News from the South - Texas News Feed

Abbott: Texas voters should weigh in on every tax increase

Gov. Greg Abbott wants to set a high bar for local tax increases

“Gov. Greg Abbott wants to set a high bar for local tax increases” was first published by The Texas Tribune, a nonprofit, nonpartisan media organization that informs Texans — and engages with them — about public policy, politics, government and statewide issues.

Sign up for The Brief, The Texas Tribune’s daily newsletter that keeps readers up to speed on the most essential Texas news.

DALLAS — Gov. Greg Abbott, in his bid to curb Texas’ high property taxes, wants Texas voters to have the final say on any property tax hike.

Local governments that collect property taxes — including cities, counties and school districts — should have to win approval from a two-thirds majority of voters if they want to raise their tax rates, Abbott said.

“No approval, no new taxes,” he said earlier this month during his State of the State address.

Putting every proposed tax rate increase before the voters would have widespread implications for localities’ ability to keep up with demand for services as the state booms, local officials, school advocates and tax policy experts said. As Texas’ population grows, so does the need for roads, schools and public safety, they said. Requiring any tax increase to clear a two-thirds majority vote is a nearly impossible task — and would make it easy to kill any measure aimed at providing basic services.

“We have to respect the people’s vote,” Austin Mayor Kirk Watson, a former state senator, said. “We shouldn’t create a system that allows a minority to thwart what the will of the majority wants.”

Such a requirement could further complicate school districts’ finances. As Texas has boomed and state funding to public schools has stagnated, school districts have increasingly turned to voters to help them boost teacher pay and cover basic costs among other initiatives, said Kevin Brown, executive director of the Texas Association of School Administrators.

[Abbott’s political muscle puts his agenda on fast track in Legislature]

“All of the things that we all see in our own lives, schools are dealing with that, too,” said Brown, a former Alamo Heights ISD superintendent. “But they’re doing it without increased resources from the state.”

The proposal also struck some as an outcropping of a yearslong campaign by Abbott and Texas Republicans to sap authority from the state’s cities and counties, often run by Democrats. But even local officials from Republican-controlled parts of the state aren’t happy with Abbott’s idea.

“While we share the goal of property tax relief, these mandates would harm effective local governance,” Rockwall Mayor Trace Johannesen wrote in a letter to Abbott posted on the social media site X.

Local governments in less populated areas of the state that already have lower property values could see disproportionate effects. Lower and slower growing property values mean taxes often don’t keep up with inflation. That makes providing basic services more expensive.

In East Texas, Angelina County Judge Keith Wright, a Republican, said he was waiting to see legislation that would codify Abbott’s idea. However, he has already expressed concerns to state lawmakers.

“Any such proposal could possibly be devastating to rural counties outside of metroplex areas,” he said.

Texans pay among the highest property taxes in the country because the state doesn’t have an income tax and relies heavily on property taxes to provide services like police and fire protection, public schools, streets and sidewalks. For the past six years, GOP lawmakers have pushed to rein in rising property tax bills — spending tens of billions of dollars on the effort. But the state’s property taxes remain high and legislators this year will once more consider ways to bring relief to homeowners and businesses.

“Republicans have been in charge of state government for almost 30 years, and they’re running short of ideas for how to bring down Texas’s already high property taxes,” said Brandon Rottinghaus, a political scientist at the University of Houston. “They’ve been hearing the yelp from the public for multiple decades about how property taxes are high, and they are desperate to find some way to put limits on that growth. I think part of it is that they’re stretched thin on ideas for how to slow down local property taxes.”

The inciting incident for Abbott: Harris County commissioners opted last year to raise their overall tax rate by about 14% to help pay for the costs of responding to three major weather events, including Hurricane Beryl.

Texas already limits how much more local governments can increase their property tax revenue t each year — a mechanism intended to contain property tax bills by forcing localities to lower their rates as property values rise. If localities want to raise more revenue than that cap allows, they have to ask voters for permission.

Local tax rates have generally fallen since state lawmakers tightened that cap in 2019. Tax-cut advocates have credited that move with slowing the growth of property tax bills, while local officials say the law has made it harder for localities to raise the funds necessary to deliver basic services.

