Kaiser Health News

‘AGGA’ Inventor Testifies His Dental Device Was Not Meant for TMJ or Sleep Apnea

Brett Kelman and Anna Werner, CBS News

Fri, 22 Dec 2023 10:00:00 +0000

A Tennessee dentist who has been sued by multiple TMJ and sleep apnea patients over an unproven dental device he invented has said under oath that he never taught dentists to use the device for those ailments — contradicting video footage of him telling dentists how to use it.

Related Articles

-

This Dental Device Was Sold to Fix Patients’ Jaws. Lawsuits Claim It Wrecked Their Teeth.

Mar 1, 2023

-

Watch: Dental Device at Center of Lawsuits Was Used on Patients Without FDA Review

Mar 2, 2023

-

Feds Launch Criminal Investigation Into ‘AGGA’ Dental Device and Its Inventor

Apr 12, 2023

Steve Galella, the inventor of the Anterior Growth Guidance Appliance, or “AGGA,” has said in court depositions that his device had been used on about 10,000 patients, and that he trained many dentists to use the AGGA in classes around the U.S. and overseas.

At least 23 patients, some of whom described being desperate for relief from sleep apnea or temporomandibular joint disorder (TMJ), have sued Galella in recent years claiming that the AGGA damaged their mouths and, in some cases, caused tooth loss. Galella denied wrongdoing in those lawsuits and has settled almost all of them within the past few months.

Galella was deposed before he settled the largest of those lawsuits. According to a deposition transcript recently obtained by KFF Health News and CBS News, Galella said under oath that he had not represented that the AGGA could treat or cure TMJ or sleep apnea.

Video footage tells a different story.

Galella repeatedly references treating TMJ and sleep apnea patients with the AGGA, sometimes in conjunction with other devices, in footage from a training session he led with Australian dentists in 2017, which was produced in discovery in an AGGA lawsuit.

At one point in the footage, Galella can be seen displaying two versions of the AGGA to the dentists, pointing to one he says is preferred by “TMJ and sleep patients” — and then saying, “And I give it to them.”

“Can you cure TMJ? Yes,” Galella told dentists as his 2017 training began, according to the footage. “Can you cure mild to moderate sleep apnea? Yes.”

The AGGA, which Galella recently rebranded as the Osseo-Restoration Appliance, resembles a retainer and uses springs to apply pressure to the front teeth and upper palate, according to a patent application filed in 2021. This year, after a joint investigation by KFF Health News and CBS News reported allegations of patients harmed by the AGGA, the FDA and the Department of Justice opened investigations into the device.

Dentists across the country have promoted the AGGA on their websites, often claiming it can “grow,” “remodel,” or “expand” an adult’s jaw without surgery, sometimes saying it has the potential to make patients more attractive and to treat common ailments like TMJ and sleep apnea, which afflict millions of Americans. Galella has said in depositions and video footage that the AGGA causes the bones in an adult’s jaw to “remodel” forward, reshaping their face.

The 2017 video footage contains other examples of Galella teaching dentists to treat TMJ and sleep apnea patients with the AGGA, which he sometimes calls a “growth appliance.” In one segment, he describes using a growth appliance on “nine out of 10” of his TMJ patients. In another instance, Galella presents photos of what he says is a TMJ patient, then proceeds to describe how he treated them with an AGGA while showing photos of the patient’s device and saying: “It’s easy with this appliance.” The footage also shows Galella calling a growth appliance “the cure” for sleep apnea, and he later says in reference to sleep apnea that “with a growth appliance, yeah, you can fix it.”

When Galella was confronted with this video footage during his recent deposition, he said his statements had been taken “out of context,” according to the deposition transcript.

The AGGA plaintiffs alleged in their lawsuits not that Galella treated them directly but instead that he or his company consulted with their dentists and prepared AGGA “treatment plans” for each patient.

Galella said during his deposition he had reviewed more than 12,000 treatment plans but said he’d never seen one that used the AGGA to treat TMJ or sleep apnea, according to the transcript. In the AGGA lawsuits, about a dozen treatment plans are filed as exhibits, and some of those plans list the patient’s “chief complaint” as TMJ or sleep apnea.

