News from the South - North Carolina News Feed

FEMA to start working with homeowners in flood zones on buyouts of destroyed homes, or elevation of homes that were partly underwater

Local homeowners who lost their homes or sustained serious damage in Helene’s floodwaters can begin applying next week to a federal program that may buy the home outright, or pay to have it elevated or rebuilt at a higher level.

Steve McGugan, the state of North Carolina’s Hazard Mitigations section chief, explained at the Buncombe County Tropical Storm Helene briefing Friday how the FEMA program works.

The Federal Emergency Management Agency provides the funding for the program, called the Hazard Mitigation Program, which the state administers.

Residents can apply for the program starting Tuesday at the FEMA location at Asheville Mall in the former Gap store location, across from Bath & Body Works. Staff will be on location from 10 a.m. to 6 p.m., Tuesday through Friday, Nov. 12-15.

“We will have a team there that will be able to answer questions, help assist you in filling out a paper application form where we get all your information,” McGugan said. “We’ll also go ahead and check your tax card to make sure we have all the proper names that need to be on the application, and signatures that we will need. We will also verify where you are located within the flood zone.”

FEMA provides funding to the state, which then flows to the community.

In Buncombe, 900 homes had substantial damage from Helene, with about 300, including 75 commercial properties, totally lost, according to Buncombe County.

Three types of assistance

The program offers three types of assistance:

Acquisition: “If your property has been severely damaged and you are located in a flood hazard area and wish to relocate from that flood hazard area, you can sign up for the acquisition program,” McGugan said. “In the acquisition program, your home would be bought just as if you were selling it to another homeowner, and moving away.”

The property would be appraised based on its value the day before the storm struck, in part based on the tax valuation. That gives a base value to work from, and appraisers will also use a “multiplier” provided by the county for homes whose valuations likely have increased, he noted. Additionally, they look at comparable homes that sold before the storm hit to arrive at the appraised amount.

Upon the home’s closing, “our closing official or a closing company would basically pay off your loan, if you have a loan on the house remaining, and then the proceeds would then be handed over to you, just like a normal acquisition process,” McGugan said.

“Once that’s completed, that property would then be deeded over to the county, and the county would retain that property,” McGugan continued. “And that property would not be available to be reoccupied or be reused for housing, but in the future the county can use those properties for such things as parks, greenways, other things in their future plan that benefit the community, as well as assist in being able to prevent future flood damages from occurring.”

Raising the home: Called “Elevations,” this program is basically what it sounds like: lifting the home, typically by 2 feet, to raise it out of the flood zone.

“An elevation project is done when your home may have had a little bit of water on the first floor — one or two feet,” McGugan said.

He showed a home before and after — on a lower brick foundation when it flooded, and then raised to a higher concrete block foundation.

“You would move out of the home — and when I say move out, we will provide you temporary lodging while the construction process takes place,” McGugan said. “You don’t have to move any household goods out, because we pick the house up as is.”

The program can accommodate homes with Americans with Disabilities Act provisions.

Mitigation reconstruction: “Mitigation reconstruction is done when first you requested an elevation, and we came in and determined that your home may be more damaged than was thought, and we cannot safely lift it and elevate it to the new height,” McGugan said.

“The old house would be torn down, a new foundation built that, again, is at an elevated level, and then a new home is built in place of the old home,” McGugan said, noting that these are not custom homes but contractor grade.

The state would “move your furniture back in, set it back up, and you would move back in again,” McGugan said.

What about the cost?

McGugan stressed that there is no cost to homeowners for these programs. For example, on acquisition, FEMA pays 75 percent of the cost to acquire and demolish the property and restore the property to green space. The state pays the other 25 percent.

“There is no cost to the homeowner for this program,” McGugan said.

Are most applications accepted?

McGugan said that a very high percentage of applications are accepted. He noted that since Hurricane Florence struck North Carolina in 2018, “if a homeowner has applied and stayed with us and did not walk away from the program, we have been able to complete their home.”

