News from the South - Missouri News Feed

Federal budget megabill would shift billions in cost to Missouri taxpayers

by Rudi Keller, Missouri Independent

July 3, 2025

The massive federal budget bill signed into law Friday by President Donald Trump would add new uncertainty to Missouri’s own budget, but the most costly portions would not hit the state for two years or more.

As Gov. Mike Kehoe signed the budget bills passed by lawmakers this year, he vetoed $310 million in general revenue spending and issued a warning that the next budget won’t have any extra money.

“The Office of Administration’s Division of Budget and Planning estimates a nearly $1 billion shortfall in general revenue starting in (fiscal year 2027),” Kehoe’s news release stated.

The biggest portion of that shortfall will be in the Medicaid program, which became a prime target for cuts in the federal budget bill. According to KFF, Missouri could lose approximately 14% of its federal Medicaid funding over the next decade, or approximately $17 billion.

Part of that reduction is due to people leaving the program. An analysis prepared at Princeton University estimates that 130,000 of the 1.25 million people currently covered by Medicaid would lose coverage over the next 10 years.

But a large part of the 10-year impact would be costs shifted to the state. Missouri would either have to replace those funds, cut the range of services offered or end coverage for tens of thousands of people.

“The bill being debated is going to blow a hole in our budget that will be hard to recover from,” said state Rep. Betsy Fogle of Springfield, the ranking Democrat on the Missouri House Budget Committee.

Missouri ended the 2025 fiscal year on Monday with a healthy $4.3 billion in the general revenue fund, plus another $1.3 billion that can be spent like general revenue. But the $50.8 billion budget for the current fiscal year consumes most of the money that can be spent like general revenue and about $2 billion more in general revenue than expected receipts.

Fogle said she opposed Kehoe’s vetoes and said worries about future spending needs should prompt him to veto a tax cut measure on his desk, which he has said he will sign.

“I do not understand why we are continuing to push that as a priority if the governor thinks he cannot pay his bills in future years,” Fogle said.

Missouri spends about $15 billion on Medicaid annually, but most of the money comes from the federal government. For every dollar from Missouri taxpayers, the state receives $1.80 to $9 of federal matching funds.

Missouri minimizes its use of general revenue in Medicaid by taxing hospitals, pharmacies, nursing homes and ambulance providers.

Missouri was already facing a shortfall of funding for Medicaid in the next fiscal year. Lawmakers this year used $778 million remaining from federal COVID-19 health care support that will have to be replaced in future years to maintain the program.

The changes in federal policy include in the budget bill that will add to the direct costs on Missouri taxpayers are:

- Lower federal match starting in federal fiscal year 2030 for adults ages 18 to 64 covered by the Medicaid expansion amendment passed by voters in 2020. The federal government currently covers 90% of the cost, pegged at $4.6 billion in the current budget.

- A cap on how much provider taxes can contribute to state Medicaid costs starting in federal fiscal year 2028. The budget approved by Kehoe appropriates $1.1 billion from provider taxes.

- Cost-sharing for the Supplemental Nutrition Assistance Program, or SNAP, that is popularly known as food stamps. Starting in federal fiscal year 2028, Missouri would have to pick up a larger share of administrative costs, plus a portion of benefit costs based on the state’s payment error rate.

Some states have laws repealing participation in the Medicaid expansion program for working-age adults, enacted in 2010, if the federal government does not maintain its 90% cost share promise. Missouri must cover that group because it is in the state Constitution.

Missouri currently pays about 35% of the cost of covering about 900,000 people covered by traditional Medicaid.

Anyone who is enrolled now in the expansion group would be covered with a 90% federal share. For new enrollees after 2030, Missouri would have to pay 35% of the cost.

Every 10% of the total cost for Medicaid expansion shifted to Missouri would increase the cost for state taxpayers by about $460 million.

The cost of expansion could escalate quickly, said Timothy McBride, co-director of the Center for Health Economics and Policy in the Institute for Public Health at Washington University in St. Louis.

“The churning in that population is pretty high,” he said in an interview with The Independent.