Galella’s attorneys did not respond to multiple recent requests for comment, and Galella declined to be interviewed when approached in person in February. One of Galella’s attorneys, Alan Fumuso, said in a written statement in February that the AGGA “is safe and can achieve beneficial results” when used properly.

The KFF Health News-CBS News investigation of the AGGA was based on interviews with 11 people who said they were hurt by the device and dental specialists who said they’d witnessed severe complications in AGGA patients. The investigation found no record of the AGGA being registered with the FDA and no peer-reviewed evidence showing the device “expands” or “remodels” the jaw as Galella and other dentists have claimed.

“The entire concept of this device, of this treatment, makes zero sense,” said Kasey Li, a maxillofacial surgeon and sleep apnea specialist who has published research on AGGA patients. “It doesn’t grow the jaw. It doesn’t widen the jaw. It just pushes the teeth out of their original position.”

In the wake of the KFF Health News-CBS News investigation, the FDA announced it was “evaluating safety concerns” about the AGGA and a similar device, the Anterior Remodeling Appliance. The agency said the devices had been used to treat TMJ and sleep apnea even though they were not cleared by the FDA and their safety and effectiveness had not been established.

Weeks later, the criminal investigation into the AGGA was disclosed in court filings by Galella and device manufacturer Johns Dental Laboratories, who said the U.S. attorney’s office in Memphis, Tennessee, was “potentially bringing criminal charges” against them. In another court filing, Johns Dental provided a copy of a grand jury subpoena seeking a wide variety of AGGA documents, including “any complaints received from any source whatsoever regarding the AGGA.”

Since then, Galella has resolved lawsuits from at least 19 AGGA plaintiffs through out-of-court settlements without any public admission of fault. Additional AGGA lawsuits were filed in Indiana, Pennsylvania, and Washington, with all plaintiffs alleging they were harmed while being treated for TMJ or sleep apnea.

Alice Runion, a 30-year-old IT consultant living outside Indianapolis, alleged in one of those lawsuits that wearing an AGGA as part of her TMJ treatment resulted in “permanent impairment and disfigurement” and “caused severe damage to the roots of [her] teeth.”

In an interview, Runion added that the AGGA caused lingering migraines that have left her unable to work on a computer for long stretches, forcing her out of her job. Runion said that even after corrective jaw surgery that cost tens of thousands of dollars, some of her teeth may still be at risk.

“My surgeon and my health care providers have told me that it is possible that I could lose teeth in the future still because of the treatment I received,” Runion said.

The AGGA is also being studied by orthodontists Neal Kravitz and Jeffrey Miller, who said they intend to publish a research paper next year on how the device hurts patients. Miller, who has been a paid consultant for some AGGA plaintiffs, said he has examined dental scans from at least 30 patients who were “damaged” by the AGGA.

“It’s not difficult to see the pattern,” Miller said. “The patients lose bone that supports the housing of their teeth.”

Miller and Kravitz said that they bought an AGGA in May for their research and that the Department of Justice sent an official to photograph the unboxing of the device for the criminal investigation.

Miller and Kravitz added that Johns Dental was willing to sell them the AGGA only if they did not refer to the device by name while purchasing it. They provided KFF Health News and CBS News with a copy of an email in which a Johns Dental employee writes: “To order the growth appliances from here on out, you’ll need to avoid using the names of those appliances or Dr. Galella’s name.”

A Johns Dental facility was inspected by the FDA in July, according to online inspection records. Those records show the company was issued seven citations pertaining to medical devices, but do not specifically mention the AGGA or any specific device. One citation was for an unspecified device whose “design history file does not demonstrate that the design was developed following the requirements” of federal law. Johns Dental declined to comment through its attorney, Jeffrey Oberlies.

Ten days after that FDA inspection, Johns Dental owner Jerry Neuenschwander was deposed in an AGGA lawsuit, court records show. He pleaded the Fifth in response to every question, according to a deposition transcript obtained by KFF Health News and CBS News.

Spokespeople for the Justice Department and the FDA declined to comment on the AGGA. Attorneys for Neuenschwander did not respond to requests for comment.

CBS News producer Nicole Keller contributed to this report.

