Mississippi News

5 things to know about the Great Mississippi Tax Cut Battle of 2022

5 things to know about the Great Mississippi Tax Cut Battle of 2022

An internecine Republican standoff over tax cuts has begun at the Mississippi Capitol, with a lot of other legislation likely to be held captive as the leadership in the House and Senate square off.

As the Senate this week sent the House an austere income tax cut plan, the House after two years of pushing to eliminate personal income taxes altogether was digging in on its position. This had lawmakers and lobbyists trying to nurse along other legislation fretting it would get killed or held hostage in the crossfire.

Republican House Speaker Philip Gunn wants a total state tax structure overhaul — a phase-out of the personal income tax coupled with an increase in sales taxes, a position championed by national and state conservative tax think tanks.

Republican Lt. Gov. Delbert Hosemann wants a more careful, measured tax cut. He says the House overhaul is foolhardy during uncertain, volatile economic times.

READ MORE: With Senate set to pass its income tax cut, House hasn’t budged on its desire for elimination

Here are five things to know about the Great Tax Cut Battle of 2022 (and a recap of the two plans is at the bottom of this story).

1. Some sort of income tax cut is inevitable

With the House and Senate so far apart in their tax cut plans, one might assume they’d just walk away and let the session end with no cuts and vow to try again next year.

But the realpolitik is, that’s very unlikely. Re-election time is right around the corner, and none of the state’s political leaders wants a failure to cut taxes hung around their necks on the campaign trail — especially in a Republican primary.

For starters, Republican Gov. Tate Reeves says he also wants the income tax eliminated, and he would very likely call lawmakers back into session on taxes. In fact, such a move would be in his political wheelhouse. He could force the issue, then take credit for getting the Legislature off the dime. Neither Gunn nor Hosemann would want that.

Also, Gunn really wants to eliminate the income tax — like, really, really wants it. It’s unclear whether he will seek another term as speaker (or maybe run for governor), and he views phasing out the income tax as his legacy. He’s even been confabbing with Reeves on it, despite their usually rocky political relationship.

Hosemann hasn’t appeared too fired up about a tax cut. He could probably take it or leave it, but Gunn and Reeves aren’t likely to let it go, and putting the tax cut genie back in the bottle would be nearly impossible politically in ruby red Mississippi.

2. What would a massive Mississippi tax cut do economically?

Nobody knows.

It would appear that Mississippi lawmakers don’t know what they don’t know when it comes to the effects of income tax cuts, in particular a complete elimination of the tax, or even what the future holds for the state and national economy.

For starters, no two studies or analyses — and at this point there have been quite a few — show the same outcome. Heck, sometimes even the same analysis shows different results. The House and Senate have ping-ponged back and forth with Legislative Budget Office, state economist and other analyses or modeling of income tax elimination. For a while, LBO or the economist would present numbers, one chamber or another wouldn’t like the prognostication, so they’d have them redo it with different numbers.

The results are clear: Income tax elimination would tank the state budget, or it wouldn’t. It would either bring GDP, job and population growth, or not.

It should be noted, however, that state legislative and budgeting leaders have been pretty bad at revenue predictions in recent years. Apparently, they’re particularly bad at predicting revenue during pandemics and volatile economies, like now. For the last two fiscal years, they’ve been about $1 billion off — on a roughly $6 billion budget — on revenue guesstimating. Some of that is intentional low-balling, but some of it is just being wrong. It’s great the state has “extra” money, but not so great that their revenue cipherin’ is so bad, particularly when they’re using it to plot a sea change in state tax structure and rates.

Proponents of phasing out Mississippi’s income tax say it will kick the economy into overdrive, like it’s done in other states. Except it’s never been done in another state.

Of the nine states that have no income tax, eight never had one to start with. Most of them have hefty oil and gas, tourism or other large revenue streams, or else they’ve got high sales or property taxes. Alaska is the only state to ever eliminate an existing income tax. It did so in the 1980s — in one fell swoop, not a phase-out — after the Trans-Alaska Pipeline System was completed and brought in billions of dollars of new revenue.

Other states in the mid-2000s either discussed or attempted to eliminate or drastically cut income taxes. But a debacle in Kansas doused that movement for a time and served as a cautionary tale of cutting taxes without cutting spending and banking on growth. But now other states, including West Virginia and Georgia, have been considering elimination of income taxes as many conservative think tanks promote the idea.

READ MORE: Kansas Republicans to Mississippi: Use us as a cautionary tale

3. The now-or-never tax cut argument

One of the most peculiar arguments about tax cuts, and the House elimination plan in particular, is that it’s now or never — Mississippi will never have this opportunity again.

