Mississippi Today

A look at what Blue Cross reimburses UMMC, both before and after the contract dispute

Blue Cross and Blue Shield of Mississippi and the University of Mississippi Medical Center went head to head for months last year over reimbursement rates.

Turns out, it wasn’t for nothing.

An analysis by Mississippi Today and The Hilltop Institute at the University of Maryland, Baltimore County shows that in March 2022, during the throes of the dispute, Blue Cross’ negotiated rates were largely lower than other major private insurance companies — Aetna, Cigna, Humana and United — for several common procedures. This was especially true for more expensive procedures and emergency room visits.

A negotiated rate is how much an insurer has agreed to pay an in-network provider through a plan for covered services.

Hospitals perform and are reimbursed for thousands of procedures each year, but what they charge and what insurers pay has largely been kept a secret — that is, until 2021, when the federal government ordered hospitals to start publishing the data.

Mississippi Today worked with The Hilltop Institute to identify 21 common adult and pediatric procedures, then analyzed what Blue Cross reimbursed the hospital for each of those in March 2022, before the entities entered the contract dispute, and in March 2023, after the two entities renegotiated their contract.

Both Blue Cross and UMMC declined to answer any of Mississippi Today’s questions for this story.

The data show that for the selected services, Blue Cross almost never paid close to what UMMC charged, unless it was for cheaper procedures. The only exam that Blue Cross paid exactly what UMMC charged in 2022 was for a fetal non-stress test, which costs $231. (In 2023, when the cost was raised to $400, Blue Cross’ payment increased to $380.)

Hospital prices as of September 2022 show that in general, commercial negotiated rates are on average around 58% of the hospital charge for a given service, according to Morgan Henderson, principal data scientist at Hilltop.

In 2022, Blue Cross largely paid less than other private insurers for more expensive procedures, though the data shows that these insurance companies generally pay less than what UMMC charges.

According to data over the past three fiscal years from the Center for Healthcare Quality and Payment Reform, UMMC charged four times more for services provided to patients than it cost to deliver those services, which Henderson said was in line with what other hospitals charge.

Hospital charges are arbitrary — they can differ substantially from hospital to hospital. It’s rare that any payer gives hospitals the full amount they charge for any service, according to Harold Miller, CEO of the Center for Healthcare Quality and Payment Reform.

Some key findings from 2022 data show:

- Other insurers paid UMMC $250 for blood tests called total metabolic panels, $151 for comprehensive metabolic panels and $127 for therapeutic exercises. Blue Cross paid $12, $15 and $35, respectively.

- With the exception of X-rays, Blue Cross paid significantly less than other private insurers did for common radiologic procedures.

- Preventative care for kids and other services, such as chest radiologic exams and hospital observations, were more equitable compared to what other insurers paid — but they were all services that cost around or less than $150.

- Blue Cross paid more for vaginal deliveries, C-sections and fetal tests than other companies.

Henderson pointed specifically to Blue Cross’ low reimbursement rates for emergency room visits, one of the more common reasons people visit a hospital.

For the base cost of emergency room visits (not including any other services often charged during ER visits), Blue Cross reimbursed UMMC in March 2022 at far lower rates than other major insurers and what UMMC charges — by thousands.

“In light of this, the fact that BCBS Mississippi pays only $537.38 for a level 5 ED facility fee – for which the charge is almost $4,800 – is especially striking,” Henderson said.

Emergency room visits are categorized, and charged, based on severity. For a mild injury, a patient is charged a base level 1 fee, excluding any tests that might be performed during that visit. The most severe injury constitutes a level 5 emergency room visit.

And as the severity of the emergency room visit goes up, so does the charge. Depending on the level of injury, UMMC can charge anywhere from $468 to $4,796 for an emergency room visit. But for the most severe ER trip, Blue Cross reimbursed UMMC $537, while other insurance companies paid thousands more.

“This is a very good deal for BCBS Mississippi, especially when compared to the negotiated rates that other large commercial insurers pay for this same service,” he said.

As state lawmakers continue not to expand Medicaid, health care administrators across the state report that people who are uninsured and can’t afford preventative care are using the ER more often for general health care needs.

A year later, data from March 2023 shows that payments from Blue Cross for common procedures generally remain lower than other private insurance companies. In some cases, Blue Cross still pays thousands less.