——————————

By: Brett Kelman and Anna Werner, CBS News

Title: ‘AGGA’ Inventor Testifies His Dental Device Was Not Meant for TMJ or Sleep Apnea

Sourced From: kffhealthnews.org/news/article/agga-inventor-testifies-dental-device-not-designed-for-tmj-or-sleep-apnea/

Published Date: Fri, 22 Dec 2023 10:00:00 +0000

Kaiser Health News

How To Find the Right Medical Rehab Services

Rehabilitation therapy can be a godsend after hospitalization for a stroke, a fall, an accident, a joint replacement, a severe burn, or a spinal cord injury, among other conditions. Physical, occupational, and speech therapy are offered in a variety of settings, including at hospitals, nursing homes, clinics, and at home. It’s crucial to identify a high-quality, safe option with professionals experienced in treating your condition.

What kinds of rehab therapy might I need?

Physical therapy helps patients improve their strength, stability, and movement and reduce pain, usually through targeted exercises. Some physical therapists specialize in neurological, cardiovascular, or orthopedic issues. There are also geriatric and pediatric specialists. Occupational therapy focuses on specific activities (referred to as “occupations”), often ones that require fine motor skills, like brushing teeth, cutting food with a knife, and getting dressed. Speech and language therapy help people communicate. Some patients may need respiratory therapy if they have trouble breathing or need to be weaned from a ventilator.

Will insurance cover rehab?

Medicare, health insurers, workers’ compensation, and Medicaid plans in some states cover rehab therapy, but plans may refuse to pay for certain settings and may limit the amount of therapy you receive. Some insurers may require preauthorization, and some may terminate coverage if you’re not improving. Private insurers often place annual limits on outpatient therapy. Traditional Medicare is generally the least restrictive, while private Medicare Advantage plans may monitor progress closely and limit where patients can obtain therapy.

Should I seek inpatient rehabilitation?

Patients who still need nursing or a doctor’s care but can tolerate three hours of therapy five days a week may qualify for admission to a specialized rehab hospital or to a unit within a general hospital. Patients usually need at least two of the main types of rehab therapy: physical, occupational, or speech. Stays average around 12 days.

How do I choose?

Look for a place that is skilled in treating people with your diagnosis; many inpatient hospitals list specialties on their websites. People with complex or severe medical conditions may want a rehab hospital connected to an academic medical center at the vanguard of new treatments, even if it’s a plane ride away.

“You’ll see youngish patients with these life-changing, fairly catastrophic injuries,” like spinal cord damage, travel to another state for treatment, said Cheri Blauwet, chief medical officer of Spaulding Rehabilitation in Boston, one of 15 hospitals the federal government has praised for cutting-edge work.

But there are advantages in selecting a hospital close to family and friends who can help after you are discharged. Therapists can help train at-home caregivers.

How do I find rehab hospitals?

The discharge planner or caseworker at the acute care hospital should provide options. You can search for inpatient rehabilitation facilities by location or name through Medicare’s Care Compare website. There you can see how many patients the rehab hospital has treated with your condition — the more the better. You can search by specialty through the American Medical Rehabilitation Providers Association, a trade group that lists its members.

Find out what specialized technologies a hospital has, like driving simulators — a car or truck that enable a patient to practice getting in and out of a vehicle — or a kitchen table with utensils to practice making a meal.

How can I be confident a rehab hospital is reliable?

It’s not easy: Medicare doesn’t analyze staffing levels or post on its website results of safety inspections as it does for nursing homes. You can ask your state public health agency or the hospital to provide inspection reports for the last three years. Such reports can be technical, but you should get the gist. If the report says an “immediate jeopardy” was called, that means inspectors identified safety problems that put patients in danger.

The rate of patients readmitted to a general hospital for a potentially preventable reason is a key safety measure. Overall, for-profit rehabs have higher readmission rates than nonprofits do, but there are some with lower readmission rates and some with higher ones. You may not have a nearby choice: There are fewer than 400 rehab hospitals, and most general hospitals don’t have a rehab unit.

You can find a hospital’s readmission rates under Care Compare’s quality section. Rates lower than the national average are better.

Another measure of quality is how often patients are functional enough to go home after finishing rehab rather than to a nursing home, hospital, or health care institution. That measure is called “discharge to community” and is listed under Care Compare’s quality section. Rates higher than the national average are better.

