News from the South - Missouri News Feed

Missouri House votes on party lines to eliminate income tax on capital gains

Missouri House votes on party lines to eliminate income tax on capital gains

by Rudi Keller, Missouri Independent

February 13, 2025

A bill to remove the state income tax on profits from the sale of long-term investments passed the Missouri House Thursday on an almost pure party-line vote.

The bill, projected to cost the state treasury $341 million in the first year and $237 million in subsequent years, exempts money known as long-term capital gains, money earned on stocks, land or other assets held for a full year or longer. House Speaker Pro Tem Chad Perkins, the sponsor of the bill, said it is intended to help small business owners and others who sell assets as they approach retirement.

“These folks have worked their entire life and have counted on that to be their retirement,” said Perkins, a Republican from Bowling Green. “And that’s and that’s who this is geared toward.”

The bill passed 100-48, with only state Rep. Raychel Proudie, a Democrat from Ferguson, crossing party lines to support the legislation. Another Democrat, state Rep. Marlene Terry of St. Louis, voted present.

Democrats opposed the bill, said state Rep. Steve Butz of St. Louis, because it will make it harder for the state to sustain education and other services.

‘The message from the Republican side is, as just stated, ‘I’m just here to cut your taxes,’” Butz said. “What they don’t ever really address is either cutting services or they’re just going to rotate or shift the tax burden to another form of taxation.”

Gov. Mike Kehoe has championed the cut as the first step in eliminating the state income tax. An identical bill is awaiting debate in the state Senate.

Missouri is sitting on a large general revenue surplus but current revenues are falling. Through Tuesday, general revenue collections for the year are down more than 2% and if the trend continues the state will receive about $300 million less than in the fiscal year that ended June. 30.

At the same time, demands for general revenue are growing. Kehoe’s supplemental budget to finish the current fiscal year sets aside $142 million to replace a shortfall in lottery and casino revenues in public schools. And the budget for the coming year increases general revenue allocations to the Department of Elementary and Secondary Education by more than $400 million, with public school backers clamoring for an additional $300 million to fully fund the state foundation formula.

During Thursday’s debate, Perkins said states that already exempt capital gains – Texas, Tennessee and Florida — have economies growing faster than Missouri. A cut would attract new business to the state, he said.

Those other states have higher taxes than Missouri in several areas, Butz said after the vote. He reminded colleagues during debate that if the state cuts taxes too much to sustain services demanded by voters, it will be hard to restore them. Any tax increase above about $100 million requires a statewide vote.

“If we make a mistake here, there’s no going back,” Butz said during the floor debate.

Since the enactment of a 2014 tax bill, the top income tax rate has fallen from 6% to 4.7%, with two additional cuts of 0.1 percentage point already part of state law. Those cuts will take place when the state sees year-over-year general revenue growth of $200 million.

In the intervening years, the Republican-dominated legislature has also eliminated the income tax on Social Security benefits and cut the top corporate tax rate.

The impact of the state capital gains exemption could be lessened if Congress accepts the proposal pushed by President Donald Trump to eliminate what is known as the carried-interest exemption. That allows investment fund managers to pay the federal capital gains rate, which is lower than the general tax rate under the federal income tax.

“The whole concept of capital gains tax elimination is so that we can grow the economy, so we can get those high paying jobs to Missouri and businesses can reinvest,” said state Rep. George Hruza, a Republican from St. Louis County.

Democrats, however, see the cut as part of a political tax policy that doesn’t meet state needs.

“Their tax policies,” said House Minority Leader Ashley Aune, “seem to be far more about the message it sends to voters than actually saving the average Missourian money.”

YOU MAKE OUR WORK POSSIBLE.

Missouri Independent is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Missouri Independent maintains editorial independence. Contact Editor Jason Hancock for questions: info@missouriindependent.com.

