Mississippi News

With Senate set to pass its income tax cut, House hasn’t budged

With Senate set to pass its income tax cut, House hasn’t budged on its desire for elimination

The Senate is expected to pass its state income and grocery tax cut plan on Wednesday’s deadline to do so, sending it to an unreceptive House that wants to go further and eliminate the income tax altogether.

“This is a measured approach, and we are doing something fiscally responsible, and we can come back in four years and see where we are and go from there,” said Senate Finance Chairman Josh Harkins, author of the Senate plan. “I think we’ve taken into account inflation, all those other concerns — I think there’s going to be (an economic) downturn, a dip … Our plan is easy to understand, it provides instant relief for taxpayers with a rebate and cut in the grocery tax, and it’s responsible.”

As lawmakers enter the homestretch of the 2022 legislative session, the Republican House and Senate leadership are at loggerheads over tax cuts. The two appear so far apart on this major issue that many political observers fear it could hinder other legislation as lawmakers are scheduled to get down to brass tacks on setting a state budget, spending billions in federal pandemic relief and agreeing on other issues to wrap the session around the end of March.

House Speaker Philip Gunn, who has vigorously championed the total phase-out of the state income tax (along with an increase in sales tax) for two years, has referred to the Senate plan as a “token” tax cut that would provide little relief to taxpayers. With state coffers overflowing, Gunn said now is the time to overhaul the state’s tax structure and eliminate the individual income tax.

Lt. Gov. Delbert Hosemann has decried the House plan as foolhardy, eliminating a third of the state’s revenue and upending state tax structure at a time of great economic uncertainty and volatility. He notes Republicans have for years disparaged using “one-time” money for recurring expenses. He said the influx of money into the state budget is from Congress dumping trillions of federal dollars into the economy and “if ever there was one-time money in Mississippi, this is it.”

READ MORE: The Mississippi Republican income tax bet

The Senate’s tax cut plan would cost about $317 million a year, plus a one-time cost of $130 million. It would:

- Phase out the 4% state income tax bracket over four years. This would mean people would pay no state income tax on their first $26,600 of income, a savings of about $50 a year.

- Reduce the state grocery tax from 7% to 5%, starting in July.

- Provide up to a 5%, one-time income tax rebate in 2022 for those who paid taxes. The rebates would range from $100 to $1,000.

- Eliminate the state fee on car tags going into the general fund, which would be about $5 off the cost of a new tag, $3.75 for renewals.

The House’s $1.5 billion tax cut plan would:

- Eliminate taxes on the first $40,000 of income for an individual and $80,000 for a couple in 2023, saving individuals about $1,300 and couples about $2,600 a year.

- Phase out the income tax over the next decade or so, pending budget growth “triggers” are met.

- Increase the sales tax on most retail items from 7% to 8.5%, and cut the cost of car tags in half.

- Reduce the grocery tax eventually from 7% to 4%.

Senate Bill 3164, the Tax Relief Act of 2022, passed the Senate Finance Committee on a voice vote with a smattering of “Nos” from both Democrats — who argue the state has too many unmet needs to cut taxes — and more conservative Republicans, who think it doesn’t go far enough.

READ MORE: Inside the income tax cut battle between House and Senate leaders

“This is just a sad situation,” said Sen. Hob Bryan, D-Amory, during committee debate. “The only reason we are here is because there is a fixation at the other (House) end of this building with eliminating the income tax. That’s not being pushed by anyone from Mississippi, but from a bunch of out-of-state organizations that believe we don’t need any taxation at all … I don’t hear the hue and cry from my constituents for it.

“… Did you all campaign on eliminating the income tax?” Bryan said. “The out-of-state people don’t care what happens with this. It’s a box to check off on their ideology … This is not a partisan issue. Maintaining highways is a function of government, not partisanship. Are we going to abolish the gas tax and not spend any money at all on roads? We have for years disregarded the law on how we fund our public schools. We’ve got the money now, why are we not doing that?

“This proposal is not as misguided as the House proposal, but I think it’s still a bad idea,” Bryan said.

Sen. Chris McDaniel, R-Ellisville, said: “I’m going to support this bill, but I don’t think it goes far enough.

“The House at least has put the proper framework before the body, income tax elimination,” McDaniel said. “That’s the long term play, that’s the proper play … We have roads. The question is are we going to have a functioning economy, which we haven’t had for a long time … It’s not our money. We should not forget that. It’s not roads vs. anarchy … We’re hearing that even minor tax cuts would be cataclysmic, and that just doesn’t make sense.”

