News from the South - North Carolina News Feed

Universal school choice funding, ICE cooperation are law | North Carolina

SUMMARY: North Carolina’s legislature has overridden Governor Roy Cooper’s veto of House Bill 10, securing funding to eliminate school choice waiting lists and requiring sheriffs to cooperate with U.S. Immigration and Customs Enforcement (ICE). The law appropriates $463 million for the Opportunity Scholarship program, expanding school choice for about 55,000 families. The law also mandates sheriffs to detain individuals suspected of being in the U.S. illegally for up to 48 hours and notify ICE. Critics argue it undermines public schools, while proponents support school choice as an investment in education. This bill’s passage marks the end of the veto override session.

The post Universal school choice funding, ICE cooperation are law | North Carolina appeared first on www.thecentersquare.com

News from the South - North Carolina News Feed

Asheville’s Urban Forestry Commission speaks for the city’s trees. It hasn’t met since Helene. • Asheville Watchdog

Asheville’s Urban Forestry Commission met on Sept. 3, 2024, with an agenda that, if unexceptional, represented the kind of work the volunteer advisory board had done since its inception at the beginning of the decade.

Its members heard an update from Keith Aitken, who a year earlier had become Asheville’s forester after the UFC successfully lobbied the city to create the position. They voted to recommend the approval of a landscaping plan for a Duke Energy substation on Rankin Avenue. And they discussed the Urban Forest Master Plan, for which City Council had approved funding that June. Local environmentalists, including the UFC, had long advocated for a roadmap for protecting and growing the city’s canopy; now one was finally on the way, with a public tree inventory and satellite analysis ready to begin.

Then Tropical Storm Helene tore the urban canopy asunder. In its aftermath, the city paused work on the Master Plan and indefinitely suspended all advisory boards, including the UFC.

Eleven months later, the UFC still has not reconvened, the Master Plan is still on hold, and their purgatorial state is causing growing alarm among advocates who see this period of recovery as a particularly crucial moment for Asheville’s trees.

Though local tree loss has not been thoroughly quantified, the North Carolina Forest Service has estimated that 40 percent of trees in Buncombe County but outside the city limits were damaged; one analysis of hundreds of fallen trees within Asheville found that the city’s medium-to-large hardwoods fared particularly poorly. Meanwhile, one of the city’s largest contiguous forested areas is on the chopping block, as the University of North Carolina Asheville is pursuing a proposal to replace 45 wooded acres with a 5,000-seat soccer stadium and surrounding development.

“Of all the times when you really need (a master plan), you’d think now would be the time, when we’re trying to think of how to prevent the next disaster caused by too much pavement and too much building and not enough stormwater absorption and not enough green infrastructure,” said Steve Rasmussen, a member of the volunteer Tree Protection Task Force for Asheville and Buncombe County, which has worked closely with the UFC.

When the UFC formed in 2020, it was part of a focus on trees that local environmentalists felt was sorely needed; a study commissioned by the city the previous year had found canopy loss of more than 6 percent coinciding with population growth over the previous decade. The UFC’s predecessor, the Tree Commission, had a narrower purview, as did the canopy ordinance the city had in place for decades. Between the UFC’s inception and the post-Helene pause, according to UFC documents, the city preserved more than 2.5 million square feet of canopy, planted about 400,000 more, and collected roughly $300,000 in fees related to landscape compliance rules.

Aitken, the city forester, was not available for an interview for this story, city spokesperson Kim Miller said. In an email, Miller pointed toward the creation of Aitken’s position and to the 2020 city ordinance that expanded canopy protections.

“The master plan contract remains in place as staff assesses the next best steps forward,” she said. “We will announce the restart of the planning process and opportunities for community involvement in the coming months.”

The UFC doesn’t have to meet for the plan to move forward; the city has already chosen its contractor and approved $269,000 in spending, and as an appointed advisory board, the UFC weighs in on city matters but doesn’t have decision-making authority.

