News from the South - Arkansas News Feed

No tax on tips, child tax credit and business tax cuts survive in big House GOP bill

by Ashley Murray, Arkansas Advocate

May 14, 2025

WASHINGTON — House Republicans advanced the tax portion of the “one big, beautiful” reconciliation package early Wednesday, a step forward in permanently extending, and in some cases expanding, the 2017 tax law and temporarily handing President Donald Trump a win on campaign promises like no tax on tips.

The House Committee on Ways and Means voted along party lines to pass the measure, 26-19, after nearly 18 hours of debate that went through the night. Republicans rejected numerous amendments offered by Democrats, including protecting tax credits meant to combat climate change enacted under Democrats’ own 2022 budget reconciliation law, the Inflation Reduction Act.

The marathon debate occurred as the House Committee on Energy and Commerce debated overnight and into Wednesday afternoon over deep budget cuts, including some to Medicaid assistance for low-income individuals, to pay for the cost of tax provisions.

As of now, the massive tax package is estimated to add $3.8 trillion to the budget deficit over 10 years, according to the nonpartisan Committee for a Responsible Federal Budget.

If any temporary expansions in the bill are eventually made permanent, it would add roughly $5.3 trillion to the deficit over the next decade, according to the CRFB. The official congressional budget score has not yet been released.

Overall the bill is “a very, very big tax cut,” said Howard Gleckman, senior fellow at the Tax Policy Center, part of the left-leaning Brookings Institution and Urban Institute. “Much of the benefit will go to higher income people.”

Tax brackets, business breaks would continue

The bill permanently extends the underlying tax provisions passed in 2017 under the GOP-backed bill titled the Tax Cuts and Jobs Act, which is set to expire in 2025.

This means:

- Individual taxpayers would remain in the same tax brackets that were lowered in 2017, and they would continue to see the doubled standard deduction — two of the most costly measures. Additionally, taxpayers will receive a boost up to $2,000 on the standard deduction through 2028.

- Individual brackets would remain at 10%, 12%, 22%, 24%, 32%, 35% and 37%, though the proposal would change how inflation adjustments are calculated, meaning income would be taxed less over time, except for those in the 37% bracket.

- The $2,000 child tax credit, per child, would remain permanent but temporarily increase to $2,500 through 2028. The refundable portion of the credit — meaning how much money taxpayers can get back — would be increased to $1,400, but the amount remains subject to income thresholds, meaning lower income households would receive less of a refund.

- The child tax credit would now only be accessible if the parent submits a Social Security number, as well as a spouse’s if legally married, in addition to the already required Social Security number of each qualifying child.

- On the business side, the corporate tax rate would stay at 21%.

- Business owners who run sole proprietorships, partnerships and S-corporations would see an increase, to 23% up from 20%, in the amount of business income they can deduct from their federal returns, otherwise referred to as the pass-through income deduction.

- Expensing for research and development would be restored through 2029, as well as deductions available to businesses for certain investments, including equipment purchases.

No tax on tips, but only for a few years

Trump promised on the campaign trail to eliminate taxes on tips, Social Security and car loan interest. House Republicans handed him a win in their bill, but only a limited one.

The bill allows individual taxpayers to deduct qualifying tips earned throughout the year, a tax break that would end in 2028. And like the new child tax credit requirement, taxpayers could only take advantage of the deduction by including a Social Security number on their federal tax return as well as their spouse’s SSN, if married.

No taxes on car loan interest would also go into effect through 2028, though taxpayers could only claim it for automobiles that received final assembly in the United States.

Senior citizens with incomes of $75,000 or less, or $150,000 for a married couple, would receive an extra $4,000 discount on taxable income, with the amount decreasing as incomes increase. The tax break would also expire in 2028. The bill does not specify an age for “seniors.”

Highly taxed states still unhappy

House Republicans raised the cap on the amount of state and local taxes, or SALT, that can be deducted, but not enough to please both GOP and Democratic lawmakers who represent highly taxed states like New York and California.