The program is voluntary, and homeowners can walk away at any point, he said, but the success rate in getting applications approved is very high.

“I will tell you that at this point, I have never not been able to get a home approved,” McGugan said. “There are many rules that go with this program and many ways that we can work together in the application to always meet a benefit-cost ratio of one, which is requirement for FEMA to approve it — that we show that the benefit-cost ratio of doing an acquisition or an elevation or a mitigation reconstruction is one.”

The state has “a lot of tools” to reach that level.

“So I have not had any denied based upon the value of a home,” McGugan said. “Really, the only thing that prevents a home from being approved is if there are issues with the title — we can’t get a clear title.”

Asheville Watchdog is a nonprofit news team producing stories that matter to Asheville and Buncombe County. John Boyle has been covering Asheville and surrounding communities since the 20th century. You can reach him at (828) 337-0941, or via email at jboyle@avlwatchdog.org. The Watchdog’s local reporting during this crisis is made possible by donations from the community. To show your support for this vital public service go to avlwatchdog.org/support-our-publication/.

Related

The post FEMA to start working with homeowners in flood zones on buyouts of destroyed homes, or elevation of homes that were partly underwater appeared first on avlwatchdog.org

News from the South - North Carolina News Feed

Asheville’s Urban Forestry Commission speaks for the city’s trees. It hasn’t met since Helene. • Asheville Watchdog

Asheville’s Urban Forestry Commission met on Sept. 3, 2024, with an agenda that, if unexceptional, represented the kind of work the volunteer advisory board had done since its inception at the beginning of the decade.

Its members heard an update from Keith Aitken, who a year earlier had become Asheville’s forester after the UFC successfully lobbied the city to create the position. They voted to recommend the approval of a landscaping plan for a Duke Energy substation on Rankin Avenue. And they discussed the Urban Forest Master Plan, for which City Council had approved funding that June. Local environmentalists, including the UFC, had long advocated for a roadmap for protecting and growing the city’s canopy; now one was finally on the way, with a public tree inventory and satellite analysis ready to begin.

Then Tropical Storm Helene tore the urban canopy asunder. In its aftermath, the city paused work on the Master Plan and indefinitely suspended all advisory boards, including the UFC.

Eleven months later, the UFC still has not reconvened, the Master Plan is still on hold, and their purgatorial state is causing growing alarm among advocates who see this period of recovery as a particularly crucial moment for Asheville’s trees.

Though local tree loss has not been thoroughly quantified, the North Carolina Forest Service has estimated that 40 percent of trees in Buncombe County but outside the city limits were damaged; one analysis of hundreds of fallen trees within Asheville found that the city’s medium-to-large hardwoods fared particularly poorly. Meanwhile, one of the city’s largest contiguous forested areas is on the chopping block, as the University of North Carolina Asheville is pursuing a proposal to replace 45 wooded acres with a 5,000-seat soccer stadium and surrounding development.

“Of all the times when you really need (a master plan), you’d think now would be the time, when we’re trying to think of how to prevent the next disaster caused by too much pavement and too much building and not enough stormwater absorption and not enough green infrastructure,” said Steve Rasmussen, a member of the volunteer Tree Protection Task Force for Asheville and Buncombe County, which has worked closely with the UFC.

When the UFC formed in 2020, it was part of a focus on trees that local environmentalists felt was sorely needed; a study commissioned by the city the previous year had found canopy loss of more than 6 percent coinciding with population growth over the previous decade. The UFC’s predecessor, the Tree Commission, had a narrower purview, as did the canopy ordinance the city had in place for decades. Between the UFC’s inception and the post-Helene pause, according to UFC documents, the city preserved more than 2.5 million square feet of canopy, planted about 400,000 more, and collected roughly $300,000 in fees related to landscape compliance rules.

Aitken, the city forester, was not available for an interview for this story, city spokesperson Kim Miller said. In an email, Miller pointed toward the creation of Aitken’s position and to the 2020 city ordinance that expanded canopy protections.

“The master plan contract remains in place as staff assesses the next best steps forward,” she said. “We will announce the restart of the planning process and opportunities for community involvement in the coming months.”

