News from the South - Florida News Feed

HCA Florida Westside “angel” nurse is credited for saving South Florida gas attendant's life

SUMMARY: A touching reunion took place in Plantation when Lewis Sanchez thanked nurse Allison Seamore, who saved his life after she recognized his heart issues while off duty at a gas station. After noticing Sanchez’s chest pains, Seamore used her stethoscope and urged him to go to the hospital. Unsure if he would follow through, she returned to ensure he got prompt treatment. At HCA Florida Westside Hospital, Sanchez underwent immediate surgery to replace a heart valve. Grateful for her intervention, he expressed that her actions gave him a new lease on life, considering it the best Christmas gift.

CBS New Miami’s Steve Maugeri was on hand for the tearful reunion with nurse Alison Seecoomar and patient Luis Sanchez-Mendia HCA Florida Westside.. She had noticed something was wrong when he went to a gas station where he was an attendant.

News from the South - Florida News Feed

Florida’s Brendan Bett planning to apologize to USF player he spit at after loss

SUMMARY: Florida defensive lineman Brendan Bett plans to apologize after being ejected for spitting at a South Florida player during an 18-16 loss. Coach Billy Napier said Bett is remorseful, acknowledging his mistake and its negative impact on the team’s image. Bett will face internal discipline and is expected to publicly apologize and personally reach out to the player he spat on. The incident occurred late in the game, contributing to Florida’s defeat. This follows similar spitting incidents in football and soccer recently. Teammates defended Bett’s character, emphasizing his regret and commitment to learning from the mistake. Suspension for the next game remains undecided.

The post Florida’s Brendan Bett planning to apologize to USF player he spit at after loss appeared first on www.tampabay28.com

News from the South - Florida News Feed

Trump celebrates West Point alumni group canceling award ceremony to honor Tom Hanks

SUMMARY: President Donald Trump praised West Point alumni for canceling an award ceremony honoring actor Tom Hanks, labeling Hanks as “destructive” and “WOKE.” Hanks was set to receive the 2025 Sylvanus Thayer Award, recognizing outstanding service aligned with West Point’s values. The cancellation reflects ongoing tensions as Trump seeks to influence military and educational institutions, including West Point’s recent policy changes on hiring and diversity programs. Hanks, known for his support of Democratic causes and criticism of Trump, has been active in political advocacy. West Point emphasized focusing on its core mission of preparing military leaders amid the controversy.

Read the full article

The post Trump celebrates West Point alumni group canceling award ceremony to honor Tom Hanks appeared first on www.news4jax.com

News from the South - Florida News Feed

Orlando bar employee arrested after allegedly stabbing patron 10 times over tab

SUMMARY: Jason Rosario, a man training to be a bartender at Grumpy’s Underground in Orlando’s Mills 50 district, was arrested after allegedly stabbing a patron ten times over a bar tab dispute. The victim was stabbed in the back and head following an argument about charges for drinks not received. The bar owner, Amanda Fields, who was present during the incident, described the event as shocking and uncharacteristic of the area. Rosario had only trained a few times and was never officially employed. The victim is expected to recover, and the Florida Department of Law Enforcement is investigating the case.

An Orlando bar employee has been arrested after he allegedly stabbed a patron 10 times following an argument over a bar tab last weekend. Jason Rosario, 30, faces an attempted second-degree murder charge.

Subscribe to FOX 35 Orlando: https://bit.ly/3ACagaO

Watch FOX 35 Orlando LIVE newscasts: https://www.FOX35Orlando.com/live

Download FOX 35 news & weather apps: https://www.fox35orlando.com/apps

FOX 35 Orlando delivers breaking news, live events and press conferences, investigations, politics, entertainment, business news and local news stories and updates from Orlando, Orlando metro, and across Florida.

Watch more from FOX 35 on YouTube

Newest videos: https://www.youtube.com/myfoxorlando/videos

Most viewed/viral videos: https://www.youtube.com/watch?v=jgNn6rfByAM&list=PLzmRitN2dDZvlKw0C1IH3nLFGlbqgvp5C

We Love Florida: https://www.youtube.com/playlist?list=PLzmRitN2dDZuWecugac4QebPGp5-HZ5XP

Central Florida’s True Crime Files: https://www.youtube.com/watch?v=QAxwHLIeahA&list=PLzmRitN2dDZvk9zWypuHs9n38zuwnUSpx

More news stories: http://www.FOX35Orlando.com

Watch FOX 35 News live: https://fox35orlando.com/live

FOX 35 News newsletter: https://www.fox35orlando.com/email

Follow FOX 35 Orlando on Facebook: https://www.facebook.com/FOX35Orlando

Follow FOX 35 Orlando on Twitter: https://twitter.com/fox35orlando

Follow FOX 35 Orlando on Instagram: https://www.instagram.com/fox35orlando

-

News from the South - Tennessee News Feed6 days ago

Tennessee ranks near the top for ICE arrests

-

Mississippi Today6 days ago

Trump proposed getting rid of FEMA, but his review council seems focused on reforming the agency

-

Mississippi Today5 days ago

Brandon residents want answers, guarantees about data center

-

News from the South - Texas News Feed4 days ago

Texas high school football scores for Thursday, Sept. 4

-

News from the South - Arkansas News Feed7 days ago

Every fall there’s a government shutdown warning. This time it could happen.

-

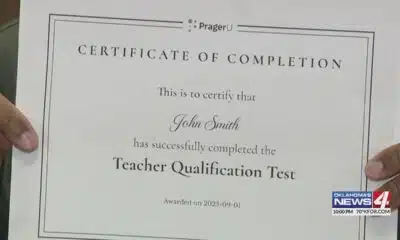

News from the South - Oklahoma News Feed7 days ago

Test taker finds it's impossible to fail 'woke' teacher assessment

-

The Conversation7 days ago

What is AI slop? A technologist explains this new and largely unwelcome form of online content

-

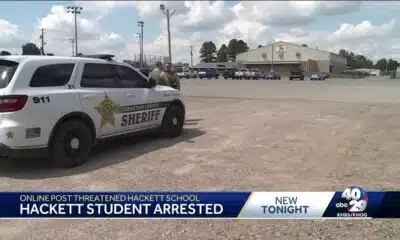

News from the South - Arkansas News Feed6 days ago

Hackett student arrested after shooting threat