News from the South - Tennessee News Feed

Tennessee lawmakers and lenders said this law would protect borrowers, but it trapped them in debt

by Adam Friedman, Tennessee Lookout

June 26, 2025

This article was produced for ProPublica’s Local Reporting Network in partnership with Tennessee Lookout . Sign up for Dispatches to get stories like this one as soon as they are published.

ProPublica and the Tennessee Lookout are continuing to investigate Harpeth Financial, which owns Flex Loan operator Advance Financial and online sportsbook Action 247. To tell us about the experience you had with either or both companies, call or text reporter Adam Friedman at 615-249-8509.

Jeanette Thomas had just made her first payment on a loan from payday lender Advance Financial when she said the company emailed her with “good news.” She could borrow $206 more.

The solicitation was a relief to Thomas, a 62-year-old grandmother who had already exhausted the $783 disability check she receives each month since her health conditions render her unable to work.

Over the next few months, Thomas made the required minimum payments on what started in 2019 as a $400 loan to buy Christmas presents. But each time she did so, the company invited her to borrow almost all of the payment back, she said, with emails or letters like “Access Your Cash Today” or “You’re Already Approved.”

“They kept trying to rope me in,” Thomas said.

In the months that followed, the company continued to expand her credit, allowing Thomas to borrow close to $1,600 in total. In the emails and letters that Thomas kept, Advance never stated how much it would cost if she continued to reborrow.

Thomas had read her original loan documents warning that the loan carried a high 279.5% interest rate and would be challenging to pay off. But as the loan balance grew, Thomas came to realize she was trapped. By the spring of 2021, Thomas had paid Advance almost $4,000, yet she still owed more than $1,000 and was paying more than $200 a month to cover the interest, depleting the disability checks that were her only source of income.

Until the Flex Loan, reborrowing or rolling over payday loans was against the law. Tennessee lawmakers first banned reborrowing when they passed the state’s payday lending law in 1997. They reaffirmed that protection in 2011 when they updated that law.

When Tennessee lawmakers passed a 2014 law allowing Flex Loans, they included no such provision.

Instead, the bill’s sponsor, current House Speaker Cameron Sexton, said the loans could be better for borrowers because it required them to make a monthly minimum payment that covered all fees, interest and 3% of the principal. This key provision would ensure that borrowers would always be paying down the principal on the loan.

Thomas and more than a dozen borrowers told the Tennessee Lookout and ProPublica that Advance has encouraged them through emails and notifications to borrow back the value of almost all of the payments they made, tearing a hole in the safety net the law tried to put in place.

All but one of the 14 borrowers who spoke to the newsrooms for this story reported having reborrowed at least once as part of their Advance loan. As with Thomas, Advance made them eligible to borrow more shortly after paying, even though they were often making the minimum payments and almost immediately borrowing the money back to cover the cost of the payment they just made. Advance went on to sue 12 of these borrowers once they stopped being able to afford the loan.

Andrea Heady, 45, was sued by Advance in Knoxville for over $7,300, despite having paid the company nearly double what she ultimately borrowed. She initially took out $750 through a Flex Loan after the hours at her university job were slashed in June 2020.

“I’ve always sent money home to my mom,” who was taking care of Heady’s sister, she said. “It was COVID. My aunt and uncle were very sick, then they passed away and I just needed money.”

Heady said Advance would send her notifications letting her know she could borrow more. One email appeared as a financial statement, but included in bold and large text was the amount she had available to borrow. The statement did not provide a payment schedule, a new loan amount, the total cost of the loan or how long it would take to pay off making minimum payments, information a lender would have been required to provide if she’d been borrowing on a credit card.

Heady reborrowed on her Flex Loan over a dozen times over the next 18 months as Advance increased her credit limit seven times. She stopped paying when her monthly payments of $650 equaled a quarter of her paycheck.

Heady hoped the company would forget about her, but it didn’t. In 2024 Advance sued and won a wage garnishment against her. Ultimately, Heady will end up paying Advance over $14,000 on the $3,850 she borrowed.

David Hill, a 36-year-old from Nashville, started by borrowing $175 from Advance in February 2020. Each month he would repay the full borrowed amount, including interest and fees, and reborrow the principal, often on the same or next day. Over 18 months, he reborrowed almost 80 times.

“COVID happened and I was going through financial trouble,” Hill said. “I would get a check and pay it off. But then I would have to borrow it back to have money.”

