News from the South - Georgia News Feed

Republicans in Congress axed the ‘green new scam,’ but it’s a red state boon

by Ashley Murray, Georgia Recorder

June 6, 2025

WASHINGTON — Clean energy manufacturers and advocates say they’re perplexed how the repeal of tax credits in President Donald Trump’s “one big beautiful bill” will keep their domestic production lines humming across the United States, particularly in states that elected him to the Oval Office.

While some Republicans have labeled the billions in tax credits a “green new scam,” statistics reviewed by State Newsroom show the jobs and benefits would boost predominantly GOP-leaning states and congressional districts. Now the industry is already slowing amid Trump’s back-and-forth tariff policy and mixed messaging on energy and manufacturing.

Trump vowed in early April to “supercharge our domestic industrial base.”

“Jobs and factories will come roaring back to our country, and you see it happening already,” he told a crowd in the White House Rose Garden while unveiling his new trade policy.

But as a way to pay for the $3.9 trillion price tag of extending and expanding the 2017 corporate and individual tax cuts, U.S. House Republicans found billions of dollars in savings by slashing over a dozen clean energy tax credits enacted in the 2022 Inflation Reduction Act under President Joe Biden.

Critics say the mega-bill, which passed the GOP-led House on May 22 in a 215-214 vote, would effectively strip away the Advanced Manufacturing and Production Credit and other incentives.

They have bolstered the production of batteries and solar components in numerous states — top among them North Carolina, Georgia, Michigan, South Carolina, Indiana, Tennessee, Texas, Nevada, Illinois and Oklahoma, according to the Clean Investment Monitor, a joint project by the Rhodium Group and the Massachusetts Institute of Technology’s Center for Energy and Environmental Policy Research.

Kevin Doffling, CEO and founder of Project Vanguard, an organization that connects veterans to clean energy jobs, warned pulling the plug on the clean energy tax credits will stifle progress the U.S. has made against other countries, namely China.

“We’re just going to see a huge pullback from investments inside of advanced manufacturing here in the U.S., and then we’ll go source it from other places, instead of doing it here,” Doffling said on a May 28 press call pressing for senators to protect the tax credits.

Doffling’s organization works in several states, including Arizona, Colorado, Indiana, Minnesota, Washington and Utah.

Moving away from fossil fuels

The suite of tax credits enacted under the IRA incentivized homeowners, car buyers, energy producers and manufacturers to invest in types of energy beyond fossil fuels, with the aim of a reduction in the effects of climate change.

For example, the IRA’s Advanced Manufacturing and Production Credit is awarded per unit produced and sold, and in some cases the capacity of energy output.

Battery cell manufacturers can earn up to $35 per battery cell multiplied by potential kilowatt hours. In the case of solar, the credit offers producers 7 cents per solar module multiplied by wattage output. For mining operations extracting critical minerals, such as lithium, companies can receive a 10% tax break on the costs of production.

Most credits phase out by 2032 under the Biden-era law, except those for critical mineral mining, which continue.

A group of House Republicans, who have dubbed the tax credits the “green new scam” — echoing Trump’s rhetoric — pushed to accelerate the expiration in the final version of the mega-bill, even for critical mineral mining and production. The federal government classifies critical minerals as crucial to national security.

The House-passed bill also severely tightens language around foreign components, titled “foreign entities of concern,” making the credit practically unusable as many parts of the clean energy manufacturing supply chain are global, industry professionals say.

The legislation also repeals “transferability,” which allows companies with little or no tax liability to sell the credits.

For example, a critical mineral mining company would not turn a profit during an initial phase and could sell the credits to offset the cost of operations.

Schneider Electric, a global corporation with a U.S. base in Massachusetts, has facilitated 18 transfer deals worth $1.7 billion in tax credits for U.S. companies since 2023. In a statement, Schneider said the deals “reflect growing market interest in flexible financing mechanisms that directly fund renewable projects.”

Silfab Solar, which recently built a solar cell manufacturing and module assembly plant in Fort Mill, South Carolina, announced in mid-May the sale of $110 million in Advanced Manufacturing and Production Credits to help fund its expansion. The company already runs a solar manufacturing site in Burlington, Washington.

Investment soared

Spurred by the Advanced Manufacturing and Production Credit, known as 45X, actual investment in clean energy manufacturing since August 2022 reached $115 billion in April, up from $21 billion over the same length of time prior to the IRA, the Clean Investment Monitor found.