There’s a carveout in the law that allows local officials to raise tax revenue past that limit if they have to use the funds to respond to a disaster like a flood or hurricane — each of which the Houston area experienced last year. Harris County used that carveout to pursue a tax rate increase without going to the voters. Officials said the funds would go toward paying for the county’s response to those weather events and prepare for future ones.

The average Harris County homeowner’s overall property tax bill rose about 5% following the hike in the county’s overall tax rate, according to a Texas Tribune analysis. But that homeowner’s bill was about 13% lower than it was before the COVID-19 pandemic when adjusted for inflation.

Houston-area Republicans balked at the increase and called it an abuse of the carveout, though Abbott had issued a disaster declaration in Beryl’s aftermath that covered Harris County.

“What happened is Harris County took a Mack truck through that disaster exemption on a Category 1 storm,” said state Sen. Paul Bettencourt, a Houston-area Republican.

Representatives for Harris County Judge Lina Hidalgo did not respond to requests for comment.

Some GOP legislators have filed bills to repeal the carveout. Bettencourt said he’s tinkering with legislation to perhaps tie the amount localities could raise taxes in a disaster scenario to, for example, directly to costs they incurred resulting from the disaster.

Abbott’s proposal would go beyond tax increases following disasters.

Many tax-rate elections and bond proposals that won with a majority of voters on last November’s ballot would not have cleared Abbott’s proposed threshold, according to a Tribune review of election records.

Travis County voters in November approved local tax increases to boost teacher pay and fund child care. But neither passed with a two-thirds majority of voters.

Together, those measures drove a 9.3% increase in the average homeowner’s tax bill in 2024, according to figures from the Travis County tax office. When adjusted for inflation, that homeowner’s bill remained slightly below where it stood just prior to the pandemic.

Forcing every proposed tax-rate increase or bond election to obtain approval from two-thirds of voters could have other negative effects, local officials and policy experts warn. Localities, they said, would likely face higher borrowing costs when seeking bonds to finance the construction of public schools, roads and other infrastructure because they wouldn’t have as much flexibility to collect tax revenue — resulting in higher costs for local taxpayers.

Some Texas cities like Austin, Houston and Dallas each face growing financial challenges in the coming years, in part because of the state’s existing limits on how much revenue localities can raise. It’s likely that those cities would face further financial pain should the state make it harder to raise tax rates, said John Diamond, senior director of the Center for Public Finance at the Baker Institute for Public Policy at Rice University.

There are other ways to reduce property tax burdens, said Kamolika Das, a tax policy analyst at the left-leaning Institute on Taxation and Economic Policy.

Texas could, as many other states do, cap property tax bills when they reach a certain level, Das said. About 30 states and the District of Columbia have programs known as “circuit breakers” that give taxpayers a credit or rebate when that happens, according to the Lincoln Institute of Land Policy, a Massachusetts-based think tank. Texas lawmakers have occasionally floated and abandoned such an idea, citing the projected cost of administering such a program.

“If the goal is to be supporting people who are having trouble paying their property taxes, there are just much better ways to do that than an across-the-board cut,” Das said.

Bettencourt, one of the Legislature’s chief tax-cut proponents, stopped short of embracing Abbott’s idea to have voters weigh in on every proposed tax increase. He noted he authored the provision in state law that allows localities to raise taxes past a certain amount if they get voter approval.

“I’m a big proponent of people voting on tax increases,” Bettencourt said. “I’m not sure a constant barrage is the right way to do it. You want the public to be involved in things that are outside the norm.”

— Jess Huff contributed.

Disclosure: Rice University, Rice University’s Baker Institute for Public Policy, Texas Association of School Administrators and University of Houston have been financial supporters of The Texas Tribune, a nonprofit, nonpartisan news organization that is funded in part by donations from members, foundations and corporate sponsors. Financial supporters play no role in the Tribune’s journalism. Find a complete list of them here.

This article originally appeared in The Texas Tribune at https://www.texastribune.org/2025/02/10/greg-abbott-property-taxes-voters/.

