Mississippi Today

A program is putting more doctors in rural Mississippi. The auditor says it needs improvements.

A program aimed at increasing doctors in rural Mississippi communities isn’t effective enough, a new report from the state auditor’s office says.

As health care worker shortages continue, the program’s success could be crucial to improving the state’s persistent health care crisis.

The Mississippi Rural Physicians Scholarship Program, established in 2007 by the Legislature and administered by the University of Mississippi Medical Center, awards money to medical school students for tuition or student loans. In exchange, recipients must spend one year practicing in Mississippi for every year they accept the money. A similar program focused on incentivizing dentists to practice in rural Mississippi followed in 2013.

Ideally, the programs would help close the state’s health care gap — half of all Mississippians live in medically underserved counties, according to a 2021 assessment from the state Health Department. Eighty of Mississippi’s 82 counties are federally classified as Health Professional Shortage Areas in either primary or dental care.

But according to State Auditor Shad White, the programs aren’t producing doctors and dentists fast enough. A former participant of the program, however, says it was never intended to solve the shortage entirely – the problem is too big and complex.

Data in the report show that the percent of need met for primary and dental care in Mississippi’s neediest communities has decreased over the past decade, despite more money being infused into the programs.

Fletcher Freeman, a spokesperson for the State Auditor’s office, said the programs, as they stand, are too small to be effective.

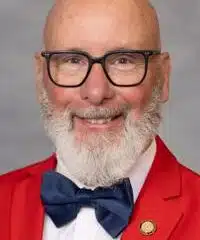

But participants like Dr. Jonathan Buchanan who moved home to Carthage in 2017 to practice family medicine said the programs are making significant changes in the communities they serve, despite the fact they are not solving the entire problem.

“I was the first physician to come back to this area in 26 years — that’s a generation’s worth of time,” he said. “Our program is currently somewhere in the 70 range of people graduated from the program and practicing, and if you asked each of those physicians, they’d say they’re making a tremendous impact on the quality of health care that rural Mississippians are receiving.”

The report takes issue with several things in particular: the programs’ definition of “rural” is too broad, and the commissions running the programs should maintain better oversight of them.

“We just don’t have the definition of ‘rural’ down,” Freeman said. “We’re using definitions when it’s convenient to potentially place doctors in Flowood.”

Though no participants have been placed in Flowood, the rules for the program allow for the Jackson suburb to be considered “rural” because of its small population. Currently, 10% of scholarship recipients practice in areas that the federal government doesn’t consider “rural.”

The report recommends adopting the federal definition of “rural” to ensure participants are placed where they’re most needed.

However, when the Legislature created the programs, they established commissions to oversee them. Those commissions decide how the programs work, including the definitions under which they operate.

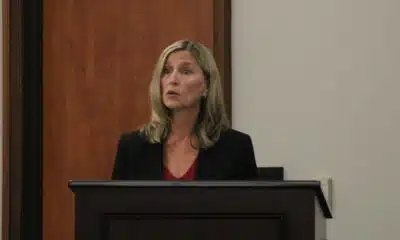

Dr. Natalie Gaughf, the University of Mississippi Medical Center’s assistant vice chancellor for academic affairs, said “it has been determined that the federal designation of ‘rural’ is not adequate” to meet the state’s needs, and what’s currently used is based on an “understanding of Mississippi’s current and historic health care landscape.”

Mississippi towns that have a population of less than 15,000 and are located more than 20 miles from a “medically served” metropolitan area are eligible for graduates to be placed for work, she said, and every practice location request is reviewed individually.

Students who aren’t from rural areas are also eligible to receive a scholarship, though Gauphf said that all of the program’s recipients have “substantial ties” to rural communities.

Additionally, the report found that a quarter of rural physician scholarship recipients and 14% of dental scholarship participants have breached their contracts.

That can mean students did not complete their commitment requirements, or they chose a non-primary care field of medicine or chose to practice in a non-rural part of Mississippi or out of the state entirely.

Breaching the contract should result in the scholarship being converted into a loan with interest. However, the report found that the scholarship programs’ offices do not accurately monitor this data. Gauphf did not expand on the challenges associated with tracking these numbers.

According to Gaughf, 49 medical school graduates have breached their contract from the time the program was created to the fall of last year.

