News from the South - Missouri News Feed

Open enrollment bill clears Missouri House for fifth year in a row

Open enrollment bill clears Missouri House for fifth year in a row

by Annelise Hanshaw, Missouri Independent

March 12, 2025

Legislation that would allow students to enroll in neighboring school districts won approval from the Missouri House on Wednesday.

The 88-69 vote saw 22 Republicans join with all but three Democrats in opposition. It now heads to the Missouri Senate.

The bill’s sponsor, Republican state Rep. Brad Pollitt of Sedalia, has filed the legislation for five years in a row. It narrowly passed the House four times but has never come to a vote in the Senate.

Over the years, the bill has shifted with protections added, like a 3% cap on the number of students that may leave a school district each year. School districts may opt in to accept students, but schools do not have an option to restrict students from leaving.

“This bill has been vetted tighter than any other bill,” Pollitt said during the debate Wednesday.

Supporters of the legislation commended it as a solution to make public schools more competitive during times when programs that allow public funding for private schools are growing nationwide.

State Rep. John Black, a Marshfield Republican, said he is “perplexed that any public-school advocate would oppose this bill.”

Black voted against a bill passed last year that boosted MOScholars, a tax credit program that diverts general fund dollars to pay for private school tuition.

State Rep. Marlene Terry, a Democrat from St. Louis, also spoke in favor of the bill Wednesday. Last year, she broke from much of her party as a deciding vote in passing the MOScholars bill.

She is grateful for her choice, she said, because a student from her district was able to attend the school of his choice. Terry became emotional, saying the boy recently died.

“Pass this bill,” she said. “Because you never know what might happen.”

Opponents say unpredictability is exactly why the bill shouldn’t pass.

GET THE MORNING HEADLINES.

State Rep. Kathy Steinhoff, a Columbia Democrat, said future legislative sessions could remove protections in the bill.

“We have no guarantees that next year bills won’t come forward to remove the opt-in provision, or remove the 3%,” she said. “And these things could devastate our communities.”

She pointed to the legislation establishing MOScholars, which passed in 2021 and was expanded last year. The program was written to be funded by tax-credit-eligible donations, but Gov. Mike Kehoe proposed in his budget this year to give $50 million to the fund.

“It’s not hard to see that we’re taking money from public schools,” she said.

Democrats in opposition asked for funding for public schools instead of open enrollment.

“We should be focusing on the issues where the students live,” said State Rep. Raychel Proudie, a Democrat from Ferguson.

If schools are marked as failing and students leave, it will hurt property values and further reduce the funding for public schools in the area because of the lower property tax revenue, she said.

YOU MAKE OUR WORK POSSIBLE.

Missouri Independent is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Missouri Independent maintains editorial independence. Contact Editor Jason Hancock for questions: info@missouriindependent.com.

The post Open enrollment bill clears Missouri House for fifth year in a row appeared first on missouriindependent.com

News from the South - Missouri News Feed

Luke Altmyer scores 3 TDs, No. 9 Illinois shuts out Western Michigan, 38-0

SUMMARY: No. 9 Illinois defeated Western Michigan 38-0, extending its winning streak to seven games, the longest since 2011. Quarterback Luke Altmyer threw two touchdowns and ran for another, while Kaden Feagin rushed for 100 yards and a touchdown. Illinois’ defense made critical stops, preserving the shutout despite only leading 10-0 at halftime. Coach Bret Bielema expressed frustration at the team’s slow start. Illinois remains turnover-free this season and has outscored opponents 128-22 in three games. Their next challenge is Big Ten play against No. 22 Indiana. Western Michigan starts MAC play next week against Toledo.

The post Luke Altmyer scores 3 TDs, No. 9 Illinois shuts out Western Michigan, 38-0 appeared first on fox2now.com

News from the South - Missouri News Feed

Panic and chaos at a St. Louis area mall false reports of shots fired

SUMMARY: Panic erupted at West County Center mall in the St. Louis area Saturday around 2:30 p.m. after a false report of shots fired in the food court. Police arrived quickly but found no active shooter. The confusion stemmed from a fight where a chair was thrown, causing fear among shoppers. Maya Emig, separated from her family, was comforted by strangers during the chaos. Traffic snarled as parents tried to reach their children. The incident, amid recent nationwide gun violence, heightened fears but no arrests were made. Authorities confirmed no guns were involved and no charges will be filed.

A fight near the food court where a chair was thrown at a victim caused some confusion, which then turned into panic and chaos amid rumors of an active shooter.

News from the South - Missouri News Feed

UTVs, ROVs may soon be allowed on Wentzville streets

SUMMARY: Wentzville’s Board of Aldermen voted 4-2 to allow utility terrain vehicles (UTVs) and recreational off-highway vehicles (ROVs) on city streets under conditions similar to golf cart rules. Use would be limited to subdivisions with speed limits of 25 mph or less, requiring valid licenses, insurance, and safety features. However, Mayor Nick Guccione vetoed the ordinance, citing safety and enforcement concerns, supported by residents and officials. The Board may override the veto on September 24. Supporters emphasize personal responsibility, while opponents worry about public safety. Enforcement challenges exist, especially regarding underage drivers. Missouri law permits municipalities to regulate such vehicles locally.

Read the full article

The post UTVs, ROVs may soon be allowed on Wentzville streets appeared first on fox2now.com

-

News from the South - North Carolina News Feed5 days ago

What we know about Charlie Kirk shooting suspect, how he was caught

-

Local News Video7 days ago

Introducing our WXXV Student Athlete of the Week, St. Patrick’s Parker Talley!

-

News from the South - North Carolina News Feed6 days ago

Federal hate crime charge sought in Charlotte stabbing | North Carolina

-

Local News6 days ago

Russian drone incursion in Poland prompts NATO leaders to take stock of bigger threats

-

The Center Square7 days ago

Weapon recovered as manhunt continues in Kirk assassination investigation | National

-

Our Mississippi Home4 days ago

Screech Owls – Small but Cute

-

News from the South - Arkansas News Feed5 days ago

NW Arkansas Championship expected to bring money to Rogers

-

News from the South - Alabama News Feed6 days ago

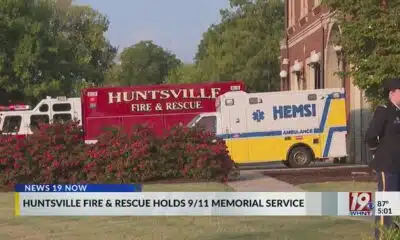

Huntsville Fire & Rescue Holds 9/11 Memorial Service | Sept. 11, 2025 | News 19 at 5 p.m.