News from the South - Missouri News Feed

Missouri lawmakers eye late push to move Kansas City Royals to Clay County

by Jason Hancock, Missouri Independent

May 9, 2025

With only a week to go before the legislature adjourns for the year, Missouri lawmakers are considering a last-minute push for a $300 million incentive package aimed at building a new stadium for the Kansas City Royals in Clay County.

The tentative plan, which according to those involved has the blessing of the governor’s office, would commit the state to $15 million a year to a newly created Clay County sports authority for the next 20 years. That money would be used to help finance a new stadium in order to prevent the team from moving to Kansas.

It’s unclear if the legislative package will include money to help the Kansas City Chiefs remodel Arrowhead Stadium in Jackson County.

Legislation sponsored by state Sen. Kurtis Gregory, a Republican from Marshall, would be the vehicle for the funding. The underlying bill, which passed the Senate and could be taken up as early as Monday in the House, would authorize Clay County to establish a county sports complex authority for the purpose of “developing or maintaining sports, convention, exhibition or trade facilities.”

Any stadium funding plans would be added to the bill as an amendment in the House, said state Rep. Brad Christ, a St. Louis County Republican handling the legislation in that chamber.

Christ said his involvement with the stadium funding is “very minimal,” and he has not been kept in the loop on any details of the proposal.

All signs point toward Clay County as the preferred location for the new stadium, Gregory said, with the idea that moving the Royals would also clear the way for the Chiefs to remain in Arrowhead, demolish Kauffman Stadium and build a covered entertainment center.

“It’s not ‘downtown,’ but Clay County works a lot better,” Gregory said of a possible North Kansas City site. “There can be better parking. You’ll have the Kansas City skyline just two miles away. They could run the streetcar out to it. It just works.”

Some sort of local support would likely still be needed, Gregory said. But he’s optimistic that can get done, because “when I was knocking doors in Clay, the most frequent question I got was ‘what are we going to do about the Chiefs and the Royals.’”

Both teams have publicly expressed interest in moving from Missouri to Kansas after Jackson County voters rejected a proposal last year to extend a 3/8-cent sales tax to help finance a downtown Kansas City baseball stadium and upgrades to Arrowhead.

Kansas lawmakers responded by expanding a tax incentive program in the hopes of convincing one or both teams to relocate. The leases for both teams’ Jackson County stadiums run through the end of the 2030 season.

Regardless of the details of any potential plan, the idea faces incredibly long odds with so little time left in the session. The House and Senate must adjourn for the year at 6 p.m. next Friday.

The tight timeline is especially problematic in the Missouri Senate, where any opposition could turn into a run-out-the-clock filibuster.

State Sen. Maggie Nurrenbern, a Kansas City Democrat who co-sponsored the Clay County sports authority bill with Gregory, said she’s not been involved in recent discussions and had doubts there was time to still get something done so late in the session.

Senate President Pro Tem Cindy O’Laughlin, a Shelbina Republican, said there have been ongoing talks all year about the idea of trying to keep the Royals in Missouri. But she has not been directly involved in formal discussions of a new plan this week, she said.

And taking a stadium funding plan from start to finish in less than a week, O’Laughlin said, will be incredibly tough.

“That would be pretty quick,” she said with a laugh.

In an emailed statement Friday afternoon, Missouri Gov. Mike Kehoe’s spokeswoman called the decision about where the Royals’ stadium should be located “a business decision that must be made by the teams, and any proposed tools put forward by the state will work in whatever Missouri location they select.”

“Local support will be critical to keeping the teams in Missouri. The state’s role is critical, but no more so than the locals who must also be committed to finding solutions,” said Gabrielle Picard, the governor’s spokeswoman. “We believe the state’s proposal will be competitive to keep these major economic engines in the state, while also being a good deal for taxpayers.”

This story was updated at 3:47 p.m. with a statement from the governor.

Missouri Independent is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Missouri Independent maintains editorial independence. Contact Editor Jason Hancock for questions: info@missouriindependent.com.

The post Missouri lawmakers eye late push to move Kansas City Royals to Clay County appeared first on missouriindependent.com

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Centrist

This content presents a straightforward news report about Missouri lawmakers considering a $300 million incentive package for a new Kansas City Royals stadium. It provides factual information, quotes from politicians on both sides of the aisle, and covers the political and logistical challenges involved. The article refrains from using persuasive or emotionally charged language, avoiding a clear partisan slant. The focus is on the legislative process and local political dynamics without favoring or criticizing any specific political ideology or party, indicating a centrist presentation.

