News from the South - Alabama News Feed

Republicans target a tax that keeps state Medicaid programs running

Republicans target a tax that keeps state Medicaid programs running

by Shalina Chatlani, Alabama Reflector

May 28, 2025

This story originally appeared on Stateline.

The tax and spending bill the U.S. House approved last week targets a strategy states have used to boost the Medicaid dollars they get from the federal government. The measure would cap or freeze the taxes states levy on medical providers, potentially leaving states with major holes in their Medicaid budgets.

As a result, states would face the choice of either replacing the lost federal money with state dollars, scaling back services or providing coverage to fewer people.

Medicaid is a joint state-federal program, primarily for people with low incomes. For the traditional Medicaid population — children and their caregivers, people with disabilities and pregnant women — the federal government matches state Medicaid spending on a sliding scale, ranging from 50% for the wealthiest states to 77% for the poorest ones.

GET THE MORNING HEADLINES.

Consider a state that gets half of its Medicaid funding from the federal government. If that state collects $100 million by taxing providers, it can use $50 million of the revenue to draw down $50 million in federal matching funds, which it can use to expand Medicaid coverage to more people. Then it can take the remaining $50 million in revenue and use that money to draw down $50 million in federal dollars to pay providers more for caring for Medicaid patients.

Forty-nine states — all but Alaska — use the strategy. In 2018, the most recent year for which data is available, states relied on provider taxes to fund 17% of their Medicaid spending, up from 7% in 2008, according to the U.S. Government Accountability Office.

As part of their effort to cut federal Medicaid spending by roughly $625 billion over the next decade, House Republicans have proposed capping the state provider taxes and freezing them in place, preventing states from raising them or implementing new ones in response to inflation. Under current law, states can levy taxes of up to 6% on tax providers’ net revenue. The GOP measure also would add work requirements for Medicaid recipients, a step that would save money by reducing the rolls.

A report from the Congressional Budget Office, the bipartisan research arm of Congress, says eliminating the taxes entirely could save the federal government hundreds of billions of dollars over the next decade.

Many conservatives say the taxes are an accounting trick that allows states to draw down money from the federal government without having to front their true share of the Medicaid program. Some have even called the provider taxes a “money laundering” scheme.

“States are gaming the system — creating complex tax schemes that shift their responsibility to invest in Medicaid and rob federal taxpayers,” Dr. Mehmet Oz, the administrator of the federal Centers for Medicare & Medicaid Services, said in a May 12 news release.

Brian Blase, president of the Paragon Health Institute, a conservative policy group that is working with Republicans to formulate Medicaid cuts, described provider taxes as “a way that states and providers can rip off the federal government.”

“States need to have some accountability for the spending in their programs,” Blase said.

But advocates of these taxes, including state Medicaid directors and even the hospitals that pay the taxes, describe them as legal and legitimate financial tools that have helped providers cover essential services and states fund their Medicaid programs for years. The result of eliminating these taxes or freezing them, they say, will be hospital closures and service cuts.

“We don’t like to pay these taxes, but the alternative is resources or access to care aren’t there for that community,” said Jason Pray, vice president of legislative affairs at America’s Essential Hospitals, an association representing about 350 hospitals. “The state would more than likely have to then tax individuals to make up for that, to keep the services at the same level and keep the resources at the same level.”

Blase said the provider taxes allow hospitals to make windfall profits from the additional federal matching funds that flow back to them, representing a type of “corporate welfare.”

But Pray said often hospitals in his association are losing money. By allowing states to boost payments to hospitals and other providers that serve Medicaid patients, he said, the tax enables hospitals to stay open in the long run, not garner a windfall.

Pray also noted that in the past, support for the taxes has been bipartisan.

“Republicans for years have shown they support provider taxes and have understood the value of them,” he said.

Republicans for years have shown they support provider taxes and have understood the value of them.

– Jason Pray, vice president of legislative affairs at America’s Essential Hospitals

Edwin Park, a research professor at the Georgetown University McCourt School of Public Policy, pointed out that some hospitals pay the tax and don’t get much back, because they serve few Medicaid patients. The hospitals that benefit most are the so-called safety net hospitals that do care for many low-income patients, he said.

Park said he is worried that once the strategy is off the table, states will have to cut their Medicaid spending to balance their budgets.

Jay Ludlam, deputy secretary for North Carolina Medicaid, is worried about that, too. In North Carolina, Ludlam said, almost all of the tax revenue the state collects from providers helps pay for Medicaid services.

“The money goes to providers when they provide services. It’s not special. It’s just another way that states tax themselves and put money into the program,” Ludlam told Stateline. “If it means that there’s going to be less money in Medicaid … we’ll have to cut eligibility, cut benefits, cut provider rates, in order to maintain the program.”

Stateline reporter Shalina Chatlani can be reached at schatlani@stateline.org.

Stateline is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Stateline maintains editorial independence. Contact Editor Scott S. Greenberger for questions: info@stateline.org.

YOU MAKE OUR WORK POSSIBLE.

Alabama Reflector is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Alabama Reflector maintains editorial independence. Contact Editor Brian Lyman for questions: info@alabamareflector.com.