Look for reviews of the hospital on Yelp and other sites. Ask if the patient will see the same therapist most days or a rotating cast of characters. Ask if the therapists have board certifications earned after intensive training to treat a patient’s particular condition.

Visit if possible, and don’t look only at the rooms in the hospital where therapy exercises take place. Injuries often occur in the 21 hours when a patient is not in therapy, but in his or her room or another part of the building. Infections, falls, bedsores, and medication errors are risks. If possible, observe whether nurses promptly respond to call lights, seem overloaded with too many patients, or are apathetically playing on their phones. Ask current patients and their family members if they are satisfied with the care.

What if I can’t handle three hours of therapy a day?

A nursing home that provides rehab might be appropriate for patients who don’t need the supervision of a doctor but aren’t ready to go home. The facilities generally provide round-the-clock nursing care. The amount of rehab varies based on the patient. There are more than 14,500 skilled nursing facilities in the United States, 12 times as many as hospitals offering rehab, so a nursing home may be the only option near you.

You can look for them through Medicare’s Care Compare website. (Read our previous guide to finding a good, well-staffed home to know how to assess the overall staffing.)

What if patients are too frail even for a nursing home?

They might need a long-term care hospital. Those specialize in patients who are in comas, on ventilators, and have acute medical conditions that require the presence of a physician. Patients stay at least four weeks, and some are there for months. Care Compare helps you search. There are fewer than 350 such hospitals.

I’m strong enough to go home. How do I receive therapy?

Many rehab hospitals offer outpatient therapy. You also can go to a clinic, or a therapist can come to you. You can hire a home health agency or find a therapist who takes your insurance and makes house calls. Your doctor or hospital may give you referrals. On Care Compare, home health agencies list whether they offer physical, occupational, or speech therapy. You can search for board-certified therapists on the American Physical Therapy Association’s website.

While undergoing rehab, patients sometimes move from hospital to nursing facility to home, often at the insistence of their insurers. Alice Bell, a senior specialist at the APTA, said patients should try to limit the number of transitions, for their own safety.

“Every time a patient moves from one setting to another,” she said, “they’re in a higher risk zone.”

KFF Health News is a national newsroom that produces in-depth journalism about health issues and is one of the core operating programs at KFF—an independent source of health policy research, polling, and journalism. Learn more about KFF.

USE OUR CONTENT

This story can be republished for free (details).

KFF Health News is a national newsroom that produces in-depth journalism about health issues and is one of the core operating programs at KFF—an independent source of health policy research, polling, and journalism. Learn more about KFF.

Subscribe to KFF Health News’ free Morning Briefing.

This article first appeared on KFF Health News and is republished here under a Creative Commons license.

The post How To Find the Right Medical Rehab Services appeared first on kffhealthnews.org

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Centrist

This article from KFF Health News provides a comprehensive, fact-based guide to rehabilitation therapy options and how to navigate insurance, care settings, and provider quality. It avoids ideological framing and presents information in a neutral, practical tone aimed at helping consumers make informed medical decisions. While it touches on Medicare and private insurance policies, it does so without political commentary or value judgments, and no partisan viewpoints or advocacy positions are evident. The focus remains on patient care, safety, and informed choice, supporting a nonpartisan, service-oriented approach to health reporting.

Kaiser Health News

States Brace for Reversal of Obamacare Coverage Gains Under Trump’s Budget Bill

Shorter enrollment periods. More paperwork. Higher premiums. The sweeping tax and spending bill pushed by President Donald Trump includes provisions that would not only reshape people’s experience with the Affordable Care Act but, according to some policy analysts, also sharply undermine the gains in health insurance coverage associated with it.

The moves affect consumers and have particular resonance for the 19 states (plus Washington, D.C.) that run their own ACA exchanges.

Many of those states fear that the additional red tape — especially requirements that would end automatic reenrollment — would have an outsize impact on their policyholders. That’s because a greater percentage of people in those states use those rollovers versus shopping around each year, which is more commonly done by people in states that use the federal healthcare.gov marketplace.