Of the 380 clean technology production facilities announced since the third quarter of 2022, 161 are now operational, according to CIM data.

The credit spurred a “sea change” in U.S. clean energy manufacturing, said Mike Williams, senior fellow at the liberal Center for American Progress and former deputy director of the BlueGreen Alliance, which advocates for the joining of labor and environmental organizations.

Despite solar technology’s roots in the U.S., the nation “didn’t even have a toe” in solar manufacturing, Williams said. Other countries, most notably Germany and then China, have dominated the industry.

“But after the Inflation Reduction Act passed, all of a sudden we see panel manufacturing, we see parts and components manufacturing, absolutely exploding. Plants have announced and started construction in Georgia, in Oklahoma,” Williams said in an interview with States Newsroom.

Active manufacturing of solar components, advanced batteries and wind turbines and vessels is concentrated in rural areas. Most are located in states that went red in the 2024 presidential election, according to the Clean Power America Association’s May 2025 State of Clean Energy Manufacturing in America report.

The renewable energy policy group estimated the industry supports 122,000 full-time manufacturing jobs across the U.S.

Active solar manufacturing sites and expansions are clustered in Texas, Ohio and Alabama, according to data from the association. Should major project announcements in Georgia pull through, the state would surpass Alabama for third place.

Advanced battery manufacturing spans 38 states, with the largest concentrations in California, Michigan and North Carolina.

But various parts of the battery production process stretch throughout the country — for example, battery cell production in Nevada and Tennessee and module production in Utah. Other supporting hardware is made in South Carolina, Arizona and Texas.

Lithium, a critical mineral for battery production, is currently mined in Nevada and California. And investors are eyeing other spots in the U.S., namely Alaska, to mine and produce graphite, another critical mineral.

China largely dominates the world’s critical mineral supply chain, according to U.S. Geological Survey data for 2024.

When accounting for the full suite of clean energy tax credits that were enacted in 2022 — including residential, electric vehicles and clean electricity credits — just over 312,900 new jobs are linked to the industry, the bulk in Republican-led congressional districts, according to the advocacy group Climate Power’s 2024 report on clean energy employment.

Troy Van Beek, CEO and founder of the Iowa-based solar company Ideal Energy, said his business weathered the pandemic and has been able to add jobs, but is now facing uncertainty again.

“We’re getting our feet under us and really starting to operate. I went from 20-some jobs to over 60 jobs, and those are good-paying jobs for people and their families. So we need that stability in the industry,” said Van Beek, who spoke on the call with Doffling.

“What troubles me is the rocking of the boat to such a degree that we can’t get anything done, and that’s been very difficult to deal with,” he said.

Industry slowdown

The industry has seen a pullback since January and the beginning of the Trump presidency.

Six announced projects representing $6.9 billion in investment were canceled in the first quarter of 2025, according to the Clean Investment Monitor’s latest State of U.S. Clean Energy Supply Chains report. While investment in clean energy overall continues to grow, the beginning of 2025 shows a slowdown from where the industry was a year ago.

Van Beek, whose solar company provides construction and installation among others services, said recent talks to strike a deal with a solar manufacturer collapsed after threats to the tax credits.

“We had worked an entire year on putting together (a deal) with one of the leading manufacturers in the world that has U.S. manufacturing to actually have joint ventures and work with them on projects,” Van Beek said. “And when this came up, that deal came to a screeching halt.”

Van Beek did not name the company on the call and did not respond to a request for a follow-up interview.

Several companies declined States Newsroom’s requests for comment while senators negotiate the bill.

Spencer Pederson of the National Electrical Manufacturers Association said the unpredictability is interrupting how operators are planning for the coming years.

“Whether large or small, just the business certainty and the ability to plan out your business is disrupted when you have any type of tax mechanism that is abruptly halted when you’re doing business planning at five- or 10-year intervals,” said Pederson, the association’s senior vice president of public affairs.

Too expensive, Republicans say

Some House Republicans, led by Rep. Jen Kiggans of Virginia, urged party colleagues to protect the clean energy tax credits — for example by removing the “overly prescriptive” restrictions on foreign entities of concern and keeping in place transferability of tax credits.

