News from the South - Virginia News Feed

Fifteen years after shuttering its tax-prep app, Va. may be ready to compete with TurboTax again

by Rob Pegoraro, Virginia Mercury

June 9, 2025

The Virginia Department of Taxation’s website parts company with the web presences of other agencies in the commonwealth: It doesn’t offer its own tools to help you complete your primary task there — taxes.

While you can renew a car registration at the Department of Motor Vehicles site and register an LLC at the State Corporation Commission’s site, Virginia Tax doesn’t let you file your state income taxes online and instead points you to commercial tax-prep services.

That’s not because Virginia Tax hasn’t developed its own filing app. It’s because 15 years ago, the department shelved the iFile app that had already drawn more than 278,000 users in 2009.

In 2010, then-Gov. Bob McDonnell, a Republican, signed a bill patroned by Del. Kathy Byron, R-Lynchburg, which had Virginia retire iFile and cede tax preparation to private providers that would offer apps for free to lower-income residents – the same proposition the Internal Revenue Service accepted in 2002.

That removed a free option from higher-income taxpayers, with Intuit’s market-leading TurboTax charging a state tax-prep fee that now stands at $64, despite the relative simplicity of the state’s Form 760. Most other commercial tax-prep services charge for state filing, although Cash App Taxes does not.

“We should not have to pay a for-profit company in order to file our taxes easily,” Del. Kathy Tran, D-Fairfax, said after reviewing a constituent’s complaints.

But even taxpayers eligible to use Free File, historically around 70% of total users, have largely ignored it. In 2024, Virginia Tax processed 89,064 Free File individual returns – far fewer than the 4,128,006 total individual returns received electronically or the 446,782 filed on paper.

Electronic returns cost 10 cents each to process and paper ones cost $5.96 each, Heather Cooper, Virginia Tax’s director of communications and training, confirmed in an email.

At the federal level, the IRS has downgraded from the Free File partnership. Pro Publica’s coverage of how Intuit had made its Free File options hard to find online led to the IRS altering its Free File arrangement in 2019 to drop that deal’s prohibition on competing with commercial tax-prep apps, and the IRS has now offered its Direct File app for two tax seasons in a row.

Vanessa Williamson, senior fellow at the Urban-Brookings Tax Policy Center, called its popularity among users “remarkable” — 74% of 440 respondents in a survey done after the 2023 tax-year filing season said they preferred it over other filing methods.

“The success of Direct File should be a model for the states,” she said.

Virginia has not been among the 25 states supporting Direct File, but it may now be ready to reverse its own Free File decision — even as the Trump administration appears intent on scrapping Direct File.

Two years after Tran introduced a bill to revive iFile that died in committee, the delegate sponsored a similar bill this year that would also have Virginia join Direct File. That one, with a companion measure sponsored by Sen. Jeremy McPike, D-Prince William, passed the General Assembly only to meet a veto from Republican Gov. Glenn Youngkin.

Youngkin’s veto message cited “uncertainty” about Direct File’s fate and also noted another recent advance towards returning Virginia to online filing: budgetary language requiring Virginia Tax’s next revenue-management system to support “an electronic filing system for individual income tax that can be used by all Virginians.”

We should not have to pay a for-profit company in order to file our taxes easily.

– Del. Kathy Tran, D-Fairfax

Tran suggested that wording in the budget could be enough to accomplish her bill’s goal, depending on how Virginia Tax interprets it.

That interpretation could rely on who the next governor appoints to her cabinet, but the two presumptive candidates, former Democratic congresswoman Abigail Spanberger and Republican Lt. Gov. Winsome Earle Winsome-Sears, have not spoken out on this issue. A query to each campaign’s press office went unanswered.

Intuit questioned the need for a public tax-prep app.

“Free filing options for state tax preparation are already available today,” spokesperson Tania Mercado said. “Filing federal and state taxes together and linking tax returns allows taxpayers to save time, ensure accuracy, improve privacy and data protection, and reduce the chances of tax refund fraud.”

Opponents of direct filing also question whether public-sector developers would have the same motivations as private-sector counterparts.

“Additionally, the private sector would have an incentive to find as much savings as possible for taxpayers when preparing their taxes,” Americans for Tax Reform said in a 2010 statement commending Virginia joining Free File.

Tran’s reply: Nobody is banning commercial tax apps.

“Having a direct free file way for you to pay your taxes is not a requirement for you to use that option,” Tran said. “That is a decision you as a taxpayer get to make.”

In Maryland, the free iFile tax-prep app the state has offered since 2001 drew relatively few users this year: 39,717 returns out of more than 2.6 million submitted electronically, a little over half of the 76,918 paper returns handled as of early May, officials said.

Almost 6,000 more returns came in via Maryland’s Direct File portal using an interface developed by Code for America, Robyne McCullough, media relations director at the Maryland comptroller’s office, said by email. When Maryland launched that partnership, officials estimated that almost 700,000 Marylanders would be eligible to use Direct File.

But Maryland taxpayers have that choice, while Virginians do not.

“The thing preventing us from having a high-quality, free public tax preparation system is not technology or logistics, it’s just politics,” said Williamson, the Urban-Brookings Tax Policy Center fellow.

Independent Journalism for All

As a nonprofit newsroom, our articles are free for everyone to access. Readers like you make that possible. Can you help sustain our watchdog reporting today?

Virginia Mercury is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Virginia Mercury maintains editorial independence. Contact Editor Samantha Willis for questions: info@virginiamercury.com.