Under the bill the committee advanced Wednesday morning, taxpayers could deduct up to $30,000 — three times the $10,000 ceiling in the 2017 law — from their federal taxable income. The full cap would apply to those making $400,000 or less in annual income but phases down for higher earners.

Raising the cap is costly and unpopular with lawmakers representing lower tax states.

Republican Reps. Mike Lawler and Nick LaLota of New York, and Rep. Young Kim of California, are threatening to vote no on the House floor if the cap isn’t raised. The House GOP cannot lose more than a handful of votes if all Republicans are present.

House Speaker Mike Johnson of Louisiana told reporters Wednesday he didn’t want to “handicap” negotiations by sharing details publicly and that he was talking to the SALT caucus until 1:30 a.m.

“But I will tell you I’m absolutely confident we’re going to be able to work out a compromise that everybody can live with,” he said.

A ‘tragic indifference’ for poor families

The committee’s party-line approval of the bill drew praise and criticism across organizations representing varying interests of Americans.

Kris Cox, director of federal tax policy for the left-leaning Center on Budget and Policy Priorities, wrote on social media that the temporary child tax credit bump does “zilch” for the roughly 17 million children whose parents do not earn enough money to receive a refund check from the credit.

“But it delivers an additional $500-per-kid to higher-income families,” Cox wrote.

The organization also slammed the bill for going “out of its way to take eligibility from 4.5 million US citizen kids who have at least one parent without an SSN.”

Kristen Crowell, executive director of the advocacy group Fair Share America, said in a statement Wednesday that the bill “shows a tragic indifference to the very real struggles of normal, working people.

“In order to save face in front of their constituents, Republicans are hiding behind misleading claims that everyone will see reductions in their taxes,” Crowell said.

The Natural Resources Defense Council, an environmental protection advocacy organization, estimates that phasing out and altogether eliminating clean energy tax credits would result in higher electricity bills in several states, including Ohio and Pennsylvania, according to an emailed statement.

‘Unshackle the economy’ for businesses

Groups representing businesses across the U.S. praised the House bill as a way to bolster investment and growth opportunities.

Former Republican Ways and Means Chair Kevin Brady of Texas released a statement Wednesday on behalf of the Alliance for Competitive Taxation praising the bill as a path to “unshackle the economy from burdensome taxes and unlock new growth.”

“The bill reported out by the House Ways and Means Committee is an encouraging step in that direction and, if implemented with its major pro-growth proposals intact, will help American businesses and workers compete at home and abroad,” Brady said.

The alliance hailed the extension of the 21% corporate tax rate and urged lawmakers to make permanent the research and development expensing, and capital investment deductions.

Kristen Silverberg, president and chief operating officer of the Business Roundtable, said her organization “applauds Chairman Smith and members of the House Ways and Means Committee for advancing a comprehensive, pro-growth tax bill,” referring to GOP Rep. Jason Smith of Missouri.

“Today’s vote is a critical step forward in securing a more competitive tax system for American businesses and workers,” said Silverberg, whose organization represents 200 CEOs of U.S.-based companies.

Arkansas Advocate is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Arkansas Advocate maintains editorial independence. Contact Editor Sonny Albarado for questions: info@arkansasadvocate.com.

The post No tax on tips, child tax credit and business tax cuts survive in big House GOP bill appeared first on arkansasadvocate.com

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Center-Right

The article primarily presents a factual account of the tax package advanced by House Republicans, discussing the details of the bill and its provisions. While the tone is mostly neutral in describing the elements of the tax measure, the framing of the legislation reflects a positive outlook, particularly from business and GOP perspectives. There is a clear emphasis on the benefits of the tax cuts for businesses and wealthier individuals, and quotes from organizations that support the bill reinforce its pro-growth message. However, criticism from left-leaning groups, such as the Center on Budget and Policy Priorities, is also included, presenting a balanced view of the opposition. The overall tone is more favorable to Republican policy goals, placing the piece in the Center-Right category.