The bill would impose an 80-hour-a-month work requirement for many adults receiving Medicaid and food stamps, including older people up to age 65. Parents of children 14 and older would have to meet the program’s work requirements.

The state will also have to verify eligibility every six months instead of annually.

“We’re going to lose some people who are not going to either be qualified because of the work requirements, or they’re going to just not fulfill paperwork requirements,” McBride said.

The Senate bill freezes provider taxes at their current levels and reduces them for the states that have expanded Medicaid.

The hospital provider tax is the largest of the four in Missouri, accounting for about $900 million of the total.

“We have been very consistent in our message that deep cuts to provider taxes will harm enrollees, access to care for all Missourians, hospitals and other providers, and the state’s budget,” said Dave Dillon, spokesman for the Missouri Hospital Association. “We’re also committed to working with all partners at the state and federal level to minimize the harm if this framework is adopted.”

Current federal law caps the provider taxes at 6%. Starting in federal fiscal year 2028, the cap would be lowered by 0.5 percentage points a year — stopping at 3.5% — for the 41 states like Missouri that have expanded Medicaid coverage to working age adults.

Missouri House passes Medicaid provider tax bill, preventing major budget cuts

The current hospital tax rate for Missouri is 5%.

The second-largest provider tax is on nursing homes, but the reconciliation bill exempts the provider tax from cuts, said Nikki Strong, director of policy at the Missouri Health Care Association, the nursing home lobbying group.

The exemption helps, she said, but nursing homes are struggling to maintain adequate staffing and, in many cases in rural areas, are considering closing. Pressure on state revenue hurts the chances of getting increased rates, she said.

“From our perspective, any cuts that are going to impact general revenue in the budget, without replacement revenues, are not good at this point in time,” she said. “It is not going to benefit us.”

The SNAP program has been paid for exclusively from the federal treasury since it was launched in the 1960s.

Under the bill, states will be required to contribute a percentage of those costs if their payment error rate exceeds 6%. The U.S. Department of Agriculture counts benefit underpayments and overpayments as errors.

Missouri’s error rate of 9.4% in 2024 would mean it would pick up about $160 million of the cost, plus an extra portion for administrative expenses.

“Missouri will struggle to pick up these costs,” said Amy Blouin, executive director of the Missouri Budget Project, “and state lawmakers will face extremely difficult choices, like whether to get rid of SNAP in Missouri, eliminate optional benefits like home- and community-based services that keep people living in their communities, or cut funding for services like education.”

This article was updated July 5 to include action making the bill law.

YOU MAKE OUR WORK POSSIBLE.

Missouri Independent is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Missouri Independent maintains editorial independence. Contact Editor Jason Hancock for questions: info@missouriindependent.com.

The post Federal budget megabill would shift billions in cost to Missouri taxpayers appeared first on missouriindependent.com

Note: The following A.I. based commentary is not part of the original article, reproduced above, but is offered in the hopes that it will promote greater media literacy and critical thinking, by making any potential bias more visible to the reader –Staff Editor.

Political Bias Rating: Center-Left

This content primarily focuses on the potential negative financial and social impacts of proposed federal Medicaid budget cuts, featuring detailed analysis of how such cuts would strain Missouri’s state budget and affect healthcare coverage for vulnerable populations. It includes critical viewpoints on GOP-led budget measures and highlights concerns from Democratic lawmakers and healthcare advocates, reflecting a perspective that prioritizes social welfare and government responsibility in healthcare funding. While it presents factual information and some neutral budgetary data, the emphasis on the risks of cuts and opposition to certain fiscal policies aligns it more closely with a center-left viewpoint.

News from the South - Missouri News Feed

Luke Altmyer scores 3 TDs, No. 9 Illinois shuts out Western Michigan, 38-0

SUMMARY: No. 9 Illinois defeated Western Michigan 38-0, extending its winning streak to seven games, the longest since 2011. Quarterback Luke Altmyer threw two touchdowns and ran for another, while Kaden Feagin rushed for 100 yards and a touchdown. Illinois’ defense made critical stops, preserving the shutout despite only leading 10-0 at halftime. Coach Bret Bielema expressed frustration at the team’s slow start. Illinois remains turnover-free this season and has outscored opponents 128-22 in three games. Their next challenge is Big Ten play against No. 22 Indiana. Western Michigan starts MAC play next week against Toledo.