Kiggans wrote to House Republican tax writers in mid-May that “the last thing any of us want is to provoke an energy crisis or cause higher energy bills for working families.”

Her co-signers included Don Bacon of Nebraska, Mark Amodei of Nevada, Rob Bresnahan of Pennsylvania, Juan Ciscomani of Arizona, Gabe Evans and Jeff Hurd of Colorado, Dave Joyce of Ohio and Dan Newhouse of Washington, who all eventually voted for the final bill.

Far-right House members won on not only shortening the lifespan of the credits, but also on keeping the restrictive foreign entity language and on repealing a company’s ability to transfer credits.

The right-leaning National Taxpayers Union hailed the “commonsense changes” championed by the far-right House Freedom Caucus, under the leadership of Maryland Rep. Andy Harris.

The organization, which favors cutting government spending and lowering taxes, pointed to the cost. According to the Penn Wharton Budget Model, the credits as of 2022 were valued at roughly $384.9 billion over ten years.

“The longer these subsidies remain in law, the more expensive they will become and the harder it will be for Congress to remove them. Now it’s up to the Senate to support the Green New Deal Rollbacks,” Thomas Aiello, NTU’s senior director of government affairs, wrote in the days following the House vote.

Hope in the Senate?

But representatives from multinational corporations to mid-size businesses and sizable trade associations are now looking to the U.S. Senate to restore measures that they say created a boom time for investment, production and new energy on the grid.

Jeannie Salo, chief public policy officer at Schneider Electric, said in a statement to States Newsroom that “The Senate should restore and extend the timelines for key energy and manufacturing credits and their transferability to ensure the nation continues to attract key investments and projects that will power the U.S. economy and help make energy more affordable.”

Pederson said the restrictions on foreign components and company ties are “particularly restrictive coming out of the House.”

“So we’re hoping to work with the Senate Finance Committee and some of the members of the Senate who have indicated some willingness to make the foreign entity of concern language a little bit more workable,” Pederson said.

Doffling believes senators have a “longer term vision” of the nation’s energy strategy than House members who face reelection every two years.

“They see what’s happening not just in their district, but in the entire state that they represent,” Doffling said.

The House bill just sets the U.S. “further behind,” he added. “This bill is all about going backwards in time and hoping for the best.”

“I wish they could look at the numbers and understand the economic impacts it’s gonna have. … But somehow we’re talking about the fact of hamstringing a whole entire industry itself over verbiage of the word ‘clean.’”

Georgia Recorder is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Georgia Recorder maintains editorial independence. Contact Editor Jill Nolin for questions: info@georgiarecorder.com.

The post Republicans in Congress axed the ‘green new scam,’ but it’s a red state boon appeared first on georgiarecorder.com

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Center-Left

This content presents a detailed critique of Republican efforts to repeal clean energy tax credits introduced under Democratic leadership. It emphasizes the economic and environmental benefits of these credits, highlights bipartisan support for clean energy jobs even in Republican districts, and expresses concern over the negative impact of the GOP-led rollback. While it includes viewpoints from various stakeholders, the overall framing favors progressive climate and clean energy policies and critiques conservative fiscal and energy positions, consistent with a center-left economic and environmental perspective.

News from the South - Georgia News Feed

Overnight fire injures 8, APS considers closing 17 schools: Tuesday afternoon headlines from FOX 5

SUMMARY: An overnight apartment fire on Joseph Lowery Boulevard injured eight people, with seven residents rescued from balconies. Fire investigators continue probing the cause. In Fulton County Superior Court, a hearing proceeds for Robert Aaron Long, charged in a deadly Atlanta spa shooting; his attorneys seek to bar media from pretrial hearings to protect jury impartiality. Meanwhile, Atlanta Public Schools (APS) may close or repurpose up to 17 schools due to declining enrollment and aging facilities, impacting hundreds of families. APS encourages community involvement through meetings. Additionally, a suspect faces charges in a Bartow County child cruelty case, and a 12-year-old boy was seriously injured during football practice in South Fulton.

