News from the South - West Virginia News Feed

New federal school voucher program poses a quandary for states: Opt in or opt out?

by Robbie Sequeira, West Virginia Watch

July 31, 2025

When President Donald Trump signed the One Big Beautiful Bill Act, he gave state leaders — not federal regulators — the power to decide whether and how to participate in the first-ever national tax credit scholarship program.

That decision now looms largest in blue states, where Democratic governors and lawmakers must weigh whether to reject the law outright on ideological grounds — or try to reshape it into something that reflects their own values.

“This isn’t the federal voucher program we were worried about five years ago,” said Jon Valant, a senior fellow in governance studies at the left-leaning Brookings Institution who testified before Congress on earlier versions of the bill. “It still has serious problems — but states now have tools to mold it into something they might actually support.”

The final law gives states wide discretion, he said. They can opt out entirely. They can opt in passively, leaving the program to operate as written. Or, as Valant suggests, they can try to redraw its footprint — focusing less on private school tuition and more on public school supports like tutoring, transportation and enrichment services in underserved districts.

“My hope is that blue states take a hard look and ask: Can this be used to address our own needs?”

For progressives and education advocates who are wary of school vouchers, the decision is fraught. Opting in could draw criticism for approving what many see as a vehicle for privatization of K-12 education. But opting out could mean turning down federal dollars — education money that states with budding or robust private school voucher infrastructures, such as Arizona and Florida, will gladly take.

“There’s money on the table, and it can be used for more than just private school tuition,” Valant said. “If blue states want to keep that money from reinforcing inequality, they’ll have to get creative, and act fast.”

Since 2020, private school choice programs — once limited to low-income or special needs students — have rapidly expanded.

In 2023, $6.3 billion was spent nationwide on private school choice programs — less than 1% of total public K-12 operational spending, according to EdChoice, a nonprofit that advocates for school choice measures. From 2023-24 to 2024-25, participation in universal private school choice programs surged nearly 40%, growing from roughly 584,000 to 805,000 students in just one school year.

By 2026-27, about half of all U.S. students will be eligible, according to estimates by FutureEd, an independent think tank at Georgetown University.

These trends, combined with new federal tax credit, could fundamentally reshape the education funding landscape across state governments, experts say.

“States will need to decide whether to encourage the redirection of funding to support private and religious schools — either by expanding existing voucher programs or, if they don’t have one, by introducing such a program for the first time,” said Sasha Pudelski, director of advocacy for AASA, The School Superintendents Association. The group opposes the national voucher plan.

State regulations

As of this May, 21 states operated tax credit scholarship programs with varying degrees of funding and oversight. According to the EdChoice Friedman Index, the states of Florida, Arkansas, Arizona and Alabama rank highest in private school access, with 100% of students eligible for school choice programs.

Some states, like Florida and Arizona, already have extensive tax credit scholarship systems. Others, including Texas, are building new infrastructure such as statewide voucher programs and education savings accounts, known as ESAs.

States with no current programs face decisions about participation, regulation and equity, but without clear federal guardrails, education advocates told Stateline.

The federal policy builds on existing state-level tax credit scholarship programs — such as Alabama’s — but significantly expands eligibility, removes scholarship caps and broadens allowable uses to include not just tuition, but also tutoring, therapy, transportation and academic support services. Beginning in 2027, scholarships will be excluded from federal taxable income.

Valant, of Brookings, told Stateline that some of his initial concerns were addressed in the version of the bill signed into law.

“There was a very realistic scenario in the earlier version of the bill where a small number of very wealthy people could essentially make money off this,” Valant said. “That was mostly addressed.”

The enacted version eliminates stock donations and caps individual tax credits at $1,700. And with states that opt in having the power to shape their own program, Valant said that gives them the chance to establish their own guardrails, such as income eligibility caps or nondiscrimination policies for participating schools.

If blue states want to keep that money from reinforcing inequality, they’ll have to get creative, and act fast.

– Jon Valant, a senior fellow in governance studies at the Brookings Institution

The scholarship-granting organizations, known as SGOs, would then be subject to new state regulations about where the money can go.

