News from the South - North Carolina News Feed

Judge throws out HCA’s counterclaims in Stein lawsuit • Asheville Watchdog

An attempt by Mission Hospital’s corporate owner to counter a lawsuit filed against it last year by North Carolina Attorney General Josh Stein has been dismissed.

North Carolina Business Court Judge Julianna Theall Earp filed an opinion Dec. 6 dismissing HCA’s counterclaims against Stein, who had sued HCA and its Mission Health system in December 2023. Stein’s lawsuit alleged they had violated the Asset Purchase Agreement (APA) entered into when HCA bought the hospital system in 2019 for $1.5 billion.

Earp’s opinion focused on the argument the attorney general and his team had made that he is shielded from HCA’s counterclaims by a legal concept known as sovereign immunity. News of the dismissal was first reported by the Asheville Citizen Times.

Sovereign immunity is defined as “the state’s immunity from most kinds of lawsuits unless the state consents to be sued,” according to the University of North Carolina School of Government.

“We are confident that Mission has fulfilled its obligations under the Asset Purchase Agreement, and we intend to defend the lawsuit filed by the Attorney General aggressively,” Mission Health spokesperson Nancy Lindell said Tuesday. “Unfortunately, the lawsuit continues to be a distraction from the important work that Mission continues to do in Western North Carolina.”

The attorney general’s office did not immediately respond to Asheville Watchdog’s request for comment.

Stein’s 2023 lawsuit on behalf of Dogwood Health Trust – the entity responsible for ensuring HCA complies with the APA – alleged the company had violated commitments it made to maintain services related to emergency and oncology care at the Asheville hospital. Those agreements were solidified in the APA, which Stein‘s office oversaw and agreed to before the sale.

In February, HCA sought dismissal of the suit, countering that it had never promised to provide quality health care but had honored its APA commitments. As Earp’s opinion noted, “HCA characterizes the Hospital Service Commitments at issue as requiring that HCA: “(1) maintain Level II trauma capabilities at Mission Hospital; and (2) maintain the capabilities to provide the emergency services and oncology services that were provided at Mission as of January 2019.”

Only a small portion of Earp’s opinion focused on the issue of HCA commitments to the APA, instead explaining why sovereign immunity justified dismissing the counterclaims.

Stein had relied on sovereign immunity in response to HCA’s counterclaims, arguing he could not be a target of legal action. HCA had countered that he couldn’t rely on such protection.

“HCA rejects the contention that sovereign immunity applies because, it argues, this action was brought by the Attorney General, not in his state-sanctioned role, but on behalf of Dogwood Health Trust, a private, non-profit corporation,” the opinion said.

Stein disagreed.

“Plaintiff [Stein] maintains that the APA’s protections and the right to enforce those protections were borne from the Attorney General’s statutory review authority and are consistent with his broad consumer protection mandate and his ‘common law’ right and power to protect the beneficiaries of charitable trusts,’” the opinion said.

No conditions for immunity

In deciding the matter, Earp turned to conditions under which immunity might be waived. None applied, she stated.

She followed that decision by explaining she would not make broad declarations about the case, sidestepping issues related to the APA, stating: “[T]o the extent Defendant’s [HCA’s] declaratory judgment claims present no new controversies and simply amount to the converse of Plaintiff’s declaratory judgment claims already pending before the Court, the Court concludes, in its discretion, that allowing Defendant’s claims to proceed would not serve a useful purpose and would ‘conflict with the interests of judicial economy and efficiency.’”

While Earp dismissed the counterclaims, she denied Stein’s request to avoid having to pay attorneys’ fees, noting it was too early in the case to make such a decision.

Stein’s lawsuit is not the only legal issue facing Nashville-based HCA in western North Carolina.

Buncombe County, the cities of Asheville and Brevard, and Madison County are suing HCA in a separate antitrust lawsuit in federal court.

Mission Hospital also fell under scrutiny of state and federal investigators earlier this year when the U.S. Centers for Medicare & Medicaid Services (CMS) found it had violated federal standards of care and placed it under immediate jeopardy, the toughest sanction a healthcare facility can face. A report following that investigation showed that four patients died in two years related to those violations of care and leadership mismanagement.

CMS lifted the immediate jeopardy sanction in February.

Asheville Watchdog is a nonprofit news team producing stories that matter to Asheville and Buncombe County. Andrew R. Jones is a Watchdog investigative reporter. Email arjones@avlwatchdog.org. The Watchdog’s local reporting during this crisis is made possible by donations from the community. To show your support for this vital public service go to avlwatchdog.org/support-our-publication/.

Related

The post Judge throws out HCA’s counterclaims in Stein lawsuit • Asheville Watchdog appeared first on avlwatchdog.org

News from the South - North Carolina News Feed

White House officials hold prayer vigil for Charlie Kirk

SUMMARY: Republican lawmakers, conservative leaders, and Trump administration officials held a prayer vigil and memorial at the Kennedy Center honoring slain activist Charlie Kirk, founder of Turning Point USA. Kirk was killed in Utah, where memorials continue at Utah Valley University and Turning Point USA’s headquarters. Police say 22-year-old Tyler Robinson turned himself in but has not confessed or cooperated. Robinson’s roommate, his boyfriend who is transitioning, is cooperating with authorities. Investigators are examining messages Robinson allegedly sent on Discord joking about the shooting. Robinson faces charges including aggravated murder, obstruction of justice, and felony firearm discharge.