Freeman couldn’t say what provoked the first-time review of the programs, aside from gauging their general effectiveness and ensuring that taxpayer dollars are being put to good use.

Since the program’s inception, more than $33.5 million in state dollars have gone toward it.

“This report was meant to highlight basically efficiencies and inefficiencies in the program to maximize every dollar they receive,” he said.

Freeman said if the offices use the report to address the programs’ deficiencies, perhaps they’ll receive more money and be able to make more of an impact. According to Gauphf, changes based on the report have already been made, including at least one new form used to track individuals who breach their contracts.

The Legislature has recently expanded both programs, putting $2.17 million into the rural physician scholarship program and $420,000 into the dentists’ program in fiscal years 2023 and 2024, according to the report.

“It’s a good program that’s effective at producing doctors,” Freeman said. “Just not at the rate we need them.”

Still, it’ll be hard for the program to keep up with the rate physicians and dentists are choosing to leave the state or retire, which Gauphf said is “faster than the programs can produce graduates.”

Buchanan, the scholarship program alumnus practicing in Carthage, sees the state’s health care worker crisis as multifactorial and not something that can be solved through a single program.

“We just don’t have enough physicians, period,” he said. “But I think this is definitely a step in the right direction.”

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.

Mississippi Today

Presidents are taking longer to declare major natural disasters. For some, the wait is agonizing

TYLERTOWN — As an ominous storm approached Buddy Anthony’s one-story brick home, he took shelter in his new Ford F-250 pickup parked under a nearby carport.

Seconds later, a tornado tore apart Anthony’s home and damaged the truck while lifting it partly in the air. Anthony emerged unhurt. But he had to replace his vehicle with a used truck that became his home while waiting for President Donald Trump to issue a major disaster declaration so that federal money would be freed for individuals reeling from loss. That took weeks.

“You wake up in the truck and look out the windshield and see nothing. That’s hard. That’s hard to swallow,” Anthony said.

Disaster survivors are having to wait longer to get aid from the federal government, according to a new Associated Press analysis of decades of data. On average, it took less than two weeks for a governor’s request for a presidential disaster declaration to be granted in the 1990s and early 2000s. That rose to about three weeks during the past decade under presidents from both major parties. It’s taking more than a month, on average, during Trump’s current term, the AP found.

The delays mean individuals must wait to receive federal aid for daily living expenses, temporary lodging and home repairs. Delays in disaster declarations also can hamper recovery efforts by local officials uncertain whether they will receive federal reimbursement for cleaning up debris and rebuilding infrastructure. The AP collaborated with Mississippi Today and Mississippi Free Press on the effects of these delays for this report.

“The message that I get in the delay, particularly for the individual assistance, is that the federal government has turned its back on its own people,” said Bob Griffin, dean of the College of Emergency Preparedness, Homeland Security and Cybersecurity at the University at Albany in New York. “It’s a fundamental shift in the position of this country.”

The wait for disaster aid has grown as Trump remakes government

The Federal Emergency Management Agency often consults immediately with communities to coordinate their initial disaster response. But direct payments to individuals, nonprofits and local governments must wait for a major disaster declaration from the president, who first must receive a request from a state, territory or tribe. Major disaster declarations are intended only for the most damaging events that are beyond the resources of states and local governments.

Trump has approved more than two dozen major disaster declarations since taking office in January, with an average wait of almost 34 days after a request. That ranged from a one-day turnaround after July’s deadly flash flooding in Texas to a 67-day wait after a request for aid because of a Michigan ice storm. The average wait is up from a 24-day delay during his first term and is nearly four times as long as the average for former Republican President George H.W. Bush, whose term from 1989-1993 coincided with the implementation of a new federal law setting parameters for disaster determinations.

The delays have grown over time, regardless of the party in power. Former Democratic President Joe Biden, in his last year in office, averaged 26 days to declare major disasters — longer than any year under former Democratic President Barack Obama.

FEMA did not respond to the AP’s questions about what factors are contributing to the trend.

Others familiar with FEMA noted that its process for assessing and documenting natural disasters has become more complex over time. Disasters have also become more frequent and intense because of climate change, which is mostly caused by the burning of fuels such as gas, coal and oil.

