News from the South - Georgia News Feed

Sister grieving after her brother and his girlfriend were found shot to death in burned home

SUMMARY: Maris Holloway is the suspect arrested in connection with the murders of Darius Woods, 35, and his girlfriend Britney Hall, 28, whose bodies were discovered burned in their DeKalb County home. Holloway was initially taken into custody in Mississippi on drug charges before police linked him to murder warrants out of DeKalb County. The victims were found shot before their home was set ablaze. Family members describe Woods as lively and joyful, while Hall’s brother mourns her loss amid ongoing confusion about the circumstances. Authorities suggest that the motive may be drug-related, and Holloway faces extradition delays.

The fire happened on Monday, Sept. 9, just before 1:30 a.m., at the home along Cohassett Lane.

News from the South - Georgia News Feed

Beaufort County warns of rabies and distemper threat to pets, animal officials urge vaccinations

SUMMARY: Beaufort County Animal Services warned residents of recent threats of rabies and distemper outbreaks. Both diseases are deadly; distemper spreads rapidly among animals, while rabies is zoonotic and nearly always fatal once symptoms appear. Rabies is common in local wildlife like bats, raccoons, and foxes, and occasionally in stray cats and dogs. Vaccination is crucial to protect pets, as unvaccinated animals exposed to rabies face a six-month quarantine, while vaccinated pets have a ten-day quarantine. If a pet is bitten or a rabid/distempered animal is spotted, report it to the health department and Department of Natural Resources immediately.

Read the full article

The post Beaufort County warns of rabies and distemper threat to pets, animal officials urge vaccinations appeared first on www.wsav.com

News from the South - Georgia News Feed

Jonesboro band culture responsible for global legacy | FOX 5

SUMMARY: Jonesboro High School’s marching band has earned invitations to perform at prestigious events: the New Year’s Day Parade in London and the Rose Parade in Pasadena, California. With 120 students from a Title I school, these opportunities are monumental, often representing students’ first trips outside Georgia. The band director emphasizes the community’s crucial financial support, as costs for London alone reach $300,000, with Pasadena estimated at $200,000-$250,000. Fundraisers, GoFundMe, and Cash App campaigns are underway. Students like junior Gabrielle Bailey express pride and excitement to represent their city and state on global stages, showcasing their talent and dedication.

Jonesboro High School’s Majestic Marching Band is preparing for an extraordinary series of performances. Students credit the …

News from the South - Georgia News Feed

AP Top 25 college football rankings show Georgia Tech, Vanderbilt and USC breaking through

SUMMARY: Ohio State, Penn State, and LSU remain the top three in the Week 4 AP Top 25 poll. Miami rose to No. 4 after dominant wins over USF and Georgia, while Georgia Tech entered the Top 25 following a 24-21 upset of Clemson. Texas A&M jumped into the top 10 after beating Notre Dame, which remains ranked despite an 0-2 start. Oregon dropped to No. 6 despite a strong win. Clemson, South Carolina, and Notre Dame suffered setbacks, risking their rankings. The Heisman race shifts as preseason favorites falter. Voters consider factors beyond scores, emphasizing performance quality and common opponents.

Read the full article

The post AP Top 25 college football rankings show Georgia Tech, Vanderbilt and USC breaking through appeared first on www.wsav.com

-

News from the South - Kentucky News Feed6 days ago

Lexington man accused of carjacking, firing gun during police chase faces federal firearm charge

-

The Center Square7 days ago

California mother says daughter killed herself after being transitioned by school | California

-

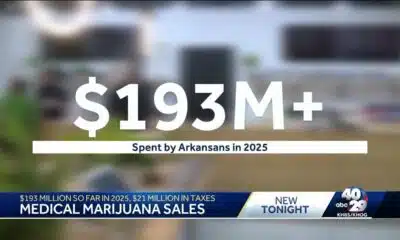

News from the South - Arkansas News Feed6 days ago

Arkansas medical marijuana sales on pace for record year

-

News from the South - Alabama News Feed6 days ago

Zaxby's Player of the Week: Dylan Jackson, Vigor WR

-

News from the South - Missouri News Feed6 days ago

Local, statewide officials react to Charlie Kirk death after shooting in Utah

-

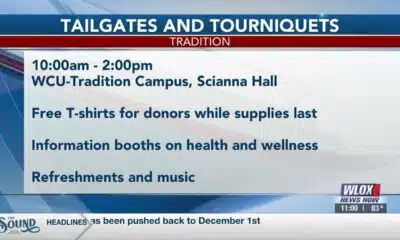

Local News Video7 days ago

William Carey University holds 'tailgates and tourniquets' blood drive

-

Local News6 days ago

US stocks inch to more records as inflation slows and Oracle soars

-

News from the South - North Carolina News Feed5 days ago

What we know about Charlie Kirk shooting suspect, how he was caught