But keeping the UFC dormant could deprive the public of an important conduit to city officials, one more powerful than sending an email or speaking for three minutes during a council meeting’s public comment section, Rasmussen said.

“It really helps to have an advocacy group, and for people in general it really helps to have a place to take their concerns about trees and tree protections and have them addressed. The UFC has been one of the most active of all these boards and commissions.”

Zoe Hoyle, the UFC’s most recent chairperson, said the advisory board could play an important role in engaging the public as the city continues to respond to Helene and, eventually, restarts the Urban Forest Master Plan.

“I think it’s really important that we do something that marks us out as a city” in Helene’s wake, she said. “‘Transformative’ is the word I like to use.”

Alison Ormsby, the co-chairperson of the Tree Protection Task Force, said she would have liked to see the UFC continue to meet after Helene — helping to steer the city’s recovery as it pertained to trees and green spaces and acting as a watchdog as criticism proliferated over the debris-removal practices of the U.S. Army Corps of Engineers and its paid-by-volume contractors.

“Eric North, a program manager for the Arbor Day Foundation, which administers the Tree City program, said in an email Asheville began its application last year but, like some other communities preoccupied by hurricane recovery, didn’t finish it. who could provide really useful input on storm response,” she said.

Future of city’s advisory boards uncertain

The UFC’s uncertain future is part of a bigger question the city now faces: What will it do about its many advisory boards? It had 13 active ones before Helene and two others that existed in name but hadn’t met for years. The boards have been paused largely because city staff hasn’t had time to help them run their meetings.

At a City Council meeting last week, city staff offered one path forward, a plan to keep the advisory boards on hold and reassemble some of their members into four so-called recovery boards. Assistant City Manager Ben Woody said the proposed arrangement would be more efficient, and eventually the individual advisory boards could still meet or take on tasks as the city wishes.

The city’s Boards and Commissions Realignment Working Group has proposed an alternate plan in which it would voluntarily help publicize and run advisory board meetings. Councilmember Kim Roney supported the idea, saying she believed it’s time for the boards to get back to work.

“I don’t know everything about everything,” she said. “But when we invite our neighbors to bring their professional and lived experience to the table, we can make better decisions as a council.”

But City Attorney Brad Branham threw cold water on the idea. Though he stopped short of shutting it down entirely, he said he worried about the boards inadvertently violating open meetings laws in the absence of city staff. Such an error could cause legal trouble for the city, he said.

Those close to the UFC hold out some hope that the city will entertain the Realignment Working Group idea. Hoyle said she has concerns about the recovery-boards plan. She believes UFC members would need seats on all four boards to be effective. (A draft Woody presented last week has UFC members on the proposed Economy and Infrastructure boards — but not on the People & Environment board.) And while advisory boards could still be called upon for occasional work, Hoyle worries the lack of regular structure would undermine that expectation.

“Our current members could lose interest and just disappear,” she said. “I don’t know what the mechanism will be for replacing our membership.”

To some observers, the progress on tree issues in recent years now feels fragile. Even Asheville’s Tree City USA distinction, which it held for nearly 45 years, has lapsed. Eric North, a program manager for the Arbor Day Foundation, which administers the Tree City program, said in an email Asheville began its application last year but, like some other communities preoccupied by hurricane recovery, didn’t finish it. He said the Foundation would welcome the city’s reapplication this year.

But to meet Tree City standards, Asheville would need a functional tree-focused board or department.

“We no longer fit the criteria,” Ormsby said. “Some folks have said we don’t deserve it.”

Asheville Watchdog welcomes thoughtful reader comments about this story, which has been republished on our Facebook page. Please submit your comments there.

Asheville Watchdog is a nonprofit news team producing stories that matter to Asheville and Buncombe County. Jack Evans is an investigative reporter who previously worked at the Tampa Bay Times. You can reach him via email at jevans@avlwatchdog.org. The Watchdog’s reporting is made possible by donations from the community. To show your support for this vital public service go to avlwatchdog.org/support-our-publication/.

