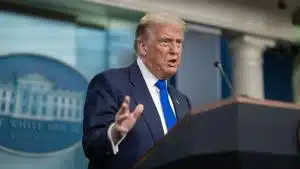

(The Center Square) – The first contract has been awarded for border wall construction under the second Trump administration.

Rebuilding and expanding border wall construction along the U.S.-Mexico border is a major part of President Donald Trump’s border security platform.

Within less than two months of being sworn into office, his administration has already made good on its promise to begin border wall construction.

U.S. Customs and Border Protection announced it awarded its first border wall contract to Granite Construction Co. for $70,285,846 to construct approximately seven miles of new border wall in Hidalgo County, Texas, in the CBP Rio Grande Valley Sector.

The construction will occur in an area to close “critical openings in the border wall that were left incomplete due to cancelled contracts during the Biden Administration.”

The RGV Sector has historically been an area of heavy foot traffic of illegal border crossings and human and drug smuggling and trafficking. Closing this area of the wall and completing construction will support federal efforts “to impede and deny illegal border crossings and the drug- and human-smuggling activities of cartels,” CBP said in an announcement.

Border wall construction is part of the Department of Homeland Security’s efforts to implement multiple executive orders Trump issued, including declaring a national emergency at the southwest border and declaring an invasion. Among other directives, the orders directed DHS “to take all appropriate actions to deploy and construct physical barriers to ensure complete operational control of the southern border of the United States.”

Under Trump’s first administration, the 450th mile of border wall system, including physical infrastructure, access roads, lights, cameras and sensors, was completed by January 2021.

On his first day in office, former President Joe Biden halted all existing border wall construction along the southwest border, costing taxpayers $6 million a day, and then $3 million a day, to not build the wall due to contractual obligations with the construction firm tasked with building it. Materials that had been purchased to build the wall were left to rust on the ground.

The Texas General Land Office and the states of Texas and Missouri sued in late 2021, arguing not using funds allocated by Congress was illegal and unconstitutional, The Center Square reported. As the cases were consolidated and progressed, the Biden administration reallocated border wall funding to focus on environmental projects and maintenance repairs.

However, by October 2023, the Biden administration reversed course, identifying 20 miles of border wall to build in Starr County, Texas, The Center Square reported. “There is presently an acute and immediate need to construct physical barriers and roads in the vicinity of the border of the United States in order to prevent unlawful entries into the United States in the project areas,” former DHS Secretary Alejandro Mayorkas said.

Mayorkas announced DHS was waiving 26 federal laws to complete a section of the border wall in an area where it was previously halted more than two years prior, after a record number of illegal border crossers poured into Texas, including in the RGV Sector.

By March 2024, Texas and Missouri won their case against the Biden administration; by August 2024, the Biden administration didn’t appeal the ruling and the court order remained in effect, The Center Square reported.

Throughout the Biden administration, contradictory approaches were taken to border wall construction and barriers. One included blocking construction citing the Endangered Species Act in 2022, to designate 691 acres in two Texas border counties, Starr and Zapata, as critical habitat for the prostrate milkweed, an endangered wildflower. Texas and Missouri sued to stop the action.

In 2023, the administration proposed expanding efforts to protect freshwater river mussels in three Texas border counties in areas where Texas’ border security efforts were underway.

Under the Biden administration, a record more than 14 million illegal border crossing were reported, including those who evaded capture, The Center Square exclusively reported. Under the Trump administration, illegal border crossings dropped by over 90% in one month and reached the lowest number in February in recorded U.S. history.