“The federal marketplace always had a message of, ‘Come back in and shop,’ while the state-based markets, on average, have a message of, ‘Hey, here’s what you’re going to have next year, here’s what it will cost; if you like it, you don’t have to do anything,’” said Ellen Montz, who oversaw the federal ACA marketplace under the Biden administration as deputy administrator and director at the Center for Consumer Information and Insurance Oversight. She is now a managing director with the Manatt Health consulting group.

Millions — perhaps up to half of enrollees in some states — may lose or drop coverage as a result of that and other changes in the legislation combined with a new rule from the Trump administration and the likely expiration at year’s end of enhanced premium subsidies put in place during the covid-19 pandemic. Without an extension of those subsidies, which have been an important driver of Obamacare enrollment in recent years, premiums are expected to rise 75% on average next year. That’s starting to happen already, based on some early state rate requests for next year, which are hitting double digits.

“We estimate a minimum 30% enrollment loss, and, in the worst-case scenario, a 50% loss,” said Devon Trolley, executive director of Pennie, the ACA marketplace in Pennsylvania, which had 496,661 enrollees this year, a record.

Drops of that magnitude nationally, coupled with the expected loss of Medicaid coverage for millions more people under the legislation Trump calls the “One Big Beautiful Bill,” could undo inroads made in the nation’s uninsured rate, which dropped by about half from the time most of the ACA’s provisions went into effect in 2014, when it hovered around 14% to 15% of the population, to just over 8%, according to the most recent data.

Premiums would rise along with the uninsured rate, because older or sicker policyholders are more likely to try to jump enrollment hurdles, while those who rarely use coverage — and are thus less expensive — would not.

After a dramatic all-night session, House Republicans passed the bill, meeting the president’s July 4 deadline. Trump is expected to sign the measure on Independence Day. It would increase the federal deficit by trillions of dollars and cut spending on a variety of programs, including Medicaid and nutrition assistance, to partly offset the cost of extending tax cuts put in place during the first Trump administration.

The administration and its supporters say the GOP-backed changes to the ACA are needed to combat fraud. Democrats and ACA supporters see this effort as the latest in a long history of Republican efforts to weaken or repeal Obamacare. Among other things, the legislation would end several changes put in place by the Biden administration that were credited with making it easier to sign up, such as lengthening the annual open enrollment period and launching a special program for very low-income people that essentially allows them to sign up year-round.

In addition, automatic reenrollment, used by more than 10 million people for 2025 ACA coverage, would end in the 2028 sign-up season. Instead, consumers would have to update their information, starting in August each year, before the close of open enrollment, which would end Dec. 15, a month earlier than currently.

That’s a key change to combat rising enrollment fraud, said Brian Blase, president of the conservative Paragon Health Institute, because it gets at what he calls the Biden era’s “lax verification requirements.”

He blames automatic reenrollment, coupled with the availability of zero-premium plans for people with lower incomes that qualify them for large subsidies, for a sharp uptick in complaints from insurers, consumers, and brokers about fraudulent enrollments in 2023 and 2024. Those complaints centered on consumers’ being enrolled in an ACA plan, or switched from one to another, without authorization, often by commission-seeking brokers.

In testimony to Congress on June 25, Blase wrote that “this simple step will close a massive loophole and significantly reduce improper enrollment and spending.”

States that run their own marketplaces, however, saw few, if any, such problems, which were confined mainly to the 31 states using the federal healthcare.gov.

The state-run marketplaces credit their additional security measures and tighter control over broker access than healthcare.gov for the relative lack of problems.

“If you look at California and the other states that have expanded their Medicaid programs, you don’t see that kind of fraud problem,” said Jessica Altman, executive director of Covered California, the state’s Obamacare marketplace. “I don’t have a single case of a consumer calling Covered California saying, ‘I was enrolled without consent.’”

Such rollovers are common with other forms of health insurance, such as job-based coverage.

“By requiring everyone to come back in and provide additional information, and the fact that they can’t get a tax credit until they take this step, it is essentially making marketplace coverage the most difficult coverage to enroll in,” said Trolley at Pennie, 65% of whose policyholders were automatically reenrolled this year, according to KFF data. KFF is a health information nonprofit that includes KFF Health News.