The terms of UMMC’s agreement with Blue Cross, which was decided when the dispute ended in December, have not been disclosed.

Medicare rates are typically used as a gold standard to judge whether insurer payments are too high or too low. While Blue Cross rates are reasonable compared to Medicare payments, they’re still lower than other private insurers.

“I found the (Blue Cross) vs. non-(Blue Cross) price gaps for emergency and some other procedures very large, but in general what you found is expected,” said Ge Bai, a professor of health policy and management at Johns Hopkins Carey Business School, in an email to Mississippi Today.

“Large insurers can flex their muscle on the negotiating table and make threats toward hospitals, such as what (Blue Cross) did last year. Small insurers’ threats won’t be as concerning to hospitals because their beneficiaries do not account for a large portion of the hospital’s patient volume. Therefore, small insurers’ negotiated prices can be relatively higher.”

At a market share of 55%, Blue Cross insures the majority of Mississippians with private insurance, and UMMC is the state’s largest public hospital.

But according to consumer advocates, insurers with lower negotiated rates are supposed to pass those savings on to consumers in the form of low premiums, and if a for-profit company has a big surplus, larger premiums shouldn’t be necessary.

However, that doesn’t seem to be the case for Blue Cross — at least for the past three years.

Alleging they had to pay more in claims than expected, Blue Cross raised premiums in January 2020 for small business plans and individual plans. Since then, the insurance company has raised rates for individual plans at an average of 18% and small group plans at an average of 15.6%, according to data from 2023.

After UMMC asked Blue Cross for substantially increased reimbursement rates last year and Blue Cross refused, the hospital system terminated its contract with the insurance company and subsequently went out of network in April. The move forced tens of thousands of Mississippians to pay significantly more or go elsewhere for health care, including for some services that are only available at one place in Mississippi: UMMC.

UMMC houses the state’s only Level 1 trauma center, Level IV neonatal intensive care unit and children’s hospital. It is also home to the state’s only organ transplant center, where transplant candidates with Blue Cross insurance were marked as “inactive” on the wait lists when the hospital was out of network with the insurer.

During the dispute, UMMC maintained that it was asking for below-market rates for academic medical centers, while Blue Cross officials said to increase reimbursement rates, Mississippians’ premiums would have to go up.

A Mississippi Today investigation found that Blue Cross was sitting on a huge reserve of money, to the tune of $750 million.

While insurers generally try to hold at least three times as much capital as the minimum requirement — a ratio of 300% — to ensure the company can pay out claims, Blue Cross’ ratio has been around 1,600% for years, financial records revealed. It’s significantly larger than Blue Cross peers in neighboring states, and perhaps the largest such surplus by percentage in the country.

State Insurance Commissioner Mike Chaney said it was UMMC’s goal during the dispute to get closer to a 160 to 170% reimbursement rate from Blue Cross compared to Medicare.

Chaney, who advocated on behalf of consumers during the dispute between Blue Cross and UMMC, has long complained about the difficulties in regulating insurance reimbursement rates. He has previously said that Blue Cross won’t make that data available to his office.

New health care price transparency rules, which went into effect in 2021, requires hospitals and insurers to publish their rates, but that doesn’t mean those numbers are easy to access. They’re published on an individual basis, hospital by hospital, and the files, which don’t always look the same, are huge and sometimes hard to decipher.

Gov. Tate Reeves axed a bill earlier this year that would have allowed Chaney’s office the authority to study and address inequalities in reimbursement rates among insurance companies. The bill, which Reeves called a “bad idea,” would have allowed the commissioner to fine companies thousands per violation if they can’t justify unequal reimbursement rates for different hospitals for the same procedures.

“Transparency should provide policy-makers an understanding of what is contributing to the critical financial issues hospitals, clinics, and health providers are facing,” said Mitchell Adcock, executive director of the Center for Mississippi Health Policy. “If payments are not equitable, there are no other financial sources that provide enough revenue to cover health providers' costs.”

And as state leaders continue to oppose expanding Medicaid to the working poor, providers rely on private insurance company payments to offset uncompensated care for people who are uninsured.

Uncompensated care and higher health care costs have worsened the state’s hospital crisis. A third of rural hospitals in Mississippi are at risk of closure.