An overnight sent at least eight people to the hospital after an apartment complex caught on fire. Atlanta Public Schools is …

News from the South - Georgia News Feed

Spirit Airlines pauses routes as Savannah Airport plans renovations

SUMMARY: Spirit Airlines, despite filing for Chapter 11 bankruptcy again, is maintaining a presence at Savannah-Hilton Head International Airport but has delayed new routes to Detroit and Nashville. It continues daily flights to Newark and will launch a Fort Lauderdale route in October. The airport is undergoing its first major cosmetic renovation in over 30 years, including new terrazzo floors, upgraded ticket counters, and refreshed dining areas. While Spirit scales back in smaller markets, Savannah remains a key regional hub. Terminal upgrades, involving more extensive structural changes, are planned to begin in spring 2026, ensuring continued growth and improved passenger experience.

The post Spirit Airlines pauses routes as Savannah Airport plans renovations appeared first on www.wsav.com

News from the South - Georgia News Feed

Man tries to save driver in deadly I-85 crash | FOX 5 News

SUMMARY: A deadly crash occurred last Thursday on I-85 in Troup County when a truck veered off the road and submerged in Flat Creek. Logan Wolf and several others, including an off-duty firefighter and a soldier, stopped to help. They jumped into the water, broke the window, and pulled the trapped driver, identified as 48-year-old Cleveland Clark Stallings of Hamilton, to dry land to perform CPR. Despite their efforts, Stallings did not survive. Wolf expressed his condolences and assured Stallings’ family that everyone did everything possible to save him. The Georgia State Patrol is now investigating the crash.

A man who jumped in to try and save a driver who crashed into a creek in Troup County is speaking out. The crash happened last Thursday along I-85 in Troup County.

Subscribe to FOX 5 Atlanta!: https://bit.ly/3vpFpcm

Watch FOX 5 Atlanta Live: https://www.fox5atlanta.com/live

FOX 5 Atlanta delivers breaking news, live events, investigations, politics, entertainment, business news and local stories from metro Atlanta, north Georgia and across the nation.

Watch more from FOX 5 Atlanta on YouTube:

FOX 5 News: https://www.youtube.com/playlist?list=PLUgtVJuOxfqkmrF1fONNmi8nKI0Z-FPE-

FOX 5 Atlanta I-Team: https://www.youtube.com/playlist?list=PLUgtVJuOxfqlb_I16wBwizoAoUsfKEeWB

Good Day Atlanta: https://www.youtube.com/playlist?list=PLUgtVJuOxfqlKT5xsbsPFgr5EBzdsWTvG

FOX 5 Extras: https://www.youtube.com/playlist?list=PLUgtVJuOxfqli-5MS_2X-i6bNGWvV0RYP

You Decide: https://www.youtube.com/playlist?list=PLUgtVJuOxfqnCKb7UkRde2NXuaoPEAXut

Download the FOX 5 Atlanta app: https://www.fox5atlanta.com/app

Download the FOX 5 Storm Team app: https://www.fox5atlanta.com/storm

Follow FOX 5 Atlanta on Facebook: https://facebook.com/fox5atlanta

Follow FOX 5 Atlanta on Twitter: https://twitter.com/FOX5Atlanta

Follow FOX 5 Atlanta on Instagram: https://www.instagram.com/fox5atlanta/

Subscribe to the Morning Brief and other newsletters from FOX 5 Atlanta: https://www.fox5atlanta.com/email

-

Mississippi Today6 days ago

Brandon residents want answers, guarantees about data center

-

News from the South - Texas News Feed5 days ago

Texas high school football scores for Thursday, Sept. 4

-

Our Mississippi Home7 days ago

Southern Miss Faculty and Student Contribute to Groundbreaking NOAA-Funded Plastic Cleanup

-

News from the South - Arkansas News Feed7 days ago

Arkansas correction division to enter settlement over disability law violations

-

The Conversation7 days ago

AI is transforming weather forecasting − and that could be a game changer for farmers around the world

-

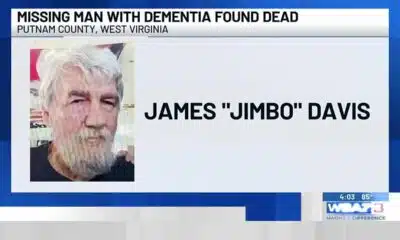

News from the South - West Virginia News Feed6 days ago

Missing man with dementia found dead

-

News from the South - South Carolina News Feed7 days ago

Trump announces that Space Command is moving from Colorado to Alabama

-

News from the South - Louisiana News Feed4 days ago

Portion of Gentilly Ridge Apartments residents return home, others remain displaced