Sen. Jeremy England, R-Vancleave, said he spent the last weekend back home at ball fields and the talk among parents was inflation. He said one he talked with owns a local ice cream shop.

“He said they’re looking at inflation and having to increase prices 20% to deal with it,” England said. “He was concerned about any increase in sales tax (like the House plan), and worried that would result in customers not coming in. We are not raising any sales tax or any other tax with this plan.”

McDaniel noted how far apart the House and Senate proposals remain.

“I sense both of these bills will die, and the people of Mississippi will continue to suffer under this tax structure,” McDaniel said.

This article first appeared on Mississippi Today and is republished here under a Creative Commons license.

Mississippi News

Suspect in Charlie Kirk assassination believed to have acted alone, says Utah governor

SUMMARY: Tyler Robinson, 22, was arrested for the targeted assassination of conservative activist Charlie Kirk in Orem, Utah. Authorities said Robinson had expressed opposition to Kirk’s views and indicated responsibility after the shooting. The attack occurred during a Turning Point USA event at Utah Valley University, where Kirk was shot once from a rooftop and later died in hospital. Engravings on bullets and chat messages helped link Robinson to the crime, which was captured on grim video. The killing sparked bipartisan condemnation amid rising political violence. President Trump announced Robinson’s arrest and plans to award Kirk the Presidential Medal of Freedom.

The post Suspect in Charlie Kirk assassination believed to have acted alone, says Utah governor appeared first on www.wjtv.com

Mississippi News

Americans mark the 24th anniversary of the 9/11 attacks with emotional ceremonies

SUMMARY: On the 24th anniversary of the 9/11 attacks, solemn ceremonies were held in New York, at the Pentagon, and in Shanksville to honor nearly 3,000 victims. Families shared personal remembrances, emphasizing ongoing grief and the importance of remembrance. Vice President JD Vance postponed his attendance to visit a recently assassinated activist’s family, adding tension to the day. President Trump spoke at the Pentagon, pledging never to forget and awarding the Presidential Medal of Freedom posthumously. The attacks’ global impact reshaped U.S. policy, leading to wars and extensive health care costs for victims. Efforts continue to finalize legal proceedings against the alleged plot mastermind.

The post Americans mark the 24th anniversary of the 9/11 attacks with emotional ceremonies appeared first on www.wcbi.com

Mississippi News

Hunt for Charlie Kirk assassin continues, high-powered rifle recovered

SUMMARY: Charlie Kirk, conservative influencer and Turning Point USA founder, was fatally shot by a sniper during a speech at Utah Valley University on September 10, 2025. The shooter, believed to be a college-aged individual who fired from a rooftop, escaped after the attack. Authorities recovered a high-powered rifle and are reviewing video footage but have not identified the suspect. The shooting highlighted growing political violence in the U.S. and sparked bipartisan condemnation. Kirk, a Trump ally, was praised by political leaders, including Trump, who called him a “martyr for truth.” The university was closed and security heightened following the incident.

The post Hunt for Charlie Kirk assassin continues, high-powered rifle recovered appeared first on www.wjtv.com

-

News from the South - Alabama News Feed7 days ago

Alabama lawmaker revives bill to allow chaplains in public schools

-

News from the South - Arkansas News Feed7 days ago

Arkansas’s morning headlines | Sept. 9, 2025

-

News from the South - Missouri News Feed7 days ago

Pulaski County town faces scrutiny after fatal overdose

-

News from the South - Texas News Feed7 days ago

‘Resilience and hope’ in Galveston: 125 years after greatest storm in US history | Texas

-

News from the South - Kentucky News Feed5 days ago

Lexington man accused of carjacking, firing gun during police chase faces federal firearm charge

-

News from the South - Arkansas News Feed6 days ago

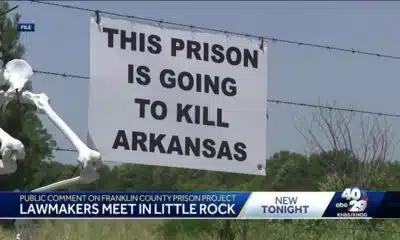

Group in lawsuit say Franklin county prison land was bought before it was inspected

-

The Center Square6 days ago

California mother says daughter killed herself after being transitioned by school | California

-

Mississippi News Video7 days ago

Carly Gregg convicted of all charges