Wait, what?

If a tax cut or elimination is truly doable and sustainable, and based on recurring revenue and sound economic policy, then it should be feasible — maybe even more feasible — next year. Or the next. Or the next.

Our full state coffers this year should be absolutely overflowing in subsequent years if revenue growth is not a one-off from the feds printing off trillions of dollars and if inflation is not going to eat our lunch. Maybe by then we’d have some, ahem, firmer revenue projections.

Some, including Gov. Reeves, argue that the future’s so bright, the House offsetting increase in sales taxes is unnecessary, we can just do away with income taxes and everything will be hunky dory. It should be noted that this would indicate an unusual acceptance by the state’s Republican leadership that the Democratic Washington administration and Congress will keep the economy percolating and inflation under control.

READ MORE: The Mississippi Republican income tax bet

The now-or-never argument would appear to be political — with an eye towards 2023 election — not fiscal.

One could argue that now might be the worst time in recent history to rework a state’s tax structure. We’re still in the midst of a global pandemic. The economy is distorted from trillions, with a T, of federal dollars being pumped in as stimulus. Inflation has spiked to a 40-year high and, oh yes, there’s a potential war brewing in Europe.

4. They’re cutting taxes, but not cutting spending

While Mississippi’s leaders are pushing tax cuts and arguing how big to make them, they’re not proposing any cut in spending of tax dollars.

It’s the opposite. The House and Senate have both passed measures at this point to spend hundreds of millions more a year on numerous programs and services. The largest so far is a more than $200 million a year teacher pay raise.

Senate leaders, including Hosemann, have noted this as another reason to keep tax cuts more modest. He notes Republicans have for years disparaged using “one-time” money for recurring expenses. He said the influx of money into the state budget is from Congress dumping trillions of federal dollars into the economy and “if ever there was one-time money in Mississippi, this is it.”

House leaders counter that the state economy was on the upswing before the pandemic and federal stimulus spending, and that state revenue almost never goes down. They say the state government can cut taxes and spend more.

5. There is some room for compromise

Lawmakers and political observers have noted the House and Senate appear leagues apart, perhaps too far to find compromise.

Gunn, Hosemann and their top lieutenants say there’s room for compromise — but they haven’t specified where that might be. Gunn has repeatedly said, “We’re not married to our plan,” but then he’s also made clear he’s pretty wedded to income tax elimination, not just cutting.

Both plans do include a cut in the sales tax on groceries. That’s one area the two could perhaps compromise. Both would cut the fee on car tags, but are drastically different there. The House would cut car tags in half, and subsidize the fees local governments have on tags (the bulk of the cost) with state tax dollars. The Senate plan would only cut the state general fund fee on tags, $5 for a new tag. It appears there could be room for negotiations there.

The Senate plan includes a one-time income tax rebate. This is a way lawmakers could ensure they’re not spending one-time money on a recurring expense. Perhaps the House could go along with such a plan.

The Senate plan raises no other taxes to offset its cuts. Reeves and others who otherwise support phasing out the income tax oppose raising other taxes. Perhaps the House would back off its sales tax increase?

But considering phase-out of the income tax appears to be a line in the sand for Gunn and the House, and perhaps Reeves, the amounts of exemptions could be lowered and phase-out extended. Instead of the House’s first-year exemptions on income tax of $40,000 for an individual and $80,000 for a couple could be lowered.

Also, one major sticking point appears to be the House’s “growth triggers” to phase out the tax after its initial cuts. It is set at 1.5% — meaning any revenue growth over 1.5% would be spent to buy down the income tax until it’s gone. Senate leaders argue this would not even cover inflation, which has averaged about 1.6% a year over many years and appears to be on a major upswing. That growth trigger could be raised, and/or the amount of growth going to eliminate the tax could be capped.

Or, the two could just agree on a plain-old tax cut, more along the lines of the Senate plan, but perhaps bigger. The House’s major talking point against the Senate plan is that it is a paltry cut that would only provide the average taxpayer a break of a couple of hundred dollars. They could agree to a larger cut, but given the Senate’s warnings that revenue could dip, inflation could skyrocket, etc., such a flat cut might be more risky along those terms.

A recap of the plans

The Senate’s tax cut plan would cost about $317 million a year, plus a one-time cost of $130 million. It would:

- Phase out the 4% state income tax bracket over four years. This would mean people would pay no state income tax on their first $26,600 of income, a savings of about $50 a year.

- Reduce the state grocery tax from 7% to 5%, starting in July.

