even if the law took effect July 1, it wouldn’t require IVF coverage to start until the month an employer’s contract renews with its insurer. Rachel Arrezola, a spokesperson for the California Department of Managed Health Care, said most of the employers subject to the law renew their contracts in January, so their employees would not be affected by a delay.

She declined to provide data on the percentage of eligible contracts that renew in July or later, which would mean those enrollees wouldn’t get IVF coverage until at least a full year from now, in July 2026 or later.

The proposed new implementation date comes amid heightened national attention on fertility coverage. California is now one of 15 states with an IVF mandate, and in February, President Donald Trump signed an executive order seeking policy recommendations to expand IVF access.

It’s the second time Newsom has asked lawmakers to delay the law. When the Democratic governor signed the bill in September, he asked the legislature to consider delaying implementation by six months. The reason, Newsom said then, was to allow time to reconcile differences between the bill and a broader effort by state regulators to include IVF and other fertility services as an essential health benefit, which would require the marketplace and other individual and small-group plans to provide the coverage.

Newsom spokesperson Elana Ross said the state needs more time to provide guidance to insurers on specific services not addressed in the law to ensure adequate and uniform coverage. Arrezola said embryo storage and donor eggs and sperm were examples of services requiring more guidance.

State Sen. Caroline Menjivar, a Democrat who authored the original IVF mandate, acknowledged a delay could frustrate people yearning to expand their families, but requested patience “a little longer so we can roll this out right.”

Sean Tipton, a lobbyist for the American Society for Reproductive Medicine, contended that the few remaining questions on the mandate did not warrant a long delay.

Lawmakers appear poised to advance the delay to a vote by both houses of the legislature, likely before the end of June. If a delay is approved and signed by the governor, the law would immediately be paused. If this does not happen before July 1, Arrezola said, the Department of Managed Health Care would enforce the mandate as it exists. All plans were required to submit compliance filings to the agency by March. Arrezola was unable to explain what would happen to IVF patients whose coverage had already begun if the delay passes after July 1.

The California Association of Health Plans, which opposed the mandate, declined to comment on where implementation efforts stand, although the group agrees that insurers need more guidance, spokesperson Mary Ellen Grant said.

Kaiser Permanente, the state’s largest insurer, has already sent employers information they can provide to their employees about the new benefit, company spokesperson Kathleen Chambers said. She added that eligible members whose plans renew on or after July 1 would have IVF coverage if implementation of the law is not delayed.

Employers and some fertility care providers appear to be grappling over the uncertainty of the law’s start date. Amy Donovan, a lawyer at insurance brokerage and consulting firm Keenan & Associates, said the firm has fielded many questions from employers about the possibility of delay. Reproductive Science Center and Shady Grove Fertility, major clinics serving different areas of California, posted on their websites that the IVF mandate had been delayed until January 2026, which is not yet the case. They did not respond to requests for comment.

Some infertility patients confused over whether and when they will be covered have run out of patience. Ana Rios and her wife, who live in the Central Valley, had been trying to have a baby for six years, dipping into savings for each failed treatment. Although she was “freaking thrilled” to learn about the new law last fall, Rios could not get clarity from her employer or health plan on whether she was eligible for the coverage and when it would go into effect, she said. The couple decided to go to Mexico to pursue cheaper treatment options.

“You think you finally have a helping hand,” Rios said of learning about the law and then, later, the requested delay. “You reach out, and they take it back.”

This article was produced by KFF Health News, which publishes California Healthline, an editorially independent service of the California Health Care Foundation.

KFF Health News is a national newsroom that produces in-depth journalism about health issues and is one of the core operating programs at KFF—an independent source of health policy research, polling, and journalism. Learn more about KFF.

USE OUR CONTENT

This story can be republished for free (details).

KFF Health News is a national newsroom that produces in-depth journalism about health issues and is one of the core operating programs at KFF—an independent source of health policy research, polling, and journalism. Learn more about KFF.

Subscribe to KFF Health News’ free Morning Briefing.

This article first appeared on KFF Health News and is republished here under a Creative Commons license.

The post California’s Much-Touted IVF Law May Be Delayed Until 2026, Leaving Many in the Lurch appeared first on kffhealthnews.org

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Center-Left

This content is presented in a factual, balanced manner typical of center-left public policy reporting. It focuses on a progressive healthcare issue (mandated IVF insurance coverage) favorably highlighting benefits for diverse family structures and individuals, including same-sex couples and single parents, which often aligns with center-left values. At the same time, it includes perspectives from government officials, industry representatives, opponents, and patients, offering a nuanced view without overt ideological framing or partisan rhetoric. The emphasis on healthcare access, social equity, and patient impact situates the coverage within a center-left orientation.

-

News from the South - Tennessee News Feed5 days ago

Bread sold at Walmart, Kroger stores in TN, KY recalled over undeclared tree nut

-

News from the South - Arkansas News Feed7 days ago

Man shot and killed in Benton County, near Rogers

-

News from the South - Georgia News Feed1 day ago

Aiken County family fleeing to Mexico due to Trump immigration policies

-

News from the South - Alabama News Feed6 days ago

Girls Hold Lemonade Stand for St. Jude Hospital | July 12, 2025 | News 19 at 10 p.m. – Weekend

-

News from the South - Georgia News Feed7 days ago

Anti-ICE demonstrators march to Beaufort County Sheriff's Office

-

News from the South - Oklahoma News Feed7 days ago

Police say couple had 50+ animals living in home

-

Mississippi Today4 days ago

Coast judge upholds secrecy in politically charged case. Media appeals ruling.

-

Mississippi Today1 day ago

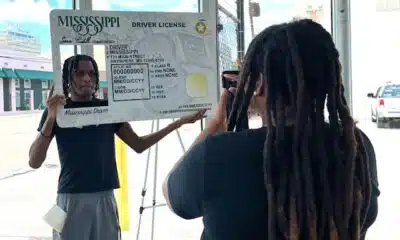

Driver’s license office moves to downtown Jackson