(The Center Square) – As a select committee in the Florida House of Representatives looks into possible property tax relief, local governments might need to help to fill a potentially gaping revenue hole.

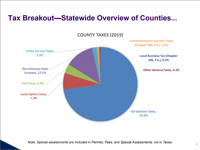

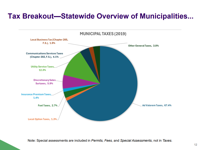

State data shows that more than 70% of county tax revenues and nearly 68% of municipal tax revenue comes from property taxes.

Gov. Ron DeSantis wants lawmakers to place an initiative on the November 2026 ballot that would possibly allow lawmakers to cap property tax rates and assessment increases, which he says have been ruinous to Florida homeowners.

Property tax is assessed at $1 per $1,000 of assessed value, known as a mill, and these revenues are used to support county and municipal operations, along with other millage collections for local school districts. Any time a home’s value increases, the assessed value increases and thus a homeowner has to pay more in taxes.

DeSantis also said he’ll veto any “Florida last” tax relief package that has a reduction in the state’s sales tax rate of 6%, saying a cut there will not benefit Floridians.

He also says the money from ever-increasing assessments has helped grow local government largesse and the data largely backs up that claim.

According to data from the Florida Legislature Office of Economic and Demographic Research presented during the House Select Committee on Property Taxes meeting on Tuesday, local government revenues increased at a rate outstripping the Bureau of Labor Statistic’s Consumer Price Index.

An analysis of tax revenues and other local government revenue showed tax collections alone increased by 36.6% from 2019 to 2023 for counties and 25.6% for cities.

The worst year for inflation according to CPI was 2022, when it was at 7.5% and has been at an average of 3.64% from 2019 to 2025.

Counties and municipalities aren’t likely to be supportive of cutting a big part of their budgets.

The data also showed property tax revenues compose 72.6% of county revenues and 67.4% of municipal revenues.

The Legislature’s research arm used 2019 data since financial and economic environments were growing yet stable in the post-Great Recession, pre-COVID and pre-inflation period.

Out of the state’s 67 counties, 51 of them have ad valorem collections as their biggest revenue source.

Florida county tax revenues.

Flagler County was the most dependent on property taxes, with 47.3% of its revenues coming from those collections, followed by Nassau County (44.2%), Sumter County (39.9%), Martin County (38.4%) and St. Lucie County (38.3%).

Least dependent on property taxes was Liberty County at 12.8%, followed by Union County (16.2%), Miami-Dade County (16.5%) and Okaloosa County (18.6%).

Among municipalities, Bay Lake was the most dependent on ad valorem taxes at 98.3%, followed by Lake Buena Vista (97.4%), Weeki Wachee (90.2%), Lazy Lake (79.7%) and Sea Ranch Lakes (79.2%).

The least dependent on ad valorem revenue was Apopka at 11%, followed by Orlando (11.7%), Plant City (12.6%), Port Orange (13.1%) and Holly Hill (13.1%).

For counties, the biggest line items in 2019 were law enforcement at 27% and road and street maintenance and construction (18%).

Municipalities also spent heavily on law enforcement (12.5% of their appropriated funds in 2019), but pension costs for employees was the next biggest outlay at 8%.

Two measures that would’ve put initiatives on the 2026 ballot died in this year’s legislative session.

House Joint Resolution 1257 and Senate Joint Resolution 1510 would’ve allowed voters to decide whether lawmakers can provide two $25,000 ad valorem tax exemptions and limit the increase in annual assessments to the lesser of 3% of the assessment for the prior year or the percent change in the consumer price index.

Florida municipal tax revenues.