“The current hospital revenue model, good or bad, is private insurance payments to help cover the limited payments from Medicare and Medicaid and help offset some of the uncompensated care cost,” Adcock said. “Therefore, private insurance payment rates have a significant impact on hospitals’ ability to operate.”

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.

Did you miss our previous article...

https://www.biloxinewsevents.com/?p=248805

Mississippi Today

Indicted Jackson prosecutor’s latest campaign finance report rife with errors

Tangled finances, thousands in personal loans and a political contribution from a supposed investor group made up of undercover FBI informants — this was all contained in a months-late campaign finance report from Hinds County District Attorney Jody Owens.

Owens, a second-term Democrat in Mississippi’s capital city region, is fighting federal bribery charges, to which he’s pleaded not guilty. At the same time, his recent campaign finance disclosure reflects a pair of transactions that correspond with key details in the government’s allegation that Owens took money from undercover informants to pay off a local official’s debt.

Regarding payments from Facility Solutions Team — the company name used in the FBI sting — to former Jackson City Councilwoman Angelique Lee, Owens allegedly stated the need to “clean it out,” according to the indictment, which was unsealed in November.

“[L]ike we always do, we’ll put it in a campaign account, or directly wire it,” he said, the indictment claims. “[T]hat’s the only way I want the paper trail to look.”

Agents recorded hundreds of hours of conversations with Owens and other officials, and after his arraignment last year, Owens responded to the charges, saying, “The cherry-picked statements of drunken locker room banter is not a crime.”

Throughout 2024, a non-election year during which federal authorities allege Owens funneled thousands of dollars in bribes to Jackson’s city officials, Owens loaned his campaign more than $20,000, according to his campaign committee’s finance report. He’d won reelection in late 2023.

Owens and his attorneys did not respond to questions about his campaign finance report.

Owens’ report, filed May 30 – months late and riddled with errors – is the latest example of how Mississippi politicians can ignore the state’s campaign finance transparency laws while avoiding meaningful consequences. It’s a lax legal environment that has led to late and illegible reports, untraceable out-of-state money that defied contribution limits, and, according to federal authorities, public corruption with campaign finance accounts serving as piggy banks.

Enforcement duties are divided among many government bodies, including the Mississippi Ethics Commission. The commission’s executive director, Tom Hood, has long complained that the state’s campaign finance laws are confusing and ineffective.

“It’s just a mess,” Hood said.

Owens filed the annual report months past the Jan. 31 deadline, after reporting from The Marshall Project – Jackson revealed he had failed to do so. He paid a $500 fine in April.

He was also late filing in previous years, paying fines in some years and failing to pay the penalties in other years, according to records provided by the Ethics Commission.

The report, which Owens signed, is full of omissions or miscalculations, with no way to tell which is which. The cover sheet of the report provides the total amount of itemized contributions and disbursements for the year — $44,000 in and $36,500 out. But the body of the report lists the line-by-line itemizations for each, and when the Marshall Project – Jackson and Mississippi Today summed the individual itemizations, the totals didn’t match those on the cover sheet.

Based on the itemized spending detailed in the body of the report, Owens’ campaign should have thousands more in cash on hand than reported. In the report’s cover sheet, Owens also reported that he received more in itemized contributions during the year than he received in total contributions, which would be impossible to do.

While the secretary of state receives and maintains campaign finance reports, it has no obligation to review the reports and no authority to investigate their accuracy. Under state law, willfully filing a false campaign finance report is a misdemeanor. Charges, however, are rare.

Owens is the only local official in the federal bribery probe — which is set to go to trial next summer — who remains in office. The government alleged that Owens accepted $125,000 to split between him and two associates in late 2023 from a group of men he believed were vying for a development project in downtown Jackson. Owens accepted several thousand dollars more to funnel to public officials for their support of the project, the indictment alleges. The use of campaign accounts was an important feature of the alleged scheme, according to the indictment.

Owens divvied up $50,000 from Facility Solutions Team, or FST, into checks from various individuals or companies — allegedly meant to conceal the bribe — to former Jackson Mayor Chokwe Lumumba’s reelection campaign, the indictment charged.

Lumumba accepted the checks during a sunset cruise on a yacht in South Florida, the indictment alleged. His campaign finance report, filed earlier this year, reflected five $10,000 contributions near the date of the trip, with no mention of FST.

Lumumba, who lost reelection in April, has pleaded not guilty.

