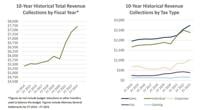

U.S. firearm sales have surged in recent years, a trend that has coincided with a steep increase in gun violence. According to the Centers for Disease Control and Prevention, a record number of Americans died of gun-related injuries in 2021. While law-abiding citizens with no intention of engaging in criminal activity account for the vast majority of gun purchases, the influx of guns in American households increases the likelihood of firearms falling into the wrong hands, particularly through theft.

According to the Bureau of Alcohol, Tobacco, Firearms, and Explosives, more than 1 million firearms were reported stolen by private citizens in the five years from 2017 to 2021. Stolen guns are most commonly burgled from homes and vehicles, but some are also taken directly from a person. Though many stolen guns are ultimately linked to crimes, they are typically first sold on the black market.

Semi-automatic pistols are by far the most commonly stolen firearm type, accounting for over 70% of all reported firearm thefts in the U.S. in the last five years. And all of the top five stolen calibers – .45, .22, .380, .40, and 9mm – are widely available in semi-automatic handguns. (Here is a look at the gun calibers most likely to be used for crime in every state.)

ATF records show that an average of 5,460 firearms were reported stolen from private citizens in Mississippi each year between 2017 and 2021. Adjusting for population, this comes out to about 185.1 stolen firearms annually for every 100,000 residents, the most among states.

An estimated 24.3% of all the firearms reported stolen between 2017 and 2021 were ultimately recovered in-state.

All data in this story is from the ATF's report National Firearms Commerce and Trafficking Assessment (NFCTA): Crime Guns – Volume Two. Firearms stolen from gun stores and gunmakers were not considered in this ranking.

| Rank | State | Annual firearm theft rate (per 100,000 people) | Avg. num. of firearms stolen from private citizens annually | Stolen firearms recovered in state (%) |

|---|---|---|---|---|

| 1 | Mississippi | 185.1 | 5,460 | 24.3 |

| 2 | Alabama | 165.7 | 8,353 | 28.4 |

| 3 | Louisiana | 155.1 | 7,170 | 30.5 |

| 4 | South Carolina | 150.8 | 7,825 | 27.3 |

| 5 | Georgia | 132.3 | 14,288 | 26.2 |

| 6 | Arkansas | 131.8 | 3,989 | 33.0 |

| 7 | Alaska | 130 | 953 | 36.2 |

| 8 | Missouri | 117.9 | 7,270 | 28.3 |

| 9 | Tennessee | 116.7 | 8,143 | 27.3 |

| 10 | Oklahoma | 111 | 4,426 | 27.0 |

| 11 | New Mexico | 106.8 | 2,260 | 23.8 |

| 12 | Kentucky | 103.9 | 4,684 | 36.5 |

| 13 | North Carolina | 103.9 | 10,961 | 28.9 |

| 14 | West Virginia | 97 | 1,730 | 19.7 |

| 15 | Montana | 88.7 | 980 | 30.3 |

| 16 | Texas | 85.6 | 25,270 | 24.6 |

| 17 | Nevada | 83.1 | 2,614 | 24.7 |

| 18 | Indiana | 77.3 | 5,260 | 26.3 |

| 19 | Kansas | 76 | 2,230 | 25.8 |

| 20 | Arizona | 70 | 5,090 | 27.9 |

| 21 | Wyoming | 64.7 | 374 | 29.5 |

| 22 | Michigan | 64.3 | 6,462 | 26.5 |

| 23 | Florida | 64 | 13,940 | 29.4 |

| 24 | Virginia | 60.4 | 5,224 | 26.5 |

| 25 | Colorado | 57.4 | 3,336 | 24.4 |

| 26 | Oregon | 57.1 | 2,423 | 26.8 |

| 27 | Ohio | 56.8 | 6,697 | 26.0 |

| 28 | Idaho | 53.6 | 1,018 | 28.0 |

| 29 | South Dakota | 53.2 | 476 | 31.1 |

| 30 | Washington | 52.6 | 4,074 | 29.1 |

| 31 | North Dakota | 45.8 | 355 | 26.8 |

| 32 | Pennsylvania | 45.3 | 5,870 | 26.9 |

| 33 | Utah | 42.1 | 1,406 | 33.5 |

| 34 | Maine | 40.8 | 559 | 13.8 |

| 35 | Iowa | 39.1 | 1,249 | 27.3 |

| 36 | Vermont | 39.1 | 253 | 19.3 |

| 37 | Delaware | 37.8 | 379 | 24.0 |

| 38 | Nebraska | 37.3 | 733 | 35.7 |

| 39 | Illinois | 33.7 | 4,265 | 30.0 |

| 40 | Minnesota | 27.3 | 1,559 | 29.2 |

| 41 | New Hampshire | 26.8 | 372 | 28.9 |

| 42 | Connecticut | 24 | 866 | 18.8 |

| 43 | California | 21.7 | 8,509 | 14.7 |

| 44 | Wisconsin | 21.3 | 1,255 | 0.1 |

| 45 | Maryland | 18.3 | 1,130 | 22.8 |

| 46 | Hawaii | 12.1 | 174 | 13.6 |

| 47 | Rhode Island | 10.7 | 117 | 21.4 |

| 48 | New York | 8.9 | 1,766 | 14.6 |

| 49 | New Jersey | 6.8 | 629 | 25.3 |

| 50 | Massachusetts | 5.4 | 378 | 22.0 |