News from the South - Arkansas News Feed

Idaho is losing OB-GYNs. Doctors who remain are trying to shoulder the extra burdens.

by Kelcie Moseley-Morris, Arkansas Advocate

August 13, 2025

Before Dr. Harmony Schroeder left her OB-GYN practice in Idaho last year for Washington, she’d had many conversations with legislators and others about how to feel safe practicing in a state with a near-total abortion ban that includes criminal and civil liabilities for violating the law.

Schroeder wanted to stay. She’d practiced in Idaho for nearly 30 years, with a patient list of about 3,000 and a group of doctors she loved. She thought once elected officials understood that a ban would mean poorer medical care and more negative outcomes, things would improve.

Instead, they got even worse, as women were airlifted out of state during a period without protection for emergency abortion care under federal law.

Schroeder felt like she was either compromising care for women or compromising herself by risking jail time.

Providers convicted of breaking the law face up to five years in prison, revocation of their medical license and at least $20,000 in civil penalties.

“People said, ‘Oh, we would never really put you in jail,’” she said. “Sometimes it felt like the legislature was giving us a pinky swear.”

Schroeder is one of 114 OB-GYNs who left Idaho or stopped practicing obstetrics between August 2022 and December 2024, according to data from a peer-reviewed study published in JAMA Open Network, a division of the Journal of the American Medical Association. That number represents 43% of the 268 physicians practicing obstetrics statewide, a higher figure than previous reports indicated.

The study showed 20 new OB-GYNs moved to Idaho during that same period, for a net loss of 94 physicians.

Subscribe to Reproductive Rights Today

Want a better understanding of abortion policy in the states? Sign up for our free national newsletter. Reproductive Rights Today is a comprehensive daily wrap-up of changes to reproductive rights in the states, the front lines in the fight over abortion access in a Post-Roe America.

It’s not the only state with a ban experiencing shifts in numbers of obstetrics providers, but it is one of the most acute. Physicians in Texas, Tennessee, Oklahoma and other ban states have spoken to the media and researchers to say they are leaving the state or retiring from the practice because of bans, and while the numbers may not always be statistically significant, the departures are often in states that already have maternal health care shortages.

The states with the highest percentage of maternity care deserts as of 2024 were North Dakota, South Dakota, Oklahoma, Missouri, Nebraska and Arkansas, according to March of Dimes. With the exceptions of North Dakota and Nebraska, every state in that list has a near-total abortion ban in place.

Out of the 55 OB-GYN physicians Idaho lost just in 2024, 23 moved out of the state, 12 retired, and 16 either shifted their practice to gynecology only or moved from a rural to urban practice site. The remaining moved elsewhere in state. All of those who moved away moved to a state that did not have abortion restrictions similar to Idaho’s.

As of 2018, four years before the U.S. Supreme Court’s Dobbs v. Jackson Women’s Health Organization decision that ended federally protected access to abortion, Idaho needed 20 more OB-GYNs to meet demand, according to a report from the U.S. Department of Health and Human Services.

Schroeder likes her new practice in Washington, but she is still sad about the realities that forced her to leave.

“I wish it didn’t have to be this way,” she said.

Study proves ‘what we feared was happening’

Susie Keller, CEO of the Idaho Medical Association, said the losses feel worse because Idaho already consistently ranked at the bottom of nationwide rankings for physician-to-patient ratios even while the population has exploded in recent years.

The Centers for Disease Control and Prevention ranked Idaho lowest in 2019 for overall patient-to-doctor ratios, and the conservative Cicero Institute ranked it 50th in 2024. According to a report from the Idaho Coalition for Safe Healthcare, the ratio of patients to obstetricians increased from 1 per 6,668 Idahoans to 1 for every 8,510 Idahoans between August 2022 and November 2023.

