News from the South - Louisiana News Feed

Morning Forecast – Monday, May 26th

SUMMARY: Widespread showers and thunderstorms are ongoing this Monday morning, with some storms producing frequent lightning, heavy rain, and localized flash flooding possible. Two storm systems are moving east-northeast and southward due to a stalled frontal boundary to the north. Rainfall totals already exceed an inch in some areas like Greenville, Mississippi. Flood watches remain in effect through Tuesday morning across parts of Arkansas. Temperatures start in the upper 60s to low 70s, with humid conditions and southerly winds. Storms may bring gusty winds, hail, and continued flooding risks through midweek, with gradual drying and warmer temperatures expected by the weekend.

Very active start this Memorial Day with more rain expected to continue through late tonight. A stalled frontal will sit just to our north as a few embedded upper-level disturbances move across the area keeping much of the ArkLaMiss unsettled through the early week. There remains a chance for strong t-storms where gusty winds and flash flooding will be possible. We should partially dry out this weekend as temperatures start to warm back up into early next week.

News from the South - Louisiana News Feed

NBC 10 News Today: LSU female drum major

SUMMARY: The LSU Golden Band from Tigerland is gearing up for an exciting season, highlighted by senior Catherine Mansfield as only the fourth female drum major in the band’s history. With 325 members, the talented group has spent countless hours perfecting their performance, emphasizing precision, passion, and flawless execution. Mansfield feels the pressure but feeds off fan excitement, while Drum Captain Brayden Ibert praises the youthful, skilled group. Associate Director Simon Holoweiko underscores the dedication behind every drill, footwork, and horn note, ensuring the band delivers a powerful, high-energy show that electrifies game day experiences for LSU fans.

The LSU Tiger Band is gearing up for the 2025 season premiere, marking a historic moment as senior drum major Catherine …

News from the South - Louisiana News Feed

Clay Higgins continues his atypical quest for political relevance

by Greg LaRose, Louisiana Illuminator

September 7, 2025

For at least a moment earlier this year, U.S. Rep. Clay Higgins was willing to depart from his typical far-right, far-fetched stances to take a position most would label liberal – on a criminal justice matter, of all things.

Yet just months later, the Lafayette Republican is back to his extremist ways. What’s different now is that he appears rudderless, permanently veering to the right to the point where it could be argued he’s merely spinning in political circles.

Heads turned during the spring session of the Louisiana Legislature when Higgins, a former policeman, gave his support to a proposal that would have let people put in Louisiana prisons by non-unanimous juries seek reviews of their cases. The lawman-turned-lawmaker urged the “swift passage” of the bill by state Sen. Royce Duplessis, D-New Orleans, arguing it preserved the U.S. Constitution’s rights to due process and a fair trial.

“You could not have told me in my 42 years on this earth that I would have a letter from Congressman Clay Higgins supporting a bill that I brought,” Duplessis told colleagues on the Senate floor before they resoundingly rejected the measure. Opponents in the Republican supermajority said the policy change would overload prosecutors and court staff.

In recent days, Higgins has come out firing on all cylinders but with no clear direction ascertainable.

On Aug. 29, he sent a letter to House Speaker Mike Johnson saying that he was stepping down from the House Homeland Security Committee after Rep. Andrew Garabino, R-N.Y., was named its new chairman. Higgins, a candidate for the post, appeared dejected after the vote.

“My Republican colleagues have chosen an alternate path for the Committee that I helped to build,” he wrote to Johnson, “a path more in alignment with the less conservative factions of our Conference, factions whose core principles are quite variant from my own conservative perspective on key issues like amnesty, ICE operations, and opposition to the surveillance state.”

That’s the Higgins we’ve come to know – bitter, self-righteous and steered by conspiracy theories. As he still sits on the House Armed Services and the Oversight and Government Reform committees (chairing the latter’s law enforcement subcommittee), there will be ample chances for him to make bluster’s last stand.

And by no means will Higgins limit himself to those matters. A week ago, he urged the House Appropriations Subcommittee on Labor, Health and Human Services to withhold federal funding from “organizations that push COVID vaccines on young children.”

