News from the South - Oklahoma News Feed

What’s Next? Lawmakers, Policy Experts Say They Will Continue Fight To Reduce Evictions

In Oklahoma, much has changed since 2016. The population has increased and more people have moved to the state’s urban centers. Oklahoma’s Latino/Hispanic population is up, as is the state’s gross domestic product. Employment is high and the prison population has declined.

Yet, eviction filings have skyrocketed.

In 2024, alone, court records show that 48,070 eviction cases were filed, an increase of more than 1,400 over 46,668 filings in 2022.

This year, a handful of lawmakers thought they had taken the first step to address that problem with Senate Bill 128, which would have added more time for tenants in the eviction process. By increasing time, advocates of the bill said, tenants had a better chance of staying in their homes.

That bill was vetoed by Gov. Kevin Stitt.

And though there was, briefly, talk of a veto override, the vote margins for the bill were too slim to support an override vote. In the House, the bill only had 51 yes votes, and of the remaining 50, 11 lawmakers were excused from voting. In the Senate, 19 members – including almost all of the Senate’s far right caucus – voted no.

“It was bipartisan, but the vote was very close,” Sen. Julia Kirt, the bill’s Senator author, said.

Politics aside, the number of eviction filings continues to increase.

According to Shelterwell, a policy group pushing for affordable housing, eviction filings in Oklahoma have jumped by almost 27% since 2016.

For Kirt, that ever-increasing rate and the politics surrounding the Residential Landlord Tenant Act, will occupy her time for the next few months. But even she acknowledged it will take more than just extending the eviction timeline to reduce the number of evictions in Oklahoma.

“We can get together on the supply side discussion, but that won’t solve everything,” Kirt said. “We also have the issue of stability. We have a ridiculously high eviction rate. We have taken for granted, for years, that we have enough affordable housing and we don’t.”

And evictions, she said, hold children back.

A study by Yale University’s Tobin Center for Economic Policy underscores that. The study, released in April, said children who are evicted from their homes are more likely to change schools, miss days of school and be chronically absent.

In addition, the study reported that evictions reduce the credits completed in high school.

“It also reduces a child’s likelihood of graduating high school by 12.5 percentage points, which suggests being evicted has about the same impact on graduation rates as juvenile incarceration,” the study said.

State Rep. Daniel Pae, the Lawton Republican who co-authored SB 128, agreed. Like Kirt, Pae said he would continue the push to upgrade the Landlord Tenant Act but, he added, reducing the eviction rate will involve changes to more than one area.

“This isn’t just about housing,” he said. “We have to think holistically when it comes to this issue. It’s also about access to good wraparound services, such as social services and other things to make sure we’re helping individuals to get on a better path.”

Pae said interim hearings on the issue and meetings with both supporters and opponents would be considered.

“We have to continue the discussions,” he said.

Policy experts said issues such as minimum wage, the amount of affordable housing available, zoning laws and even changes in the court system all needed to be addressed.

Victoria Wilson, an attorney for Oklahoma City University’s Tenant Rights Clinic, said part of the state’s eviction problem is a low minimum wage and rapidly increasing rental costs.

“Fewer and fewer people can afford them (increasing rent cost) and very, very few low-income folks actually get any kind of housing subsidy, so money is the broader answer,” she said.

Data from the federal Department of Housing and Urban Development shows that nationally, just 92,000 residents lived in subsidized housing in 2023.

Wilson isn’t alone in that belief. Kafrey Landers, the executive director of the Apartment Association of Central Oklahoma, told Oklahoma Watch last year that skyrocketing multifamily insurance rates have played a big role in the rising cost of rent.

A survey by the Federal Reserve Bank of Minneapolis reported that annual premiums had increased by an average of 14% from 2021 to 2022, 22% from 2022 to 2023, and 45% from 2023 to 2024.