The post Republicans target a tax that keeps state Medicaid programs running appeared first on alabamareflector.com

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Center-Left

The content presents a detailed examination of a Republican-led proposal to cap or freeze Medicaid-related provider taxes, highlighting potential consequences for state Medicaid funding and healthcare services. It includes perspectives from both conservative policymakers critical of the tax strategy and advocates who emphasize its necessity for funding care, with an emphasis on the potential harm to vulnerable populations if these taxes are restricted. While the article is fairly balanced, it leans slightly center-left by focusing on the risks of cuts to Medicaid and the impact on hospitals serving low-income communities, framing Republican policy efforts as threats to access and services.

News from the South - Alabama News Feed

Alabama lawmaker revives bill to allow chaplains in public schools

by Andrea Tinker, Alabama Reflector

September 9, 2025

An Alabama representative is pushing for chaplains to be allowed in public school.

Rep. Mark Gidley, R-Hokes Bluff, prefiled HB 8 for the 2026 legislative session, which starts in January. It would allow school boards to decide whether to allow campus chaplains and teachers in public school.

Gidley has filed similar legislation in the past. The most recent version cleared the House with a vote of 91 to 4 in April but did not make it to the Senate Education Policy Committee. He said in an interview Monday that getting the bill in earlier will give it a better chance to pass.

“We were a little bit late getting it on the floor this past year. It didn’t fail in the Senate because of any problems, it just ran out of time. So I think getting it in earlier is going to help us to be able to work it through both chambers this year,” he said.

Gidley’s goal for the chaplains is that they go to the schools as needed to provide services and support for the faculty and staff in schools. He said this could help teachers in rural counties who lack resources for mental health services.

“It could be a resource they could tap into when they may not be able to tap into other resources that could offer support,” Gidley said.

Critics of the legislation said the measure would violate the separation of church and state in schools.

Each local board of education would vote on whether to approve volunteer chaplains for schools under the measure. If approved by the board, volunteers would have to complete a “recognized chaplain training program” and a background check.

The legislation specifies that schools cannot accept a volunteer who’s been “adjudicated or convicted of an offense that requires registration as a sex offender.”

Sen. Rodger Smitherman, D-Birmingham, backed a similar bill last year. SB294 was passed by the Senate, but it failed to get House approval.

He said in a phone interview Thursday that chaplains are needed in schools.

“We have many situations in our schools that require a need for counseling and for support — not only for students, but for staff and teachers as well,” he said.

Chaplains would provide “support, services and programs” as requested by teachers under the measure. But Smitherman said these types of motions are not meant to replace guidance counselors.

“Some of these situations need additional assistance in the areas that those chaplains can provide,” Smitherman said. “And the guidance counselor is not for the teachers and the staff workers, so this will make it available to them as well.”

Gidley said guidance counselors and chaplains serve different functions within the school.

“They’re not even in the same category and so it’s totally absurd to even think that one would replace the other,” he said. “These chaplains are strictly there for moral, and if need be, spiritual guidance. Whatever the situation is, if somebody needs a confidential nonpartisan place to share something they could be dealing with, I think that could be extremely helpful with our teachers and administrators in the school system.”

The Alabama Legislature will begin meeting Jan. 13.

Alabama Reflector is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Alabama Reflector maintains editorial independence. Contact Editor Brian Lyman for questions: info@alabamareflector.com.

The post Alabama lawmaker revives bill to allow chaplains in public schools appeared first on alabamareflector.com

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Center-Right

This content reflects a center-right political bias primarily through its focus on legislative efforts led by a Republican lawmaker advocating for chaplains in public schools, an initiative often associated with conservative values emphasizing religion in public life. The article presents the bill and its supporters in a factual and balanced manner, including some perspectives of critics concerned about church-state separation, which tempers any overt partisan slant. The respect shown for religious support roles aligned with traditional moral guidance aligns with center-right priorities, while the inclusion of bipartisan mentions adds a moderate tone overall.

News from the South - Alabama News Feed

Judge to decide on evidence, video in Jabari Peoples' death by Friday

SUMMARY: A judge is expected to decide by Friday whether to review police body cam footage related to Jabari Peoples’ death. Peoples was fatally shot by a Homewood officer in June, with the death ruled justified. The family has seen portions of the video but not the full footage or a copy. Peoples’ mother’s legal team requested preservation of all evidence for potential wrongful death litigation. Concerns were raised about discrepancies between what the district attorney and the family observed in the video. Black Lives Matter protesters supported the family’s demand for transparency. The judge requested the investigating agency to submit all related videos for review.

Judge to decide on evidence, video in Jabari Peoples’ death by Friday

Subscribe to WVTM on YouTube now for more: https://bit.ly/2jvAaUD

Get more Birmingham news: http://www.wvtm13.com

Like us: https://www.facebook.com/WVTM13/

Follow us: https://twitter.com/WVTM13

Instagram: https://www.instagram.com/wvtm13/

News from the South - Alabama News Feed

Montgomery court grants temporary restraining order against AHSAA eligibility policy

by Andrea Tinker, Alabama Reflector

September 8, 2025

A state court Friday blocked an Alabama High School Athletic Association (AHSSA) policy barring transfer student-athletes from immediately participating in sports if they receive CHOOSE Act funds amid a lawsuit from Gov. Kay Ivey and Alabama House Speaker Nathaniel Ledbetter, R-Rainsville.