The wait for disaster declarations has spiked as Trump’s administration undertakes an ambitious makeover of the federal government that has shed thousands of workers and reexamined the role of FEMA. A recently published letter from current and former FEMA employees warned the cuts could become debilitating if faced with a large-enough disaster. The letter also lamented that the Trump administration has stopped maintaining or removed long-term planning tools focused on extreme weather and disasters.

Shortly after taking office, Trump floated the idea of “getting rid” of FEMA, asserting: “It’s very bureaucratic, and it’s very slow.”

FEMA’s acting chief suggested more recently that states should shoulder more responsibility for disaster recovery, though FEMA thus far has continued to cover three-fourths of the costs of public assistance to local governments, as required under federal law. FEMA pays the full cost of its individual assistance.

Former FEMA Administrator Pete Gaynor, who served during Trump’s first term, said the delay in issuing major disaster declarations likely is related to a renewed focus on making sure the federal government isn’t paying for things state and local governments could handle.

“I think they’re probably giving those requests more scrutiny,” Gaynor said. “And I think it’s probably the right thing to do, because I think the (disaster) declaration process has become the ‘easy button’ for states.”

The Associated Press on Monday received a statement from White House spokeswoman Abigail Jackson in response to a question about why it is taking longer to issue major natural disaster declarations:

“President Trump provides a more thorough review of disaster declaration requests than any Administration has before him. Gone are the days of rubber stamping FEMA recommendations – that’s not a bug, that’s a feature. Under prior Administrations, FEMA’s outsized role created a bloated bureaucracy that disincentivized state investment in their own resilience. President Trump is committed to right-sizing the Federal government while empowering state and local governments by enabling them to better understand, plan for, and ultimately address the needs of their citizens. The Trump Administration has expeditiously provided assistance to disasters while ensuring taxpayer dollars are spent wisely to supplement state actions, not replace them.”

In Mississippi, frustration festered during wait for aid

The tornado that struck Anthony’s home in rural Tylertown on March 15 packed winds up to 140 mph. It was part of a powerful system that wrecked homes, businesses and lives across multiple states.

Mississippi’s governor requested a federal disaster declaration on April 1. Trump granted that request 50 days later, on May 21, while approving aid for both individuals and public entities.

On that same day, Trump also approved eight other major disaster declarations for storms, floods or fires in seven other states. In most cases, more than a month had passed since the request and about two months since the date of those disasters.

If a presidential declaration and federal money had come sooner, Anthony said he wouldn’t have needed to spend weeks sleeping in a truck before he could afford to rent the trailer where he is now living. His house was uninsured, Anthony said, and FEMA eventually gave him $30,000.

In nearby Jayess in Lawrence County, Dana Grimes had insurance but not enough to cover the full value of her damaged home. After the eventual federal declaration, Grimes said FEMA provided about $750 for emergency expenses, but she is now waiting for the agency to determine whether she can receive more.

“We couldn’t figure out why the president took so long to help people in this country,” Grimes said. “I just want to tie up strings and move on. But FEMA — I’m still fooling with FEMA.”

Jonathan Young said he gave up on applying for FEMA aid after the Tylertown tornado killed his 7-year-old son and destroyed their home. The process seemed too difficult, and federal officials wanted paperwork he didn’t have, Young said. He made ends meet by working for those cleaning up from the storm.

“It’s a therapy for me,” Young said, “to pick up the debris that took my son away from me.”

Historically, presidential disaster declarations containing individual assistance have been approved more quickly than those providing assistance only to public entities, according to the AP’s analysis. That remains the case under Trump, though declarations for both types are taking longer.

About half the major disaster declarations approved by Trump this year have included individual assistance.

Some people whose homes are damaged turn to shelters hosted by churches or local nonprofit organizations in the initial chaotic days after a disaster. Others stay with friends or family or go to a hotel, if they can afford it.

But some insist on staying in damaged homes, even if they are unsafe, said Chris Smith, who administered FEMA’s individual assistance division under three presidents from 2015-2022. If homes aren’t repaired properly, mold can grow, compounding the recovery challenges.

That’s why it’s critical for FEMA’s individual assistance to get approved quickly — ideally, within two weeks of a disaster, said Smith, who’s now a disaster consultant for governments and companies.