- Provide up to a 5%, one-time income tax rebate in 2022 for those who paid taxes. The rebates would range from $100 to $1,000.

- Eliminate the state fee on car tags going into the general fund, which would be about $5 off the cost of a new tag, $3.75 for renewals.

The House’s $1.5 billion tax cut plan would:

- Eliminate taxes on the first $40,000 of income for an individual and $80,000 for a couple in 2023, saving individuals about $1,300 and couples about $2,600 a year.

- Phase out the income tax over the next decade or so, pending budget growth “triggers” of more than 1.5% a year are met.

- Increase the sales tax on most retail items from 7% to 8.5%, and cut the cost of car tags in half.

- Reduce the grocery tax eventually from 7% to 4%.

READ MORE: Inside the income tax cut battle between House and Senate leaders

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.

Mississippi News

Suspect in Charlie Kirk assassination believed to have acted alone, says Utah governor

SUMMARY: Tyler Robinson, 22, was arrested for the targeted assassination of conservative activist Charlie Kirk in Orem, Utah. Authorities said Robinson had expressed opposition to Kirk’s views and indicated responsibility after the shooting. The attack occurred during a Turning Point USA event at Utah Valley University, where Kirk was shot once from a rooftop and later died in hospital. Engravings on bullets and chat messages helped link Robinson to the crime, which was captured on grim video. The killing sparked bipartisan condemnation amid rising political violence. President Trump announced Robinson’s arrest and plans to award Kirk the Presidential Medal of Freedom.

The post Suspect in Charlie Kirk assassination believed to have acted alone, says Utah governor appeared first on www.wjtv.com

Mississippi News

Americans mark the 24th anniversary of the 9/11 attacks with emotional ceremonies

SUMMARY: On the 24th anniversary of the 9/11 attacks, solemn ceremonies were held in New York, at the Pentagon, and in Shanksville to honor nearly 3,000 victims. Families shared personal remembrances, emphasizing ongoing grief and the importance of remembrance. Vice President JD Vance postponed his attendance to visit a recently assassinated activist’s family, adding tension to the day. President Trump spoke at the Pentagon, pledging never to forget and awarding the Presidential Medal of Freedom posthumously. The attacks’ global impact reshaped U.S. policy, leading to wars and extensive health care costs for victims. Efforts continue to finalize legal proceedings against the alleged plot mastermind.

The post Americans mark the 24th anniversary of the 9/11 attacks with emotional ceremonies appeared first on www.wcbi.com

Mississippi News

Hunt for Charlie Kirk assassin continues, high-powered rifle recovered

SUMMARY: Charlie Kirk, conservative influencer and Turning Point USA founder, was fatally shot by a sniper during a speech at Utah Valley University on September 10, 2025. The shooter, believed to be a college-aged individual who fired from a rooftop, escaped after the attack. Authorities recovered a high-powered rifle and are reviewing video footage but have not identified the suspect. The shooting highlighted growing political violence in the U.S. and sparked bipartisan condemnation. Kirk, a Trump ally, was praised by political leaders, including Trump, who called him a “martyr for truth.” The university was closed and security heightened following the incident.

The post Hunt for Charlie Kirk assassin continues, high-powered rifle recovered appeared first on www.wjtv.com

-

News from the South - Arkansas News Feed7 days ago

‘One Pill Can Kill’ program aims to reduce opioid drug overdose

-

News from the South - Alabama News Feed6 days ago

Alabama lawmaker revives bill to allow chaplains in public schools

-

News from the South - Arkansas News Feed6 days ago

Arkansas’s morning headlines | Sept. 9, 2025

-

News from the South - Texas News Feed6 days ago

‘Resilience and hope’ in Galveston: 125 years after greatest storm in US history | Texas

-

News from the South - Missouri News Feed6 days ago

Pulaski County town faces scrutiny after fatal overdose

-

News from the South - Georgia News Feed7 days ago

Man tries to save driver in deadly I-85 crash | FOX 5 News

-

News from the South - Kentucky News Feed5 days ago

Lexington man accused of carjacking, firing gun during police chase faces federal firearm charge

-

Mississippi News Video6 days ago

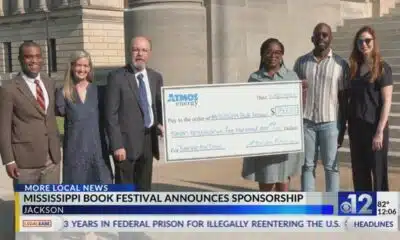

2025 Mississippi Book Festival announces sponsorship