Federal data shows about 22% of federal sign-ups in 2024 were automatic-reenrollments, versus 58% in state-based plans. Besides Pennsylvania, the states that saw such sign-ups for more than 60% of enrollees include California, New York, Georgia, New Jersey, and Virginia, according to KFF.

States do check income and other eligibility information for all enrollees — including those being automatically renewed, those signing up for the first time, and those enrolling outside the normal open enrollment period because they’ve experienced a loss of coverage or other life event or meet the rules for the low-income enrollment period.

“We have access to many data sources on the back end that we ping, to make sure nothing has changed. Most people sail through and are able to stay covered without taking any proactive step,” Altman said.

If flagged for mismatched data, applicants are asked for additional information. Under current law, “we have 90 days for them to have a tax credit while they submit paperwork,” Altman said.

That would change under the tax and spending plan before Congress, ending presumptive eligibility while a person submits the information.

A white paper written for Capital Policy Analytics, a Washington-based consultancy that specializes in economic analysis, concluded there appears to be little upside to the changes.

While “tighter verification can curb improper enrollments,” the additional paperwork, along with the expiration of higher premiums from the enhanced tax subsidies, “would push four to six million eligible people out of Marketplace plans, trading limited fraud savings for a surge in uninsurance,” wrote free market economists Ike Brannon and Anthony LoSasso.

“Insurers would be left with a smaller, sicker risk pool and heightened pricing uncertainty, making further premium increases and selective market exits [by insurers] likely,” they wrote.

KFF Health News is a national newsroom that produces in-depth journalism about health issues and is one of the core operating programs at KFF—an independent source of health policy research, polling, and journalism. Learn more about KFF.

USE OUR CONTENT

This story can be republished for free (details).

KFF Health News is a national newsroom that produces in-depth journalism about health issues and is one of the core operating programs at KFF—an independent source of health policy research, polling, and journalism. Learn more about KFF.

Subscribe to KFF Health News’ free Morning Briefing.

This article first appeared on KFF Health News and is republished here under a Creative Commons license.

The post States Brace for Reversal of Obamacare Coverage Gains Under Trump’s Budget Bill appeared first on kffhealthnews.org

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Center-Left

This content presents a critique of Republican-led changes to the Affordable Care Act, emphasizing potential negative impacts such as increased premiums, reduced enrollment, and the erosion of coverage gains made under the ACA. It highlights the perspective of policy analysts and state officials who express concern over these measures, while also presenting conservative viewpoints, particularly those focusing on fraud reduction. Overall, the tone and framing lean toward protecting the ACA and its expansions, which traditionally aligns with Center-Left media analysis.

Kaiser Health News

Dual Threats From Trump and GOP Imperil Nursing Homes and Their Foreign-Born Workers

In a top-rated nursing home in Alexandria, Virginia, the Rev. Donald Goodness is cared for by nurses and aides from various parts of Africa. One of them, Jackline Conteh, a naturalized citizen and nurse assistant from Sierra Leone, bathes and helps dress him most days and vigilantly intercepts any meal headed his way that contains gluten, as Goodness has celiac disease.

“We are full of people who come from other countries,” Goodness, 92, said about Goodwin House Alexandria’s staff. Without them, the retired Episcopal priest said, “I would be, and my building would be, desolate.”

The long-term health care industry is facing a double whammy from President Donald Trump’s crackdown on immigrants and the GOP’s proposals to reduce Medicaid spending. The industry is highly dependent on foreign workers: More than 800,000 immigrants and naturalized citizens comprise 28% of direct care employees at home care agencies, nursing homes, assisted living facilities, and other long-term care companies.

But in January, the Trump administration rescinded former President Joe Biden’s 2021 policy that protected health care facilities from Immigration and Customs Enforcement raids. The administration’s broad immigration crackdown threatens to drastically reduce the number of current and future workers for the industry. “People may be here on a green card, and they are afraid ICE is going to show up,” said Katie Smith Sloan, president of LeadingAge, an association of nonprofits that care for older adults.

Existing staffing shortages and quality-of-care problems would be compounded by other policies pushed by Trump and the Republican-led Congress, according to nursing home officials, resident advocates, and academic experts. Federal spending cuts under negotiation may strip nursing homes of some of their largest revenue sources by limiting ways states leverage Medicaid money and making it harder for new nursing home residents to retroactively qualify for Medicaid. Care for 6 in 10 residents is paid for by Medicaid, the state-federal health program for poor or disabled Americans.

