(The Center Square) – Twenty-one states' attorneys general on Monday wrote a letter opposing Department of Energy regulations regarding gas stoves.

Iowa Attorney General Brenna Bird joined the coalition in a letter to Energy Secretary Jennifer Granholm that said the department's standards for consumer conventional cooking products are an attempt to micro-manage Americans' lives.

The department released a supplemental notice of proposed rulemaking in February. Responses were accepted through Monday.

The document said that the Energy Policy and Conservation Act, with its 2020 amendments, stipulates that any energy conservation standard must seek the maximum improvement in energy efficiency that the department determines is technologically feasible and economically justified. It must result in a significant conservation of energy.

The Department of Energy's Feb. 1 document said that under its authority in 42 U.S.C. 6295(h)(2), it proposes that beginning in 2026, conventional gas cooking tops must have no more than 1,204 kBtu per year. Conventional ovens will not be allowed to have a control system with a linear power supply. The control system for gas ovens couldn't be equipped with a constant burning pilot light. The energy secretary had to publish a final rule in 1992 to determine whether standards for kitchen ranges and ovens should be amended and provide that the amendment applies to products beginning in 1995.

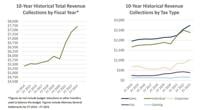

With a 7% discount rate for consumer benefits and costs and nitrous oxides and sulfur dioxide reduction benefits, and a 3% discount rate case for greenhouse gas social costs, the estimated cost of the proposed standards for consumer conventional cooking products is $32.5 million annually in increased product costs, the department said. The estimated annual benefits are $100.8 million in reduced product operating costs, $67.0 million in climate benefits and $64.9 million in health benefits. The net benefit would be $200.3 million per year.

According to the department, the ruling doesn't pose an issue to federalism because states can petition the department for exemption under the Energy Policy and Conservation Act.

In the letter, the attorneys general said the ruling does pose issues regarding federalism. The letter said that the proposed standards would preempt state procurement rules and state institutions consume energy, including natural gas.

The department's also relying too much on the social costs of carbon, methane and nitrous oxide because the IWG's model is flawed. The attorneys general said the department should exclude intrastate commerce in stoves and ovens from any final standards to avoid constitutional issues with the regulation.

“At a minimum, the Department must adjust its analysis to reflect the fact that the federal government can regulate purely intrastate activity under the Commerce Clause only where such activity has a substantial effect on interstate commerce,” the letter said.

Bird said the ruling's a power grab from the Biden Administration to advance its goals regarding climate change.

“While Americans struggle to make ends meet, Biden wants to ban the sale of most gas stoves and burden Americans with higher costs,” she said. “We must hold the federal government accountable.”

Louisiana and Tennessee led the letter.

Louisiana Attorney General Jeff Landry said in a statement that the rule's an unlawful, unattainable green energy fantasy.

The attorneys general from Alabama, Alaska, Arkansas, Florida, Georgia, Idaho, Kansas, Kentucky, Mississippi, Missouri, Montana, Nebraska, New Hampshire, Ohio, Oklahoma, South Carolina, Texas, Utah and Virginia also signed the letter.