News from the South - Oklahoma News Feed

Oklahoma Has Nation’s Highest Average Homeowners Insurance Premiums

After Oklahoma Watch debunked a claim that hail explained skyrocketing homeowners insurance rates, Oklahoma Insurance Department Commissioner Glen Mulready — who amplified the hail claims — backtracked in a statement published on the department’s website entitled “It’s Not Just Hail: A Look Into Oklahoma Homeowners Rates.”

According to a June 9 Lending Tree report, Oklahoma has the highest average homeowners insurance premium in the country at $6,133 per year, 2.2 times the national average of $2,801. Rates in Oklahoma have climbed 50.8% from 2019, the year Mulready took office, through 2024, rising faster than the national average of 40.4% the report said.

Mulready explained that insurance rates are driven by a combination of factors beyond hail, and championed the work of the department on behalf of consumers.

A new Oklahoma Watch investigation revealed some of these claims to be dubious.

A False Claim

Mulready said that the department fields complaints, enforces laws, and ensures that companies treat consumers fairly.

“We take action to protect consumers when insurers act illegally or violate contracts,” Mulready said.

Mulready said that $12 million was returned to consumers in 2024 by the Consumer Assistance/Claims Division of the OID. However, the Consumer Assistance/Claims Division has no impact on homeowners rates as set by insurance companies.

Mulready said that Oklahoma law prevents the OID from interfering on rates.

“OID has no statutory authority to set or approve homeowners rates except in certain, extraordinary circumstances,” Mulready said.

He went on to claim that 38 states follow a similar model.

That is false.

Mulready ignored the fact that Oklahoma’s tornado alley neighbors, Texas and Kansas, which by various measures enjoy lower homeowners insurance rates while suffering from weather conditions similar to or worse than Oklahoma, follow the same model but do in fact perform regulatory work to approve rates.

The difference is the role of actuaries, the number crunchers of the insurance world.

The Last of the Actuaries

“What I’ve found is that most people have not heard of us,” said Thomas Cummins, 83, who as far as he knows is the only independent actuary left in the state of Oklahoma.

Originally from Duncan, Cummins studied math at Oklahoma State University, but had to go to the University of Iowa to study actuarial science, which he defined as the effort to measure the financial impact of certain occurrences on financial markets or people.

Actuaries are financial statisticians, Cummins said. When they are employed by an insurance company, their role is to ensure that the company has enough money to cover claims on the policies they have written.

Cummins said there are about 30,000 actuaries in the United States, but he was aware of only three in Oklahoma: an actuary who lives in Tulsa but does most of his work in California, another actuary who is employed by Blue Cross Blue Shield, and Cummins himself, in business since 1981 and the last independent actuary working in the state, as far as he knows.

!function(){“use strict”;window.addEventListener(“message”,function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.source){var d=a.data[“datawrapper-height”][t]+”px”;r.style.height=d}}})}();

Kim Holland, who served as Oklahoma’s insurance commissioner from 2005 to 2011, recalled that an actuary had been employed on the health side of the department during her tenure, but at that time there was no actuary on the property and casualty side, which included homeowners insurance.

Today, OID does employ a chief actuary. According to OID’s 2024 annual report, the chief actuary is Andy Schallhorn, who is also the deputy commissioner in charge of the financial division. Schallhorn’s job is described as monitoring the financial solvency of insurance companies and working to ensure compliance with Oklahoma law.

Oklahoma law is the problem.

The Devil in the Details

Mulready’s claim that Oklahoma’s insurance model matched that of 38 other states ignored significant state-to-state variety.

“All states have different regulatory requirements and prerogatives that vary on the needs and dynamics of that particular state,” Holland said.

Rich Gibson of the American Academy of Actuaries said what Mulready likely meant was that 38 states operate on what’s known as a file-and-use model.

File-and-use means insurance companies file rate changes and put them into use immediately to charge customers; states that scrutinize rate filings before they are put into use are known as prior approval states.

That’s where it gets tricky, because there are significant differences that separate file-and-use states.

In Texas and Kansas, when filings are put into use, actuaries immediately review them to ensure that rates are adequate (to protect insurance companies), not excessive (to protect consumers), or unfairly discriminatory.