The post Fifteen years after shuttering its tax-prep app, Va. may be ready to compete with TurboTax again appeared first on virginiamercury.com

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Center-Left

This content critiques the privatization of state tax filing services and highlights the advocacy for publicly provided free tax preparation, a position more commonly associated with progressive or center-left policies that favor government intervention to ensure broader access to essential services. It presents statements from Democratic officials supporting the return of free state-provided filing options and portrays Republican decisions, such as Gov. Glenn Youngkin’s veto, as obstacles to such efforts. The balanced inclusion of opposing views from private-sector representatives and conservative groups maintains an overall fair tone, though the framing leans slightly toward favoring expanded government role in tax preparation services.

News from the South - Virginia News Feed

Some employers take action against employees for social media comments on Charlie Kirk's death

SUMMARY: Following Charlie Kirk’s death, some Virginia employers have taken action against employees who made controversial social media comments. In healthcare and education sectors, individuals were placed on leave or terminated for remarks deemed unprofessional or supportive of violence. Riverside Walter Reed Hospital fired an anesthesiologist, and Newport News and Accomack County schools disciplined staff members. Experts highlight the blurred line between personal expression and professional conduct due to social media’s reach. William and Mary law professor Margaret Hugh emphasized that employment laws and at-will policies allow employers broad authority to act. She urges unity and respect amid heightened tensions.

Some Virginia employers are taking action against employees for social media comments made regarding Charlie Kirk’s death. A legal expert weighed in on where the line is drawn.

Subscribe: https://www.youtube.com/user/wvectv/?sub_confirmation=1

Download the 13News Now app: https://bit.ly/13NewsNowApp

Watch 13News Now+ for free on streaming: https://www.13newsnow.com/13NewsNowPlus

Check out our website: https://www.13newsnow.com/

Like us on Facebook: https://www.facebook.com/13newsnow/

Follow us on X/Twitter: https://x.com/13newsnow

Follow us on Instagram: https://www.instagram.com/13newsnow/

News from the South - Virginia News Feed

Area of interest forms in the Atlantic

SUMMARY: On September 11, 2025, Chief Meteorologist Tim Pandages reported on Hurricane Hub Live about tropical developments in the Atlantic and eastern Pacific. In the Atlantic, a low-chance area of interest near the Cabo Verde Islands may become Tropical Storm Gabrielle but requires favorable conditions. Recent tropical waves have struggled due to stable atmospheric conditions. Models show possible development east of the Leeward Islands with a likely recurving path away from Bermuda. In the eastern Pacific, Tropical Depression 13E has formed, expected to become Hurricane Mario, the season’s 8th hurricane. The Atlantic has had only one hurricane so far, Major Hurricane Aaron. Activity is expected to increase into October.

The newly formed area of interest could become Invest 92-L off the coast of Africa. Find out about that and more during tonight’s episode of Hurricane Hub LIVE! Livestream from Thursday, September 11, 2025.

Subscribe: https://www.youtube.com/user/wvectv/?sub_confirmation=1

Download the 13News Now app: https://bit.ly/13NewsNowApp

Watch 13News Now+ for free on streaming: https://www.13newsnow.com/13NewsNowPlus

Check out our website: https://www.13newsnow.com/

Like us on Facebook: https://www.facebook.com/13newsnow/

Follow us on X/Twitter: https://x.com/13newsnow

Follow us on Instagram: https://www.instagram.com/13newsnow/

News from the South - Virginia News Feed

Cat cafes, chromotherapy and pumpkin delivery: Here’s what’s new in RVA this September

SUMMARY: This September in RVA, Patch to Porch RVA delivers handpicked pumpkins from local farms, offering design, setup, and cleanup services for homes and events in Richmond, Henrico, and Chesterfield. Shore Pump introduces Beam Light Sauna, featuring infrared sauna and chromotherapy, promoting detox, skin renewal, and wellness with customizable sessions and memberships. The Fan now hosts River City’s first cat café, The Perfect Bean, combining a coffee bar with an adoptable cat lounge upstairs. Sourced locally, their drinks include seasonal, cat-themed specials. Cats come from Purring Hearts VA rescue, offering adoption opportunities, fostering community engagement and animal welfare.

What’s New in RVA is dedicated to informing you about the latest happenings in the Richmond area.

-

News from the South - Kentucky News Feed6 days ago

Lexington man accused of carjacking, firing gun during police chase faces federal firearm charge

-

The Center Square7 days ago

California mother says daughter killed herself after being transitioned by school | California

-

News from the South - Arkansas News Feed6 days ago

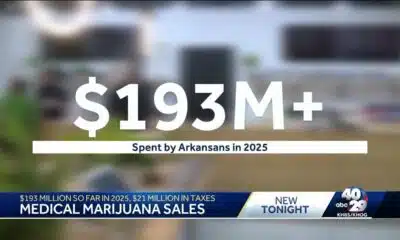

Arkansas medical marijuana sales on pace for record year

-

News from the South - Missouri News Feed6 days ago

Local, statewide officials react to Charlie Kirk death after shooting in Utah

-

Local News6 days ago

US stocks inch to more records as inflation slows and Oracle soars

-

Local News Video6 days ago

William Carey University holds 'tailgates and tourniquets' blood drive

-

News from the South - Alabama News Feed6 days ago

Zaxby's Player of the Week: Dylan Jackson, Vigor WR

-

News from the South - North Carolina News Feed4 days ago

What we know about Charlie Kirk shooting suspect, how he was caught