White House officials and Republican lawmakers gathered at the Kennedy Center at 6 p.m. to hold a prayer vigil in remembrance of conservative activist Charlie Kirk.

https://abc11.com/us-world/

Download: https://abc11.com/apps/

Like us on Facebook: https://www.facebook.com/ABC11/

Instagram: https://www.instagram.com/abc11_wtvd/

Threads: https://www.threads.net/@abc11_wtvd

TIKTOK: https://www.tiktok.com/@abc11_eyewitnessnews

News from the South - North Carolina News Feed

Family, friends hold candlelight vigil in honor of Giovanni Pelletier

SUMMARY: Family and friends held a candlelight vigil in Apex to honor Giovanni Pelletier, a Fuquay Varina High School graduate whose body was found last month in a Florida retention pond. Giovanni went missing while visiting family, after reportedly acting erratically and leaving his cousins’ car. Loved ones remembered his infectious smile, laughter, and loyal friendship, expressing how deeply he impacted their lives. His mother shared the family’s ongoing grief and search for answers as authorities continue investigating his death. Despite the sadness, the community’s support has provided comfort. A celebration of life mass is planned in Apex to further commemorate Giovanni’s memory.

“It’s good to know how loved someone is in their community.”

More: https://abc11.com/post/giovanni-pelletier-family-friends-hold-candlelight-vigil-honor-wake-teen-found-dead-florida/17811995/

Download: https://abc11.com/apps/

Like us on Facebook: https://www.facebook.com/ABC11/

Instagram: https://www.instagram.com/abc11_wtvd/

Threads: https://www.threads.net/@abc11_wtvd

TIKTOK: https://www.tiktok.com/@abc11_eyewitnessnews

News from the South - North Carolina News Feed

NC Courage wins 2-1 against Angel City FC

SUMMARY: The North Carolina Courage defeated Angel City FC 2-1 in Cary, ending their unbeaten streak. Monaca scored early at the 6th minute, followed by Bull City native Brianna Pinto’s goal at the 18th minute, securing a 2-0 halftime lead. Angel City intensified in the second half, scoring in the 88th minute, but the Courage held firm defensively to claim victory. Pinto expressed pride in the win, emphasizing the team’s unity and playoff ambitions. Nearly 8,000 fans attended. Coverage continues tonight at 11, alongside college football updates, including the Tar Heels vs. Richmond game live from Chapel Hill.

Saturday’s win was crucial for the Courage as the regular season starts to wind down.

https://abc11.com/post/north-carolina-courage-wins-2-1-angel-city-fc/17810234/

Download: https://abc11.com/apps/

Like us on Facebook: https://www.facebook.com/ABC11/

Instagram: https://www.instagram.com/abc11_wtvd/

Threads: https://www.threads.net/@abc11_wtvd

TIKTOK: https://www.tiktok.com/@abc11_eyewitnessnews

-

News from the South - Kentucky News Feed6 days ago

Lexington man accused of carjacking, firing gun during police chase faces federal firearm charge

-

News from the South - Arkansas News Feed7 days ago

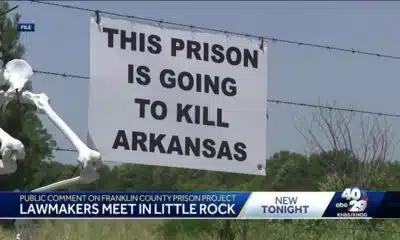

Group in lawsuit say Franklin county prison land was bought before it was inspected

-

The Center Square6 days ago

California mother says daughter killed herself after being transitioned by school | California

-

News from the South - Arkansas News Feed6 days ago

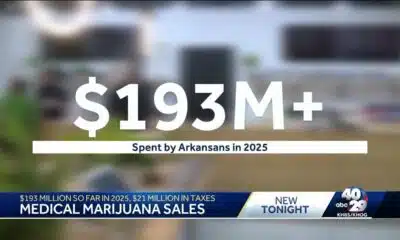

Arkansas medical marijuana sales on pace for record year

-

News from the South - Missouri News Feed6 days ago

Local, statewide officials react to Charlie Kirk death after shooting in Utah

-

Local News6 days ago

US stocks inch to more records as inflation slows and Oracle soars

-

Local News Video6 days ago

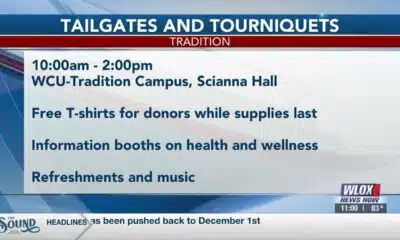

William Carey University holds 'tailgates and tourniquets' blood drive

-

News from the South - Alabama News Feed6 days ago

Zaxby's Player of the Week: Dylan Jackson, Vigor WR