News from the South - North Carolina News Feed

Buncombe’s spending, contracting for Helene recovery tops $26 million • Asheville Watchdog

Buncombe County has spent or dedicated more than $26 million toward Tropical Storm Helene recovery efforts so far and has gone public with the details using an online dashboard.

Buncombe has spent $9.07 million in the two months since the disaster and has contracted with more than 60 entities for an additional $17.5 million. About $12 million of the contracts are dedicated to three companies –– a disaster recovery consultant and two services related to debris recovery.

Asheville Watchdog reported Nov. 14 that the city of Asheville had committed $21.7 million to disaster recovery, with the largest portion of the money going toward emergency repairs on its damaged water distribution system. Combined with the Buncombe expenditures, the total for storm recovery comes to $47.7 million.

County officials unveiled the details of the fiscal toll leveled by the storm when they announced at Monday’s daily Helene briefing that the online dashboard was up and running.

The county’s dashboard shows specifics about the spending, delineating and categorizing individual expenditures.

Money already spent is labeled and categorized in the dashboard — $3.5 million went toward payroll and benefits and $3.4 million went toward contracted services.

The payroll and benefits are overtime related to the storm response, county spokesperson Kassi Day said.

The dashboard will be updated monthly along with the closing of the county’s ledger, Day said.

The largest contracts that the county has committed to include:

- $8.03 million for Tetra Tech Inc, a disaster recovery consultant

- $2.8 million for DebrisTech, a debris removal monitoring service

- $2.4 million for Southern Disaster Recovery, a debris removal service

- $1.03 million for MHC Kenworth to replace six dump trucks at the county’s transfer station

- $689,693 for EnviroServ to bring potable water to the county jail

- $665,400 for Hale Trailer Brake & Wheel to replace six refuse trailers at the transfer station

- $371,613 for Cotton Commercial USA for emergency mitigation services

Details about the contracts are not posted on the dashboard.

When asked why, Buncombe County’s Financial Planning and Analysis Manager Matt Evans said the contracts “are not completed accounting transactions and are more fluid” than actual spending. Evans said that once there is actual spending, the dashboard will include the details.

Like the city of Asheville, Buncombe will seek reimbursements from the Federal Emergency Management Agency.

“We will be requesting reimbursements for expenses, but we will not know the status of those until approved,” spokesperson Lillian Govus said.

When those payments come in, however, they won’t be reflected on the dashboard, Day said, citing FEMA’s lengthy reimbursement process.

Asheville’s transparency efforts pending

As of Nov. 27, the city of Asheville did not have a public-facing method to show exactly how it’s using taxpayer dollars on Helene recovery.

After The Watchdog obtained documents that revealed the city’s Helene spending, City Councilmember Kim Roney said the city was working with an emergency management consulting firm, Hagerty Consulting Inc., to create a public dashboard.

Asked this week when the city’s transparency effort would move forward, spokesperson Kim Miller said various arms of the government are working on it but did not provide details.

“In our continued commitment to transparency with the community, development of the City’s dashboard is currently underway,” Miller said. “City Council will have an opportunity to provide feedback on some of the preliminary data that we plan to make available in a public dashboard at the December 5 Agenda Briefing meeting.”

With Buncombe and the city of Asheville’s expenditures and commitments totaling more than $47 million, area leaders say they need more financial assistance and traveled to Washington, D.C., on Nov. 20 to meet with President Joe Biden and members of Congress to ask for aid.

Those requests totaled more than $2 billion, The Watchdog reported Nov. 19.

Asheville Watchdog is a nonprofit news team producing stories that matter to Asheville and Buncombe County. Andrew R. Jones is a Watchdog investigative reporter. Email arjones@avlwatchdog.org. The Watchdog’s local reporting during this crisis is made possible by donations from the community. To show your support for this vital public service go to avlwatchdog.org/support-our-publication/.