Via email, Advance kept increasing his credit limit and encouraging him to borrow more. “Dear David,” started two of the emails, which contained notes like “good news — you have $645 available.” Hill eventually reached a point where he couldn’t afford the minimum payment, totaling over $400 a month.

He stopped paying and the company sued him in 2023 for over $4,700.

The Lookout and ProPublica sent detailed questions to Cullen Earnest, the senior vice president of public policy at Advance Financial. Earnest repeated what he said in a previous statement, that the company has an A+ rating from the Better Business Bureau. He added that the Tennessee Department of Financial Institutions has received just 91 complaints about flexible credit lenders since 2020, representing less than 0.001% of all new flex loan agreements, and that this data reflects the satisfaction of the vast majority of Advance’s customers.

The Tennessee Lookout and ProPublica previously reported that the company has sued over 110,000 Tennesseeans since it began offering the Flex Loan in 2015, making it one of the largest single plaintiffs in the state. One of the subjects in that story reborrowed on her Flex Loan over a dozen times, turning $4,400 in borrowed cash into more than $12,500 in payments to Advance. The company sued her and won a judgment that led to the garnishment of her wages.

Christopher Peterson, a senior official with the federal Consumer Financial Protection Bureau from 2012 to 2016 and a contributor to multiple reports about payday loans, said the agency sought to limit reborrowing on payday and title loans because the desire to borrow again often indicated that borrowers couldn’t afford the loans and would be paying them off forever. That is especially true of the Flex Loan in Tennessee, he said.

“It’s a nasty loan,” he said.

A better loan?

The CFPB began targeting high-interest lenders in 2013, releasing a report on the dangers of payday loans and how reborrowing often led to debt traps.

With the threat of federal regulation looming, Advance Financial Chairman Michael Hodges started working with Tennessee lawmakers to create a new type of high-interest loan that would avoid federal oversight, he told the Nashville Business Journal.

In Tennessee’s state House, Advance and other high-interest lenders turned to Sexton to sponsor the legislation.

Sexton was then the majority whip, a position typically reserved for ambitious state House members hoping to travel up the party’s ranks. Sexton also knew banking. He worked at a local bank as a business development executive, a position he still holds today, along with having a seat on its board.

Starting in the spring of 2014, Sexton began guiding Flex Loan legislation through Tennessee’s state House committees. On the surface, the bill appeared to be a new type of loan with a 24% interest rate, which would be significantly cheaper than the triple-digit interest on payday and title loans. But the actual cost could be found in the bill’s details, which gave lenders the right to charge a 0.7% daily customary fee, which over a year adds another 255.5%.

Official video recordings from legislative committee hearings show that neither legislators nor Sexton discussed reborrowing or the loan’s interest rate.

When Sexton took to the Tennessee House floor in April 2014, his colleagues showed him deference because of his banking experience, said former Rep. Craig Fitzhugh, a rural West Tennessee Democrat and the minority leader at the time, who sponsored the original payday lending legislation in 1997.

During the hearing, Fitzhugh asked Sexton if he thought the soon-to-be-created Flex Loan was “a step up for consumers” compared to payday and title loans. Sexton said that was a “fair statement.”

When a lawmaker asked about the interest rate, Sexton said it was 190% to 210%, which is lower than the actual rate. But Sexton once again assured lawmakers that the minimum payment would reduce the cost of the loan for consumers.

“When you reduce the principal each and every month, obviously you’re decreasing the amount of interest,” Sexton said from the House floor.

The Flex Loan legislation passed the Tennessee House 83-6, with Fitzhugh abstaining from the vote. Fitzhugh said the high-interest lending landscape in Tennessee has only “gotten worse” over the past decade because of Flex Loans.

Rep. Gloria Johnson, a Knoxville Democrat, said she regrets voting for the Flex Loan legislation and feels like proponents of the legislation misled her.

“I definitely would not vote that way today, and would like to work to fix that massive mistake that’s hurt so many Tennesseans,” Johnson said.

A spokesperson for Sexton did not respond to questions from Tennessee Lookout and ProPublica.

Since passing the Flex Loans bill in 2014, Sexton has received over $105,000 in contributions to his campaign and political action committee from Advance Financial and its affiliated PACs, making them one of his largest contributors.

No money for food

Over five years after the law passed, Jeanette Thomas walked into an Advance Financial store three weeks before Christmas 2019 and filled out an application.