Related

The post Asheville’s Urban Forestry Commission speaks for the city’s trees. It hasn’t met since Helene. • Asheville Watchdog appeared first on avlwatchdog.org

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Center-Left

The article presents a detailed account of Asheville’s Urban Forestry Commission and related environmental efforts, emphasizing local advocacy, preservation, and sustainable urban planning. The tone supports environmental protection and community involvement, topics often aligned with progressive or center-left priorities. However, it remains fact-focused and refrains from overt political rhetoric or partisan framing. It highlights concerns over government delays and environmental degradation without explicit ideological critique, reflecting a measured, policy-oriented perspective consistent with a center-left viewpoint focused on green issues and civic engagement.

News from the South - North Carolina News Feed

Trump’s executive order could worsen state’s involuntary commitment system

SUMMARY: President Trump’s executive order easing removal of homeless individuals into mental health or addiction treatment raises concerns among North Carolina advocates and experts. They fear the order could worsen the overused and harmful involuntary commitment system, which already traps many without adequate legal representation or treatment in overwhelmed emergency departments. Expanding criteria for commitment to include those unable to care for themselves may increase institutionalization beyond current state capacity. Advocates argue the order criminalizes homelessness and lacks housing solutions, violating civil liberties. They call for community-based prevention, peer support, and improved services rather than widespread forced commitments, which can do more harm than good.

The post Trump’s executive order could worsen state’s involuntary commitment system appeared first on ncnewsline.com

News from the South - North Carolina News Feed

Back-to-School meals don’t have to be boring

SUMMARY: Back-to-school meals don’t have to be boring. To help kids focus and perform well, breakfasts should include protein, healthy fats, fiber, and carbohydrates. Ideas include whole wheat toast with nut butter and fruit, breakfast burritos with eggs and veggies, or veggie-filled egg muffins prepared in advance. For lunch, homemade “Lunchables” with low-sodium meat, cheese, whole wheat crackers, veggies, and fruit offer nutrition and variety. Leftover pasta with veggies and hummus or chicken salad with fruit and crackers are healthy options. Always pack water for hydration, and keep cold foods safe with at least two cold packs in lunchboxes.

Back-to-school meals don’t have to be boring. Some healthy options for your children.

https://abc11.com/backtoschool/

Download: https://abc11.com/apps/

Like us on Facebook: https://www.facebook.com/ABC11/

Instagram: https://www.instagram.com/abc11_wtvd/

Threads: https://www.threads.net/@abc11_wtvd

TIKTOK: https://www.tiktok.com/@abc11_eyewitnessnews

-

News from the South - Texas News Feed6 days ago

Rural Texas uses THC for health and economy

-

Mississippi Today3 days ago

After 30 years in prison, Mississippi woman dies from cancer she says was preventable

-

News from the South - Alabama News Feed7 days ago

Decision to unfreeze migrant education money comes too late for some kids

-

News from the South - Georgia News Feed4 days ago

Woman charged after boy in state’s custody dies in hot car

-

Mississippi Today7 days ago

They own the house. Why won’t they cut the grass?

-

News from the South - Arkansas News Feed7 days ago

Trump’s big proposed cuts to health and education spending rebuffed by US Senate panel

-

News from the South - Georgia News Feed7 days ago

Delta jet makes emergency landing | FOX 5 News

-

Mississippi News Video7 days ago

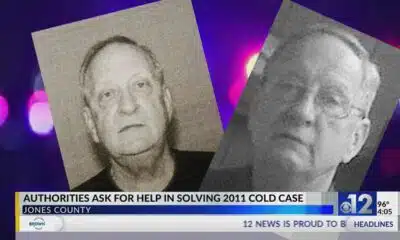

Jones County investigators work to solve 2011 cold case