Related

The post Buncombe’s spending, contracting for Helene recovery tops $26 million • Asheville Watchdog appeared first on avlwatchdog.org

News from the South - North Carolina News Feed

‘Highballed’: Data shows tax assessment inequalities affecting longtime homeowners

SUMMARY: Longtime homeowners in historically Black neighborhoods like Hillsborough face disproportionate property tax burdens compared to wealthier, mostly white areas nearby. Beverly Walton, a 66-year resident of Renshaw Street, inherited her home but struggles to afford rising taxes despite no renovations. Her house, valued lower than newer homes, is taxed at a higher rate, leading to financial strain on fixed incomes. Data from Wake, Durham, and Orange counties reveal majority nonwhite neighborhoods pay about $9 more per $100,000 in home value, despite lower average home prices. Advocates call for fairer assessments to prevent pricing out longtime residents amid regional growth.

Data shows tax assessment inequalities affecting longtime homeowners

https://abc11.com/post/highballed-data-shows-tax-assessment-inequalities-affecting-longtime-homeowners/17473973/

Download: https://abc11.com/apps/

Like us on Facebook: https://www.facebook.com/ABC11/

Instagram: https://www.instagram.com/abc11_wtvd/

Threads: https://www.threads.net/@abc11_wtvd

TIKTOK: https://www.tiktok.com/@abc11_eyewitnessnews

News from the South - North Carolina News Feed

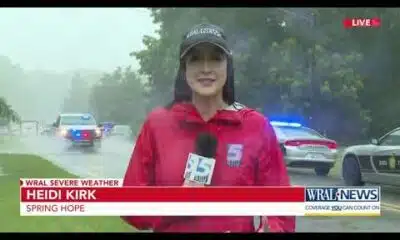

Two deaths, sinkholes, downed trees: The impacts of severe flooding in Triangle

SUMMARY: Severe flooding in the Triangle region has caused two deaths, sinkholes, and downed trees. In Nash County, 55-year-old Raymond Evans Jr. and 24-year-old Lahie Alustin died after their minivan was swept into a ravine. Evans heroically tried to save Alustin after police efforts failed. A memorial has grown at the site. In Apex, heavy rain caused a sinkhole on Olive Chapel Road, collapsing a section already slated for repairs. Town officials are working with the Department of Transportation to expedite repairs, possibly earlier than the initially expected November timeline. Residents face detours and ongoing disruptions.

WRAL is tracking the impact of severe flooding that occurred all through Wednesday. Rain will continue on-and-off on Thursday, and it could be heavy at times.

News from the South - North Carolina News Feed

Family desperate for answers after NC 18-year-old disappears in FL

SUMMARY: Giovanni Pelletier, an 18-year-old from Fuquay-Varina, NC, disappeared nearly a week ago in Florida after meeting his biological dad’s family. During a family trip, Giovanni was last seen around 1:30 AM when his cousins picked him up, but he was later reported left on the side of the road following an alleged altercation. His backpack and phone were found by a truck driver. His family is desperate for answers, struggling with conflicting information from his cousins. Giovanni recently graduated high school, and his parents are continuing the search, offering a $25,000 reward for information, with help from Florida authorities.

“Somewhere along the ride, something happened.”

More: https://abc11.com/post/giovanni-pelletier-family-searching-north-carolina-18-year-old-went-missing-traveling-florida/17457613/

Download: https://abc11.com/apps/

Like us on Facebook: https://www.facebook.com/ABC11/

Instagram: https://www.instagram.com/abc11_wtvd/

Threads: https://www.threads.net/@abc11_wtvd

TIKTOK: https://www.tiktok.com/@abc11_eyewitnessnews

-

Mississippi Today5 days ago

After 30 years in prison, Mississippi woman dies from cancer she says was preventable

-

News from the South - Georgia News Feed6 days ago

Woman charged after boy in state’s custody dies in hot car

-

News from the South - Texas News Feed5 days ago

Texas redistricting: What to know about Dems’ quorum break

-

News from the South - North Carolina News Feed3 days ago

Two people unaccounted for in Spring Lake after flash flooding

-

News from the South - Florida News Feed6 days ago

Warning for social media shoppers after $22K RV scam

-

News from the South - Texas News Feed7 days ago

Texas VFW holds memorial service for WWII pilot from Georgetown

-

News from the South - Georgia News Feed6 days ago

Georgia lawmakers to return this winter to Capitol chambers refreshed with 19th Century details

-

News from the South - Alabama News Feed7 days ago

Flood Watch for Alabama: Storms linger overnight, with cooler weather in the forecast