It followed his pledge on social media to “defund” the New Orleans Health Department for promoting the American Academy of Pediatrics’ guidance on COVID-19 vaccines for children from 6 months to 2 years old.

“State sponsored weakening of the citizenry, absolute injury to our children and calculated decline of fertility,” Higgins wrote in an Aug. 20 X post.

Call me a skeptic, but if there’s a group out there that’s least likely to be anti-fertility, it’s probably pediatricians. It’s not good for their business model.

YOU MAKE OUR WORK POSSIBLE.

Higgins’ latest play for political relevance came Thursday when he joined forces with Rep. James Comer, R-Ky., Oversight and Government Reform chairman, to investigate allegations that pharmacy chain CVS Health used “confidential patient information” to lobby the Louisiana Legislature.

Caremark, a CVS subsidiary, is the prescription benefit manager for the health insurance plan that covers state employees in Louisiana. Attorney General Liz Murrill is suing the company, saying it used information gained through that contract to send text messages to state employees asking them to oppose proposed legislation. The bill in question would have prohibited prescription benefit managers from co-owning pharmacies. Ultimately, lawmakers opted for a less aggressive, transparency measure with the support of independent pharmacies.

Critics consider the co-ownership arrangement self-serving, as the management entities have a direct say in how their affiliated pharmacies price – and profit from – prescription drugs.

Comer and Higgins have requested CVS Health president and CEO David Joyner provide a slate of records to aid in their investigation.

David Whitrap, who handles external relations for CVS, said in an email the company plans to respond to Comer and Higgins. With regards to the text messages, its communication with customers, patients and the community “was consistent with the law,” he said.

As much as he wants to position himself to the far right, Higgins’ involvement in accountability efforts such as this makes him a centrist – at least on this issue. The battle against pharmacy benefit managers is a bipartisan one, with both sides looking to claim the win for bringing down prescription drug and health insurance costs.

Regardless, it’s a welcome moment of lucidity from Higgins, much like Rep. Marjorie Taylor Greene’s demand for the U.S. Department of Justice to produce all its files on Jeffrey Epstein.

No one expects it, but it’s certainly welcomed.

For Higgins, more frequent stances like this could help him emerge from the shadow of Louisiana’s more prominent Republicans in the House – Speaker Johnson, Majority Leader Steve Scalise and Rep. Julia Letlow, a member of the powerful House Appropriations Committee.

But if history portends what lies ahead from Higgins, expect him to once again find his comfort zone on the fringes.

Louisiana Illuminator is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Louisiana Illuminator maintains editorial independence. Contact Editor Greg LaRose for questions: info@lailluminator.com.

The post Clay Higgins continues his atypical quest for political relevance appeared first on lailluminator.com

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Center-Left

The content critiques U.S. Rep. Clay Higgins from a perspective that highlights his far-right positions and labels some of his views as extremist, while also acknowledging occasional bipartisan or centrist actions. The tone is skeptical of conservative stances, particularly on issues like criminal justice, immigration, and COVID-19 vaccines, and it uses language that suggests disapproval of right-wing conspiracy theories. However, it also recognizes moments when Higgins aligns with more moderate or bipartisan efforts, indicating a nuanced but generally center-left leaning viewpoint.

News from the South - Louisiana News Feed

States break with FDA restrictions on COVID vaccines, ensuring broader access

by Shalina Chatlani, Louisiana Illuminator

September 6, 2025

Several states, including Colorado, Massachusetts, New Mexico, New York and Pennsylvania, announced this week that they would be breaking with restrictive eligibility policies unveiled last week by the U.S. Food and Drug Administration on the newly approved COVID-19 vaccines for the fall season.

In New York, Democratic Gov. Kathy Hochul signed an executive order Friday morning to authorize pharmacists to provide the shot to anyone who desires it for the next 30 days, which can be renewed.

“When they said that they are not going to be requiring COVID shots and other vaccinations for our families, I said, ‘No, here in New York we will make parents have the option.’ If you want your child to have a COVID shot, it should be available to you and it should be covered by insurance,” Hochul said during a news conference Friday morning, where she signed the order.