The critical difference: Oklahoma does not examine rates to protect consumers. In fact, Oklahoma law prevents the Insurance Department from protecting consumers by ensuring that rates are not excessive.

“OID has no statutory authority to set or approve homeowners rates except in certain, extraordinary circumstances.”

Glen Mulready

When Mulready said that Oklahoma may set or approve rates only in extraordinary circumstances, he was not citing a similarity between Oklahoma and other states; rather, he was referencing a significant distinction between Oklahoma and its file-and-use, tornado alley neighbors.

Specifically, the automatic process of actuarial scrutiny in Texas and Kansas is applied to every rate filing. By way of contrast, Oklahoma can scrutinize rate filings only if the commissioner has previously found the market to be non-competitive.

As Oklahoma Watch documented in its original investigation, the process for declaring a non-competitive market is legally murky and not widely understood; it’s unclear whether the state’s lone 2016 invocation of the non-competitive market statute was fully legal.

Also unclear is the precise job of the chief actuary. The 2024 annual report made a brief reference to the chief actuary protecting consumers, but how the actuary can protect consumers when the law prevents scrutiny of excessive rates is an open question.

In response to an interview request, Mulready cited dissatisfaction with Oklahoma Watch’s original story. He indicated that he had instructed the public agency’s staff to no longer engage with Oklahoma Watch.

“We will not be participating in this story,” Mulready said in an email.

Texas and Kansas Save Consumers Millions

The Texas Department of Insurance employs 18 actuaries to review rate filings, of whom 12 are dedicated to scrutinizing an annual average of 3,000 property and casualty filings, which include homeowners insurance.

Texas Department of Insurance actuaries submit questions to insurance companies or request changes on approximately 75% of filings; 10% of filings are withdrawn or rejected.

Since 2021, actuarial review of filings has saved Texas consumers $131.7 million, a TDI spokesman said in a written statement.

The Kansas Insurance Department employs a Chief of Actuarial Services and utilizes a pool of consulting actuaries to evaluate hundreds of property and casualty rate filings annually, said KID Deputy Chief of Staff Kyle Strathman.

Filings are evaluated for rate reasonableness, to ensure that rates are not excessive, inadequate or unfairly discriminatory.

“If a filing is found to be out of compliance, the carrier is required to make an adjustment to the filing,” Strathman said, while declining to provide a precise dollar estimate on what the rate review process saves consumers each year.

It’s not Just Homeowners Insurance

Rather than encouraging competition by advising consumers to discriminate and shop among insurance companies, an I-44 billboard featuring Commissioner Mulready’s face alongside images of severe weather incidents sends a dire message: you can’t fight higher rates, so batten down the hatches and ride out the storm.

The problem of rising property insurance rates extends beyond homeowners insurance.

Sherie Donahay, president of the Bradbury Corner Homeowners’ Association in Edmond, reached out to OID to complain when the association’s rates skyrocketed despite the fact that Bradbury Corner had few assets to insure.

“I know the policy had doubled since 2023,” Donahay said, adding that she was aware of rate increases at other HOAs as well.

Donahay expressed her concern to OID that Bradbury Corner was being used to cover costs in other states where there were huge homeowners associations.

“I continue to see record profits on Wall Street by insurance companies.”

Keith Easley

In 2023, Sasakwa Public Schools Superintendent Kyle Wilson was featured in a story about rapidly rising property insurance rates for schools; Wilson fretted over whether out-of-control rate hikes would affect his ability to hire much-needed teachers.

Since then, Wilson said, rates had continued to rise for Sasakwa Public Schools; the anticipated 2026 rate of $151,000 was more than three times the 2020 rate of $45,000.

Insurance Companies Review Themselves, Actually

Oklahoma law does require insurance companies to submit an annual statement of actuarial opinion; however, the statement, by law, is authored by the company’s own appointed actuary.

In Oklahoma, insurance companies review themselves, actually.

Former commissioner Holland noted that during her tenure OID worked to clean up old regulations, and interacted with lawmakers constantly to suggest legislative changes.

Holland recalled that she had support from both political parties during her time in office. It helped that she had worked in insurance her whole career; she wasn’t hostile to the industry, but continued to believe that oversight was necessary.

“Do I think they need to be held accountable?” Holland said. “I did then, and I do now.”