News from the South - Missouri News Feed

Luke Altmyer scores 3 TDs, No. 9 Illinois shuts out Western Michigan, 38-0

SUMMARY: No. 9 Illinois defeated Western Michigan 38-0, extending its winning streak to seven games, the longest since 2011. Quarterback Luke Altmyer threw two touchdowns and ran for another, while Kaden Feagin rushed for 100 yards and a touchdown. Illinois’ defense made critical stops, preserving the shutout despite only leading 10-0 at halftime. Coach Bret Bielema expressed frustration at the team’s slow start. Illinois remains turnover-free this season and has outscored opponents 128-22 in three games. Their next challenge is Big Ten play against No. 22 Indiana. Western Michigan starts MAC play next week against Toledo.

The post Luke Altmyer scores 3 TDs, No. 9 Illinois shuts out Western Michigan, 38-0 appeared first on fox2now.com

News from the South - Missouri News Feed

Panic and chaos at a St. Louis area mall false reports of shots fired

SUMMARY: Panic erupted at West County Center mall in the St. Louis area Saturday around 2:30 p.m. after a false report of shots fired in the food court. Police arrived quickly but found no active shooter. The confusion stemmed from a fight where a chair was thrown, causing fear among shoppers. Maya Emig, separated from her family, was comforted by strangers during the chaos. Traffic snarled as parents tried to reach their children. The incident, amid recent nationwide gun violence, heightened fears but no arrests were made. Authorities confirmed no guns were involved and no charges will be filed.

A fight near the food court where a chair was thrown at a victim caused some confusion, which then turned into panic and chaos amid rumors of an active shooter.

News from the South - Missouri News Feed

UTVs, ROVs may soon be allowed on Wentzville streets

SUMMARY: Wentzville’s Board of Aldermen voted 4-2 to allow utility terrain vehicles (UTVs) and recreational off-highway vehicles (ROVs) on city streets under conditions similar to golf cart rules. Use would be limited to subdivisions with speed limits of 25 mph or less, requiring valid licenses, insurance, and safety features. However, Mayor Nick Guccione vetoed the ordinance, citing safety and enforcement concerns, supported by residents and officials. The Board may override the veto on September 24. Supporters emphasize personal responsibility, while opponents worry about public safety. Enforcement challenges exist, especially regarding underage drivers. Missouri law permits municipalities to regulate such vehicles locally.

Read the full article

The post UTVs, ROVs may soon be allowed on Wentzville streets appeared first on fox2now.com

-

News from the South - Kentucky News Feed6 days ago

Lexington man accused of carjacking, firing gun during police chase faces federal firearm charge

-

The Center Square7 days ago

California mother says daughter killed herself after being transitioned by school | California

-

News from the South - Arkansas News Feed6 days ago

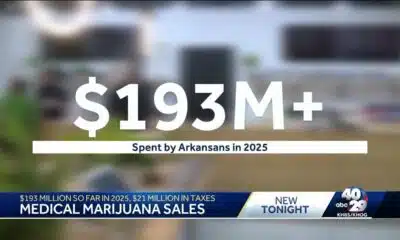

Arkansas medical marijuana sales on pace for record year

-

News from the South - Alabama News Feed6 days ago

Zaxby's Player of the Week: Dylan Jackson, Vigor WR

-

Local News Video7 days ago

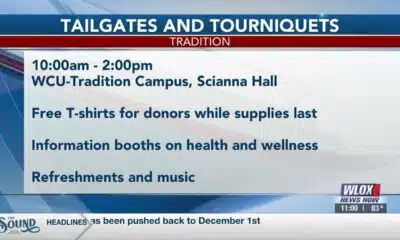

William Carey University holds 'tailgates and tourniquets' blood drive

-

News from the South - North Carolina News Feed5 days ago

What we know about Charlie Kirk shooting suspect, how he was caught

-

News from the South - Missouri News Feed6 days ago

Local, statewide officials react to Charlie Kirk death after shooting in Utah

-

Local News6 days ago

US stocks inch to more records as inflation slows and Oracle soars