Thomas said she listed her income, gave them her debit card number and permission to directly charge her bank account the required monthly minimum payment. A borrower isn’t required to put up any assets, like a car or future paycheck, to get a Flex Loan.

Unlike some other borrowers, Advance allowed Thomas to pay monthly, instead of biweekly, because that’s how she received her federal disability benefits. Thomas said she suffered physical abuse for decades that left her with a traumatic brain injury.

The company deposited $400 into her account the same day she walked into the store.

At the time of the loan, Thomas had been trying to build a better relationship with her two sons and three grandchildren. She used the money to purchase gift cards, art supplies and toys. She was happy to be able to give her family something for the holidays.

Thomas’ first minimum payment to Advance was due Dec. 31 and was a manageable $51.78. That December had been cold, and when Thomas’ heat bill came in $50 higher than normal, she started to worry.

Then, just two days after her loan payment, Thomas said an unsolicited email arrived from Advance telling her she was eligible to borrow $206 more. Thomas thought she could afford it. Why would Advance loan her money she couldn’t pay back, she said she thought.

What Thomas did not realize was her first bill had only been for a 13-day payment period, meaning she’d been charged less than two weeks of interest. By taking the additional loan for an entire month, her monthly payment would almost triple to $130 per month.

Over the next two months, the company offered her a lifeline, extending her credit limit enough that she could make her payments with the money she’d just borrowed.

Eventually, Advance stopped increasing her credit limit and her monthly payment had increased to $230 a month, almost a third of her disability check.

Thomas cut her spending to the bone, hoping that a few months of payments would get her out of debt. She turned to friends to help pay for food, and to a local church to cover her utility bill.

Thomas said Advance sent her mailers and emails multiple times a month, offering to let her borrow any of the principal she had paid off. She tried to resist, but inevitably, she would have an unexpected expense, like medical bills from a series of mini strokes.

Thomas found herself in the position the CFPB had warned about when it sought to restrict reborrowing. Former CFPB official Peterson, who’s now a law professor at the University of Utah, helped work on the agency’s 2017 payday regulations. At the time, the agency wrote that consumers who reborrowed would inevitably be forced to choose between making an unaffordable payment on the loan or paying for necessities like food or rent.

By May 2021, Thomas could no longer afford to pay. The company kept her loan open and unpaid for 90 days, allowing the interest and fees to accumulate, nearly doubling the amount due to $1,700. Advance then charged Thomas two times in one week, withdrawing $430, or half of her monthly budget.

“I can remember just lying in my bed, stomach hurting and doubled over in pain because I couldn’t get something to eat,” Thomas said.

Not knowing where to turn for help, Thomas filed a complaint with the Tennessee attorney general’s Division of Consumer Affairs. In her complaint, she wrote that Advance “needs to stop abusing their power.”

“Now I cannot pay my rent,” she said.

The state investigated the case and took no action. By October 2022, Advance noted on one of Thomas’s monthly bills that it had “written off” her loan and closed her account. Unlike the other 110,000 Tennesseans who fell behind in their payments, Advance hasn’t sued Thomas, whose federal benefits are protected from garnishment.

The company also agreed in a letter to the state to “cease all communications” with Thomas, but Advance continues to send bills requesting a minimum payment of $226.49.

Mollie Simon contributed research.

Tennessee Lookout is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Tennessee Lookout maintains editorial independence. Contact Editor Holly McCall for questions: info@tennesseelookout.com.

The post Tennessee lawmakers and lenders said this law would protect borrowers, but it trapped them in debt appeared first on tennesseelookout.com

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Center-Left

This article presents a critical examination of payday lending practices, focusing on the negative impact of Flex Loans on vulnerable borrowers in Tennessee. The detailed personal stories and emphasis on predatory lending behaviors highlight concerns often aligned with consumer protection and economic justice advocacy, themes generally associated with a center-left perspective. The reporting critiques legislation and lawmakers tied to the lending industry’s influence, suggesting skepticism toward deregulatory or business-friendly policies. However, it maintains factual, investigative journalism standards without overt partisan rhetoric, grounding its critique in documented practices and regulatory context rather than ideological framing alone.