In Oklahoma Watch’s original investigation, former legislator Kevin Easley, who championed a law that was later warped into the statutes that now govern homeowners insurance, spoke passionately about the changes to the legislation he had helped pass.

“They can damn sure change it back, can’t they?” Easley said at the time.

Now an oil and gas executive, Easley seconded Holland’s nostalgia for a time when agency heads worked closely with lawmakers to make problem-solving recommendations.

Easley was unimpressed with Mulready’s description of Oklahoma’s insurance model. Regardless of whether the model was similar to other states, Easley doubted whether 38 states were having the same kinds of problems Oklahoma is having.

“I continue to see record profits on Wall Street by insurance companies,” Easley said. “If the model in Oklahoma does not provide the authority to get involved in setting rates that are market-based, then maybe Mulready needs to be recommending to the legislature that the model be changed. If the model isn’t working, we should be changing the model.”

This article first appeared on Oklahoma Watch and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.

The post Oklahoma Has Nation’s Highest Average Homeowners Insurance Premiums appeared first on oklahomawatch.org

Oklahoma Watch, at oklahomawatch.org, is a nonprofit, nonpartisan news organization that covers public-policy issues facing the state.

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Left-Leaning

This article from Oklahoma Watch presents a critical examination of Insurance Commissioner Glen Mulready’s claims and the broader policy framework governing homeowners insurance in Oklahoma. While it cites factual data and sources, the language and framing—such as labeling Mulready’s statements as “false,” using pointed headlines like “Insurance Companies Review Themselves, Actually,” and concluding with statements emphasizing corporate profits—indicate a skeptical stance toward deregulated markets and industry-friendly policy. The article implicitly advocates for stronger regulatory oversight, aligning with policy preferences typically associated with the political left, thus suggesting a left-leaning bias in tone and presentation.

News from the South - Oklahoma News Feed

Family sues Roblox, accusing them of failing to protect kids from predators

SUMMARY: An Oklahoma family is suing Roblox, accusing the popular gaming platform of failing to protect children from predators. The suit centers on a 12-year-old girl allegedly groomed and sexually extorted by a man posing as a 15-year-old boy. According to court documents, the predator coerced the girl into sending explicit photos, threatened to kill her family, and manipulated her using Roblox’s digital currency. The family claims Roblox is a “hunting ground for child predators” and profits from these dangers. Roblox states it has safeguards and recently announced plans to better detect risks. The lawsuit does not specify damages sought.

Family sues Roblox, accusing them of failing to protect kids from predators

Stay informed about Oklahoma news and weather! Follow KFOR News 4 on our website and social channels.

https://kfor.com/

https://www.youtube.com/c/kfor4news

https://www.facebook.com/kfor4

https://twitter.com/kfor

https://www.instagram.com/kfortv4/

News from the South - Oklahoma News Feed

Thousands of State Employees Still Working Remotely

More than 8,500 state employees are working remotely at least some of the time, with the arrangement mostly from a lack of space at agencies.

The Office of Management and Enterprise Services compiled the latest numbers after a December executive order issued by Gov. Kevin Stitt mandating a return to the office for state employees.

The Oklahoma Corporation Commission and the Department of Environmental Quality went in opposite directions on remote work in the second quarter report. Just 12% of employees at the Corporation Commission were on remote work in the first quarter. That jumped to 59% in the second quarter. The agency has relocated as its longtime office, the Jim Thorpe Building, undergoes renovations.

Brandy Wreath, director of administration for the Corporation Commission, said the agency has a handful of experienced employees in its public utility division who work out of state and were hired on a telework basis. Some other employees are working remotely because of doctor’s orders limiting their interactions. The agency got rid of space and offices in the Jim Thorpe Building before the renovations started. The building project is expected to be completed in the next six months.

“At Jim Thorpe, we were right-sized for everyone to be in the office,” Wreath said. “Whenever we moved to Will Rogers, we are in temporary space, and we don’t have enough space for everyone to be in every day.”

Wreath said the Corporation Commission uses the state’s Workday system that has codes for employees to use when they are logged in and working remotely. Employees also know they are subject to random activity audits.