Wilson said that in addition to low incomes and high rental costs, tenants in Oklahoma have fewer rights than those in other states. She said many tenants have seen massive maintenance problems with the property they are renting and they eventually end up in court.

“When you’re in court over non-payment of rent, it’s almost never going to come up in front of the judge that you have maintenance issues,” Wilson said. “And when it does come up, it’s almost never helpful to the tenant’s case.”

Oklahoma’s Landlord Tenant Act does not include rent control, so landlords can increase rent anytime. In addition, the law doesn’t include a right to counsel for tenants and has no anti-retaliation provisions.

Katie Dilks, the executive director of the Oklahoma Access to Justice Foundation, told Oklahoma Watch in December that Oklahoma renters experience eviction at higher rates than most Americans.

“This is not because they are poorer or worse tenants, or because housing costs are higher here, but because our laws have been structured to make evictions cheap and fast,” Dilks said.

Wilson said the state needs to extend the amount of time an eviction case has to be set.

“When the case is filed, it has to be set for hearing in a five-day window,” she said. “And that has caused us many problems over the years.”

Wilson said that in Oklahoma, if you miss rent on the first of the month, you can be locked out of your dwelling by the ninth. She also called for changes in how the court handles the eviction docket.

“I frequently see people get evicted the same month they miss rent,” Wilson said. “It happens a lot in under 30 days.”

Wilson, who has worked with more than 1,000 clients on rental issues, said some eviction dockets have more than 300 cases set and the docket is only two hours long.

“That creates a lot of due process issues,” she said. “How are you supposed to get due process if you’re just running through the system and there really isn’t time for your case to be heard?”

Tenants need more time, she said, to understand everything that is happening.

Sabine Brown, a senior policy analyst with the Oklahoma Policy Institute, said in addition to higher wages and more affordable housing, state lawmakers need to modernize the Landlord-Tenant Act with provisions such as anti-retaliation.

“… Oklahoma is one of only six states that doesn’t have anti-retaliation protection.”

Sabine Brown, Oklahoma Policy Institute

“The first thing I’d point out is that Oklahoma is one of only six states that doesn’t have anti-retaliation protection,” she said. “This means that if a tenant requests repairs for a health or safety issue, instead of making that repair, the landlord could just end their lease, evict them, increase their lease and all that is perfectly legal in Oklahoma.”

Brown said the state should also make investments in affordable housing, including housing that targets the lowest-income families. She said the state is approximately 85,000 units short for low-income renters.

“We don’t have nearly enough housing stock,” she said. “Right now, it’s really hard for developers to build housing for low-income renters. The state could help bridge that gap by investing in affordable housing and making it possible for developers to build housing and keep their rent lower.”

Brown pointed to the Oklahoma Housing Stability Program as an example. That program invested $250 million in workforce housing using low-interest and zero-interest loans. She also called on public officials, both state and local, to update zoning laws to allow for more housing options, including multi-family housing.

“That’s typically been an issue that’s been left up to cities,” she said. “But we’ve seen other states across the country dive into zoning reform and look at ways they can open up more land for more affordable housing options.”

States such as California, Oregon, and Washington have banned single-family-only zoning in many areas, while other states, including Maryland, New Jersey, and New York, have passed housing legislation with zoning reforms.

With just days left before the 60th Session of the Oklahoma Legislature adjourns, it’s unlikely that any legislation addressing affordable housing or the changes to the Landlord Tenant Act will make it to the governor’s desk.

But for Pae, Kirt, Brown and Wilson, the end of the session opens a new platform for continuing their work and the push to modernize the law.

“There’s a lot more out there to do,” Kirt said. “Lots of people to talk to and issues to discuss. We’re going to keep at it. This is important.”

This article first appeared on Oklahoma Watch and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.

The post What’s Next? Lawmakers, Policy Experts Say They Will Continue Fight To Reduce Evictions appeared first on oklahomawatch.org

Oklahoma Watch, at oklahomawatch.org, is a nonprofit, nonpartisan news organization that covers public-policy issues facing the state.