The post Luke Altmyer scores 3 TDs, No. 9 Illinois shuts out Western Michigan, 38-0 appeared first on fox2now.com

News from the South - Missouri News Feed

Panic and chaos at a St. Louis area mall false reports of shots fired

SUMMARY: Panic erupted at West County Center mall in the St. Louis area Saturday around 2:30 p.m. after a false report of shots fired in the food court. Police arrived quickly but found no active shooter. The confusion stemmed from a fight where a chair was thrown, causing fear among shoppers. Maya Emig, separated from her family, was comforted by strangers during the chaos. Traffic snarled as parents tried to reach their children. The incident, amid recent nationwide gun violence, heightened fears but no arrests were made. Authorities confirmed no guns were involved and no charges will be filed.

A fight near the food court where a chair was thrown at a victim caused some confusion, which then turned into panic and chaos amid rumors of an active shooter.

News from the South - Missouri News Feed

UTVs, ROVs may soon be allowed on Wentzville streets

SUMMARY: Wentzville’s Board of Aldermen voted 4-2 to allow utility terrain vehicles (UTVs) and recreational off-highway vehicles (ROVs) on city streets under conditions similar to golf cart rules. Use would be limited to subdivisions with speed limits of 25 mph or less, requiring valid licenses, insurance, and safety features. However, Mayor Nick Guccione vetoed the ordinance, citing safety and enforcement concerns, supported by residents and officials. The Board may override the veto on September 24. Supporters emphasize personal responsibility, while opponents worry about public safety. Enforcement challenges exist, especially regarding underage drivers. Missouri law permits municipalities to regulate such vehicles locally.

Read the full article

The post UTVs, ROVs may soon be allowed on Wentzville streets appeared first on fox2now.com

-

News from the South - Arkansas News Feed7 days ago

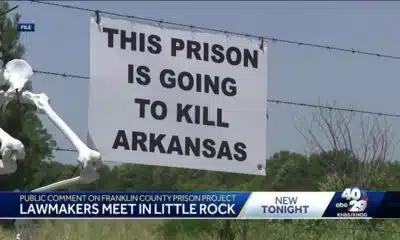

Group in lawsuit say Franklin county prison land was bought before it was inspected

-

News from the South - Kentucky News Feed6 days ago

Lexington man accused of carjacking, firing gun during police chase faces federal firearm charge

-

The Center Square6 days ago

California mother says daughter killed herself after being transitioned by school | California

-

News from the South - Arkansas News Feed6 days ago

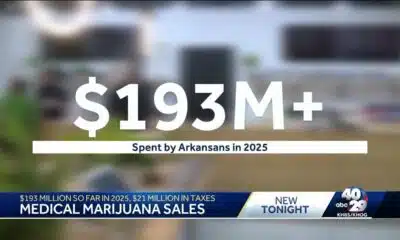

Arkansas medical marijuana sales on pace for record year

-

Local News Video6 days ago

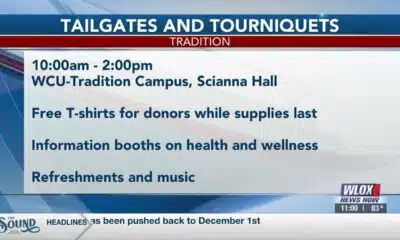

William Carey University holds 'tailgates and tourniquets' blood drive

-

News from the South - Alabama News Feed6 days ago

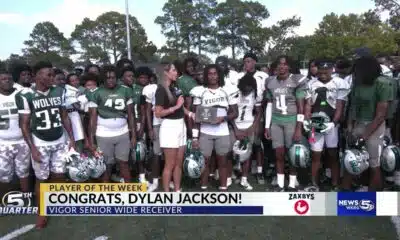

Zaxby's Player of the Week: Dylan Jackson, Vigor WR

-

News from the South - Missouri News Feed6 days ago

Local, statewide officials react to Charlie Kirk death after shooting in Utah

-

Local News6 days ago

US stocks inch to more records as inflation slows and Oracle soars