“We are facing the collision of two policies here that could further erode staffing in nursing homes and present health outcome challenges,” said Eric Roberts, an associate professor of internal medicine at the University of Pennsylvania.

The industry hasn’t recovered from covid-19, which killed more than 200,000 long-term care facility residents and workers and led to massive staff attrition and turnover. Nursing homes have struggled to replace licensed nurses, who can find better-paying jobs at hospitals and doctors’ offices, as well as nursing assistants, who can earn more working at big-box stores or fast-food joints. Quality issues that preceded the pandemic have expanded: The percentage of nursing homes that federal health inspectors cited for putting residents in jeopardy of immediate harm or death has risen alarmingly from 17% in 2015 to 28% in 2024.

In addition to seeking to reduce Medicaid spending, congressional Republicans have proposed shelving the biggest nursing home reform in decades: a Biden-era rule mandating minimum staffing levels that would require most of the nation’s nearly 15,000 nursing homes to hire more workers.

The long-term care industry expects demand for direct care workers to burgeon with an influx of aging baby boomers needing professional care. The Census Bureau has projected the number of people 65 and older would grow from 63 million this year to 82 million in 2050.

In an email, Vianca Rodriguez Feliciano, a spokesperson for the Department of Health and Human Services, said the agency “is committed to supporting a strong, stable long-term care workforce” and “continues to work with states and providers to ensure quality care for older adults and individuals with disabilities.” In a separate email, Tricia McLaughlin, a Department of Homeland Security spokesperson, said foreigners wanting to work as caregivers “need to do that by coming here the legal way” but did not address the effect on the long-term care workforce of deportations of classes of authorized immigrants.

Goodwin Living, a faith-based nonprofit, runs three retirement communities in northern Virginia for people who live independently, need a little assistance each day, have memory issues, or require the availability of around-the-clock nurses. It also operates a retirement community in Washington, D.C. Medicare rates Goodwin House Alexandria as one of the best-staffed nursing homes in the country. Forty percent of the organization’s 1,450 employees are foreign-born and are either seeking citizenship or are already naturalized, according to Lindsay Hutter, a Goodwin spokesperson.

“As an employer, we see they stay on with us, they have longer tenure, they are more committed to the organization,” said Rob Liebreich, Goodwin’s president and CEO.

Jackline Conteh spent much of her youth shuttling between Sierra Leone, Liberia, and Ghana to avoid wars and tribal conflicts. Her mother was killed by a stray bullet in her home country of Liberia, Conteh said. “She was sitting outside,” Conteh, 56, recalled in an interview.

Conteh was working as a nurse in a hospital in Sierra Leone in 2009 when she learned of a lottery for visas to come to the United States. She won, though she couldn’t afford to bring her husband and two children along at the time. After she got a nursing assistant certification, Goodwin hired her in 2012.

Conteh said taking care of elders is embedded in the culture of African families. When she was 9, she helped feed and dress her grandmother, a job that rotated among her and her sisters. She washed her father when he was dying of prostate cancer. Her husband joined her in the United States in 2017; she cares for him because he has heart failure.

“Nearly every one of us from Africa, we know how to care for older adults,” she said.

Her daughter is now in the United States, while her son is still in Africa. Conteh said she sends money to him, her mother-in-law, and one of her sisters.

In the nursing home where Goodness and 89 other residents live, Conteh helps with daily tasks like dressing and eating, checks residents’ skin for signs of swelling or sores, and tries to help them avoid falling or getting disoriented. Of 102 employees in the building, broken up into eight residential wings called “small houses” and a wing for memory care, at least 72 were born abroad, Hutter said.

Donald Goodness grew up in Rochester, New York, and spent 25 years as rector of The Church of the Ascension in New York City, retiring in 1997. He and his late wife moved to Alexandria to be closer to their daughter, and in 2011 they moved into independent living at the Goodwin House. In 2023 he moved into one of the skilled nursing small houses, where Conteh started caring for him.