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Center-Left

This article largely presents facts and perspectives highlighting challenges faced by renters in Oklahoma, emphasizing the rising eviction rates and the need for stronger tenant protections and affordable housing. It includes voices from policymakers and advocates calling for reforms such as extending eviction timelines, increasing affordable housing, and updating tenant rights. The framing leans toward progressive solutions to housing insecurity and critiques current policies, especially those associated with conservative opposition (e.g., Gov. Kevin Stitt’s veto). However, it also includes a Republican co-author’s acknowledgment of broader social needs, reflecting some bipartisan engagement. Overall, the tone favors reform and tenant advocacy while remaining largely factual and policy-focused.

News from the South - Oklahoma News Feed

Family sues Roblox, accusing them of failing to protect kids from predators

SUMMARY: An Oklahoma family is suing Roblox, accusing the popular gaming platform of failing to protect children from predators. The suit centers on a 12-year-old girl allegedly groomed and sexually extorted by a man posing as a 15-year-old boy. According to court documents, the predator coerced the girl into sending explicit photos, threatened to kill her family, and manipulated her using Roblox’s digital currency. The family claims Roblox is a “hunting ground for child predators” and profits from these dangers. Roblox states it has safeguards and recently announced plans to better detect risks. The lawsuit does not specify damages sought.

Family sues Roblox, accusing them of failing to protect kids from predators

Stay informed about Oklahoma news and weather! Follow KFOR News 4 on our website and social channels.

https://kfor.com/

https://www.youtube.com/c/kfor4news

https://www.facebook.com/kfor4

https://twitter.com/kfor

https://www.instagram.com/kfortv4/

News from the South - Oklahoma News Feed

Thousands of State Employees Still Working Remotely

More than 8,500 state employees are working remotely at least some of the time, with the arrangement mostly from a lack of space at agencies.

The Office of Management and Enterprise Services compiled the latest numbers after a December executive order issued by Gov. Kevin Stitt mandating a return to the office for state employees.

The Oklahoma Corporation Commission and the Department of Environmental Quality went in opposite directions on remote work in the second quarter report. Just 12% of employees at the Corporation Commission were on remote work in the first quarter. That jumped to 59% in the second quarter. The agency has relocated as its longtime office, the Jim Thorpe Building, undergoes renovations.

Brandy Wreath, director of administration for the Corporation Commission, said the agency has a handful of experienced employees in its public utility division who work out of state and were hired on a telework basis. Some other employees are working remotely because of doctor’s orders limiting their interactions. The agency got rid of space and offices in the Jim Thorpe Building before the renovations started. The building project is expected to be completed in the next six months.

“At Jim Thorpe, we were right-sized for everyone to be in the office,” Wreath said. “Whenever we moved to Will Rogers, we are in temporary space, and we don’t have enough space for everyone to be in every day.”

Wreath said the Corporation Commission uses the state’s Workday system that has codes for employees to use when they are logged in and working remotely. Employees also know they are subject to random activity audits.

“We’re supportive of the idea of having employees in the workplace and willing to serve,” Wreath said. “We also realize the value of having employees in rural Oklahoma and still being a part of the state structure. Our goal is to make sure our employees are productive, no matter where they are working. We are supportive of return-to-office, and we are utilizing the tools OMES has given us to ensure the state is getting its money’s worth.”

The Department of Environmental Quality now has just 1% of its employees working remotely. That’s down from 30% in the first quarter. Spokeswoman Erin Hatfield said the agency, with 527 employees, is in full compliance with the executive order. Seven employees are on telework, with all but one on temporary telework status as they recover from medical issues.

There are three exceptions to the return-to-office policy: employees whose hours are outside normal business hours; employees who already work in the field; and when new or additional office space would have to be acquired at additional cost.