“You want to keep the people where they are living. You want to ensure those communities are going to continue to be viable and recover,” Smith said. “And the earlier that individual assistance can be delivered … the earlier recovery can start.”

In the periods waiting for declarations, the pressure falls on local officials and volunteers to care for victims and distribute supplies.

In Walthall County, where Tylertown is, insurance agent Les Lampton remembered watching the weather news as the first tornado missed his house by just an eighth of a mile. Lampton, who moonlights as a volunteer firefighter, navigated the collapsed trees in his yard and jumped into action. About 45 minutes later, the second tornado hit just a mile away.

“It was just chaos from there on out,” Lampton said.

Walthall County, with a population of about 14,000, hasn’t had a working tornado siren in about 30 years, Lampton said. He added there isn’t a public safe room in the area, although a lot of residents have ones in their home.

Rural areas with limited resources are hit hard by delays in receiving funds through FEMA’s public assistance program, which, unlike individual assistance, only reimburses local entities after their bills are paid. Long waits can stoke uncertainty and lead cost-conscious local officials to pause or scale-back their recovery efforts.

In Walthall County, officials initially spent about $700,000 cleaning up debris, then suspended the cleanup for more than a month because they couldn’t afford to spend more without assurance they would receive federal reimbursement, said county emergency manager Royce McKee. Meanwhile, rubble from splintered trees and shattered homes remained piled along the roadside, creating unsafe obstacles for motorists and habitat for snakes and rodents.

When it received the federal declaration, Walthall County took out a multimillion-dollar loan to pay contractors to resume the cleanup.

“We’re going to pay interest and pay that money back until FEMA pays us,” said Byran Martin, an elected county supervisor. “We’re hopeful that we’ll get some money by the first of the year, but people are telling us that it could be [longer].”

Lampton, who took after his father when he joined the volunteer firefighters 40 years ago, lauded the support of outside groups such as Cajun Navy, Eight Days of Hope, Samaritan’s Purse and others. That’s not to mention the neighbors who brought their own skid steers and power saws to help clear trees and other debris, he added.

“That’s the only thing that got us through this storm, neighbors helping neighbors,” Lampton said. “If we waited on the government, we were going to be in bad shape.”

Lieb reported from Jefferson City, Missouri, and Wildeman from Hartford, Connecticut.

Update 98/25: This story has been updated to include a White House statement released after publication.

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.

The post Presidents are taking longer to declare major natural disasters. For some, the wait is agonizing appeared first on mississippitoday.org

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Center-Left

This article presents a critical view of the Trump administration’s handling of disaster declarations, highlighting delays and their negative impacts on affected individuals and communities. It emphasizes concerns about government downsizing and reduced federal support, themes often associated with center-left perspectives that favor robust government intervention and social safety nets. However, it also includes statements from Trump administration officials defending their approach, providing some balance. Overall, the tone and framing lean slightly left of center without being overtly partisan.

Mississippi Today

Northeast Mississippi speaker and worm farmer played key role in Coast recovery after Hurricane Katrina

The 20th anniversary of Hurricane Katrina slamming the Mississippi Gulf Coast has come and gone, rightfully garnering considerable media attention.

But still undercovered in the 20th anniversary saga of the storm that made landfall on Aug. 29, 2005, and caused unprecedented destruction is the role that a worm farmer from northeast Mississippi played in helping to revitalize the Coast.

House Speaker Billy McCoy, who died in 2019, was a worm farmer from the Prentiss, not Alcorn County, side of Rienzi — about as far away from the Gulf Coast as one could be in Mississippi.

McCoy grew other crops, but a staple of his operations was worm farming.

Early after the storm, the House speaker made a point of touring the Coast and visiting as many of the House members who lived on the Coast as he could to check on them.

But it was his action in the forum he loved the most — the Mississippi House — that is credited with being key to the Coast’s recovery.

Gov. Haley Barbour had called a special session about a month after the storm to take up multiple issues related to Katrina and the Gulf Coast’s survival and revitalization. The issue that received the most attention was Barbour’s proposal to remove the requirement that the casinos on the Coast be floating in the Mississippi Sound.