While the indictment accused Owens of saying that public officials use campaign accounts to finance their personal lives, state law prohibits the use of political contributions for personal use.

The indictment alleges Owens accepted $60,000 — some for the purpose of funneling to local politicians — from the men representing themselves as FST in the backroom of Owens’ cigar bar on Feb. 13, 2024. On his campaign finance report, he listed a $12,500 campaign contribution from FST two days later, the same day the indictment alleges he paid off $10,000 of former Councilwoman Lee’s campaign debt. Lee pleaded guilty to charges related to the alleged bribery scheme in 2024.

Also on Feb. 15, 2024, the campaign finance report Owens filed shows a $10,000 payment to 1Vision, a printing company that used to go by the name A2Z Printing, for the purpose of “debt retirement.” Lee had her city paycheck garnished starting in 2023 to pay off debts to A2Z Printing, according to media reports. No mention of Lee was made in the campaign finance report filed by Owens. The printing company did not respond to requests for comment.

Campaigns are allowed to contribute money to other campaigns or political action committees. If Owens’ committee used campaign funds to pay off debt owed by Lee’s campaign, the transaction should have been structured as a contribution to Lee’s campaign and reported as such by both campaigns, said Sam Begley, a Jackson-based attorney and election law expert who has advised candidates about their financial disclosures.

The alleged debt payoff on behalf of Lee is not the first time Owens has described transactions on his campaign finance filings in ways that may obscure how his campaign is spending money. Confusing or unclear descriptions of spending activity are common on campaign finance reports across the state.

Owens previously reported that in 2023, he paid $1,275 to a staff member in the district attorney’s office who also worked on his campaign. The payment was labeled a reimbursement, which Owens explained in a May email to The Marshall Project – Jackson was for expenditures this person made on behalf of the campaign, “such as meals for volunteers/workers, evening/weekend canvassers, and election day workers.”

State law requires campaigns to itemize all contributions and expenses over $200. Begley said he believes Owens’ committee should have itemized any payments over $200 made by anyone on behalf of the campaign.

Upfront payments, with the expectation of repayment by the campaign, might also be considered a loan, according to a spokesperson for the secretary of state. Campaigns are barred from spending money to repay undocumented loans.

The state Ethics Commission has addressed undocumented loan repayments in several opinions, outlining the required documentation to make repayments legal.

Since 2018, the Ethics Commission has had the power to issue advisory opinions upon request to help candidates and campaigns sort through laws that Hood, the commission’s executive director, said aren’t always clear.

The commission has issued just six opinions in seven years.

“I was surprised in the first few years that there weren’t more,” Hood said. “But now it seems to be clear that for whatever reason, most people don’t think they need advice.”

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.

The post Indicted Jackson prosecutor's latest campaign finance report rife with errors appeared first on mississippitoday.org

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Center-Left

The article critically examines the conduct of Hinds County District Attorney Jody Owens, a Democrat, and highlights systemic weaknesses in Mississippi’s campaign finance laws. While the reporting is grounded in factual evidence, legal documents, and expert commentary, the tone leans toward exposing flaws in enforcement and transparency—issues typically emphasized by center-left or reform-oriented journalism. The article does not display partisan rhetoric or ideological framing beyond its focus on accountability and legal integrity. Its publication by Mississippi Today and The Marshall Project, both known for investigative work with slight progressive leanings, further supports a Center-Left classification.

Mississippi Today

Whooping cough cases increase in Mississippi

The Mississippi State Department of Health issued an alert Wednesday that cases of pertussis, or whooping cough, are climbing in the state.

The year-to-date number of cases in Mississippi ballooned to 80 as of July 10. That compares to 49 cases in all of 2024.

No whooping cough deaths have been reported. Ten people have been hospitalized related to whooping cough, seven of whom were children under 2 years old.

Cases have largely been clustered in northeast Mississippi. The region accounts for 40% of cases statewide.

The nation has also seen rising rates of whooping cough, though cases have been climbing less steeply than in Mississippi. About 15,000 whooping cough cases have been reported nationwide this year, according to the Centers for Disease Control and Prevention.

The highly contagious respiratory illness is named for the “whooping” sound people make when gasping for air after a coughing fit. It may begin like a common cold but can last for weeks or months. Babies younger than 1 year are at greatest risk for getting whooping cough, and can have severe complications that often require hospitalization.