The Department of Human Services continued to have more than 80% of its 6,060 employees on some type of telework, according to the second quarter report. The agency said those numbers stemmed mostly from a lack of available office space. DHS closed dozens of county offices or found other agency office space for its employees to use in the first years of the COVID-19 pandemic, when there was a huge shift to remote work.

The latest telework report covers 29,250 of the state’s 31,797 employees. About 30% of employees were on some version of telework in the second quarter. Dozens of agencies did not submit quarterly reports to the Office of Management and Enterprise Services.

Paul Monies has been a reporter with Oklahoma Watch since 2017 and covers state agencies and public health. Contact him at (571) 319-3289 or pmonies@oklahomawatch.org. Follow him on Twitter @pmonies.

Related

The post Thousands of State Employees Still Working Remotely appeared first on oklahomawatch.org

Oklahoma Watch, at oklahomawatch.org, is a nonprofit, nonpartisan news organization that covers public-policy issues facing the state.

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Centrist

This content provides a fact-based report on the remote work status of Oklahoma state employees following an executive order from Governor Kevin Stitt. It presents information from multiple state agencies with no apparent favor or criticism of the executive order or political figures involved. The tone is neutral and focuses on the practical reasons and outcomes of remote work policies, reflecting a balanced approach without clear ideological leanings.

News from the South - Oklahoma News Feed

Test taker finds it's impossible to fail 'woke' teacher assessment

SUMMARY: Oklahoma’s “America First” teacher qualification test aims to weed out “woke” educators from states like California and New York, focusing on civics, parental rights, and biology. However, many find it nearly impossible to fail. Test-takers, including independent publisher Ashley, report multiple attempts allowed per question, enabling passing regardless of knowing answers, often by guessing until correct. Average Oklahomans tested struggled with the questions, highlighting the test’s difficulty and questionable effectiveness. Critics say the test’s ease defeats its purpose of ensuring teacher knowledge. The state superintendent’s office was contacted for comment but had yet to respond.

Test taker finds it’s impossible to fail ‘woke’ teacher assessment

Stay informed about Oklahoma news and weather! Follow KFOR News 4 on our website and social channels.

https://kfor.com/

https://www.youtube.com/c/kfor4news

https://www.facebook.com/kfor4

https://twitter.com/kfor

https://www.instagram.com/kfortv4/

-

Mississippi Today4 days ago

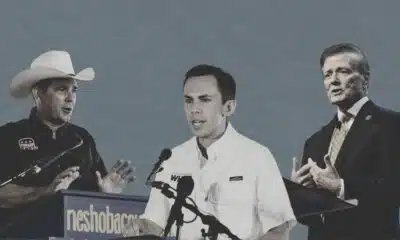

DEI, campus culture wars spark early battle between likely GOP rivals for governor in Mississippi

-

News from the South - Louisiana News Feed7 days ago

K+20: Katrina alters local health care landscape, though underlying ills still the same

-

News from the South - North Carolina News Feed6 days ago

Parasocial party: Why people are excited for the Taylor Swift, Travis Kelce engagement

-

Local News6 days ago

Police say Minneapolis church shooter was filled with hatred and admired mass killers

-

Local News Video5 days ago

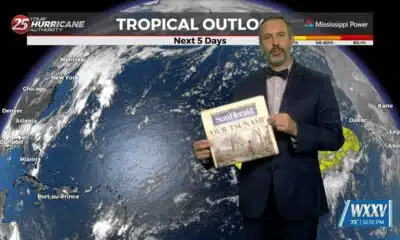

08/29 Ryan's “Wet End to the Week” Friday Forecast

-

News from the South - Kentucky News Feed6 days ago

Lexington Man Convicted of Firearms Offenses

-

News from the South - Arkansas News Feed7 days ago

Catholic community in Fayetteville prays for Minneapolis victims, reflects on safety

-

The Conversation7 days ago

Pregnant women face tough choices about medication use due to lack of safety data − here’s why medical research cuts will make it worse