www.youtube.com – KTVE – 2024-11-07 14:23:46 SUMMARY: In today’s NBC News Daily update, Maya Holloway reports on two key community events. Von Toyota in Bastrop has...

Read the full article The post Republicans retain supermajorities in Florida Legislature | Florida appeared first on www.thecentersquare.com

www.youtube.com – WKRN News 2 – 2024-11-06 17:00:57 SUMMARY: Tennessee’s Democratic Party faced significant losses in the recent elections, failing to gain seats from the Republican...

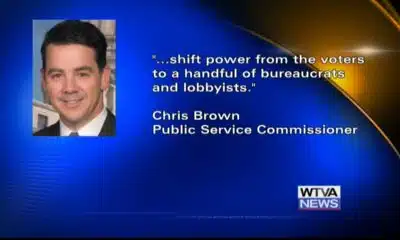

www.youtube.com – WTVA 9 News – 2024-10-30 17:26:01 SUMMARY: Governor Tate Reeves is aware of the ongoing debate in Jackson regarding whether some elected officials should...

www.youtube.com – WLOX News – 2024-10-29 22:38:03 SUMMARY: The Pascagoula Redevelopment Authority hosted an open house to showcase ongoing city improvements, including plans for a new...

www.youtube.com – FOX 4 Dallas-Fort Worth – 2024-10-21 21:20:37 SUMMARY: A juror from the trial of death row inmate Robert Roberson testified that she now believes...

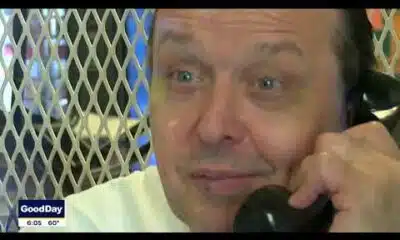

www.youtube.com – FOX 4 Dallas-Fort Worth – 2024-10-21 09:13:53 SUMMARY: Robert Robertson, 57, is set to testify before a Texas state house committee after his scheduled...

www.youtube.com – FOX 4 Dallas-Fort Worth – 2024-10-20 23:57:00 SUMMARY: Texas man Robert Roberson, whose execution was halted, will testify before the Texas legislature via Zoom,...

www.youtube.com – KFOR Oklahoma’s News 4 – 2024-10-18 17:10:56 SUMMARY: In Oklahoma, a recent law prohibits paddling students with disabilities, but some candidates for state legislature,...

www.youtube.com – CBS Miami – 2024-10-13 07:30:06 SUMMARY: Hurricane Milton made landfall in Florida, causing significant damage, particularly in Sarasota, and is projected to have economic...