Keller said the medical association has tried hard to find solutions that would help retain physicians, including failed efforts over the past two years to add a health exception in the abortion law.

“Every time there’s been some sort of event that sustained this difficult environment or made it worse, we heard about folks leaving,” Keller said.

The study, which was led by Dr. J. Edward McEachern, is a clear demonstration of what Keller said the medical association already knew anecdotally. It’s also proof, she said, for the elected officials who have accused them of fabricating stories or data and exaggerating the situation. Idaho Attorney General Raúl Labrador said in June 2024 that Idaho doctors who left were doing so because they made “the vast majority of their money” from performing abortions, but he did not provide evidence for that claim. Republican Rep. Brent Crane, who is chairman of the committee where abortion-related legislation would be considered, said in April 2024 that hospital legal counsel was being disingenuous with providers about the vagueness of the law because they want to undermine and ultimately repeal it.

“This kind of dialed-in study really gives us a very clear picture of what we had feared was happening,” Keller said.

Among clinics, not everyone is in agreement about the problems. Scott Tucker, practice administrator for Women’s Health Associates in Boise, said the providers they have lost over the past three years were mostly due to other factors. Increases in clinic wait times are up across the valley because of population growth, he said, and there is a national shortage of OB-GYNs and primary care providers.

“(Idaho’s abortion ban) really hasn’t impacted us much, other than we get a lot of questions and a lot of requests for contraception counseling,” Tucker said.

He added that while it’s never easy to recruit new physicians, and the ban has created extra challenges, they’ve onboarded a new physician once every nine months for the past four years and have two candidates slated to start in 2026. Much of the interest comes from candidates in the Midwest and the East, he said, and “much of what they’re hearing is hyperbole.”

‘I don’t know if it’s fair to the public for them to never feel like this is a problem’

Dr. Becky Uranga practiced with Schroeder for 14 years at OGA, a physician-owned OB-GYN clinic in the Boise area. She watched Schroeder leave, along with another doctor at OGA who went into a different medical field and one who retired.

In June, another longtime OB-GYN announced his departure. Dr. Scott Armstrong, who had practiced in the area for 26 years, sent a letter to patients saying his last day at OGA will be on Oct. 17, when he will move back to the Midwest “to help care for my aging parents and embark on a new chapter in my life.”

Uranga said the practice will have eight practicing OB-GYNs by October — down from 12 a few years ago. And the closure of other labor and delivery units in the area, which is the most populous in the state, has increased workloads for clinics like OGA as well. Uranga’s practice provides the full spectrum of obstetrics and gynecological care for women of all ages, including surgeries and labor and delivery.

“All those people (from the closed clinics) then came to us,” Uranga said.

What used to be two or four deliveries on average in a 24-hour shift is now five to six.

“That’s a lot, and it’s a really special moment that you want to be all in, present and available for whatever could happen … and it doesn’t feel like that anymore,” she said.

When a physician leaves, especially ones that have been practicing for a long time, Uranga said it leaves a hole. Schroeder had 3,000 patients, and many of them were receiving care for menopause, which she specialized in. Uranga sought out extra training to become board certified in menopause care to fill that gap.

While they juggled the transition with fewer physicians, OGA temporarily limited new patients for certain services, including some Medicaid patients. Uranga also isn’t traveling to a rural area of Idaho anymore to provide surgeries, something she and Schroeder used to do together.

When she’s not doing clinic visits, patient calls, surgeries or deliveries, she’s helping with organizing and fundraising efforts for the reproductive rights ballot initiative that would restore abortion access in Idaho. And in between all that, she’s scheduling recruiting calls with potential physicians.

She recently had to tell a recruitment coordinator that they need to be transparent up front about Idaho’s abortion laws, because she wasted too much time talking to candidates who responded with a hard no after learning about the medical environment.

“My nurse will tell you that I am fitting people in before, during, and after (hours) all the time, which isn’t fair to my family, it’s not fair to my nurse, and I don’t know if it’s fair to the public for them to never feel like this is a problem,” Uranga said.