The UFC doesn’t have to meet for the plan to move forward; the city has already chosen its contractor and approved $269,000 in spending, and as an appointed advisory board, the UFC weighs in on city matters but doesn’t have decision-making authority.

But keeping the UFC dormant could deprive the public of an important conduit to city officials, one more powerful than sending an email or speaking for three minutes during a council meeting’s public comment section, Rasmussen said.

“It really helps to have an advocacy group, and for people in general it really helps to have a place to take their concerns about trees and tree protections and have them addressed. The UFC has been one of the most active of all these boards and commissions.”

Zoe Hoyle, the UFC’s most recent chairperson, said the advisory board could play an important role in engaging the public as the city continues to respond to Helene and, eventually, restarts the Urban Forest Master Plan.

“I think it’s really important that we do something that marks us out as a city” in Helene’s wake, she said. “‘Transformative’ is the word I like to use.”

Alison Ormsby, the co-chairperson of the Tree Protection Task Force, said she would have liked to see the UFC continue to meet after Helene — helping to steer the city’s recovery as it pertained to trees and green spaces and acting as a watchdog as criticism proliferated over the debris-removal practices of the U.S. Army Corps of Engineers and its paid-by-volume contractors.

“Eric North, a program manager for the Arbor Day Foundation, which administers the Tree City program, said in an email Asheville began its application last year but, like some other communities preoccupied by hurricane recovery, didn’t finish it. who could provide really useful input on storm response,” she said.

Future of city’s advisory boards uncertain

The UFC’s uncertain future is part of a bigger question the city now faces: What will it do about its many advisory boards? It had 13 active ones before Helene and two others that existed in name but hadn’t met for years. The boards have been paused largely because city staff hasn’t had time to help them run their meetings.

At a City Council meeting last week, city staff offered one path forward, a plan to keep the advisory boards on hold and reassemble some of their members into four so-called recovery boards. Assistant City Manager Ben Woody said the proposed arrangement would be more efficient, and eventually the individual advisory boards could still meet or take on tasks as the city wishes.

The city’s Boards and Commissions Realignment Working Group has proposed an alternate plan in which it would voluntarily help publicize and run advisory board meetings. Councilmember Kim Roney supported the idea, saying she believed it’s time for the boards to get back to work.

“I don’t know everything about everything,” she said. “But when we invite our neighbors to bring their professional and lived experience to the table, we can make better decisions as a council.”

But City Attorney Brad Branham threw cold water on the idea. Though he stopped short of shutting it down entirely, he said he worried about the boards inadvertently violating open meetings laws in the absence of city staff. Such an error could cause legal trouble for the city, he said.

Those close to the UFC hold out some hope that the city will entertain the Realignment Working Group idea. Hoyle said she has concerns about the recovery-boards plan. She believes UFC members would need seats on all four boards to be effective. (A draft Woody presented last week has UFC members on the proposed Economy and Infrastructure boards — but not on the People & Environment board.) And while advisory boards could still be called upon for occasional work, Hoyle worries the lack of regular structure would undermine that expectation.

“Our current members could lose interest and just disappear,” she said. “I don’t know what the mechanism will be for replacing our membership.”

To some observers, the progress on tree issues in recent years now feels fragile. Even Asheville’s Tree City USA distinction, which it held for nearly 45 years, has lapsed. Eric North, a program manager for the Arbor Day Foundation, which administers the Tree City program, said in an email Asheville began its application last year but, like some other communities preoccupied by hurricane recovery, didn’t finish it. He said the Foundation would welcome the city’s reapplication this year.

But to meet Tree City standards, Asheville would need a functional tree-focused board or department.

“We no longer fit the criteria,” Ormsby said. “Some folks have said we don’t deserve it.”

Asheville Watchdog welcomes thoughtful reader comments about this story, which has been republished on our Facebook page. Please submit your comments there.