Whooping cough cases fell in Mississippi after the COVID-19 pandemic began, but have since rebounded. This is likely due to people now taking fewer mitigation measures, like masking and remote learning, State Epidemiologist Renia Dotson said at the state Board of Health meeting July 9.

The majority of cases – 76% – have occurred in children. Of the 73 cases reported in people who were old enough to be vaccinated, 28 were unvaccinated. Of those 28 people, 23 were children.

“Vaccines are the best defense against vaccine preventable diseases,” State Health Officer Dr. Dan Edney said after the State Board of Health meeting.

Mississippi has long had the highest child vaccination rates in the country. But the state’s kindergarten vaccination rates have dropped since a federal judge ruled in 2023 that parents can opt out of vaccinating their children for school on account of religious beliefs.

The pertussis vaccination is administered in a five-dose series for children under 7 and booster doses for older children and adults. The health department recommends that pregnant women, grandparents and family or friends that may come in close contact with an infant should get booster shots to ensure they do not pass the illness to children, particularly those too young to be vaccinated.

Immunity from pertussis vaccination wanes over time, and there is not a routine recommendation for boosters.

State health officials also encourage vaccination against other childhood illnesses, like measles. While Mississippi has not reported any measles cases, Texas has had recent outbreaks.

The Mississippi Health Department offers vaccinations to children and uninsured adults at county health departments.

Correction 7/16/25: This story has been updated to reflect that the age of the seven hospitalized children is under 2 years old.

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.

The post Whooping cough cases increase in Mississippi appeared first on mississippitoday.org

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Centrist

This article presents a straightforward, fact-based account of rising whooping cough cases in Mississippi without ideological framing. It cites official sources such as the Mississippi State Department of Health and the Centers for Disease Control and Prevention, offering context, statistics, and public health recommendations. While it mentions a 2023 federal court ruling that allowed religious exemptions to vaccinations—a potentially contentious topic—it does so factually without editorializing or assigning blame. The overall tone remains neutral and informative, aligning with public health reporting rather than political advocacy.

Mississippi Today

Driver’s license office moves to downtown Jackson

The driver’s license office in Jackson has moved downtown as the Mississippi Department of Public Safety prepares to shift its headquarters from the capital city to suburban Rankin County.

The department last month announced it was closing the license office that had operated for decades next to its headquarters just off Interstate 55 at Woodrow Wilson Avenue, near the VA Medical Center.

The new office is at 430 State St., near Jackson’s main post office and a few blocks from the Capitol.

“This location provides easier access for those who live and work in the area and ensures we can continue offering vital driver services in a more convenient and accessible space within the city of Jackson,” said Bailey Martin, spokesperson for the Department of Public Safety.

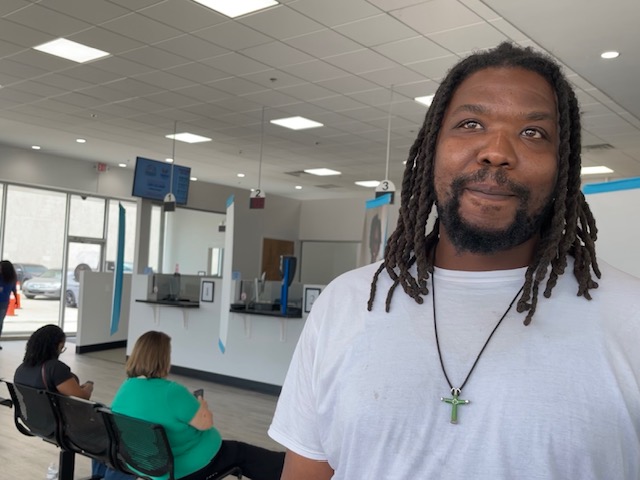

Mississippi has 35 driver’s licenses offices. The new Jackson office is in a former car dealership – an all-white building with floor-to-ceiling windows that fill the space with sunlight. On Wednesday, customers sat on black benches, chatting or scrolling on their phones while waiting to be called up to get or renew a license.

Carlos Lakes, 34, from Yazoo City, said he first went to the Richland office that issues commercial driver’s licenses but couldn’t get what he needed there. He said he then went to the old office on Woodrow Wilson and saw a note on the door showing the office had moved.

“So, it’s been about two hours of running around,” said Lakes, a truck driver.