“States could say SGOs can’t give money to schools that discriminate based on sexual orientation. … There’s quite a lot of room here for state regulation,” he said.

Looking ahead, Valant said he’ll be watching how states interpret their regulatory powers — and how effective scholarship-granting organizations are at fundraising under the new rules, which prohibit large stock gifts and rely instead on millions of smaller donations.

“Now it’s a strange pitch: ‘Can you front me $300 to give to the SGO? I swear the IRS will give it back,’” he said. “It’s going to take time to figure out how to sell this to families.”

Concerns over transparency and equity remain. The program allows donors, scholarship-granting organizations and families to direct funds with little public accountability, critics say. And in states without robust oversight, Valant warns that funds could be misused — or channeled to institutions that exclude students based, for example, on identity or beliefs about sexual orientation.

He also emphasized that early participation is likely to skew toward families already in private schools, particularly in wealthier ZIP codes — mirroring patterns seen in programs in Arizona, Florida and Georgia.

“One big risk is that the funds will disproportionately flow to wealthier families — just like we’ve seen in many ESA programs,” Valant said.

What do these programs look like across the country?

FutureEd studied eight states — Arizona, Arkansas, Florida, Iowa, Indiana, Ohio, Oklahoma and West Virginia — where 569,000 students participated in school choice programs at a cost to taxpayers of $4 billion in 2023-24.

The FutureEd analysis found significant differences among the states in design, funding and oversight.

Arizona’s ESA program was the first of its kind in 2011, and also the first to shift toward universal eligibility in 2022.

Florida operated the largest and most expensive program, with broad eligibility, no caps or accreditation requirements, and a major influx of higher-income families, though it mandated some university-led performance reviews. Iowa fully funded ESAs and, like other states, saw mostly existing private school families benefit.

Arkansas had a cautious rollout due to legal delays and geographic clustering of participants, while West Virginia allowed spending across state lines with no performance reporting.

Newcomer North Carolina began with income-based prioritization but quickly expanded under political pressure or demand, while Alabama and Louisiana will launch ESA programs in 2025-26 using general state revenues.

Utah enacted a universal voucher program in 2023, providing up to $8,000 per student for private school or homeschool expenses. A state teachers union sued, arguing that participating schools were not “free and open to all children” and that the program diverted public school funds. A state court this April ruled the program was unconstitutional.

As the new federal law opens the door for tax-credit-funded tuition support, Texas is building its first universal school voucher program, aided through ESAs to begin in the 2026-27 school year. The program is funded with $1 billion over two years, with $10,000-$11,000 per student — up to $30,000 for students with disabilities and $2,000 for homeschoolers.

The Texas comptroller will oversee the program, and private schools must be open for at least two years to be eligible for funds.

Voucher programs can drain state budgets, and budget wonks predict the cost for Texas could rise to around $4.8 billion by 2030, The Texas Tribune reported.

A spokesperson for the Texas comptroller’s office said that details are still being finalized; the state has issued a request for proposals due Aug. 4 to select eligible educational assistance organizations that would help funnel scholarship dollars to schools.

Other states may be more cautious. The Missouri National Education Association filed a lawsuit this summer to block $51 million in state appropriations to private school scholarships through the MOScholars program. The suit argues that using general revenue rather than private donations violates the state constitution and undermines public education funding.

Stateline reporter Robbie Sequeira can be reached at rsequeira@stateline.org.

West Virginia Watch is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. West Virginia Watch maintains editorial independence. Contact Editor Leann Ray for questions: info@westvirginiawatch.com.

The post New federal school voucher program poses a quandary for states: Opt in or opt out? appeared first on westvirginiawatch.com

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Center-Right

This content provides a generally factual overview of the One Big Beautiful Bill Act and the national tax credit scholarship program it established. It presents perspectives from various stakeholders, including education policy analysts from the left-leaning Brookings Institution and advocacy groups critical of voucher programs. The article leans slightly toward a Center-Right bias by focusing on expanding school choice, including the benefits of private school access and state flexibility, while also acknowledging concerns raised by progressives and education advocates. The nuanced discussion of potential equity and oversight issues alongside support for school choice funding frameworks suggests an overall balanced but slightly pro-school-choice, market-oriented viewpoint typical of Center-Right coverage.