This story has been updated.

Arkansas Advocate is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Arkansas Advocate maintains editorial independence. Contact Editor Sonny Albarado for questions: info@arkansasadvocate.com.

The post Idaho is losing OB-GYNs. Doctors who remain are trying to shoulder the extra burdens. appeared first on arkansasadvocate.com

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Left-Leaning

This content highlights the negative consequences of strict abortion bans on healthcare providers and patient care in Idaho, emphasizing the challenges faced by OB-GYNs and the resulting healthcare shortages. It presents critical perspectives on the state’s abortion restrictions and includes voices advocating for reproductive rights, which aligns with a left-leaning viewpoint that supports abortion access and critiques restrictive policies.

News from the South - Arkansas News Feed

Look inside the newly-renovated Greer Lingle Middle School in Rogers

SUMMARY: Greer Lingle Middle School in Rogers reopens after being closed for over a year due to tornado damage causing $12.7 million in repairs. Renovations include new floors, ceilings, lights, and updated hallways. Contractors are finishing final touches inside and outside the building as 680 students prepare to return. Principal Eric Sokol praised the community’s resilience and noted the academic challenges faced during the temporary relocation to Rogers New Tech. Despite delays, students had a solid year. The renovated school features a new science classroom and library, aiming to create a safe, welcoming environment. Some projects, like the performing arts center, remain underway.

Students in the Rogers School District return to class on Wednesday

Subscribe to 40/29 on YouTube now for more: http://bit.ly/PTElbK

Get more Northwest Arkansas news: http://www.4029tv.com

Like us: http://facebook.com/4029news

Follow us: http://twitter.com/4029news

Instagram: https://www.instagram.com/4029news/

News from the South - Arkansas News Feed

U.S. Education Secretary visits Arkansas

SUMMARY: U.S. Education Secretary Linda McMahon visited Arkansas as part of her nationwide tour promoting the return of education control to states. Meeting with Governor Sarah Huckabee Sanders at Dunn Roberts Elementary School in Little Rock, McMahon emphasized dismantling the Department of Education to reduce federal bureaucracy and increase local decision-making. The Trump administration argues this shift will expand family choices and empower communities, while critics warn it may reduce oversight and harm vulnerable students. McMahon highlighted Louisiana’s educational improvements as a model. After Little Rock, she toured the Saline County Career and Technical campus in Benton. Full coverage will follow in evening news.

U.S. Secretary of Education Linda McMahon is visiting Arkansas as part of the “Returning Education to the States” 50-state tour.

-

News from the South - Oklahoma News Feed5 days ago

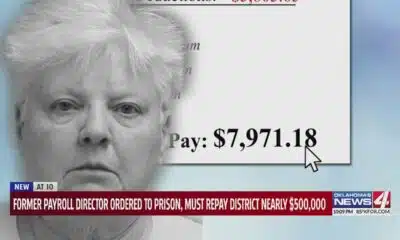

Former payroll director ordered to prison, must repay district nearly $500,000

-

News from the South - Missouri News Feed7 days ago

Man accused of running over Kansas City teacher with car before shooting, killing her

-

News from the South - Texas News Feed6 days ago

Jim Lovell, Apollo 13 moon mission leader, dies at 97

-

News from the South - Louisiana News Feed7 days ago

Mandeville man facing multiple allegations involving drugs, cruelty to juveniles

-

News from the South - Alabama News Feed7 days ago

Community Fundraisers Support Family of Mountain Gap Student Killed on Bike | Aug. 8, 2025 | News 19

-

News from the South - North Carolina News Feed7 days ago

Two deaths, sinkholes, downed trees: The impacts of severe flooding in Triangle

-

Local News7 days ago

3 Sept. 11 victims’ remains are newly identified, nearly 24 years later

-

News from the South - Tennessee News Feed6 days ago

Dollywood shares hints about new attraction coming in 2026