He said the customer service at the new office was good, aside from the long wait time.

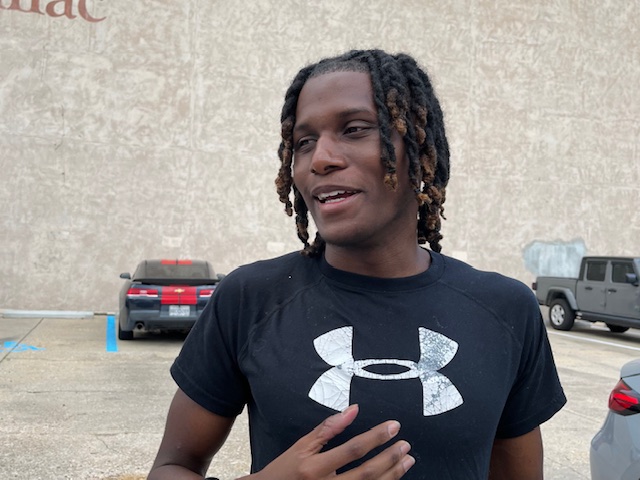

Medical student Seth Holton, 22, had a similar experience. He drove in from Flora, in Madison County, and went to the Woodrow Wilson location before finding the new office. He said it was his first time getting his license renewed.

“I think it looks nice,” Holton said of the new location. “I think it’s organized. There’s good seating. It’s pretty quick, for the most part.”

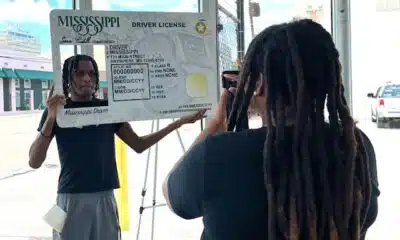

Student Marquerion Brown, 19, posed for photos with a large cardboard frame of a driver’s license in the corner of the new office. He’d just passed his driver’s test for the first time.

“I’m just lucky and thankful to get this one this time,” Brown said. He hadn’t decided where he wanted to drive first. “I got a lot of places in mind.”

The Department of Public Safety headquarters will open in Pearl within the next year, near the state’s crime lab, fire academy and emergency management agency.

Martin said the new headquarters will allow the department to have its divisions in one place – the highway patrol, bureau of investigation, bureau of narcotics, homeland security office and commercial transportation enforcement.

“As such, this move will enhance operational efficiency with other public safety partners, improve interagency collaboration, and position the department for future growth,” Martin said.

The headquarters move has been in the making for over five years. Public safety officials said the old building on Woodrow Wilson fell into disrepair after years of neglect.

Sen. David Blount, D-Jackson, was part of a group of lawmakers who proposed moving the headquarters to a different location inside Jackson.

“I personally think that the state government should be based in the state capital,” he said.

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.

The post Driver's license office moves to downtown Jackson appeared first on mississippitoday.org

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Centrist

This article from *Mississippi Today* offers a factual and neutral report on the relocation of the Jackson driver’s license office and the broader headquarters move by the Mississippi Department of Public Safety. It includes quotes from officials and everyday citizens without editorializing or promoting a specific viewpoint. The inclusion of Sen. David Blount’s comment presents a mild political contrast, but it is balanced and not framed in a confrontational or ideological way. The tone remains focused on public service logistics and community impact rather than political narrative.

-

News from the South - Tennessee News Feed5 days ago

Bread sold at Walmart, Kroger stores in TN, KY recalled over undeclared tree nut

-

News from the South - Arkansas News Feed7 days ago

Man shot and killed in Benton County, near Rogers

-

News from the South - Georgia News Feed1 day ago

Aiken County family fleeing to Mexico due to Trump immigration policies

-

News from the South - Alabama News Feed6 days ago

Girls Hold Lemonade Stand for St. Jude Hospital | July 12, 2025 | News 19 at 10 p.m. – Weekend

-

News from the South - Georgia News Feed7 days ago

Anti-ICE demonstrators march to Beaufort County Sheriff's Office

-

News from the South - Oklahoma News Feed7 days ago

Police say couple had 50+ animals living in home

-

Mississippi Today4 days ago

Coast judge upholds secrecy in politically charged case. Media appeals ruling.

-

Local News5 days ago

Oyster spawning begins as MDMR-USM Hatchery Program enters production phase using mobile hatchery