News from the South - West Virginia News Feed

Ohio neighborhood fears landslide as retaining wall slips

SUMMARY: In Portsmouth, Ohio, a retaining wall has been slipping for about five years, causing fear among residents like the Yuri family who moved in just before the slip began. Despite support beams installed two years ago, cracks in the wall allow water to gush through, flooding parts of the road and raising concerns about a potential catastrophic landslide. Local councilman Shawn Dun highlights questions about the wall’s stability and estimates repair costs near $2 million, with the city seeking grants to fund the work. Residents anxiously await repairs, hoping the problem will be resolved soon to prevent disaster.

A cloud of concern hovers over one Portsmouth neighborhood. Those living along Richardson Road wonder how much longer a retaining wall will hold and keep a hillside from sliding that would damage their property. The support wall began slipping 5 years ago. A couple years later, support beams were put in place for a problem that those living along the street say is a ticking time bomb.

FULL STORY: https://wchstv.com/news/local/a-ticking-time-bomb-has-a-portsmouth-neighborhood-living-in-fear

_________________________________________

For the latest local and national news, visit our website: https://wchstv.com/

Sign up for our newsletter: https://wchstv.com/sign-up

Follow WCHS-TV on social media:

Facebook: https://www.facebook.com/eyewitnessnewscharleston/

Twitter: https://twitter.com/wchs8fox11

Instagram: https://www.instagram.com/wchs8fox11/

News from the South - West Virginia News Feed

Christian's Latest Forecast: More Dry Days; Rain Potential Late Next Week

SUMMARY: Storm Watch meteorologist Christian Boler reports mild, mostly dry weather continuing through the weekend with temperatures around 80°F and partly cloudy skies. A high-pressure system will maintain these warm, dry conditions into early next week. Some unorganized tropical rainstorms may bring isolated showers from Tuesday night into Wednesday morning, followed by a dry midweek. Saturday promises significant rainfall, helping to relieve recent dry and minor drought conditions affecting vegetation. Temperatures have shifted from below to above average this week but will dip below average later in the month. Overall, expect more dry days with rain potential late next week, improving moisture levels regionally.

FOLLOW US ON FACEBOOK AND TWITTER: https://facebook.com/WOAYNewsWatch https://twitter.com/WOAYNewsWatch.

News from the South - West Virginia News Feed

Road-widening project gets completion date, property issues remain unclear

SUMMARY: The Cross Lanes road-widening project, expanding Route 622 from Golf Mountain Road to Route 62 near Andrew Jackson Middle School, has resumed after a ten-month pause. Originally set for completion in June 2025, the new completion date is February 2027 due to delays caused by utility pole relocations. Construction is causing traffic congestion, especially around the Kroger turning light, which is being studied for timing adjustments. Despite frustrations, officials emphasize the long-term benefits. Property issues, including damage claims and easements, remain unresolved. Kanawha County lawmakers continue to provide updates as the project progresses.

Source

-

News from the South - Arkansas News Feed7 days ago

Group in lawsuit say Franklin county prison land was bought before it was inspected

-

News from the South - Kentucky News Feed6 days ago

Lexington man accused of carjacking, firing gun during police chase faces federal firearm charge

-

Mississippi News Video7 days ago

Carly Gregg convicted of all charges

-

Mississippi News Video7 days ago

2025 Mississippi Book Festival announces sponsorship

-

The Center Square6 days ago

California mother says daughter killed herself after being transitioned by school | California

-

News from the South - Missouri News Feed6 days ago

Local, statewide officials react to Charlie Kirk death after shooting in Utah

-

Local News6 days ago

US stocks inch to more records as inflation slows and Oracle soars

-

News from the South - Arkansas News Feed6 days ago

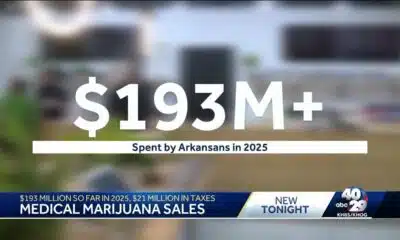

Arkansas medical marijuana sales on pace for record year