News from the South - Tennessee News Feed

Analysis shows Tennessee ranks high for relocation | Tennessee

SUMMARY: Tennessee is experiencing significant population growth, ranking fifth in the U.S. for inbound migration, according to recent data from the U.S. Census Bureau and U-Haul. The state’s appeal is largely attributed to its lower tax burden, with Tennessee having no income tax. An analysis shows that states with lower overall tax burdens tend to attract more residents, while those with higher taxes face outbound migration. Tennessee’s population rose from 7.1 million in 2023 to 7.2 million in 2024, continuing its growth trend since reaching 7 million for the first time in 2022. Other top states for inbound migration include South Carolina and Idaho.

The post Analysis shows Tennessee ranks high for relocation | Tennessee appeared first on www.thecentersquare.com

News from the South - Tennessee News Feed

Mobile opioid addiction treatment in Tennessee requires workarounds, for now

SUMMARY: Belmont University is launching two mobile units funded by $6.4 million in opioid settlement money to provide harm reduction and medication-assisted treatment (MAT) for opioid addiction, focusing on transient and unhoused populations. MAT, which uses drugs like buprenorphine (Suboxone), eases withdrawal symptoms and lowers overdose risk but can’t be dispensed outside clinics under Tennessee law. The mobile teams offer wound care, primary care, and mental health services, connecting patients to brick-and-mortar clinics for treatment and transportation. Security concerns also limit on-site dispensing. Similar mobile MAT efforts in Tennessee and Rhode Island highlight regulatory and community challenges.

The post Mobile opioid addiction treatment in Tennessee requires workarounds, for now appeared first on wpln.org

News from the South - Tennessee News Feed

STUDY: 14% of Tennesseans feel lonely

SUMMARY: A study by mental health provider A Mission For Michael found that 14% of Tennesseans feel lonely, with 4.6% (261,451 people) reporting they are “always lonely.” The highest chronic loneliness rates are in Haywood and Lewis counties (5.5%), while Williamson and Hamilton counties have the lowest (4.4%). Loneliness varies across Tennessee, and persistent loneliness can severely impact well-being. Executive Director Anand Mehta emphasized the importance of professional support to help individuals cope and connect. Nationally, Tennessee ranks low in loneliness compared to Mississippi (71%) and other states. The study used surveys and county health data for comprehensive analysis.

Read the full article

The post STUDY: 14% of Tennesseans feel lonely appeared first on www.wkrn.com

News from the South - Tennessee News Feed

Immigrant detainees begin arriving at former prison in rural Tennessee town

SUMMARY: Immigrant detainees have begun arriving at the West Tennessee Detention Facility in Mason, a former prison converted into an ICE detention center operated by CoreCivic. The facility reopened after Mason officials approved agreements with ICE and CoreCivic despite public opposition. The prison, closed in 2021 under a Biden administration order, was reopened following Trump’s reversal to support mass deportations. CoreCivic claims the center will create nearly 240 jobs and generate significant tax revenue for Mason, a financially struggling majority-Black town. However, concerns persist over detainee mistreatment, with CoreCivic facing fines and lawsuits related to abuse and understaffing at Tennessee prisons.

Read the full article

The post Immigrant detainees begin arriving at former prison in rural Tennessee town appeared first on wpln.org

-

News from the South - Alabama News Feed6 days ago

Alabama lawmaker revives bill to allow chaplains in public schools

-

News from the South - Arkansas News Feed7 days ago

‘One Pill Can Kill’ program aims to reduce opioid drug overdose

-

News from the South - Arkansas News Feed6 days ago

Arkansas’s morning headlines | Sept. 9, 2025

-

News from the South - Texas News Feed6 days ago

‘Resilience and hope’ in Galveston: 125 years after greatest storm in US history | Texas

-

News from the South - Missouri News Feed6 days ago

Pulaski County town faces scrutiny after fatal overdose

-

News from the South - Georgia News Feed7 days ago

Man tries to save driver in deadly I-85 crash | FOX 5 News

-

News from the South - Arkansas News Feed6 days ago

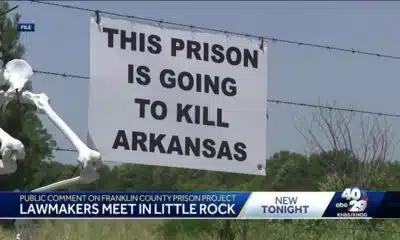

Group in lawsuit say Franklin county prison land was bought before it was inspected

-

News from the South - Kentucky News Feed5 days ago

Lexington man accused of carjacking, firing gun during police chase faces federal firearm charge