“We’re supportive of the idea of having employees in the workplace and willing to serve,” Wreath said. “We also realize the value of having employees in rural Oklahoma and still being a part of the state structure. Our goal is to make sure our employees are productive, no matter where they are working. We are supportive of return-to-office, and we are utilizing the tools OMES has given us to ensure the state is getting its money’s worth.”

The Department of Environmental Quality now has just 1% of its employees working remotely. That’s down from 30% in the first quarter. Spokeswoman Erin Hatfield said the agency, with 527 employees, is in full compliance with the executive order. Seven employees are on telework, with all but one on temporary telework status as they recover from medical issues.

There are three exceptions to the return-to-office policy: employees whose hours are outside normal business hours; employees who already work in the field; and when new or additional office space would have to be acquired at additional cost.

The Department of Human Services continued to have more than 80% of its 6,060 employees on some type of telework, according to the second quarter report. The agency said those numbers stemmed mostly from a lack of available office space. DHS closed dozens of county offices or found other agency office space for its employees to use in the first years of the COVID-19 pandemic, when there was a huge shift to remote work.

The latest telework report covers 29,250 of the state’s 31,797 employees. About 30% of employees were on some version of telework in the second quarter. Dozens of agencies did not submit quarterly reports to the Office of Management and Enterprise Services.

Paul Monies has been a reporter with Oklahoma Watch since 2017 and covers state agencies and public health. Contact him at (571) 319-3289 or pmonies@oklahomawatch.org. Follow him on Twitter @pmonies.

Related

The post Thousands of State Employees Still Working Remotely appeared first on oklahomawatch.org

Oklahoma Watch, at oklahomawatch.org, is a nonprofit, nonpartisan news organization that covers public-policy issues facing the state.

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Centrist

This content provides a fact-based report on the remote work status of Oklahoma state employees following an executive order from Governor Kevin Stitt. It presents information from multiple state agencies with no apparent favor or criticism of the executive order or political figures involved. The tone is neutral and focuses on the practical reasons and outcomes of remote work policies, reflecting a balanced approach without clear ideological leanings.

News from the South - Oklahoma News Feed

Test taker finds it's impossible to fail 'woke' teacher assessment

SUMMARY: Oklahoma’s “America First” teacher qualification test aims to weed out “woke” educators from states like California and New York, focusing on civics, parental rights, and biology. However, many find it nearly impossible to fail. Test-takers, including independent publisher Ashley, report multiple attempts allowed per question, enabling passing regardless of knowing answers, often by guessing until correct. Average Oklahomans tested struggled with the questions, highlighting the test’s difficulty and questionable effectiveness. Critics say the test’s ease defeats its purpose of ensuring teacher knowledge. The state superintendent’s office was contacted for comment but had yet to respond.

Test taker finds it’s impossible to fail ‘woke’ teacher assessment

Stay informed about Oklahoma news and weather! Follow KFOR News 4 on our website and social channels.

https://kfor.com/

https://www.youtube.com/c/kfor4news

https://www.facebook.com/kfor4

https://twitter.com/kfor

https://www.instagram.com/kfortv4/

-

Mississippi Today4 days ago

DEI, campus culture wars spark early battle between likely GOP rivals for governor in Mississippi

-

News from the South - Louisiana News Feed7 days ago

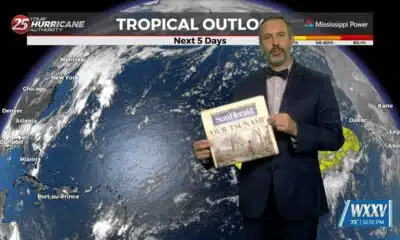

K+20: Katrina alters local health care landscape, though underlying ills still the same

-

News from the South - North Carolina News Feed6 days ago

Parasocial party: Why people are excited for the Taylor Swift, Travis Kelce engagement

-

Local News6 days ago

Police say Minneapolis church shooter was filled with hatred and admired mass killers

-

Local News Video5 days ago

08/29 Ryan's “Wet End to the Week” Friday Forecast

-

News from the South - Arkansas News Feed7 days ago

Catholic community in Fayetteville prays for Minneapolis victims, reflects on safety

-

News from the South - Kentucky News Feed6 days ago

Lexington Man Convicted of Firearms Offenses

-

The Conversation7 days ago

Pregnant women face tough choices about medication use due to lack of safety data − here’s why medical research cuts will make it worse