The Texas Tribune is a member-supported, nonpartisan newsroom informing and engaging Texans on state politics and policy. Learn more at texastribune.org.

News from the South - Texas News Feed

Frustrated with poor play against UTEP, Arch Manning will 'get back to basics'

SUMMARY: Texas quarterback Arch Manning and coach Steve Sarkisian acknowledge the team’s underwhelming offensive performance in a 27-10 win over UTEP. Manning completed 11 of 25 passes for 114 yards with a touchdown and an interception, frustrating fans expecting a stronger showing at home. Despite a rough first half with 10 consecutive incompletions, Manning showed flashes of promise and scored twice on the ground. Sarkisian emphasized Manning’s mental struggle rather than physical injury and expressed confidence in his growth and consistency. Manning committed to improving fundamentals and handling in-game pressure ahead of tougher matchups, including their SEC opener against Florida on Oct. 4.

The post Frustrated with poor play against UTEP, Arch Manning will 'get back to basics' appeared first on www.kxan.com

News from the South - Texas News Feed

Texas nursing students return from life-changing internship in Africa

SUMMARY: Two Texas nursing students, Tom Strandwitz and Valerie Moon, participated in Mercy Ships’ inaugural nursing internship aboard the Africa Mercy hospital ship in Madagascar. Selected from nationwide applicants, they gained hands-on experience in various departments, providing free surgeries and care in underserved regions. Their travel expenses were covered by over $11,000 raised through community GoFundMe campaigns. Both students were deeply impacted by patient interactions, such as cataract surgeries restoring sight and building trust with families. The internship broadened their perspectives on global health care. They plan to continue careers in intensive care and public health, with hopes to return to international nursing missions.

Read the full article

The post Texas nursing students return from life-changing internship in Africa appeared first on www.kxan.com

News from the South - Texas News Feed

Austin becoming FEMA-approved emergency alert authority, planning 1st test alert

SUMMARY: On Monday, Sept. 29, Austin will conduct a test of the Integrated Public Alert and Warning System (IPAWS), becoming a FEMA-approved alerting authority able to send emergency alerts via Wireless Emergency Alerts (WEA) to cell phones and Emergency Alert System (EAS) messages to TV and radio. This coordinated test at 3 p.m. will cover the city across its three counties—Travis, Hays, and Williamson. The alerts will clearly indicate a test and require no action. IPAWS allows authenticated, geotargeted emergency notifications without subscription, enhancing public safety communication. More details are available at ReadyCentralTexas.org and Ready.gov/alerts.

The post Austin becoming FEMA-approved emergency alert authority, planning 1st test alert appeared first on www.kxan.com

-

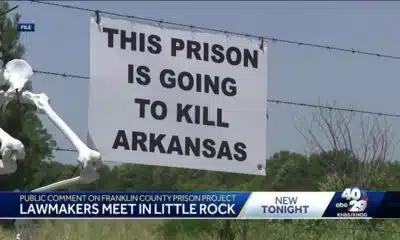

News from the South - Arkansas News Feed7 days ago

Group in lawsuit say Franklin county prison land was bought before it was inspected

-

News from the South - Kentucky News Feed6 days ago

Lexington man accused of carjacking, firing gun during police chase faces federal firearm charge

-

The Center Square6 days ago

California mother says daughter killed herself after being transitioned by school | California

-

Mississippi News Video7 days ago

Carly Gregg convicted of all charges

-

Mississippi News Video7 days ago

2025 Mississippi Book Festival announces sponsorship

-

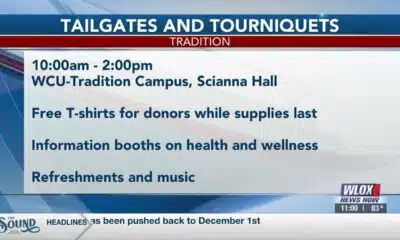

Local News Video6 days ago

William Carey University holds 'tailgates and tourniquets' blood drive

-

News from the South - Missouri News Feed6 days ago

Local, statewide officials react to Charlie Kirk death after shooting in Utah

-

Local News6 days ago

US stocks inch to more records as inflation slows and Oracle soars