“So what I’m doing now is signing an executive order, because extreme times call for extreme measures. And this is the power I have to use in the interim until we are able to have the legislature get back in January and pass legislation that mandates this.”

Previous FDA policy recommended that COVID-19 vaccine booster shots be made available to anyone 6 months or older regardless of their health status. But in August, the federal agency announced restrictions for the new shot.

The FDA limited access to the vaccines to people who are 65 and older and to younger people with at least one underlying health condition, such as asthma or obesity, that would put them at risk of developing a severe illness without a booster shot. Children are eligible only if a medical provider is consulted. Additionally, the Pfizer vaccine, one of the three that were approved, will no longer be available for any child under 5.

“The American people demanded science, safety, and common sense. This framework delivers all three,” U.S. Health and Human Services Secretary Robert F. Kennedy Jr. wrote on social media platform X on Aug. 27.

Other states are also taking measures to ensure more people can get access to the vaccines.

On Thursday, Massachusetts Democratic Gov. Maura Healey ordered health insurers in the state to continue covering the vaccine. The state also issued an order to allow pharmacies to continue providing shots to residents above the age of 5.

Massachusetts is “leading efforts to create a public health collaboration with states in New England and across the Northeast committed to safeguarding public health as the federal government backs away from its responsibilities,” the governor’s office said in a release.

This week, the State Board of Pharmacy in Pennsylvania held a special meeting to vote to bypass federal vaccine recommendations and allow pharmacists to continue administering COVID-19 vaccines.

“Health care decisions should be up to individuals — not the federal government and certainly not RFK Jr. My Administration will continue to protect health care access for all Pennsylvanians,” Pennsylvania Democratic Gov. Josh Shapiro said.

Colorado and New Mexico took similar steps this week, with state officials signing public health orders asking state agencies to take steps necessary to require insurers to cover the vaccines and instructing pharmacists to provide the shots without a doctor’s note.

Stateline reporter Shalina Chatlani can be reached at schatlani@stateline.org.

This story was originally produced by Stateline, which is part of States Newsroom, a nonprofit news network which includes Louisiana Illuminator, and is supported by grants and a coalition of donors as a 501c(3) public charity.

Louisiana Illuminator is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Louisiana Illuminator maintains editorial independence. Contact Editor Greg LaRose for questions: info@lailluminator.com.

The post States break with FDA restrictions on COVID vaccines, ensuring broader access appeared first on lailluminator.com

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Center-Left

The content highlights actions taken primarily by Democratic governors and states to expand access to COVID-19 vaccines beyond federal restrictions. It presents these efforts positively, emphasizing public health and individual choice, while framing federal limitations as overly restrictive. The focus on Democratic leadership and public health advocacy aligns with center-left perspectives that prioritize government intervention in health care and vaccine accessibility.

-

Mississippi Today6 days ago

Trump proposed getting rid of FEMA, but his review council seems focused on reforming the agency

-

News from the South - Tennessee News Feed6 days ago

Tennessee ranks near the top for ICE arrests

-

News from the South - Missouri News Feed7 days ago

Missouri joins dozens of states in eliminating ‘luxury’ tax on diapers, period products

-

News from the South - Texas News Feed3 days ago

Texas high school football scores for Thursday, Sept. 4

-

News from the South - Arkansas News Feed6 days ago

Every fall there’s a government shutdown warning. This time it could happen.

-

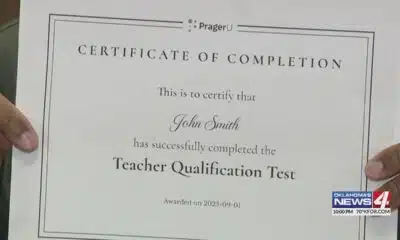

News from the South - Oklahoma News Feed6 days ago

Test taker finds it's impossible to fail 'woke' teacher assessment

-

Mississippi News Video7 days ago

WTOK Weather – Zack Rogers 8/30/25

-

Mississippi Today5 days ago

Brandon residents want answers, guarantees about data center