News from the South - South Carolina News Feed

Nigerian extradited to US to face charges over nude photo that led to teen’s death

SUMMARY: A Nigerian man, Hassanbunhussein Abolore Lawal, has been extradited to the U.S. and charged in connection with the death of a South Carolina teen who died by suicide after being extorted online. Lawal posed as a woman, tricked the teen into sending nude photos, and demanded more money. The teen, pressured by the extortion, tragically took his own life. The suspect faces multiple charges, including child exploitation resulting in death. This case follows the passing of “Gavin’s Law” in South Carolina, which criminalizes sextortion. Lawal’s extradition underscores the seriousness of online exploitation.

The post Nigerian extradited to US to face charges over nude photo that led to teen’s death appeared first on www.abccolumbia.com

News from the South - South Carolina News Feed

Governor to set limits on SNAP benefits.

SUMMARY: South Carolina Governor Henry McMaster plans to issue an executive order imposing new restrictions on SNAP benefits, affecting over 580,000 recipients. The order aims to limit purchases of items like candy and soft drinks, citing “common sense” and promoting healthier eating. Critics, including SNAP recipients and public health officials, argue these restrictions reduce personal freedom and may harm vulnerable populations. Dr. Bambi Gaddis highlights concerns about expanded work requirements and impacts on uninsured, unemployed, and undocumented individuals. She warns that cuts could increase food insecurity, especially among college students, and stresses the need for careful consideration before finalizing the changes.

Gov. Henry McMaster announced Wednesday that South Carolina will soon impose new restrictions on how low-income residents …

News from the South - South Carolina News Feed

Four radioactive wasp nests found in South Carolina

SUMMARY: Four radioactive wasp nests have been found near the Savannah River nuclear site in South Carolina, first discovered in July and now totaling four. Experts explain these wasps likely accessed radioactive material from contaminated soil or small leaks at the site. While the nests tested positive for nuclear waste traces, specialists say the wasps pose little threat to humans, as radiation cannot be transmitted by stings or proximity; ingestion would be the only risk. Officials affirm there is no health risk to workers, residents, or the environment, emphasizing ongoing commitment to safety and containment at the facility.

Concerns are rising in the Lowcountry as four wasp nests have tested positive for traces of nuclear waste.

The first nest was discovered in July and subsequently removed. Now, just a month later, four additional nests have been identified. Despite the alarming nature of these findings, experts assure the public that the nests pose minimal risk to humans.

“I’m not sure it’s spreading,” said David Jenkins, a forest health program manager at the South Carolina Forestry Commission. “Maybe they hadn’t tested before, and they’re seeing nests that are radioactive.”

#bugs #trending #wasp #radioactivity #hazard #hazmat #nuclear

_______________

Stay up to date with our social media:

WPDE on Facebook: https://www.facebook.com/WPDEABC15/

WPDE on Twitter: https://twitter.com/wpdeabc15

Subscribe to WPDE on YouTube: https://www.youtube.com/channel/UCn0sxo5Ocp8eSFqr9F1URpg/?sub_confirmation=1

Daily News Playlist:

https://www.youtube.com/playlist?list=PLCFE982C7D59E70C1

For more information, visit https://wpde.com/

Have a news tip? Send it directly to us:

Email us: abc15news@wpde.com

Call the Newsroom: 843.487.3001

WPDE is a SC based station and an ABC Television affiliate owned and operated by Sinclair Broadcast Group. WWMB is a SC based station and a CW Television affiliate owned and operated by Howard Stirk Holdings and receives certain services from an affiliation of Sinclair Broadcast Group.

#WPDE #ABC15News #ABC15 #WPDE15 #MyrtleBeach

News from the South - South Carolina News Feed

For The Health of It: Understanding MAST

SUMMARY: Tyler Ryan and Hima Dalal discuss Mast Cell Activation Syndrome (MCAS), an immune disorder where mast cells release inflammatory mediators causing symptoms like hives, brain fog, anxiety, and digestive issues. Common triggers include stress, infections, and certain foods. Integrative and functional medicine approaches involve low-histamine diets, enzyme supplements, natural mast cell stabilizers, stress reduction, and addressing root causes such as gut imbalances. Hima Dalal, an integrative occupational therapist, uses Eastern and conventional therapies like yoga, meditation, Reiki, and myofascial release to manage MCAS symptoms, focusing on stress regulation and holistic healing. Coordination with medical providers is recommended for optimal care.

The post For The Health of It: Understanding MAST appeared first on www.abccolumbia.com

-

Mississippi Today5 days ago

After 30 years in prison, Mississippi woman dies from cancer she says was preventable

-

News from the South - Georgia News Feed6 days ago

Woman charged after boy in state’s custody dies in hot car

-

News from the South - Texas News Feed5 days ago

Texas redistricting: What to know about Dems’ quorum break

-

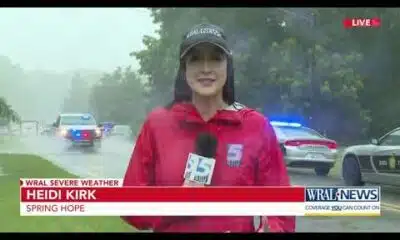

News from the South - North Carolina News Feed3 days ago

Two people unaccounted for in Spring Lake after flash flooding

-

News from the South - Texas News Feed7 days ago

Texas VFW holds memorial service for WWII pilot from Georgetown

-

News from the South - Florida News Feed6 days ago

Warning for social media shoppers after $22K RV scam

-

News from the South - Georgia News Feed6 days ago

Georgia lawmakers to return this winter to Capitol chambers refreshed with 19th Century details

-

News from the South - Alabama News Feed7 days ago

Flood Watch for Alabama: Storms linger overnight, with cooler weather in the forecast