The CHOOSE Act is a voucher-like program that offers families up to $7,000 per qualifying child per year for “non-public education” expenses, including private school tuition. The program currently operates under income caps scheduled to be lifted next year.

The lawsuit, filed in Montgomery County Circuit Court, alleges AHSAA’s rules “specifically and unlawfully sideline CHOOSE Act students from AHSAA-sanctioned interscholastic athletic events for an entire year solely because they receive CHOOSE Act funds.”

“Every child deserves true choice in their education and that includes their right to participate in school athletics,” Ivey said in a statement Friday afternoon. “The court’s decision restores fairness to the process which is, of course, the very basis of the CHOOSE Act.”

A message seeking comment was left with AHSAA on Friday. The AHSAA considers the CHOOSE Act a form of financial aid similar to scholarships or tuition reductions, and it requires students who receive that to be ineligible for sports for one year. AHSAA said in a statement Thursday that the rule is in place to prevent students from having unfair advantages.

“This policy, established by our member schools, promotes competitive equity and deters recruitment,” the organization said in its statement.

When the act was initially introduced in 2024, there was no language about high school athletics. During House floor debate over the bill in February of that year, Rep. Joe Lovvorn, R-Auburn, introduced an amendment saying that “Nothing in this chapter shall affect or change the athletic eligibility of student athletes governed by the Alabama High School Athletic Association or similar association.”

The amendment was adopted on a 74-17 vote. The language remained in the final version of the bill.

Messages seeking comment were left Friday with Lovvorn.

Rep. Danny Garrett, R-Trussville, the sponsor of the CHOOSE Act and the chair of the House Ways and Means Education Committee, wrote in an email Friday that AHSAA was aware the governor and other politicians didn’t agree with the organization’s interpretation of the law.

“The Governor, Lieutenant Governor, Speaker of the House, the chief legislative legal officer and the bill sponsor have expressed the legislative intent of the CHOOSE Act during numerous conversations with AHSAA officials. The AHSAA’s position and response is obtuse, baffling and certainly not with the best interest of children and families in mind,” he wrote.

Ledbetter said in a statement Thursday AHSAA created the policy without getting clarification from policymakers which leaves families at a disadvantage, and implied that action from policymakers could be taken against AHSAA during the upcoming legislative session.

“For the AHSAA’s leadership to take such drastic action just as football season begins tells me they are not concerned with the best interests of all student-athletes.” the statement said. “While I fully expect members of the House and Senate will take a hard look at how the AHSAA operates in the upcoming session, this situation demands action today. My hope is the court will side with our student-athletes and not allow this organization to wrongfully take away their opportunity to compete.”

The AHSAA in 2016 altered its rules to allow homeschooled students to play sports in the public school districts in which they reside.

Alabama Reflector is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Alabama Reflector maintains editorial independence. Contact Editor Brian Lyman for questions: info@alabamareflector.com.

The post Montgomery court grants temporary restraining order against AHSAA eligibility policy appeared first on alabamareflector.com

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Center-Right

This content primarily focuses on a legislative and legal dispute involving a voucher-style education program (the CHOOSE Act) and its impact on high school athletics in Alabama. The CHOOSE Act, supported by prominent Republican figures like Gov. Kay Ivey and Alabama House Speaker Nathaniel Ledbetter, reflects a Center-Right position promoting school choice and private education funding. The article covers the controversy surrounding the Alabama High School Athletic Association’s eligibility rules, presenting statements from both sides without overt editorializing. The emphasis on school vouchers, legislative intent, and intervention to support families’ educational choices aligns with a Center-Right perspective typically associated with Republican policy priorities.

-

Mississippi Today7 days ago

Brandon residents want answers, guarantees about data center

-

News from the South - Texas News Feed5 days ago

Texas high school football scores for Thursday, Sept. 4

-

Our Mississippi Home7 days ago

Southern Miss Faculty and Student Contribute to Groundbreaking NOAA-Funded Plastic Cleanup

-

The Conversation7 days ago

AI is transforming weather forecasting − and that could be a game changer for farmers around the world

-

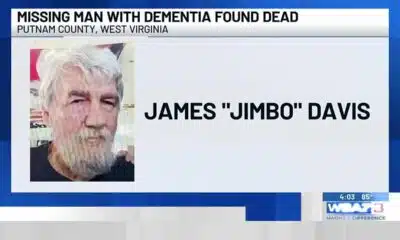

News from the South - West Virginia News Feed6 days ago

Missing man with dementia found dead

-

News from the South - Louisiana News Feed5 days ago

Portion of Gentilly Ridge Apartments residents return home, others remain displaced

-

News from the South - South Carolina News Feed7 days ago

Trump announces that Space Command is moving from Colorado to Alabama

-

News from the South - North Carolina News Feed5 days ago

Hanig will vie for 1st Congressional District seat of Davis | North Carolina