Katrina wreaked havoc on the floating casinos, and many operators said they would not rebuild if their casinos had to be in the Gulf waters. That was a crucial issue since the casinos were a major economic engine on the Coast, employing an estimated 30,000 in direct and indirect jobs.

It is difficult to fathom now the controversy surrounding Barbour’s proposal to allow the casinos to locate on land next to the water. Mississippi’s casino industry that was birthed with the early 1990s legislation was still new and controversial.

Various religious groups and others had continued to fight and oppose the casino industry and had made opposition to the expansion of gambling a priority.

Opposition to casinos and expansion of casinos was believed to be especially strong in rural areas, like those found in McCoy’s beloved northeast Mississippi. It was many of those rural areas that were the homes to rural white Democrats — now all but extinct in the Legislature but at the time still a force in the House.

So, voting in favor of casino expansion had the potential of being costly for what was McCoy’s base of power: the rural white Democrats.

Couple that with the fact that the Democratic-controlled House had been at odds with the Republican Barbour on multiple issues ranging from education funding to health care since Barbour was inaugurated in January 2004.

Barbour set records for the number of special sessions called by the governor. Those special sessions often were called to try to force the Democratic-controlled House to pass legislation it killed during the regular session.

The September 2005 special session was Barbour’s fifth of the year. For context, current Gov. Tate Reeves has called four in his nearly six years as governor.

There was little reason to expect McCoy to do Barbour’s bidding and lead the effort in the Legislature to pass his most controversial proposal: expanding casino gambling.

But when Barbour ally Lt. Gov. Amy Tuck, who presided over the Senate, refused to take up the controversial bill, Barbour was forced to turn to McCoy.

The former governor wrote about the circumstances in an essay he penned on the 20th anniversary of Hurricane Katrina for Mississippi Today Ideas.

“The Senate leadership, all Republicans, did not want to go first in passing the onshore casino law,” Barbour wrote. “So, I had to ask Speaker McCoy to allow it to come to the House floor and pass. He realized he should put the Coast and the state’s interests first. He did so, and the bill passed 61-53, with McCoy voting no.

“I will always admire Speaker McCoy, often my nemesis, for his integrity in putting the state first.”

Incidentally, former Rep. Bill Miles of Fulton, also in northeast Mississippi, was tasked by McCoy with counting, not whipping votes, to see if there was enough support in the House to pass the proposal. Not soon before the key vote, Miles said years later, he went to McCoy and told him there were more than enough votes to pass the legislation so he was voting no and broached the idea of the speaker also voting no.

It is likely that McCoy would have voted for the bill if his vote was needed.

Despite his no vote, the Biloxi Sun Herald newspaper ran a large photo of McCoy and hailed the Rienzi worm farmer as a hero for the Mississippi Gulf Coast.

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.

The post Northeast Mississippi speaker and worm farmer played key role in Coast recovery after Hurricane Katrina appeared first on mississippitoday.org

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Centrist

The article presents a factual and balanced account of the political dynamics surrounding Hurricane Katrina recovery efforts in Mississippi, focusing on bipartisan cooperation between Democratic and Republican leaders. It highlights the complexities of legislative decisions without overtly favoring one party or ideology, reflecting a neutral and informative tone typical of centrist reporting.

Mississippi Today

PSC moves toward placing Holly Springs utility into receivership

NEW ALBANY — After five hours in a courtroom where attendees struggled to find standing room, the Mississippi Public Service Commission voted to petition a judge to put the Holly Springs Utility Department into a receivership.

The PSC held the hearing Thursday about a half hour drive west from Holly Springs in New Albany, known as “The Fair and Friendly City.” Throughout the proceedings, members of the PSC, its consultants and Holly Springs officials emphasized there was no precedent for what was going on.

The city of Holly Springs has provided electricity through a contract with the Tennessee Valley Authority since 1935. It serves about 12,000 customers, most of whom live outside the city limits. While current and past city officials say the utility’s issues are a result of financial negligence over many years, the service failures hit a boiling point during a 2023 ice storm where customers saw outages that lasted roughly two weeks as well as power surges that broke their appliances.

Those living in the service area say those issues still occur periodically, in addition to infrequent and inaccurate billing.