News from the South - Tennessee News Feed

Nashville’s geology has been misunderstood in tunneling talks — including by a Boring Company executive

SUMMARY: The Boring Company plans to build a tunnel connecting downtown Nashville to the airport, but the city’s limestone geology poses challenges. Nashville sits on porous limestone formed during the Ordovician period, making it prone to sinkholes and underground instability. Experts warn tunneling in this karst terrain is hazardous, risking sinkhole formation and disrupting water flow. Studies urge disaster planning due to unpredictable fractured rock and water movement. Local geological data is outdated, complicating risk assessment. Nashville’s climate extremes, including heavy rainfall, could exacerbate these issues. Elon Musk’s company favors fewer pre-project reviews, raising safety concerns amid uncertain environmental impacts.

The post Nashville’s geology has been misunderstood in tunneling talks — including by a Boring Company executive appeared first on wpln.org

News from the South - Tennessee News Feed

Former Mid-South prison could become Tennessee ICE detention center

SUMMARY: A small West Tennessee town is deciding whether to reopen a former Mid-South prison as an ICE detention center. The facility, closed since 2021 after the Biden administration phased out private prison contracts, is owned by CoreCivic. Town leaders will vote on a contract with ICE and CoreCivic to house immigrants. Residents have mixed reactions: some worry about the impact of an ICE facility, while others see potential job opportunities, with CoreCivic promising nearly 240 local jobs and over 3,000 applicants. CoreCivic emphasizes they do not enforce immigration laws but provide care and legal due process.

Town leaders in Mason are set to decide Tuesday whether to reopen a closed detention facility as an Immigration and Customs Enforcement (ICE) site—a proposal that is drawing mixed reactions from residents. READ MORE: https://www.fox13memphis.com/news/residents-divided-on-possible-new-mid-south-ice-facility/article_a4523a44-68c8-4ef3-a0da-b9cf86a2d916.html

ABOUT FOX13 MEMPHIS:

FOX13 Memphis is your home for breaking news, live video, traffic, weather and your guide to everything local for the Mid-South.

CONNECT WITH FOX 13 MEMPHIS:

Visit the FOX13 Memphis WEBSITE: https://www.fox13memphis.com/

Like FOX13 Memphis on FACEBOOK: https://www.facebook.com/fox13news.myfoxmemphis

Follow FOX13 Memphis on TWITTER: https://twitter.com/FOX13Memphis

Follow FOX13 Memphis on INSTAGRAM: https://www.instagram.com/fox13memphis

News from the South - Tennessee News Feed

Small West Tennessee town weighs ICE detention contract

SUMMARY: Mason, Tennessee, a small town of about 1,300, is deciding whether to approve a contract with ICE and CoreCivic to reopen the West Tennessee Detention Facility, closed since 2021. CoreCivic aims to house immigrant detainees, promising nearly 240 jobs and significant tax revenue for Mason. However, lifelong resident Eloise Thompson and immigrant rights groups oppose the plan, citing community harm and the negative impact of a for-profit private prison. CoreCivic insists it will provide humane care under government oversight and does not enforce immigration laws. A special town meeting Tuesday will finalize the decision amid expected protests.

The post Small West Tennessee town weighs ICE detention contract appeared first on www.wkrn.com

-

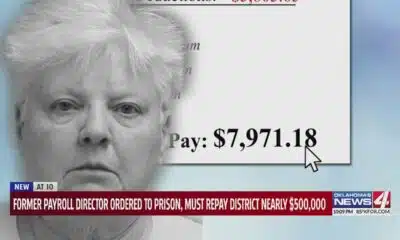

News from the South - Oklahoma News Feed3 days ago

Former payroll director ordered to prison, must repay district nearly $500,000

-

News from the South - North Carolina News Feed6 days ago

Two people unaccounted for in Spring Lake after flash flooding

-

News from the South - Tennessee News Feed5 days ago

Trump’s new tariffs take effect. Here’s how Tennesseans could be impacted

-

News from the South - Texas News Feed4 days ago

Jim Lovell, Apollo 13 moon mission leader, dies at 97

-

News from the South - Missouri News Feed5 days ago

Man accused of running over Kansas City teacher with car before shooting, killing her

-

News from the South - Oklahoma News Feed6 days ago

Tulsa, OKC Resort to Hostile Architecture to Deter Homeless Encampments

-

News from the South - Arkansas News Feed6 days ago

Why congressional redistricting is blowing up across the US this summer

-

News from the South - Louisiana News Feed6 days ago

Drugs, stolen vehicles and illegal firearms allegedly found in Slidell home