Asheville Watchdog is a nonprofit news team producing stories that matter to Asheville and Buncombe County. Jack Evans is an investigative reporter who previously worked at the Tampa Bay Times. You can reach him via email at jevans@avlwatchdog.org. The Watchdog’s reporting is made possible by donations from the community. To show your support for this vital public service go to avlwatchdog.org/support-our-publication/.

Related

The post Asheville’s Urban Forestry Commission speaks for the city’s trees. It hasn’t met since Helene. • Asheville Watchdog appeared first on avlwatchdog.org

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Center-Left

The article presents a detailed account of Asheville’s Urban Forestry Commission and related environmental efforts, emphasizing local advocacy, preservation, and sustainable urban planning. The tone supports environmental protection and community involvement, topics often aligned with progressive or center-left priorities. However, it remains fact-focused and refrains from overt political rhetoric or partisan framing. It highlights concerns over government delays and environmental degradation without explicit ideological critique, reflecting a measured, policy-oriented perspective consistent with a center-left viewpoint focused on green issues and civic engagement.

News from the South - North Carolina News Feed

Trump’s executive order could worsen state’s involuntary commitment system

SUMMARY: President Trump’s executive order easing removal of homeless individuals into mental health or addiction treatment raises concerns among North Carolina advocates and experts. They fear the order could worsen the overused and harmful involuntary commitment system, which already traps many without adequate legal representation or treatment in overwhelmed emergency departments. Expanding criteria for commitment to include those unable to care for themselves may increase institutionalization beyond current state capacity. Advocates argue the order criminalizes homelessness and lacks housing solutions, violating civil liberties. They call for community-based prevention, peer support, and improved services rather than widespread forced commitments, which can do more harm than good.

The post Trump’s executive order could worsen state’s involuntary commitment system appeared first on ncnewsline.com

News from the South - North Carolina News Feed

Back-to-School meals don’t have to be boring

SUMMARY: Back-to-school meals don’t have to be boring. To help kids focus and perform well, breakfasts should include protein, healthy fats, fiber, and carbohydrates. Ideas include whole wheat toast with nut butter and fruit, breakfast burritos with eggs and veggies, or veggie-filled egg muffins prepared in advance. For lunch, homemade “Lunchables” with low-sodium meat, cheese, whole wheat crackers, veggies, and fruit offer nutrition and variety. Leftover pasta with veggies and hummus or chicken salad with fruit and crackers are healthy options. Always pack water for hydration, and keep cold foods safe with at least two cold packs in lunchboxes.

Back-to-school meals don’t have to be boring. Some healthy options for your children.

https://abc11.com/backtoschool/

Download: https://abc11.com/apps/

Like us on Facebook: https://www.facebook.com/ABC11/

Instagram: https://www.instagram.com/abc11_wtvd/

Threads: https://www.threads.net/@abc11_wtvd

TIKTOK: https://www.tiktok.com/@abc11_eyewitnessnews

-

News from the South - Texas News Feed6 days ago

Rural Texas uses THC for health and economy

-

Mississippi Today3 days ago

After 30 years in prison, Mississippi woman dies from cancer she says was preventable

-

News from the South - Alabama News Feed7 days ago

Decision to unfreeze migrant education money comes too late for some kids

-

News from the South - Georgia News Feed4 days ago

Woman charged after boy in state’s custody dies in hot car

-

News from the South - Arkansas News Feed7 days ago

Trump’s big proposed cuts to health and education spending rebuffed by US Senate panel

-

Mississippi Today7 days ago

They own the house. Why won’t they cut the grass?

-

News from the South - Georgia News Feed7 days ago

Delta jet makes emergency landing | FOX 5 News

-

Mississippi News Video7 days ago

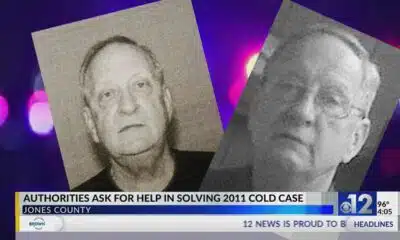

Jones County investigators work to solve 2011 cold case