“I moved to Marshall County in 2020 as a place for retirement for my husband and I, and it’s been a nightmare for five years,” customer Monica Wright told the PSC at Thursday’s hearing. “We’ve replaced every electronic device we own, every appliance, our well pump and our septic pumps. It has financially broke us.

“We’re living on prayers and promises, and we need your help today.”

Another customer, Roscoe Sitgger of Michigan City, said he recently received a series of monthly bills between $500 and $600.

Following a scathing July report by Silverpoint Consulting that found Holly Springs is “incapable” of running the utility, the three-member PSC voted unanimously on Thursday to determine the city isn’t providing “reasonably adequate service” to its customers. That language comes from a 2024 state bill that gave the commission authority to investigate the utility.

The bill gives a pathway for temporarily removing the utility’s control from the city, allowing the PSC to petition a chancery judge to place the department into the hands of a third party. The PSC voted unanimously to do just that.

Thursday’s hearing gave the commission its first chance to direct official questions at Holly Springs representatives. Newly elected Mayor Charles Terry, utility General Manager Wayne Jones and City Attorney John Keith Perry fielded an array of criticism from the PSC. In his rebuttal, Perry suggested that any solution — whether a receivership or selling the utility — would take time to implement, and requested 24 months for the city to make incremental improvements. Audience members shouted, “No!” as Perry spoke.

“We are in a crisis now,” responded Northern District Public Service Commissioner Chris Brown. “To try to turn the corner in incremental steps is going to be almost impossible.”

It’s unclear how much it would cost to fix the department’s long list of ailments. In 2023, TVPPA — a nonprofit that represents TVA’s local partners — estimated Holly Springs needs over $10 million just to restore its rights-of-way, and as much as $15 million to fix its substations. The department owes another $10 million in debt to TVA as well as its contractors, Brown said.

“The city is holding back the growth of the county,” said Republican Sen. Neil Whaley of Potts Camp, who passionately criticized the Holly Springs officials sitting a few feet away. “You’ve got to do better, you’ve got to realize you’re holding these people hostage, and it’s not right and it’s not fair… They are being represented by people who do not care about them as long as the bill is paid.”

In determining next steps, Silverpoint Principal Stephanie Vavro told the PSC it may be hard to find someone willing to serve as receiver for the utility department, make significant investments and then hand the keys back to the city. The 2024 bill, Vavro said, doesn’t limit options to a receivership, and alternatives could include condemning the utility or finding a nearby utility to buy the service area.

Answering questions from Central District Public Service Commissioner De’Keither Stamps, Vavro said it’s unclear how much the department is worth, adding an engineer’s study would be needed to come up with a number.

Terry, who reminded the PSC he’s only been Holly Springs’ mayor for just over 60 days, said there’s no way the city can afford the repair costs on its own. The city’s median income is about $47,000, roughly $8,000 less than the state’s as a whole.

This article first appeared on Mississippi Today and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.

The post PSC moves toward placing Holly Springs utility into receivership appeared first on mississippitoday.org

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Centrist

This article presents a factual and balanced account of the situation involving the Holly Springs Utility Department and the Mississippi Public Service Commission. It includes perspectives from various stakeholders, such as city officials, residents, and state commissioners, without showing clear favoritism or ideological slant. The focus is on the practical challenges and financial issues faced by the utility, reflecting a neutral stance aimed at informing readers rather than advocating a particular political viewpoint.

-

News from the South - Louisiana News Feed7 days ago

Portion of Gentilly Ridge Apartments residents return home, others remain displaced

-

News from the South - North Carolina News Feed7 days ago

Hanig will vie for 1st Congressional District seat of Davis | North Carolina

-

News from the South - Alabama News Feed7 days ago

Alabama state employee insurance board to seek more funding, benefit changes

-

News from the South - West Virginia News Feed7 days ago

WV Supreme Court will hear BOE’s appeal in vaccine lawsuit — but not right away

-

Local News Video7 days ago

9/4 – Sam Lucey's “A Little More Humid” Thursday Night Forecast

-

News from the South - Missouri News Feed7 days ago

ICE arrests fell in August despite show of force in DC, Los Angeles

-

Our Mississippi Home7 days ago

Cruisin’ the Coast: Where Memory Meets the Open Road

-

Mississippi Today7 days ago

PSC moves toward placing Holly Springs utility into receivership