News from the South - Missouri News Feed

Luke Altmyer scores 3 TDs, No. 9 Illinois shuts out Western Michigan, 38-0

SUMMARY: No. 9 Illinois defeated Western Michigan 38-0, extending its winning streak to seven games, the longest since 2011. Quarterback Luke Altmyer threw two touchdowns and ran for another, while Kaden Feagin rushed for 100 yards and a touchdown. Illinois’ defense made critical stops, preserving the shutout despite only leading 10-0 at halftime. Coach Bret Bielema expressed frustration at the team’s slow start. Illinois remains turnover-free this season and has outscored opponents 128-22 in three games. Their next challenge is Big Ten play against No. 22 Indiana. Western Michigan starts MAC play next week against Toledo.

The post Luke Altmyer scores 3 TDs, No. 9 Illinois shuts out Western Michigan, 38-0 appeared first on fox2now.com

News from the South - Missouri News Feed

Panic and chaos at a St. Louis area mall false reports of shots fired

SUMMARY: Panic erupted at West County Center mall in the St. Louis area Saturday around 2:30 p.m. after a false report of shots fired in the food court. Police arrived quickly but found no active shooter. The confusion stemmed from a fight where a chair was thrown, causing fear among shoppers. Maya Emig, separated from her family, was comforted by strangers during the chaos. Traffic snarled as parents tried to reach their children. The incident, amid recent nationwide gun violence, heightened fears but no arrests were made. Authorities confirmed no guns were involved and no charges will be filed.

A fight near the food court where a chair was thrown at a victim caused some confusion, which then turned into panic and chaos amid rumors of an active shooter.

News from the South - Missouri News Feed

UTVs, ROVs may soon be allowed on Wentzville streets

SUMMARY: Wentzville’s Board of Aldermen voted 4-2 to allow utility terrain vehicles (UTVs) and recreational off-highway vehicles (ROVs) on city streets under conditions similar to golf cart rules. Use would be limited to subdivisions with speed limits of 25 mph or less, requiring valid licenses, insurance, and safety features. However, Mayor Nick Guccione vetoed the ordinance, citing safety and enforcement concerns, supported by residents and officials. The Board may override the veto on September 24. Supporters emphasize personal responsibility, while opponents worry about public safety. Enforcement challenges exist, especially regarding underage drivers. Missouri law permits municipalities to regulate such vehicles locally.

Read the full article

The post UTVs, ROVs may soon be allowed on Wentzville streets appeared first on fox2now.com

-

News from the South - Arkansas News Feed7 days ago

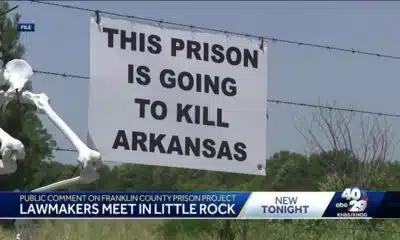

Group in lawsuit say Franklin county prison land was bought before it was inspected

-

News from the South - Kentucky News Feed6 days ago

Lexington man accused of carjacking, firing gun during police chase faces federal firearm charge

-

The Center Square6 days ago

California mother says daughter killed herself after being transitioned by school | California

-

Mississippi News Video7 days ago

Carly Gregg convicted of all charges

-

Mississippi News Video7 days ago

2025 Mississippi Book Festival announces sponsorship

-

News from the South - Arkansas News Feed6 days ago

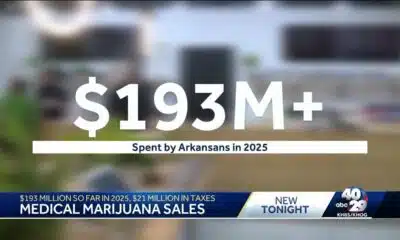

Arkansas medical marijuana sales on pace for record year

-

Local News Video6 days ago

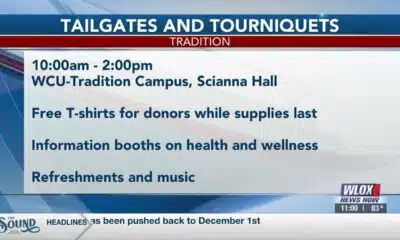

William Carey University holds 'tailgates and tourniquets' blood drive

-

News from the South - Missouri News Feed6 days ago

Local, statewide officials react to Charlie Kirk death after shooting in Utah