News from the South - Georgia News Feed

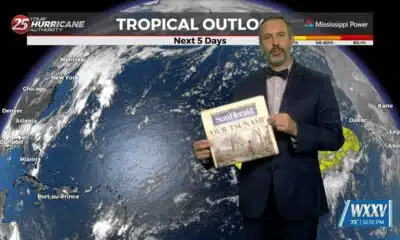

Hurricane season 2025 begins: What you need to know

SUMMARY: The 2025 Atlantic hurricane season, starting June 1, is expected to be above average, with forecasts predicting 13-19 named storms, 6-10 hurricanes, and 3-5 major hurricanes. This is due to an ENSO-neutral pattern, meaning neither El Niño nor La Niña is present, allowing storms to form more easily with warm Atlantic waters. The National Hurricane Center has improved forecasting with longer lead times (72 hours), smarter models, a smaller cone of uncertainty, extended wind forecasts, and better communication tools. Though inland, the CSRA should prepare for heavy rain, flooding, and wind impacts. Residents are advised to review emergency plans and stay alert.

The post Hurricane season 2025 begins: What you need to know appeared first on www.wjbf.com

News from the South - Georgia News Feed

Remaining mall shooting suspects face judge, youngest suspect makes public debut

SUMMARY: In Savannah, Georgia, 20-year-old Aujawan Hymon and 16-year-old Dahmil Johnson, the final suspects in the Oglethorpe Mall shooting, appeared in court. Johnson made his first public court appearance, supported by his lawyer. Defense attorneys argued insufficient evidence links the shootout to Tina Smith’s death, attributed to heart complications during the chaos. They moved to dismiss felony murder charges, calling them an overreach, but Judge Crystal Harmon denied the motions, citing probable cause. The shooting reportedly began after a scuffle involving a gold chain. Both face felony murder, assault, and firearm charges, with additional weapons charges. The State aims to indict all six suspects by October 1.

The post Remaining mall shooting suspects face judge, youngest suspect makes public debut appeared first on www.wsav.com

News from the South - Georgia News Feed

After more than 50 years, Augusta’s Villa Europa is closed

SUMMARY: Augusta’s historic Villa Europa restaurant is temporarily closed due to financial and regulatory challenges, including obligations to the Department of Revenue and pandemic impacts. The Schaffer Neises family, who operated the German-Italian American eatery for over 50 years, expressed gratitude to patrons and hope for future investors to continue the legacy. While the restaurant remains closed, their food truck, Villa Wagen, will operate when possible, though its future is uncertain. The family will serve at the Germany tent at this year’s Arts in the Heart for the last time and is working on a cookbook to preserve Villa Europa’s recipes and stories.

Read the full article

The post After more than 50 years, Augusta's Villa Europa is closed appeared first on www.wjbf.com

News from the South - Georgia News Feed

Richmond Hill votes to roll back millage rate

SUMMARY: Richmond Hill City Council voted to roll back the millage rate from the proposed 4.132 to 3.981, avoiding a nearly 4% property tax increase. This decision followed several public hearings where residents expressed concerns about rising housing costs and the impact of higher property taxes on affordability. Critics questioned the city’s spending, citing funds tied up in unused land and city hall renovations amid infrastructure issues. Georgia law requires public hearings for maintaining or increasing millage rates. Mayor Russ Carpenter emphasized careful financial planning to balance taxpayer relief with maintaining essential city services.

The post Richmond Hill votes to roll back millage rate appeared first on www.wsav.com

-

Mississippi Today4 days ago

DEI, campus culture wars spark early battle between likely GOP rivals for governor in Mississippi

-

News from the South - Louisiana News Feed7 days ago

K+20: Katrina alters local health care landscape, though underlying ills still the same

-

News from the South - North Carolina News Feed7 days ago

Parasocial party: Why people are excited for the Taylor Swift, Travis Kelce engagement

-

Local News6 days ago

Police say Minneapolis church shooter was filled with hatred and admired mass killers

-

Local News Video6 days ago

08/29 Ryan's “Wet End to the Week” Friday Forecast

-

News from the South - Kentucky News Feed6 days ago

Lexington Man Convicted of Firearms Offenses

-

Mississippi Today7 days ago

Two Mississippi media companies appeal Supreme Court ruling on sealed court files

-

News from the South - Arkansas News Feed6 days ago

Sylvan Hills defeats Maumelle in Zero Week thriller