“I have a bad leg and I can’t stand on it very much, or I’d fall over,” he said. “She’s in there at 7:30 in the morning, and she helps me bathe.” Goodness said Conteh is exacting about cleanliness and will tell the housekeepers if his room is not kept properly.

Conteh said Goodness was withdrawn when he first arrived. “He don’t want to come out, he want to eat in his room,” she said. “He don’t want to be with the other people in the dining room, so I start making friends with him.”

She showed him a photo of Sierra Leone on her phone and told him of the weather there. He told her about his work at the church and how his wife did laundry for the choir. The breakthrough, she said, came one day when he agreed to lunch with her in the dining room. Long out of his shell, Goodness now sits on the community’s resident council and enjoys distributing the mail to other residents on his floor.

“The people that work in my building become so important to us,” Goodness said.

While Trump’s 2024 election campaign focused on foreigners here without authorization, his administration has broadened to target those legally here, including refugees who fled countries beset by wars or natural disasters. This month, the Department of Homeland Security revoked the work permits for migrants and refugees from Cuba, Haiti, Nicaragua, and Venezuela who arrived under a Biden-era program.

“I’ve just spent my morning firing good, honest people because the federal government told us that we had to,” Rachel Blumberg, president of the Toby & Leon Cooperman Sinai Residences of Boca Raton, a Florida retirement community, said in a video posted on LinkedIn. “I am so sick of people saying that we are deporting people because they are criminals. Let me tell you, they are not all criminals.”

At Goodwin House, Conteh is fearful for her fellow immigrants. Foreign workers at Goodwin rarely talk about their backgrounds. “They’re scared,” she said. “Nobody trusts anybody.” Her neighbors in her apartment complex fled the U.S. in December and returned to Sierra Leone after Trump won the election, leaving their children with relatives.

“If all these people leave the United States, they go back to Africa or to their various countries, what will become of our residents?” Conteh asked. “What will become of our old people that we’re taking care of?”

KFF Health News is a national newsroom that produces in-depth journalism about health issues and is one of the core operating programs at KFF—an independent source of health policy research, polling, and journalism. Learn more about KFF.

Subscribe to KFF Health News’ free Morning Briefing.

This article first appeared on KFF Health News and is republished here under a Creative Commons license.

The post Dual Threats From Trump and GOP Imperil Nursing Homes and Their Foreign-Born Workers appeared first on kffhealthnews.org

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Center-Left

This content primarily highlights concerns about the impact of restrictive immigration policies and Medicaid spending cuts proposed by the Trump administration and Republican lawmakers on the long-term care industry. It emphasizes the importance of immigrant workers in healthcare, the challenges that staffing shortages pose to patient care, and the potential negative effects of GOP policy proposals. The tone is critical of these policies while sympathetic toward immigrant workers and advocates for maintaining or increasing government support for healthcare funding. The framing aligns with a center-left perspective, focusing on social welfare, immigrant rights, and concern about the consequences of conservative economic and immigration policies without descending into partisan rhetoric.

-

Mississippi Today5 days ago

After 30 years in prison, Mississippi woman dies from cancer she says was preventable

-

News from the South - Georgia News Feed6 days ago

Woman charged after boy in state’s custody dies in hot car

-

News from the South - Texas News Feed5 days ago

Texas redistricting: What to know about Dems’ quorum break

-

News from the South - North Carolina News Feed3 days ago

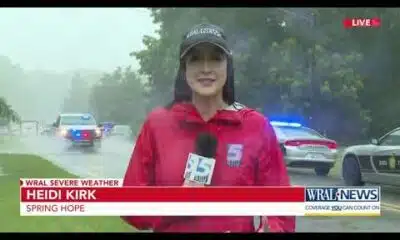

Two people unaccounted for in Spring Lake after flash flooding

-

News from the South - Texas News Feed7 days ago

Texas VFW holds memorial service for WWII pilot from Georgetown

-

News from the South - Florida News Feed6 days ago

Warning for social media shoppers after $22K RV scam

-

News from the South - Georgia News Feed6 days ago

Georgia lawmakers to return this winter to Capitol chambers refreshed with 19th Century details

-

News from the South - North Carolina News Feed6 days ago

Chapel Hill family starts nonprofit after twin daughters diagnosed with rare disease