News from the South - North Carolina News Feed

Fiery crash blocks I-87 in Wake County for hours

SUMMARY: I-87 South experienced a major traffic disruption this morning due to a crash involving two tractor trailers around 7:30 AM. The incident occurred when one truck failed to slow down, resulting in a fiery wreck that produced thick smoke, causing poor visibility for passing drivers. Fortunately, the road has reopened following cleanup efforts, and there were no serious injuries reported. The driver of the truck involved sustained minor injuries and is currently hospitalized. Authorities are investigating the specifics of the crash, including the cargo the truck was carrying. Traffic is now flowing smoothly through the area.

A tractor-trailer fire on Monday closed the southbound lanes of Interstate 87 for several hours in Wake County.

The crash was reported around 7:30 a.m. near Exit 9 (Smithfield Road) near Zebulon. The State Highway Patrol (SHP) said a tractor-trailer rear-ended a tanker truck, and the tractor-trailer went up in flames.

News from the South - North Carolina News Feed

White House officials hold prayer vigil for Charlie Kirk

SUMMARY: Republican lawmakers, conservative leaders, and Trump administration officials held a prayer vigil and memorial at the Kennedy Center honoring slain activist Charlie Kirk, founder of Turning Point USA. Kirk was killed in Utah, where memorials continue at Utah Valley University and Turning Point USA’s headquarters. Police say 22-year-old Tyler Robinson turned himself in but has not confessed or cooperated. Robinson’s roommate, his boyfriend who is transitioning, is cooperating with authorities. Investigators are examining messages Robinson allegedly sent on Discord joking about the shooting. Robinson faces charges including aggravated murder, obstruction of justice, and felony firearm discharge.

White House officials and Republican lawmakers gathered at the Kennedy Center at 6 p.m. to hold a prayer vigil in remembrance of conservative activist Charlie Kirk.

https://abc11.com/us-world/

Download: https://abc11.com/apps/

Like us on Facebook: https://www.facebook.com/ABC11/

Instagram: https://www.instagram.com/abc11_wtvd/

Threads: https://www.threads.net/@abc11_wtvd

TIKTOK: https://www.tiktok.com/@abc11_eyewitnessnews

News from the South - North Carolina News Feed

Family, friends hold candlelight vigil in honor of Giovanni Pelletier

SUMMARY: Family and friends held a candlelight vigil in Apex to honor Giovanni Pelletier, a Fuquay Varina High School graduate whose body was found last month in a Florida retention pond. Giovanni went missing while visiting family, after reportedly acting erratically and leaving his cousins’ car. Loved ones remembered his infectious smile, laughter, and loyal friendship, expressing how deeply he impacted their lives. His mother shared the family’s ongoing grief and search for answers as authorities continue investigating his death. Despite the sadness, the community’s support has provided comfort. A celebration of life mass is planned in Apex to further commemorate Giovanni’s memory.

“It’s good to know how loved someone is in their community.”

More: https://abc11.com/post/giovanni-pelletier-family-friends-hold-candlelight-vigil-honor-wake-teen-found-dead-florida/17811995/

Download: https://abc11.com/apps/

Like us on Facebook: https://www.facebook.com/ABC11/

Instagram: https://www.instagram.com/abc11_wtvd/

Threads: https://www.threads.net/@abc11_wtvd

TIKTOK: https://www.tiktok.com/@abc11_eyewitnessnews

News from the South - North Carolina News Feed

NC Courage wins 2-1 against Angel City FC

SUMMARY: The North Carolina Courage defeated Angel City FC 2-1 in Cary, ending their unbeaten streak. Monaca scored early at the 6th minute, followed by Bull City native Brianna Pinto’s goal at the 18th minute, securing a 2-0 halftime lead. Angel City intensified in the second half, scoring in the 88th minute, but the Courage held firm defensively to claim victory. Pinto expressed pride in the win, emphasizing the team’s unity and playoff ambitions. Nearly 8,000 fans attended. Coverage continues tonight at 11, alongside college football updates, including the Tar Heels vs. Richmond game live from Chapel Hill.

Saturday’s win was crucial for the Courage as the regular season starts to wind down.

https://abc11.com/post/north-carolina-courage-wins-2-1-angel-city-fc/17810234/

Download: https://abc11.com/apps/

Like us on Facebook: https://www.facebook.com/ABC11/

Instagram: https://www.instagram.com/abc11_wtvd/

Threads: https://www.threads.net/@abc11_wtvd

TIKTOK: https://www.tiktok.com/@abc11_eyewitnessnews

-

News from the South - Kentucky News Feed7 days ago

Lexington man accused of carjacking, firing gun during police chase faces federal firearm charge

-

News from the South - Alabama News Feed7 days ago

Zaxby's Player of the Week: Dylan Jackson, Vigor WR

-

News from the South - Arkansas News Feed7 days ago

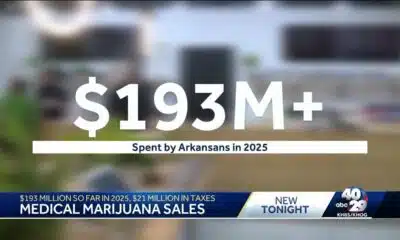

Arkansas medical marijuana sales on pace for record year

-

Local News Video7 days ago

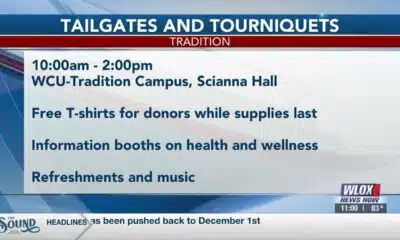

William Carey University holds 'tailgates and tourniquets' blood drive

-

News from the South - North Carolina News Feed5 days ago

What we know about Charlie Kirk shooting suspect, how he was caught

-

News from the South - Missouri News Feed7 days ago

Local, statewide officials react to Charlie Kirk death after shooting in Utah

-

Local News7 days ago

US stocks inch to more records as inflation slows and Oracle soars

-

Local News6 days ago

Russian drone incursion in Poland prompts NATO leaders to take stock of bigger threats